Global Clot Management Devices Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

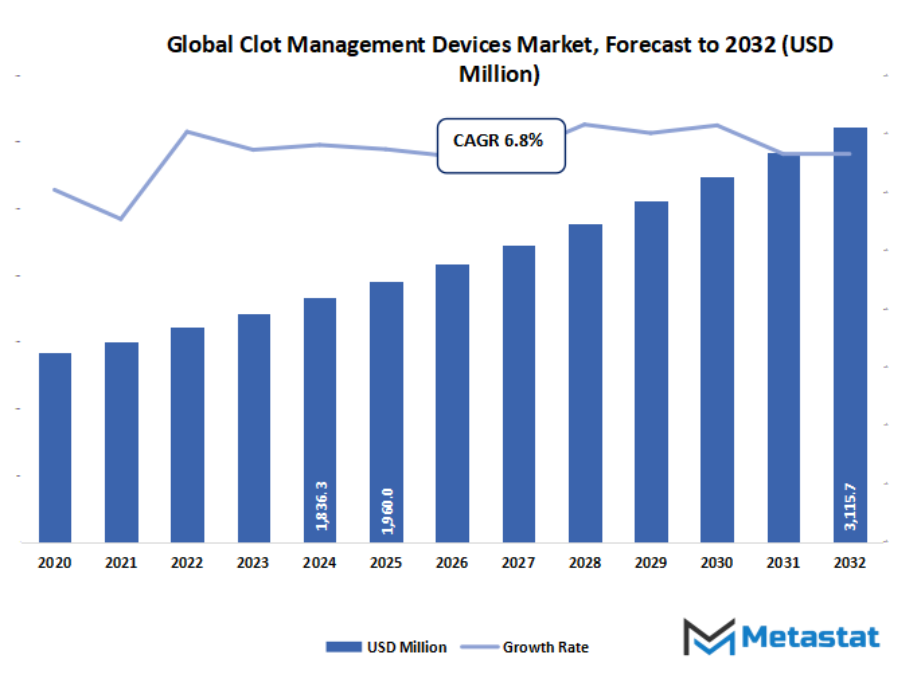

- The global clot management devices market valued at approximately USD 1960 million in 2025, growing at a CAGR of around 6.8% through 2032, with potential to exceed USD 3115.7 million.

- Embolectomy Balloon Catheters account for a market share of 15.7% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising incidence of cardiovascular and cerebrovascular diseases globally., Increasing adoption of minimally invasive thrombectomy and catheter-based systems.

- Opportunities include: Growing advancements in mechanical thrombectomy and aspiration systems.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

In the future, the global clot management devices market and its wider industry are likely to pass well beyond the boundaries that mould it today, onto a path where medical technology will assume a stronger place in everyday care. As healthcare systems continue to face changing demands, this space will evolve into one in which patient needs will drive most decisions. Development in the future will depend not only on the betterment of existing tools but also on the reshaping of how hospitals and clinics tackle urgent conditions. Rather than focusing on treatment gaps that exist today, the industry will be pushed toward the manufacture of devices capable of quickening response times and guaranteeing safer outcomes for people of all regions.

In the coming years, work associated with this market will extend beyond machines and materials. It will foster increased collaboration between doctors, engineers, and clinical researchers who will attempt to reimagine the way blood flow complications are treated. The change will not stop at technology but will also impact training as healthcare professionals become confident users of the technological advancements. Those countries that have limited access to specialized care will benefit as manufacturers explore avenues to design devices adapted to various settings, making sure that new innovations do not remain confined to large medical facilities.

Market Segmentation Analysis

The global clot management devices market is mainly classified based on Product, Percutaneous Thrombectomy Devices Type, End User.

By Product is further segmented into:

- Embolectomy Balloon Catheters

With safer and more precise approaches towards clot removal, embolectomy balloon catheters are expected to face higher demand in healthcare systems, leading to wider acceptance for smoother procedures and faster recovery pathways. This growth across advanced clinical settings will encourage better outcomes, not adding on any pressure to medical teams, thereby supporting progression in the global clot management devices market.

- Catheter-Directed Thrombolysis Devices

As modern vascular care shifts to more targeted treatment, catheter-directed thrombolysis devices will gain even stronger traction. Increased efficiency in drug delivery, reduced tissue damage, and quicker patient stabilization will become better supported. Continuous enhancement in the design will bring higher confidence among specialists and encourage more use in structured therapeutic programs.

