Global Commercial Seaweeds Market- Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global commercial seaweeds market has developed from a historic seaside practice to one of the most dynamic markets of the sea-based economy. Seaweed farming has been traditionally utilized as a food and medicine source by nations along Asia, particularly Japan, China, and Indonesia. What was initially localized collection along rocky shores gradually evolved into commercial trade in the twentieth century, when nations first began to value the nutritional and industrial potential of these sea vegetables. The transition from traditional collection to cultivation marked the first significant milestone, revolutionizing coast economies and laying the groundwork for a disciplined worldwide system of trade.

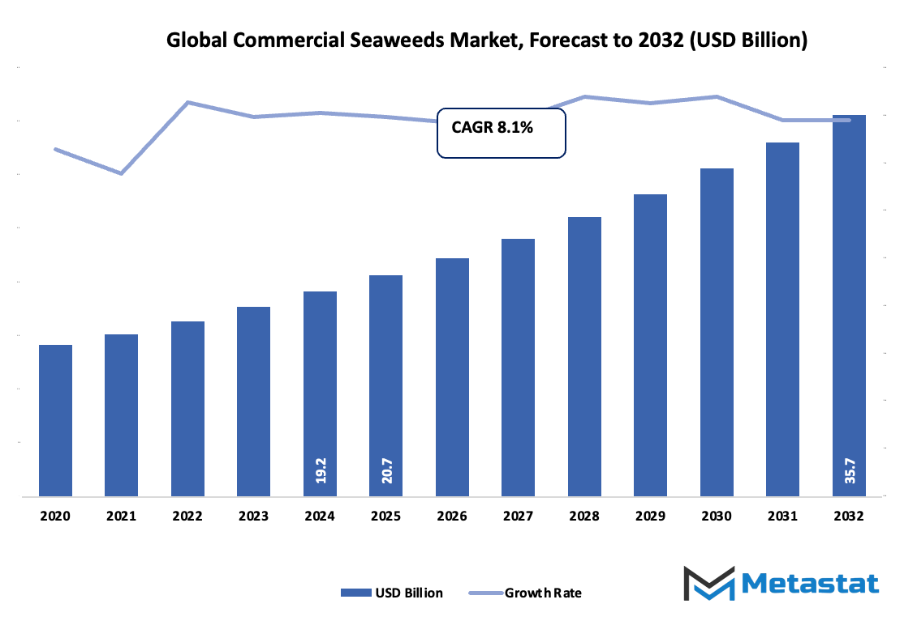

- Global commercial seaweeds market value of around USD 20.7 billion in 2025 with a growth rate of around 8.1% CAGR during 2032, which can further grow to more than USD 35.7 billion.

- Red Seaweed possess around 54.3% market share, driving innovation and expanding usage through intensive research.

- Key growth trends: Growing demand for seaweed-derived food products along with organic additives, Growing use of seaweeds for agricultural purposes as biofertilizers and soil conditioners

- Opportunities include: Higher applications of seaweeds in biofuel and bioplastic production

- Key insight: The industry will grow exponentially in value over the next decade, which indicates stupendous growth opportunity.

- By the end of the 1900s, aquaculture technology began to revolutionize seaweed production and processing.

The controlled farm method innovation allowed the producer to regulate quality and quantity more accurately. Governments and research institutions started to invest in marine biotechnology, finding novel uses for seaweed extracts in the food, pharma, and agricultural industries. This era brought with it a tide of innovation that led the global commercial seaweeds market away from its customary regional source, forging global value chains and expanding its applications. The twenty-first century witnessed a sea change when sustainability entered mainstream vocabulary. Consumers around the world began seeking natural and renewable alternatives to man-made products, compelling companies to transform the manner in which they acquired and manufactured.

Seaweed, being environmentally friendly, became an attractive option for those companies that dealt with green ingredients and packaging systems. For the food industry, it soon added seaweed-based items into their lists, not just for taste and texture, but also for nutritional value. Regulatory frameworks also began to evolve, with increased demands on harvesting methods and labeling of the product to retain traceability and safety. Dryness, extraction, and preservation technologies will only go on to guide the future of the global commercial seaweeds market, making it more available and uniform. As consumerism becomes increasingly sustainable consumption and governments encourage marine resource management, the market will go on to evolve. From the shores of yore to the laboratories of today, commercial seaweed farming has been a story of innovation converging with tradition, and its next chapter still to be penned.

Market Segments

The global commercial seaweeds market is mainly classified based on Product, Form, End-Uses.

