Global Coffee Concentrates Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global coffee concentrates market developed from being a quirky experimental commodity to being a dynamic player in the larger beverages industry. It initially began surfacing during the early twentieth century when businesspeople started looking for advantageous ways of extending the shelf life of the coffee brew. Early experiments were few in quantity, sometimes being to provide cheapers with the means of supplying travelers and soldiers with an affordable alternative for their regular coffee. Those initial liquid concentrations were unprocessed but introduced commercial concentrated coffee into the market as a simple alternative to grinding beans and brewing fresh.

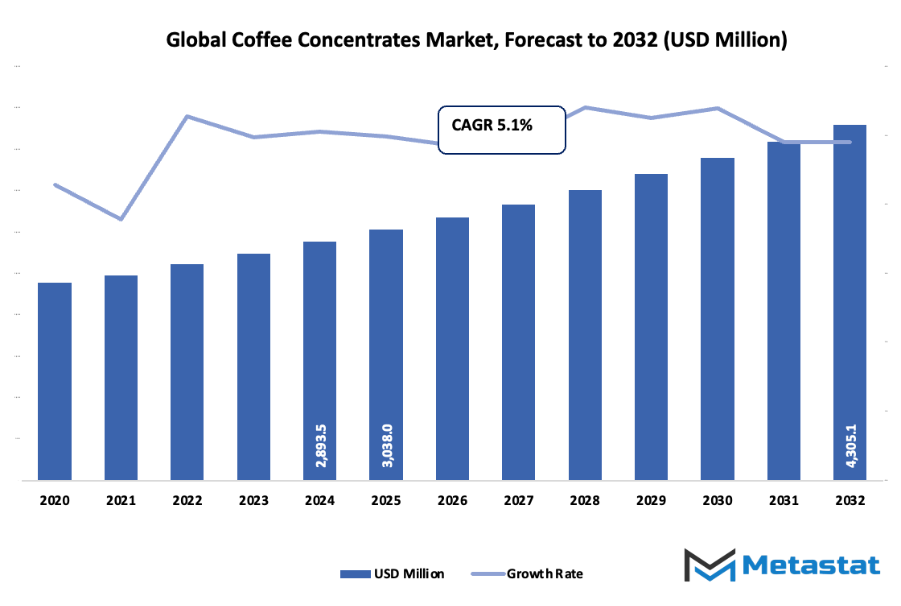

- Global coffee concentrates market size of approximately USD 3038 million in 2025 with a growth rate of approximately 5.1% from 2032, may exceed over USD 4305.1 million.

- Caffeinated has the highest market share of approximately 83.2%, encouraging commercialization and broadened uses by extensive research.

- Major growth trends: Growing customer need for convenience and portable coffee products, Ready-to-drink (RTD) coffee and specialty beverages market expansion

- Opportunities are: Expanding application in foodservice, bakeries, and cocktail mixes to other than pure coffee use

- Key insight: The market will grow exponentially in value over the next decade, being a massive growth opportunity.

The global coffee concentrates market first found its first true traction after the war, with advances in food packaging and preservation providing new business opportunities. Mass producers first were creating extraction methods, purifying and stabilizing extracts but keeping a lot of the original flavor essence of the coffee. Supermarkets subsequently began to retail extracts of coffee in a bottle to homes worried about convenience products.

Break-through was when specialist coffee in the 1980s and 1990s re-wrote consumers' expectations. Speciality coffee connoisseurs had demanded better flavour, better quality beans, and authenticity even within convenient packs. Manufacturers responded by refining on sourcing procedures, promoting single-origin beans and better roasting profiles before extraction. This break-through served to have coffee densities that could stand for quality, and not convenience. Technological innovation was the force that propelled the market to where it stands today.

Cold brew extraction, for instance, transitioned from café countertops to factory floors and journeyed as smooth, less acidic concentrates to distant points of the world. Precision brewing equipment, vacuum sealing, and aseptic packaging lengthened shelf life and flavor stability, enabling concentrates to travel longer distances and arrive in more remote markets. E-commerce has also given opportunity to niche brands to provide craft coffee concentrates to global consumers. Consumer behavior has kept pace with diversification. Busy lives and convenience of drinking home-brew café-quality beverages have driven demand for taste-strong concentrates that can be served hot, cold, or used to make new-beverage variations. Consumer consciousness regarding sustainability has also pushed companies to go for eco-friendly sourcing and recyclable packaging simultaneously.

And now, the international coffee concentrates market is no longer an afterthought in coffee. It's a category founded on decades of creativity, shifting flavors, and the delicate balance between convenience and craftsmanship with its destiny even more refined and accessible.

Market Segments

The global coffee concentrates market is mainly classified based on Type, Packaging, Distribution Channel.