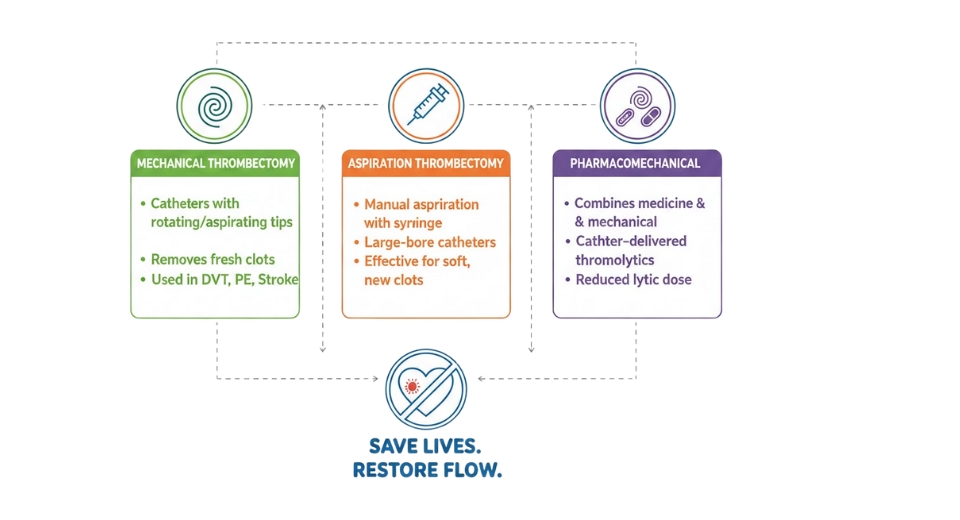

- Mechanical/Percutaneous Thrombectomy Devices

Mechanical and percutaneous thrombectomy devices will continue to expand as hospitals move toward rapid-response treatment for complex clots. Advancements will strengthen precision during emergency interventions. Reliable performance by the devices will contribute to the trend of hospitals seeking quicker restoration of blood flow, making this category a dependable contributor to progress within the broader market landscape.

- Inferior Vena Cava Filters

IVC filters will see continued growth due to increased international emphasis on prevention-based treatment. As risks associated with pulmonary embolisms become better known, proactive use of the devices-especially in high-risk cases-will continue to rise. Future upgrades will support easier placement and retrieval, further solidifying the value of these filters across care protocols.

- Neurovascular Embolectomy/Thrombectomy Devices

Neurovascular embolectomy and thrombectomy devices will continue to be in demand as the world places greater emphasis on speedier stroke intervention. Improved navigation systems and enhanced clot capture techniques will facilitate better neurological recovery. Intense investment in stroke-management infrastructure will improve acceptance and extend long-term use across specialized neurological centers.

By Percutaneous Thrombectomy Devices Type the market is divided into:

- Aspiration Thrombectomy Devices

The aspiration thrombectomy devices will attract broader attention because the simplification of clot removal will continue to draw clinical interest. Lower procedural complexity will support wider utilization, especially in time-sensitive cases. Future designs will focus on facilitating smoother navigation and stronger suction efficiency to align with a broader hospital focus on quicker decision-making and lower treatment delays.

- Percutaneous Mechanical Thrombectomy Devices

Percutaneous mechanical thrombectomy devices will be advanced through continuous upgrades that facilitate stronger clot engagement. Greater reliability will be extended to attract specialists involved in addressing complex vascular occlusions. Better designs will be able to use safer urgent care to support the adoption of minimal invasion strategies within emerging treatment settings globally in the vascular care ecosystem.

By End User the market is further divided into:

- Hospitals

They will continue to be the major end-users as the advanced treatment protocols are expanding to every emergency and critical care department. Robust investment in specialized equipment will further push hospitals to adopt newer devices for quicker clot removal. Organized training programs and increased focus on precision treatment will also further solidify adoption rates within this setting.

- Ambulatory Surgical Centers

Ambulatory surgical centers will see increased utilization as minimally invasive therapy continues to grow. Efficient case throughput will prompt centers to incorporate contemporary thrombectomy devices into standard practice. Simplified workflows and intuitive device designs will support the diffusion of the technology, especially in scheduled interventions where predictability is important for operational efficiency.

- Specialty Clinics

Specialty clinics will grow steadily as focused vascular care gains acceptance. Advanced imaging support, along with tailored therapeutic planning, allows clinics to take on more targeted cases. Continuous improvements in the safety of devices and control of procedures will make specialty clinics important contributors to the future expansion across the broader market landscape.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1960 Million |

|

Market Size by 2032 |

$3115.7 Million |

|

Growth Rate from 2025 to 2032 |

6.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

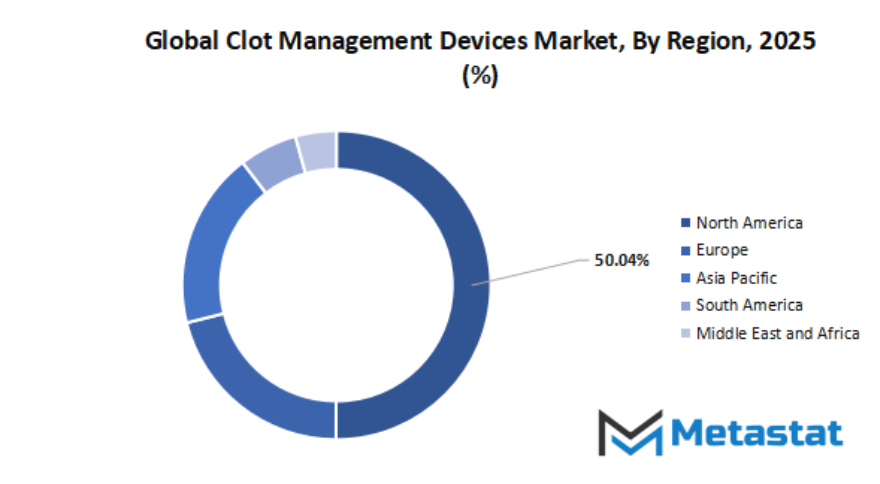

By Region:

- Based on geography, the global clot management devices market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Market Dynamics

Growth Drivers:

Increasing incidence of cardiovascular and cerebrovascular diseases worldwide.

