MARKET OVERVIEW

The Global Commercial Cleaning Products market represents a dynamic and essential industry, catering to a wide array of sectors that demand hygiene and sanitation. This market encompasses various cleaning agents, detergents, disinfectants, and equipment specifically designed for commercial use, ensuring cleanliness in environments such as offices, healthcare facilities, educational institutions, hotels, and industrial settings. The necessity for such products stems from the need to maintain sanitary conditions, prevent the spread of infections, and create a safe and welcoming environment for employees, clients, and customers.

Commercial cleaning products are formulated to meet stringent standards of efficacy and safety. These products differ from household cleaners in their concentration, formulation, and effectiveness, often being more potent to tackle the more significant demands of commercial environments. Manufacturers in this market continuously innovate to enhance the efficiency of their products, reduce environmental impact, and adhere to regulatory requirements. This innovation includes the development of eco-friendly and sustainable cleaning solutions, reflecting the growing global emphasis on environmental responsibility.

In recent years, the Global Commercial Cleaning Products market has witnessed a surge in demand, driven by heightened awareness of hygiene and sanitation, especially in the wake of global health crises. This increased focus on cleanliness has led businesses to adopt more rigorous cleaning protocols, further propelling the need for high-quality commercial cleaning products. As a result, the market has expanded, with numerous players vying to offer superior products and capture a larger market share.

The industry is characterized by a diverse range of products, from general-purpose cleaners and sanitizers to specialized solutions for particular applications. For example, in healthcare settings, there is a critical need for disinfectants that can eliminate pathogens and ensure sterile conditions. In contrast, the hospitality industry may prioritize products that not only clean but also leave a pleasant fragrance and contribute to a positive guest experience. This diversity necessitates continuous research and development to meet the evolving needs of different sectors.

Technological advancements play a crucial role in shaping the future of the Global Commercial Cleaning Products market. Innovations such as automated dispensing systems, smart cleaning devices, and the integration of artificial intelligence in cleaning processes are set to redefine industry standards. These advancements aim to improve the efficiency and effectiveness of cleaning operations while reducing costs and minimizing human error. The adoption of such technologies is expected to rise, driving further growth in the market.

The market also faces challenges, including regulatory compliance, environmental concerns, and the need for constant product innovation. Regulations governing the safety and environmental impact of cleaning products vary across regions, requiring companies to navigate complex legal landscapes. Additionally, the push for sustainable and green cleaning products necessitates significant investment in research and development, as well as adjustments in manufacturing processes.

Despite these challenges, the Global Commercial Cleaning Products market is poised for continued expansion. The increasing emphasis on health and hygiene, coupled with technological advancements and a growing demand for sustainable solutions, will drive the market forward. Companies that can adapt to changing regulations, innovate in product development, and effectively market their offerings will thrive in this competitive landscape.

The Global Commercial Cleaning Products market is a vital and rapidly evolving industry. Its importance spans various sectors, driven by the universal need for cleanliness and sanitation. As technological advancements and sustainability trends shape the market, it will continue to grow, adapting to meet the ever-changing demands of businesses and consumers worldwide.

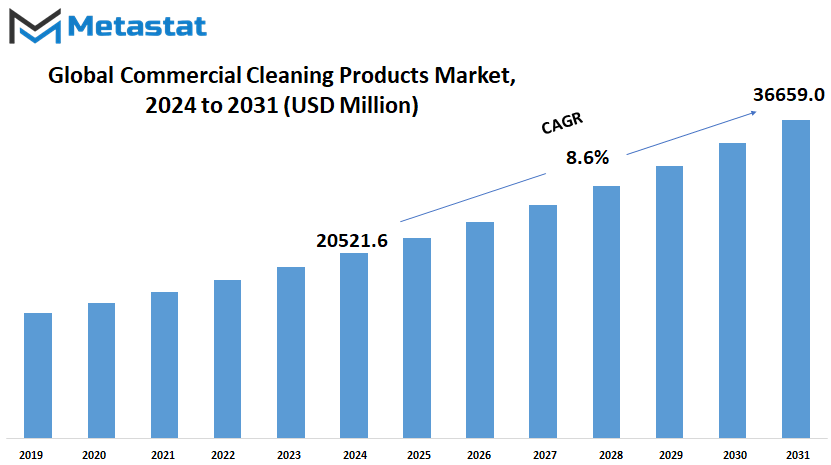

Global Commercial Cleaning Products market is estimated to reach $36659.0 Million by 2031; growing at a CAGR of 8.6% from 2024 to 2031.

