MARKET OVERVIEW

The Global Coaxial Power Divider market and its industry extend far beyond conventional applications, shaping the way power distribution is managed across multiple sectors. These devices play a crucial role in ensuring seamless signal transmission, particularly in telecommunications, aerospace, defense, and research facilities. While traditionally associated with splitting radio frequency signals with minimal loss, advancements in technology continue to redefine their function and relevance in modern industries.

For long, coaxial power dividers have been used to improve the efficiency of the network in the telecommunications sector, but it's not just the simple division of signal. As the demand for high-speed connectivity increases, it also improves systems' integrity and lessens interference. Integration in 5G infrastructure and satellite communications denotes its ability to update to the modern developments in technology. These devices also benefit the defense industry.

They are used in radar systems, surveillance equipment, and secure communication networks. The precision with which they distribute signals ensures reliability in critical operations, demonstrating their importance in maintaining national security and defense strategies. Research institutions and laboratories use the devices in each experiment that involves a need to accurately distribute the power.

Even in particle physics and medical imaging, the necessity for accurate division of signals would mean the right outcome. With scientific investigation evolving, more demands for highly performing power dividers will help realize breakthroughs in medical diagnostics, space travel, and quantum computing. Given the expanding view of technological developments, these gadgets are sure to back up novel discoveries.Beyond immediate applications, the Global Coaxial Power Divider market will likely witness transformations influenced by emerging industries and technological shifts.

As artificial intelligence and machine learning become integral to communication networks, power distribution components must evolve to support smarter, more adaptive systems. The role of these dividers in optimizing performance across interconnected networks highlights their continued relevance in an increasingly digital environment.

Additionally, sustainability initiatives will influence future designs, encouraging manufacturers to develop energy-efficient solutions that minimize signal loss and power consumption. Standardization and regulatory compliance will shape the market’s trajectory, as industries demand high-quality components that adhere to stringent performance standards. Organizations involved in space technology, for instance, will require highly specialized power dividers capable of withstanding extreme conditions.

As human exploration extends into deeper space missions, signal integrity will remain a priority, reinforcing the necessity of durable and adaptable components. Economic and geopolitical factors will also impact market dynamics, influencing supply chains and production strategies. The demand for localized manufacturing will prompt companies to explore regional production hubs, reducing dependency on global supply chains. This shift could lead to advancements in material science, where innovative conductive materials enhance the efficiency and longevity of power dividers.

In the coming years, the Global Coaxial Power Divider market will continue to expand its influence beyond traditional sectors. As technology progresses, its role in supporting next-generation communication, defense, and research applications will solidify its importance in modern infrastructure. With evolving industrial requirements and technological breakthroughs, these devices will remain a key component in ensuring stable and efficient signal distribution across various fields.

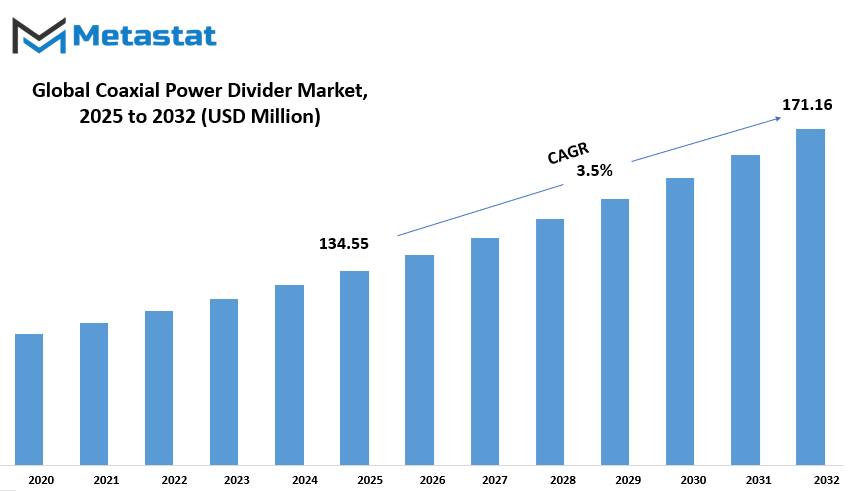

Global Coaxial Power Divider market is estimated to reach $171.16 Million by 2032; growing at a CAGR of 3.5% from 2025 to 2032.

GROWTH FACTORS

The Global Coaxial Power Divider market is witnessing high growth as there is an increased demand for advanced communication infrastructure, especially with the growth of 5G networks. As technology advances, there is a greater need for efficient signal distribution in communication systems, and coaxial power dividers are one of the most important components in such systems. They ensure smooth signal transmission, minimizing interference and maximizing overall system performance.