By Type is further segmented into:

- Caffeinated: Caffeinated coffee concentrates will remain popular as they provide instant power boost. Consumers will opt for natural flavor and strong smelling variety. Advances in technology in extraction and preservation will provide enhanced quality and shelf life, making the applications at the home and commercial fronts feasible.

- Decaffeinated: Concentrates of decaffeinated coffee will be supported by increased health-oriented consumers seeking alternatives without flavor compromise. Improved decaffeination methods will preserve taste and aroma more effectively, improving these products. Convergence into alternative segments of the global coffee concentrates market will enhance availability and provide solutions for sensitive consumers, establishing a balanced population base in the future.

By Packaging the market is divided into:

- Bottles: Bottled coffee concentrates will remain in fashion among consumers who seek convenience and portability. Improved design and environmentally-friendly material will propel bottles to become more sustainable. Improved labeling and tamper-proof technology will ensure consumer assurance, with ready-to-drink packaging allowing broader application, placing bottles on top in the global coffee concentrates market.

- Pouches: Pouch packaging will grow with cost reduction and space efficiency and convenient storage. Growing technology in flexible packaging will drive shelf life and freshness of product. Pouches will also be favored by consumers for one-time usage or small pack sizes, leading to innovation of resealable and sustainable formats.

- Others: Other specialty markets will be addressed by other packaging forms such as cans, jars, or sachets that are tailored to special needs. Sustainability drivers will drive use of recyclable or biodegradable packages. Customized packaging for specific brands will allow brands to reach specialized groups of consumers, resulting in more differentiated coverage of the market and more widespread presence of the product globally.

By Distribution Channel the market is further divided into:

- Supermarkets-Hypermarkets: Supermarkets and hypermarkets will remain key distribution points due to convenience and variety. Expansion of shelf space and in-store promotions will influence consumer purchase decisions. Integration with loyalty programs and targeted marketing will boost sales and help introduce new products, ensuring supermarkets continue to drive market growth.

- Business-to-business: B2B channels will see growth as cafes, restaurants, and hotels increasingly adopt coffee concentrates for operational efficiency. Bulk orders, long-term contracts, and quality consistency will play a major role. Technological solutions in supply chain management will make distribution faster and more reliable, strengthening B2B partnerships.

- Departmental Stores: Departmental stores will serve as premium outlets for high-quality coffee concentrates. Focus on brand experience and product demonstration will attract consumers. Expansion of in-store sampling and interactive displays will encourage purchase decisions, supporting visibility and adoption of innovative products in the global coffee concentrates market.

- Convenience Stores: Convenience stores will remain vital for impulse purchases and quick access. Compact packaging and ready-to-drink formats will drive sales. Strategic locations and extended operating hours will help maintain market penetration. Growth in urban areas and increased consumer awareness will boost the role of convenience stores in the global coffee concentrates market.

- Online Sales Channel: Online sales channels will dominate due to ease of access, wide product range, and competitive pricing. E-commerce platforms will integrate subscription models and personalized recommendations to attract consumers. Improved logistics and fast delivery will make online shopping a preferred option, enhancing global reach and contributing significantly to market growth.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$3038 Million |

|

Market Size by 2032 |

$4305.1 Million |

|

Growth Rate from 2025 to 2032 |

5.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

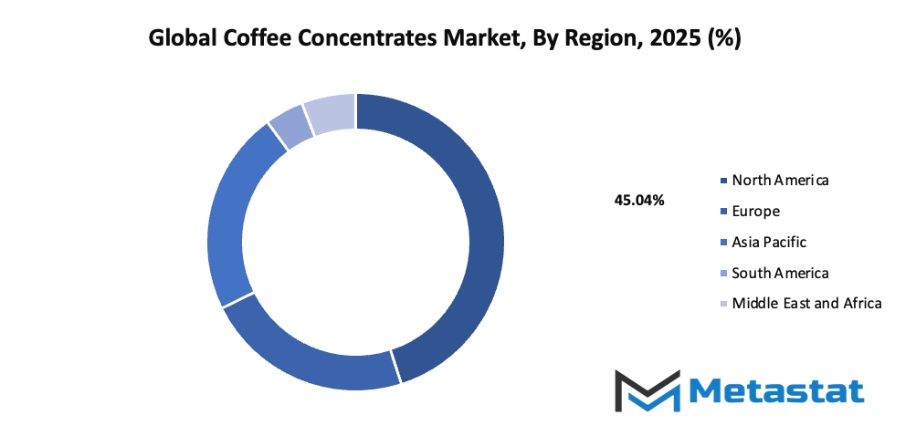

By Region:

- Based on geography, the global coffee concentrates market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising consumer demand for convenient and on-the-go coffee solutions: The global coffee concentrates market will see significant growth as consumers increasingly look for easy and quick coffee options. Busy lifestyles and the need for instant refreshment drive the preference for concentrated coffee that can be prepared quickly at home, work, or during travel, making it a practical choice for modern life.