By Product is further segmented into:

- Red Seaweed: global commercial seaweeds market for red seaweed will grow steadily as it is increasingly being used in foods and beverages for its gelling and thickening properties. Red seaweed will also be required in medicines due to bioactive substances that promote health and wellness.

- Brown Seaweed: Brown seaweed will see an increase in demand in the market owing to its high alginate and other minerals composition. It will find application in agriculture as an organic fertilizer and in cosmetics and personal care in skin hydration and nutrition.

- Green Seaweed: Green seaweed in the global commercial seaweeds market will expand due to its rich nutrient content and versatility of application. It will be utilized in foods and supplements for animal feed and research will be conducted on its potential for pharmacy and cosmetics.

By Form the market is divided into:

- Powder: Powdered form in the international market for Commercial Seaweeds will grow as it is easy to add to food, drinks, and animal feed. It will also find application in pharmaceuticals and cosmetics because it is convenient and does not lose any nutrients in processing.

- Flakes: Flakes in global commercial seaweeds market will remain sought after for their application in foods and beverages and agriculture. Their convenience of application and texture will make them remain a preference option for industrial as well as household application.

- Liquid: Liquid form in the global commercial seaweeds market will see increasing demand as it can be utilized directly in cosmetics, pharmaceuticals, and agriculture. Liquids allow for rapid absorption and effectiveness within applications and therefore are a sought-after product from manufacturers.

By End-Uses the market is further divided into:

- Food and Beverage: The food and beverage segment in the global commercial seaweeds market will continue to grow as seaweeds provide natural thickening, flavour, and nutritional benefits. Consumers are increasingly choosing seaweed-based products for health and dietary reasons, driving market demand.

- Agriculture: Agriculture will benefit from the market as seaweed-based products improve soil health, plant growth, and crop yields. Natural fertilizers and plant stimulants derived from seaweeds will become more common as sustainable farming practices gain popularity.

- Animal Feed Additives: Animal feed additives in the market will rise due to their ability to improve livestock health and growth. Seaweed supplements will be valued for their vitamins, minerals, and digestibility, helping improve overall productivity and animal wellbeing.

- Pharmaceuticals: Pharmaceuticals will see an increase in demand from the market as bioactive compounds in seaweeds support health treatments and supplements. Researchers will continue exploring medicinal benefits, including anti-inflammatory and antioxidant properties.

- Cosmetics and Personal Care: Cosmetics and personal care products will benefit from the global commercial seaweeds market as ingredients provide hydration, anti-aging benefits, and skin nourishment. The market will expand as consumers favor natural and eco-friendly formulations using seaweed extracts.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$20.7 Billion |

|

Market Size by 2032 |

$35.7 Billion |

|

Growth Rate from 2025 to 2032 |

8.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

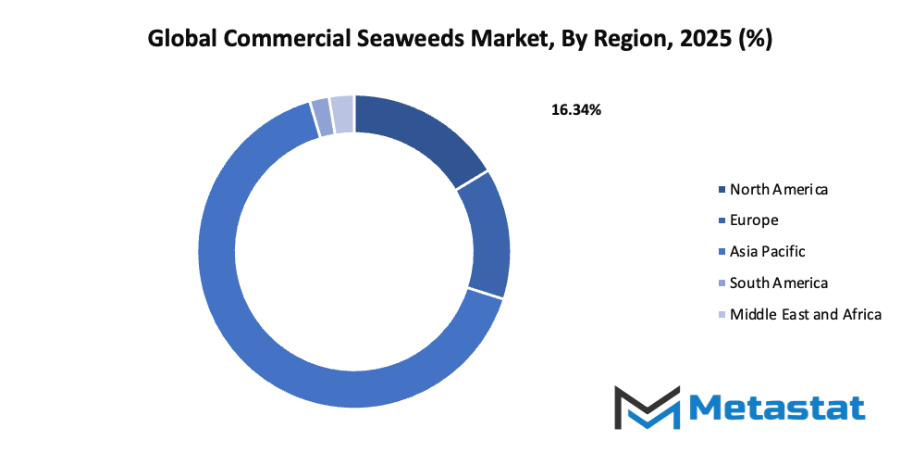

By Region:

- Based on geography, the global commercial seaweeds market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising demand for seaweed-based food products and natural additives: The global commercial seaweeds market will see increased demand due to the growing preference for healthier and natural food options. Seaweeds provide essential nutrients, vitamins, and minerals, making them a popular choice in processed foods, snacks, and dietary supplements. This trend will drive market growth steadily.