GROWTH FACTORS

The global commercial cleaning products market is poised for significant growth in the coming years, driven by several key factors. One of the primary reasons for this expected expansion is the increasing awareness of the importance of hygiene and cleanliness in both the workplace and public spaces. Businesses are recognizing that maintaining a clean environment not only ensures the health and safety of employees and customers but also enhances the overall image and reputation of the company. This growing emphasis on cleanliness is prompting organizations to invest more in high-quality cleaning products.

Another driving factor is the rapid urbanization and industrialization taking place across the globe. As cities expand and industries grow, the demand for commercial cleaning products rises. Large office complexes, manufacturing plants, and public infrastructure all require regular and thorough cleaning to maintain operational efficiency and public health standards. Furthermore, the rise of the service industry, including hotels, restaurants, and healthcare facilities, has created a sustained demand for specialized cleaning solutions that cater to specific needs.

Technological advancements in cleaning products are also contributing to market growth. Innovations such as eco-friendly and sustainable cleaning agents, automated cleaning machines, and smart cleaning technologies are revolutionizing the industry. These advancements not only enhance the effectiveness and efficiency of cleaning operations but also align with the increasing consumer preference for environmentally responsible products. As more companies adopt these advanced cleaning solutions, the market is expected to grow steadily.

However, certain challenges might hamper the market growth. One such challenge is the high cost associated with advanced and sustainable cleaning products. Small and medium-sized enterprises (SMEs), in particular, may find it difficult to afford these products, limiting their adoption. Additionally, the availability of counterfeit or low-quality cleaning products in the market can undermine the reputation of established brands and affect consumer trust.

Despite these challenges, the market presents lucrative opportunities for growth. The rising awareness of environmental issues and the increasing demand for green cleaning products provide a significant opportunity for manufacturers to develop and market eco-friendly alternatives. Moreover, the integration of artificial intelligence and robotics in cleaning operations offers promising prospects for the industry. Automated cleaning systems and AI-driven maintenance can significantly reduce labor costs and improve cleaning efficiency, making them attractive options for large-scale commercial applications.

The global commercial cleaning products market is set to experience robust growth due to heightened awareness of hygiene, urbanization, technological advancements, and the increasing demand for sustainable solutions. While cost and quality control challenges exist, the opportunities presented by eco-friendly products and technological innovations are expected to drive the market forward in the coming years.

MARKET SEGMENTATION

By Type

The global market for commercial cleaning products, categorized by type, is undergoing substantial growth and diversification. In 2023, the Surface Cleaners segment held significant value, amounting to 8042 USD Million. This segment encompasses a wide array of cleaning agents tailored for various surfaces, ensuring effective sanitation and hygiene in diverse environments. With increasing awareness regarding cleanliness and sanitation, the demand for surface cleaners is projected to surge even further.

Metal Surface Cleaners, constituting another prominent category, accrued a substantial value of 4113.4 USD Million in 2023. As industries continue to expand and modernize, the need for specialized cleaning solutions for metal surfaces becomes increasingly pronounced. These cleaners are formulated to effectively remove dirt, grease, and stains from metallic surfaces, thereby maintaining their appearance and integrity.

Similarly, the Glass Cleaners segment witnessed notable growth, reaching a value of 2094.3 USD Million in 2023. With the proliferation of glass structures in architectural designs and the automotive industry, there arises a corresponding demand for cleaning products specifically formulated for glass surfaces. These cleaners not only ensure clarity and shine but also contribute to the overall aesthetics and longevity of glass surfaces.