- Growth of the ready-to-drink (RTD) coffee and specialty beverage market: The global coffee concentrates market for ready-to-drink coffee and specialty beverages will continue to expand as more people seek diverse flavours and premium coffee experiences without spending extra time brewing. This trend will be supported by innovations in packaging, flavours, and the increasing availability of RTD options in retail and online channels.

Challenges and Opportunities

- Shorter shelf life compared to instant coffee powders: Concentrated coffee products will face limitations due to their shorter shelf life compared to traditional instant coffee powders. Maintaining freshness and flavour stability during storage and distribution will remain critical, requiring improved packaging solutions and storage techniques to meet consumer expectations and reduce waste.

- Higher production and storage costs limiting affordability in some markets: The cost of producing and storing coffee concentrates will be higher, which can limit affordability in price-sensitive markets. Investments in efficient production processes, scalable manufacturing, and cost-effective distribution strategies will be necessary to make these products more accessible to a wider audience.

Opportunities

- Expanding applications in foodservice, bakeries, and cocktail mixes beyond traditional coffee consumption: The global coffee concentrates market will benefit from expanding applications beyond traditional coffee consumption. These include use in foodservice, bakeries, and cocktail mixes, allowing coffee concentrates to reach new consumer segments and create innovative products that combine convenience with creativity in culinary and beverage applications.

Competitive Landscape & Strategic Insights

The global coffee concentrates market will continue to grow as consumer demand shifts toward convenience, quality, and sustainability. This industry is a mix of both international industry leaders and emerging regional competitors. Important competitors include Starbucks, Nestlé, Keurig Dr Pepper, Stok, Califia Farms, La Colombe Coffee Roasters, Chameleon Cold-Brew, Kohana Coffee, Rise Brewing Co., Caveman Coffee Co., Lucky Jack Coffee, Secret Squirrel Cold Brew, High Brew Coffee, Wandering Bear Coffee, Cuvee Coffee, Kitu Super Coffee, Highwire Coffee Roasters, Slingshot Coffee Co., Grady’s Cold Brew, RISE Nitro Brewing Co., Allegro Coffee Company, Jim’s Coffee Concentrates, Counter Culture Coffee, Death Wish Coffee Co., and The J.M. Smucker Company. These companies will continue to drive innovation, expand distribution channels, and introduce new flavours and formats to attract a wide range of consumers.

Soon, the global coffee concentrates market will see an increased focus on functional beverages, with options enriched with vitamins, proteins, or adaptogens to meet health-conscious consumer needs. Packaging will become more sustainable, with companies adopting eco-friendly materials and refillable systems to reduce environmental impact. Technology will also play a role, as automated production and smart brewing solutions will allow for more consistent quality and faster delivery to consumers.

Regional competitors will increasingly challenge global leaders by offering unique flavors and locally sourced ingredients that appeal to niche markets. These emerging brands will also leverage social media and online platforms to build strong communities around their products, creating loyalty and recognition even without the resources of multinational companies. Collaborations between global and regional players may emerge, blending scale with creativity to capture evolving consumer preferences.

Market size is forecast to rise from USD 3038 million in 2025 to over USD 4305.1 million by 2032. Coffee Concentrates will maintain dominance but face growing competition from emerging formats.

Overall, the global coffee concentrates market will not only expand in size but will transform in the way products are developed, marketed, and consumed. Sustainability, health benefits, and technological enhancements will define the next stage of growth, while competition between international leaders and regional challengers will drive continuous innovation and consumer choice. The future will be shaped by brands that can balance quality, convenience, and environmental responsibility while responding to changing tastes and lifestyle demands.

Report Coverage

This research report categorizes the global coffee concentrates market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global coffee concentrates market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global coffee concentrates market.

Coffee Concentrates Market Key Segments:

By Type

- Caffeinated

- Decaffeinated

By Packaging

- Bottles

- Pouches

- Others

By Distribution Channel

- Supermarkets-Hypermarkets

- Business-to-business

- Departmental Stores

- Convenience Stores

- Online Sales Channel

Key Global Coffee Concentrates Industry Players

- Starbucks

- Nestlé

- Keurig Dr Pepper

- Stok

- Califia Farms

- La Colombe Coffee Roasters

- Chameleon Cold-Brew

- Kohana Coffee

- Rise Brewing Co.

- Caveman Coffee Co.

- Lucky Jack Coffee

- Secret Squirrel Cold Brew

- High Brew Coffee

- Wandering Bear Coffee

- Cuvee Coffee

- Kitu Super Coffee

- Highwire Coffee Roasters

- Slingshot Coffee Co.

- Grady’s Cold Brew

- RISE Nitro Brewing Co.

- Allegro Coffee Company

- Jim’s Coffee Concentrates

- Counter Culture Coffee

- Death Wish Coffee Co.

- The J.M. Smucker Company

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252