Their role of dealing with multi-path signals gives them a strategic position in many modern network applications. RF parts are increasingly employed in aerospace and defense applications, primarily because most navigation, surveillance, and confidential transmission require a high frequency for communication. A coaxial power divider is essentially an important tool in radar applications, satellite communication, and other electronic warfare programs. Therefore, the increasing demand for advanced and reliable RF components in these sectors further accelerates market growth.

Despite these growth opportunities, the market faces certain challenges. One major concern is performance limitations at higher frequencies. As the demand for high-speed and high-frequency applications increases, power dividers must maintain efficiency and accuracy. However, at extremely high frequencies, signal losses and performance issues can arise, limiting their effectiveness. Manufacturers must continually innovate and enhance product designs to overcome these obstacles.

One major issue is the complexity of making and designing custom applications. In many sectors, specific power dividers are needed, which necessitates raising the cost of manufacturing and development time. Customization requires significant testing and knowledge of engineering; most manufacturers lack the capacity to rapidly upscale production for such configurations. Such factors could hinder market growth, and where such players are small, the effect may be very pronounced.

Despite these, however, the market still holds promising opportunities in the continued development of IoT and wireless communication technologies. With developing systems of smart devices and connected systems, combined with the explosive growth of wireless networks, there is an increased demand for efficient solutions to the distribution of signals. Coaxial power dividers are primarily used in ensuring stable and high-quality communication in IoT applications and, hence, constitute a significant component in the future direction of wireless connectivity.

Going forward, it will be incumbent on manufacturers to make innovation their focal point along with improving product efficiency and eliminating performance challenges. Increased demand will arise from a growing need for more efficient communication infrastructure and from greater use of RF components. Businesses that spend in research and development to further develop power dividers' adaptability will gain better opportunities as demand expands within these industries.

MARKET SEGMENTATION

By Product Type

The Global Coaxial Power Divider market is one of the key sectors in the telecommunications and electronics industries, where it plays a crucial role in distributing power effectively across multiple outputs. The market is categorized into various product types, each addressing specific needs in the industry. One of the most prominent product types in this market is the Dual-Band Power Divider, which has gained much attention due to its versatility in handling two distinct frequency bands.

The market for Dual-Band Power Dividers is valued at approximately $26.65 million. This makes it one of the most important segments, as it offers both efficiency and cost-effectiveness for users in a variety of applications.

The Reactive Power Divider is the other product on offer within the market. This type functions in systems with reactive power as it distributes power within such systems. Reactive power serves various aspects like maintaining voltage in any given system for stable operation of such electrical systems. The Reactive Power Divider plays a crucial role in cases where the systems demand a specific control of such power; these include communications devices and other sensitive electronic equipment.

Unequal Power Dividers are also an essential part of the market. These dividers are designed to split the power unevenly among the outputs, which is useful in situations where specific output levels are needed for certain applications. The flexibility of Unequal Power Dividers allows them to meet various industry requirements, especially where load conditions differ between channels or outputs.

Lastly, the Wideband Power Divider is another high-demand product type. These are wideband devices, meaning they can handle broad frequencies, thus they are perfect for a number of systems requiring broad-spectrum power distribution. Due to their flexibility, Wideband Power Dividers are highly demanded in broadband networks and wide-area communications applications where covering wide frequency ranges is typical.

Each of these product types contributes to the overall growth and development of the Global Coaxial Power Divider market. As the demand for high-performance, reliable power distribution systems continues to grow across industries such as telecommunications, aerospace, and electronics, these power dividers will remain crucial components. Their ability to meet the specific power distribution needs of various systems ensures their continued importance in the market.

By Number Of Outputs

The coaxial power divider market is segmented by the number of outputs. This kind of divider is essential for the distribution of power across channels. The market has been segmented into three types, which are further available in the market: four-way dividers, three-way dividers, and two-way dividers.

Four-way dividers are power devices that distribute power to four different outputs. Such a power divider is used where the signal has to be split into multiple parts without losing its strength. In general, such dividers are used in applications where several devices or systems need to be simultaneously used, with signal integrity being a prime consideration. Their application is found in the telecommunications and radar systems where accurate power distribution is necessary.

In contrast, three-way dividers divide power between three outputs. Dividers are applied whenever there is the need to moderate the number of outputs required for a specific function. In other applications, like communication networks, dividers allow for signal transfer to more than one device or system. Because three-way dividers are versatile in their application in different industries and balance the output number with signal stability across the outputs, it is the ideal divider to be used.