Fabric Cleaners represent another pivotal category within the commercial cleaning products market, with a value of 3864.5 USD Million in 2023. As textile industries continue to flourish and consumer preferences evolve, there is an escalating need for effective fabric care solutions. Fabric cleaners are designed to tackle stains, odors, and dirt embedded in various fabrics, thereby preserving their quality and prolonging their lifespan.

Additionally, the Others segment, valued at 1050.6 USD Million in 2023, encompasses a diverse range of cleaning products catering to specialized needs and applications. This segment includes niche cleaning agents designed for specific surfaces, materials, or purposes, reflecting the dynamic and innovative nature of the commercial cleaning products market.

By Distribution Channel

The global market for commercial cleaning products is witnessing significant growth, propelled by various factors such as increasing awareness regarding hygiene and cleanliness, rising demand from commercial sectors including hospitality, healthcare, and corporate offices, and advancements in cleaning technologies. In 2023, the offline segment of the market, referring to traditional brick-and-mortar stores, was valued at 14992.9 USD Million.

Looking ahead, this trend is expected to continue as the market responds to evolving consumer preferences and industry dynamics. One key aspect driving this growth is the distribution channels through which these cleaning products are made available to consumers. Presently, the market is divided into two main distribution channels: online and offline.

The online distribution channel, characterized by e-commerce platforms and online retailers, is gaining prominence due to the convenience it offers to consumers. With the proliferation of smartphones and internet access, more consumers are opting to purchase commercial cleaning products online. This trend is expected to persist and even intensify in the future, as technological advancements further streamline the online shopping experience and enhance the accessibility of these products.

On the other hand, the offline distribution channel, comprising physical stores such as supermarkets, hypermarkets, and specialty stores, continues to play a significant role in the market. While online shopping offers convenience, offline channels provide a tactile experience, allowing consumers to physically inspect and compare products before making a purchase. Additionally, offline channels often cater to immediate needs, offering same-day or even instant gratification, which can be appealing to certain consumer segments.

However, with the rapid digitalization of retail and changing consumer behaviors, offline channels are also adapting to remain competitive. Many brick-and-mortar stores are integrating online platforms into their business models, offering click-and-collect services or partnering with third-party delivery services to extend their reach and cater to the growing demand for online shopping.

In the future, the commercial cleaning products market is poised for further growth and innovation, driven by advancements in distribution channels and evolving consumer preferences. While online channels will continue to expand their market share, offline channels will adapt and innovate to maintain their relevance in an increasingly digital landscape. Ultimately, both channels will play complementary roles in meeting the diverse needs of consumers in the global market for commercial cleaning products.

By End-User

In the vast landscape of the global market, one sector that is constantly evolving and expanding is the commercial cleaning products market. This market encompasses a wide array of products designed to maintain cleanliness and hygiene in various settings, ranging from healthcare facilities to retail stores and beyond.

When we peer into the future of this market, one can anticipate significant growth and diversification, driven by the increasing emphasis on cleanliness and sanitation in both public and private spaces. As societies become more conscious of the importance of maintaining clean and hygienic environments, the demand for commercial cleaning products will continue to soar.