- Growing use of seaweeds in agriculture as biofertilizers and soil conditioners: Seaweeds will become more important in agriculture because they enhance soil fertility and support plant growth naturally. As biofertilizers, they improve nutrient content in the soil, reduce dependency on chemical fertilizers, and promote sustainable farming practices, supporting the overall expansion of the market.

Challenges and Opportunities

- Seasonal dependency and limited availability of raw materials: The global commercial seaweeds market faces challenges due to seasonal growth patterns and restricted availability of raw materials. Harvesting is dependent on specific environmental conditions, which can cause supply fluctuations. These limitations can impact production cycles and create instability in meeting market demand efficiently.

- High processing and cultivation costs in certain regions: Cultivating and processing seaweeds in some regions remains expensive, affecting pricing and market competitiveness. Investments in infrastructure, labour, and technology add to operational costs. These financial pressures can slow market expansion and influence decisions on sourcing and production strategies in the market.

Opportunities

- Expanding application of seaweeds in biofuel production and bioplastics: The global commercial seaweeds market will benefit from emerging applications in sustainable energy and eco-friendly materials. Seaweeds offer potential for biofuel production and bioplastics, providing renewable alternatives to fossil fuels and plastics. Growing interest in environmental solutions will create new avenues for market growth and innovation.

Competitive Landscape & Strategic Insights

The global commercial seaweeds market is positioned at an important stage of development, shaped by a mix of both international industry leaders and emerging regional competitors. The industry will continue to grow as demand for natural, sustainable, and functional ingredients rises across multiple sectors, including food, agriculture, pharmaceuticals, and cosmetics. Important competitors include Cargill, Incorporated, DuPont de Nemours, Inc., CP Kelco, Acadian Seaplants Limited, Qingdao Gather Great Ocean Algae Industry Group Co., Ltd., CEAMSA, Seasol International Pty Ltd., Roullier Group, Algaia, Ocean Harvest Technology, The Seaweed Company, Compo GmbH & Co. KG, and Leili Group. These players have already established strong positions in the market, with advanced research, diversified product portfolios, and global distribution networks.

In the coming years, the industry will witness increased collaboration between established companies and emerging players, leading to accelerated innovation and the introduction of novel seaweed-based products. Innovations will focus on improving extraction techniques, enhancing nutritional value, and developing eco-friendly production methods that reduce environmental impact. Regional competitors will increasingly challenge traditional leaders by leveraging local resources, lower production costs, and specialized knowledge of specific species. This dynamic will push the global commercial seaweeds market toward more competitive pricing, higher quality standards, and faster product development cycles.

The future of the industry will also be shaped by growing consumer awareness of sustainability and health benefits associated with seaweed products. Companies will invest in advanced biotechnology, sustainable harvesting, and supply chain transparency to meet rising global expectations. By adopting innovative cultivation practices and eco-conscious processes, the market will achieve a balance between profitability and environmental responsibility. Additionally, strategic partnerships, mergers, and acquisitions will help companies expand into new regions and increase market share, creating a more interconnected and resilient global market.

Market size is forecast to rise from USD 20.7 billion in 2025 to over USD 35.7 billion by 2032. Commercial Seaweeds will maintain dominance but face growing competition from emerging formats.

Overall, the Commercial Seaweeds market will continue to evolve through the combined efforts of international leaders and regional competitors, driving technological advancement, sustainable practices, and wider adoption of seaweed products. The trajectory of growth suggests that the industry will not only expand its economic footprint but also contribute positively to environmental sustainability and human health in the decades to come.

Report Coverage

This research report categorizes the global commercial seaweeds market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global commercial seaweeds market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global commercial seaweeds market.

Commercial Seaweeds Market Key Segments:

By Product

- Red Seaweed

- Brown Seaweed

- Green Seaweed

By Form

- Powder

- Flakes

- Liquid

By End-Uses

- Food and Beverage

- Agriculture

- Animal Feed Additives

- Pharmaceuticals

- Cosmetics and Personal Care

Key Global Commercial Seaweeds Industry Players

- Cargill, Incorporated

- DuPont de Nemours, Inc.

- CP Kelco

- Acadian Seaplants Limited

- Qingdao Gather Great Ocean Algae Industry Group Co., Ltd.

- CEAMSA

- Seasol International Pty Ltd.

- Roullier Group

- Algaia

- Ocean Harvest Technology

- The Seaweed Company

- Compo GmbH & Co. KG

- Leili Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383