There are two kinds of dividers: two-way dividers that split power into two outputs. These are used in most cases in various types of industries and are especially found in systems where power needs to be divided into two systems or devices. Two-way dividers are more utilized in very basic communication systems as they demand less than two outlets. Such circuits are economical as well and popular in industries for commercial as well as for use in large projects. As people find simplicity easier to be adapted, using this type of divisor is most probable.

Present days, a highly increased interest toward communication and signaling devices that power them causes their efficient divisors to emerge continuously. Every kind of divider has a purpose and therefore will see more expansion in this market with industrial developments. This would focus manufacturers to develop a more effective, flexible performance by dividers and, as a result, a broader application capability for such a divider. Maintaining reliability with less signal loss in power distribution would continue to propel the market.

By Frequency Range

The global coaxial power divider market is categorized into three major types based on frequency range, which include high frequency dividers, low frequency dividers, and mid-frequency dividers. Each type is defined with its specific range of frequencies; for instance, high frequency dividers, ranging from 6 GHz to 18 GHz; low frequency dividers, working within a 2 GHz frequency; and mid-frequency dividers, working within the range between 2 GHz to 6 GHz. All these frequencies have specific applications in different industries and cater to various technological requirements.

High-frequency dividers operate in 6 to 18 GHz and are typically used in advanced communication systems, radar technologies, and aerospace applications. They perform well with high-speed signals, making them suitable for cutting-edge technologies that require accurate signal distribution. On the contrary, low-frequency dividers find their applications widely in systems not requiring high speed data transmission, up to a frequency of 2 GHz. These dividers are used in older communication systems, basic signal distribution networks, and other similar areas where the performance at a high frequency is not required.

Mid-frequency dividers range between 2 to 6 GHz. They therefore offer a mid-range balance of the capabilities that both high and low frequency dividers offer. They are used in various applications, such as satellite communication, wireless infrastructure, and medical technologies. The moderate speed and frequency capabilities of these devices enable them to fulfill the needs of industries that demand such capabilities. Each of these categories of frequency ranges plays an important role in the growth and development of the coaxial power divider market as it ensures that the technology is suited to the unique demands of various applications.

In general, the coaxial power divider market is growing globally, based on heightened demand from individual sectors such as telecommunications, aerospace, and defense. Further growth in this market will be influenced by increased demands for highly efficient and reliable power dividers, based on evolving technologies. Knowledge of the various specific frequency requirements for these systems will remain essential for the design of high-performance dividers that will meet current technology's differing needs.

By End-User

The global Coaxial Power Divider market is segregated on the basis of end-users like Telecommunications, Aerospace and Defense, Automotive, Industrial Electronics, and Healthcare. These segments comprise the highest demanding industries with diverse applications of Coaxial Power Dividers.

In telecommunication, for example, it finds wide-scale use in a series of distributions to various communications. The main cause for the surge in the utilization of Coaxial Power Dividers in this sector is increased demand for speedier and more dependable communication technology, such as 5G networks. In order to distribute power efficiently in several channels, ensuring signal integrity is maintained at its best possible condition, Coaxial Power Dividers hold an important place in the circuitry. Increasing the demand for more advanced forms of communication means the telecommunications industry remains a large player in this Coaxial Power Divider market.

Another highly significant driver is the Aerospace and Defense industry. These are Coaxial Power Dividers that are critical to various applications like radar systems, satellite communication, and electronic warfare. Since reliability and high-performance equipment are essential in these sectors, Coaxial Power Dividers are usually found in advanced and critical systems where signal distribution is necessary for the system's operation. As defense technologies continue to evolve, the demand for advanced Coaxial Power Dividers will likely remain strong within this industry.

In the automotive sector, Coaxial Power Dividers are becoming increasingly used in modern vehicles and are preferred in advanced driver-assistance systems (ADAS) and autonomous driving technologies. These systems depend on high-frequency signals for radar and communication purposes, where Coaxial Power Dividers help manage the distribution of power efficiently. As the automotive industry shifts toward more connected and automated vehicles, the demand for reliable signal distribution systems will continue to fuel the growth of the Coaxial Power Divider market.

Industrial Electronics is another key market driver. Coaxial Power Dividers are used in equipment manufacturing, testing devices, and automation systems. They are utilized to distribute power in high frequency applications and make the system function smoothly in many industrial environments. As industries get more automated and technologically advanced, the requirement for reliable Coaxial Power Dividers will increase.