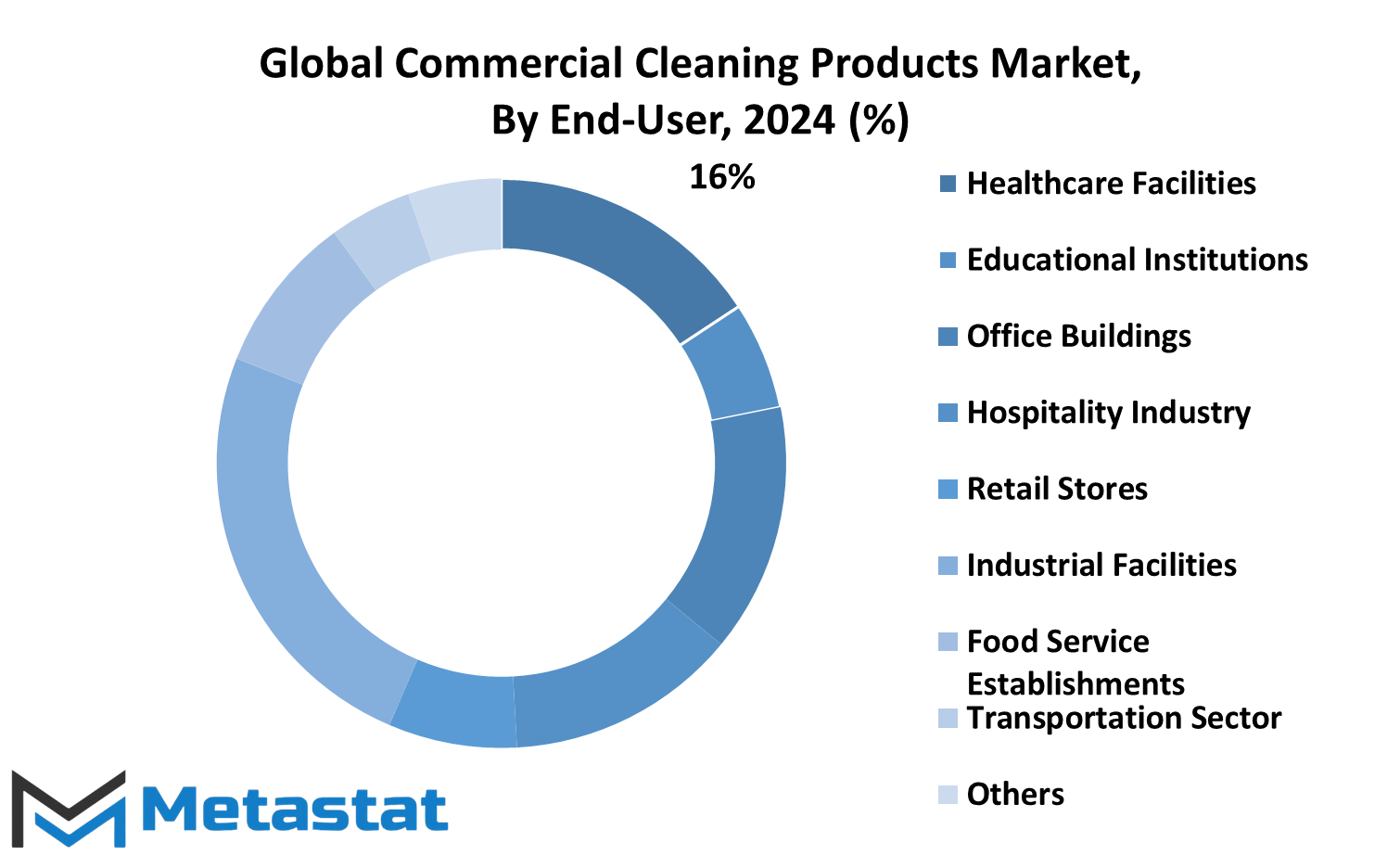

One key aspect that shapes the dynamics of the commercial cleaning products market is the segmentation based on end-users. These end-users represent different sectors and industries that rely on cleaning products to uphold hygiene standards in their respective environments. Among these end-users, we find healthcare facilities, educational institutions, office buildings, the hospitality industry, retail stores, industrial facilities, food service establishments, the transportation sector, and others.

Each segment within the market holds its own significance and presents unique opportunities for growth and innovation. For instance, healthcare facilities require specialized cleaning products that can effectively eliminate harmful pathogens and maintain sterile environments to safeguard patient health. Similarly, educational institutions, such as schools and universities, demand cleaning products that are safe, effective, and suitable for high-traffic areas frequented by students and staff

Retail stores, another significant segment, place a premium on cleanliness to create a pleasant shopping experience for customers while also adhering to health and safety regulations. Industrial facilities, on the other hand, require robust cleaning solutions capable of tackling tough grease, oil, and grime commonly found in manufacturing environments.

As we look ahead, the future of the commercial cleaning products market will be shaped by technological advancements, environmental considerations, and changing consumer preferences. Innovations such as eco-friendly cleaning agents, automated cleaning systems, and smart sensors will likely revolutionize the way cleaning is done across various industries.

Furthermore, as the world continues to grapple with global health challenges and outbreaks, the importance of maintaining clean and sanitary environments will only become more pronounced. This will drive further investment and innovation in the commercial cleaning products market, ensuring that it remains a vital component of modern society's infrastructure.

In conclusion, the global commercial cleaning products market is poised for continued growth and expansion as societies place increasing importance on cleanliness and hygiene. With diverse end-users and evolving demands, this market will continue to evolve and innovate to meet the needs of a cleaner and safer world.

By Ingredient Type

The global market for commercial cleaning products is a dynamic landscape, constantly shaped by evolving consumer needs and technological advancements. In recent years, there has been a notable shift towards more eco-friendly and sustainable cleaning solutions. This trend is reflected in the growing popularity of products categorized under Enzyme Cleaners, Probiotics, Bio-Surfactants, pH Adjusters, Disinfectants, and Others.

Among these categories, Probiotics have emerged as a particularly lucrative segment, with a valuation of 3303.6 USD Million in 2023. Probiotic cleaners harness the power of beneficial bacteria to break down organic matter and eliminate odors, offering a natural and environmentally friendly alternative to traditional cleaning agents.

Bio-Surfactants, valued at 1717.8 USD Million in 2023, are another key player in the commercial cleaning products market. These biodegradable compounds reduce surface tension and facilitate the removal of dirt and grease, making them highly effective in a wide range of applications.

pH Adjusters, Disinfectants, and other categories also play vital roles in meeting the diverse needs of consumers across various industries. pH Adjusters help maintain the optimal pH balance for cleaning solutions, while Disinfectants provide essential protection against harmful pathogens. The category labeled as "Others" encompasses a variety of niche products catering to specific cleaning requirements, such as specialty cleaners for industrial equipment or sensitive surfaces.

Looking ahead, the commercial cleaning products market is poised for further growth and innovation. As environmental concerns continue to drive consumer preferences, we can expect to see an increased emphasis on sustainable ingredients and packaging materials. Advances in biotechnology and nanotechnology may also lead to the development of more efficient and versatile cleaning solutions.

Moreover, the ongoing digital revolution is likely to reshape the way cleaning products are manufactured, distributed, and utilized. Smart sensors and internet-connected devices could enable real-time monitoring of cleaning performance, allowing for more precise and efficient usage of resources. Additionally, data analytics tools may provide valuable insights into consumer behavior and preferences, helping companies tailor their products and marketing strategies to better meet market demands.

The global commercial cleaning products market is a dynamic and diverse industry driven by innovation and evolving consumer trends. By embracing sustainable practices and harnessing the power of technology, companies can capitalize on emerging opportunities and stay ahead in this competitive landscape..

REGIONAL ANALYSIS

The global market for commercial cleaning products is analyzed based on different regions around the world. These regions include North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

In North America, the market is further divided into the United States, Canada, and Mexico. Europe comprises countries such as the United Kingdom, Germany, France, Italy, and other European nations. The Asia-Pacific region encompasses major economies like India, China, Japan, South Korea, and other countries in the region. South America includes nations like Brazil, Argentina, and other parts of the continent. Lastly, the Middle East & Africa region consists of GCC Countries, Egypt, South Africa, and other countries in the Middle East and Africa.

This regional analysis provides insights into the demand for commercial cleaning products across different parts of the world. Understanding the market dynamics in each region is essential for businesses operating in the commercial cleaning industry to tailor their strategies effectively.

North America, being one of the prominent regions, is expected to witness significant growth in the commercial cleaning products market due to factors such as increasing awareness about hygiene and cleanliness, stringent regulations regarding workplace safety and cleanliness, and the presence of key market players. Similarly, Europe is projected to showcase considerable growth owing to the rising adoption of eco-friendly cleaning products and the implementation of stringent regulations regarding environmental sustainability.