Lastly, the healthcare industry has begun to incorporate Coaxial Power Dividers in medical equipment that relies on high-frequency signals, such as imaging and diagnostic devices. As medical technology advances, the need for precise signal distribution in medical devices will likely expand, further boosting the demand for Coaxial Power Dividers.

Overall, these diverse end-user industries will continue to drive the growth of the global Coaxial Power Divider market, each benefiting from the increasing demand for high-performance, reliable power distribution solutions.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$134.55 million |

|

Market Size by 2032 |

$171.16 Million |

|

Growth Rate from 2024 to 2031 |

3.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

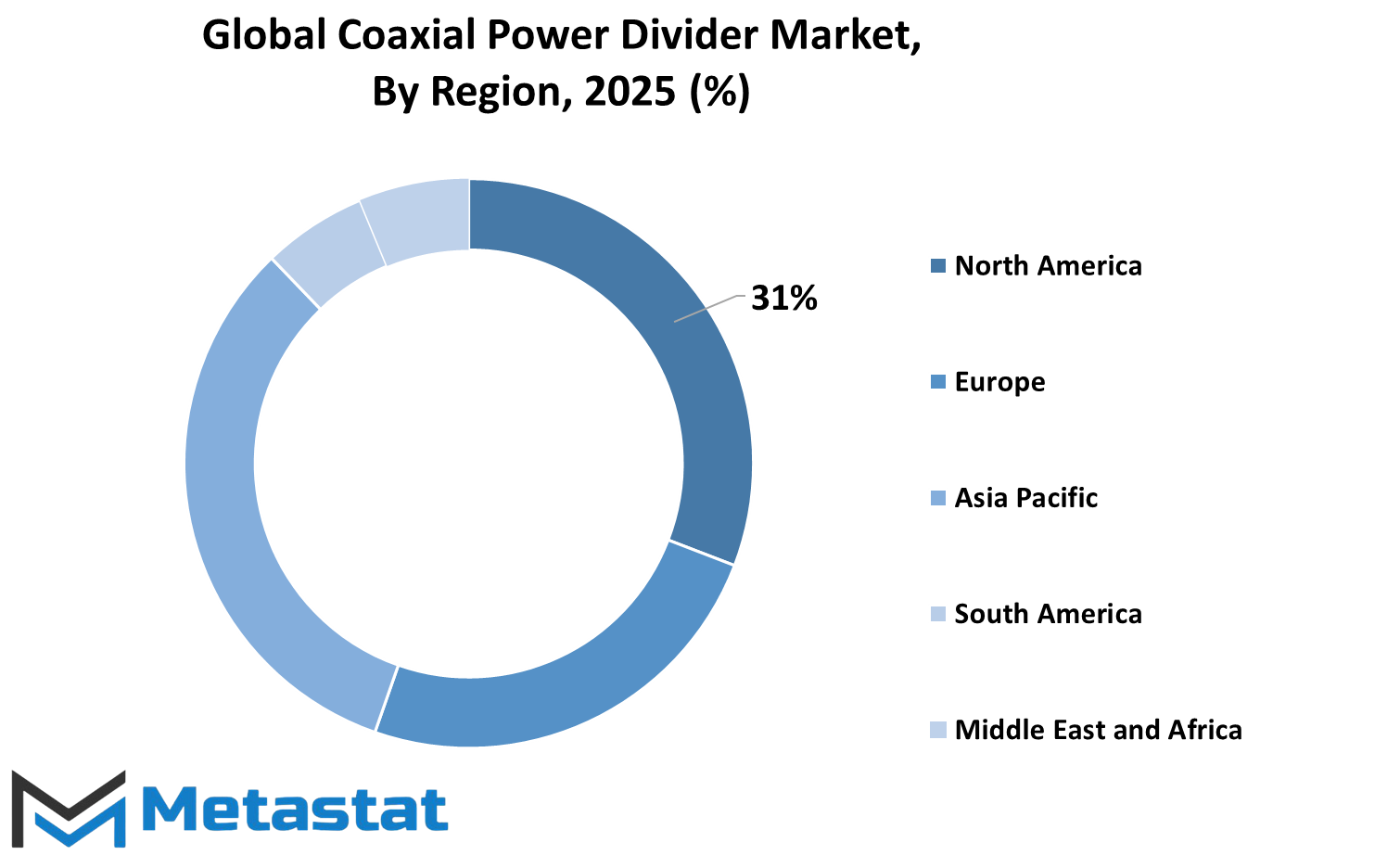

The global Coaxial Power Divider market is categorized by region, with major divisions into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. In North America, the market is further split into the United States, Canada, and Mexico. In Europe, key countries include the United Kingdom, Germany, France, and Italy, along with other parts of Europe grouped as the Rest of Europe. Asia-Pacific comprises some of the largest economies, including India, China, Japan, and South Korea.