The Asia-Pacific region, with its rapidly growing economies such as China and India, presents lucrative opportunities for market expansion. The increasing urbanization, rising disposable income levels, and growing awareness about cleanliness and sanitation are driving the demand for commercial cleaning products in this region.

South America and the Middle East & Africa regions are also anticipated to witness steady growth in the commercial cleaning products market. Factors such as urbanization, industrialization, and the implementation of hygiene regulations are expected to contribute to market growth in these regions.

The regional analysis of the global commercial cleaning products market provides valuable insights into the market dynamics and growth prospects across different geographical regions. Businesses can use this information to devise effective marketing and expansion strategies tailored to specific regional requirements and preferences.

COMPETITIVE PLAYERS

In the vast expanse of the Global Commercial Cleaning Products market, there exists a dynamic landscape of competitive players. These key participants, comprising established entities and emerging contenders, shape the trajectory of the industry through their innovative strategies and commitment to excellence.

Among the prominent figures in this domain are 3M Company, Betco Corporation, The Clorox Company, and Diversey Holdings Ltd. These stalwarts bring decades of experience and expertise to the table, driving forward the standards of quality and efficacy in commercial cleaning solutions.

Additionally, Ecolab, Inc., Henkel AG & Co. KGaA, and Alpha Chemical Services, Inc. contribute their unique strengths and capabilities to the competitive fray. With a focus on sustainability and environmental responsibility, these players pave the way for a greener future in the cleaning products market.

In the realm of healthcare and hygiene, Medline Industries, Inc., Procter and Gamble Company, and Alfred Kärcher SE & Co. KG stand as pillars of innovation and reliability. Their advanced formulations and state-of-the-art technologies ensure optimal cleanliness and safety in diverse settings.

Meanwhile, S.C. Johnson & Son, Inc., Unilever Plc, and BASF SE bring their global reach and diversified portfolios to bear on the industry landscape. Their multifaceted approach encompasses a wide array of cleaning solutions tailored to meet the needs of various sectors and applications.

Arrow Solutions, The Armakleen Company, and Stepan Company represent a new wave of players, harnessing cutting-edge research and development to push the boundaries of performance and efficiency. With a focus on continuous improvement and customer satisfaction, these entities are poised to make significant strides in the competitive arena.

Furthermore, GOJO Industries, Inc., Zep, Inc., and Spartan Chemical Company, Inc. demonstrate a commitment to innovation and versatility in their product offerings. From industrial cleaning to institutional sanitation, these players offer comprehensive solutions that address the diverse needs of their clientele. Croda International Plc rounds out the roster of competitive players, leveraging its expertise in specialty chemicals to deliver high-performance cleaning formulations for a wide range of applications.

In the ever-evolving landscape of the Commercial Cleaning Products market, these competitive players will continue to drive innovation, foster sustainability, and raise the bar for excellence in the industry. As they navigate the challenges and opportunities that lie ahead, their collective efforts will shape the future of clean, safe, and healthy environments worldwide.

Commercial Cleaning Products Market Key Segments:

By Type

- Surface Cleaners

- Metal Surface Cleaners

- Glass Cleaners

- Fabric Cleaners

- Others

By Distribution Channel

- Online

- Offline

By End-Users

- Healthcare Facilities

- Educational Institutions

- Office Buildings

- Hospitality Industry

- Retail Stores

- Industrial Facilities

- Food Service Establishments

- Transportation Sector

- Others

By Ingredient Type

- Enzyme Cleaners

- Probiotics

- Bio-Surfactants

- pH Adjusters

- Disinfectants

- Others

Key Global Commercial Cleaning Products Industry Players

- 3M Company

- Betco Corporation

- The Clorox Company

- Diversey Holdings Ltd.

- Ecolab, Inc.

- Henkel AG & Co. KGaA

- Alpha Chemical Services, Inc.

- Medline Industries, Inc.

- Procter and Gamble Company

- Alfred Kärcher SE & Co. KG

- S.C. Johnson & Son, Inc.

- Unilever Plc

- BASF SE

- Arrow Solutions

- The Armakleen Company

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252