The remaining countries in this region are categorized under Rest of Asia-Pacific. South America's market comprises countries such as Brazil and Argentina, and the remaining South American countries are grouped as the Rest of South America. The Middle East & Africa region is divided into the Gulf Cooperation Council (GCC) countries, Egypt, South Africa, and other parts of the Middle East & Africa, which are grouped as Rest of Middle East & Africa.

This segmentation allows businesses and analysts to better understand the varying demands and dynamics in each geographic area. With such a wide geographical scope, businesses looking to enter or expand within this market can tailor their strategies to specific regional characteristics. For example, North America, with its developed infrastructure and technology, is likely to experience demand driven by industries such as telecommunications and electronics, while regions like South America may face growing demand as local industries develop. Asia-Pacific is likely to be dominated by countries with the fastest-growing economies, such as China and India.

Understanding regional differences will allow companies to recognize opportunities and challenges that may arise in each part of the world. Marketing and product strategies need to be adapted to the needs and demands of each region to be successful. This also aids in anticipating trends, finding potential growth areas, and identifying methods of approaching product distribution and pricing in that region. Moreover, through its specific needs and opportunities in North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, companies would make adequate decisions and find their way in the Coaxial Power Divider market more effectively.

COMPETITIVE PLAYERS

The global coaxial power divider market is seeing significant growth, driven by the demand for effective signal distribution in various communication systems. Coaxial power dividers are essential components used to split an input signal into multiple output signals while maintaining the signal's integrity and strength. This technology finds widespread application across industries such as telecommunications, aerospace, defense, and electronics.

They have the efficiency in the power supply of several channels without significant loss in the signals. Several companies have participated in this coaxial power divider business. Some companies help the growth of this industry with their innovations in coaxial power divider solutions. Some prominent names are Werlatone, Inc. because it specializes in advanced designs with great performance.

Mini-Circuits is another leading company specialising in the production of high-quality passive components, which cater for a wide range of applications in communications. Keysight Technologies is the electronic measurement leader; besides offering a coaxial power divider suitable for a variety of applications in testing and measurement, this places it at the top in this market.

RF-Lambda specializes in developing power dividers with exceptional reliability, supporting industries such as RF and microwave systems. Pasternack Enterprises is known for its wide array of passive components, including coaxial power dividers, and its commitment to offering reliable solutions. RLC Electronics is another significant contributor to the market, offering versatile power dividers that meet the needs of different communication systems.

High-power performance dividers offered by Marki Microwave have applications in the military, aerospace, and industrial markets, hence contributing to efficient systems. Eravant, specializing in high-end coaxial power dividers, continues innovating in its products and, thus, develops solutions for customers who require tailored applications. The distribution of RF and microwave components has been enhanced through RFMW, which further ensures that good quality power dividers are availed to its customers.

Mega Industries, LLC delivers high-performance coaxial power dividers that serve both commercial and military applications. Anritsu, with its focus on advanced measurement solutions, supplies power dividers that are integral to ensuring precision in testing and signal distribution. JFW Industries is another key player, providing a broad selection of power dividers that help optimize system designs across different sectors.

R&K Company Limited and Broadwave Technologies, Inc. are also market contributors through their power dividers designed for specific industry requirements. These companies' ongoing developments and innovations in coaxial power dividers are driving the growth of the global coaxial power divider market, enabling efficient and reliable signal distribution in communication systems.

Coaxial Power Divider Market Key Segments:

By Product Type

- Dual-Band Power Dividers

- Reactive Power Dividers

- Unequal Power Dividers

- Wideband Power Dividers

By Number Of Outputs

- Four-Way Dividers

- Three-Way Dividers

- Two-Way Dividers

By Frequency Range

- High Frequency Dividers (6 to 18 GHz)

- Low Frequency Dividers (Up to 2 GHz)

- Mid Frequency Dividers (2 to 6 GHz)

By End-User Industry

- Telecommunications

- Aerospace and Defense

- Automotive

- Industrial Electronics

- Healthcare

Key Global Coaxial Power Divider Industry Players

- Werlatone, Inc.

- Mini-Circuits

- Keysight Technologies

- RF-Lambda

- Pasternack Enterprises

- RLC Electronics

- Marki Microwave

- Eravant

- RFMW

- Mega Industries, LLC

- Anritsu

- JFW Industries

- R&K Company Limited

- Broadwave Technologies, Inc

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252