The growing numbers of heart and brain-related clot cases will drive healthcare facilities towards adopting modern solutions within the global clot management devices market. Demand for quicker intervention tools is expected to increase with hospitals working to decrease treatment delays and further enhance survival outcomes. Such pressure for timely care will stimulate its adoption across various regions.

Growing adoption of minimally invasive thrombectomy and catheter-based systems.

Healthcare centers will continue to move toward procedures that decrease recovery time, thereby supporting stronger uptake of advanced systems in the global clot management devices market. As technology becomes safer and more accurate, and integration into routine care pathways becomes easier, there is growing confidence in minimally invasive tools.

Restraints & Challenges:

High device costs and procedural risks are limiting accessibility in developing regions.

Many hospitals in low-resource areas will find it difficult to implement premium tools offered within the global clot management devices market due to the expansion being slowed by budget restrictions and supply issues. Safety concerns around complex procedures will also discourage adoption, leaving treatment gaps in locations that are already facing limited specialist availability.

Complexity of use, requirement for skilled interventional specialists.

Advanced systems in the global clot management devices market will need professionals trained to handle sensitive procedures with no scope for errors. The opportunities for training will be limited, and unequal distribution of specialists will restrict the pace, especially in regions building early interventional infrastructure.

Opportunities:

Growing advancements in mechanical thrombectomy and aspiration systems.

The next wave of innovation in the global clot management devices market will facilitate ease of clot removal and accuracy during urgent care. Designs of new devices will support easy navigation, good control, and speedier results, thus enabling healthcare centers to respond with efficiency to complicated cases.

Competitive Landscape & Strategic Insights

The global clot management devices market has been shaped by a wide mix of long-established manufacturers and fast-growing regional companies, creating a space where constant updates on products and use of technologies will guide progress. A growing focus on safer and effective clot removal tools has encouraged steady activity, supported by steady attention from healthcare systems to support demand. Continuous improvement will be central to allowing better access to treatments for patients across different regions.

Strong participation from global names has shaped the standards in the global clot management devices market. Participants which include Medtronic Plc, Boston Scientific Corporation, Penumbra Inc, Stryker Corporation, Terumo Corporation, Edwards Lifesciences, Teleflex Incorporated, Johnson & Johnson, LeMaitre Vascular Inc, AngioDynamics Inc, Inari Medical, Cook Group Incorporated, Cardinal Health, iVascular SLU, Strub Medical GmbH & Co KG, Abbott Laboratories, Terumo Aortic, BD (Becton, Dickinson and Company), Thrombolex Inc, and Penumbra (Indigo) have been strengthening product portfolios and extending technical strengths. Competition amongst these players encourages further steady upgrades in tool protection, ease of use, and performance.

Fresh energy has been given to the global clot management devices market due to growing interest from regional manufacturers. In fact, more locally developed tools have come out that are intended for specific needs in treatments. These small companies have been advocating for affordable options, opening up access for more budget-constrained hospitals and clinics. Today, this mix of established brands and rising stars brings diversity to the table for healthcare providers, offering a greater choice based on treatment intentions or economic considerations.

Strong competition will keep pushing innovation across the global clot management devices market, with more healthcare centers adopting minimally invasive treatment methods. There will be a steady increase in demand for reliable clot removal tools, supported by continuous technical upgrades and wider product availability. As both global giants and regional manufacturers participate actively, the market will move toward safer, quicker, and more efficient options for treatment that support better recovery for the patients who depend on timely clot management solutions.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 1960 million in 2025 to over USD 3115.7 million by 2032. Clot Management Devices will maintain dominance but face growing competition from emerging formats.

In the years to come, the industry will lay more emphasis on system building that will connect data, monitoring, and treatment in a smoother way. As digital tools become more commonplace within hospitals, clot management devices will, in all probability, be coupled with tracking platforms that help medical teams act quicker. The movement will shape a future wherein decision-making is going to become more accurate as uncertainty during critical moments diminishes. Thus, the global clot management devices market will stand as a driver of ideas that will expand medical support and enable healthcare providers to respond with both skill and speed to conditions that require action instantly.

Report Coverage

This research report categorizes the Clot Management Devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Clot Management Devices market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Clot Management Devices market.

Clot Management Devices Market Key Segments:

By Product

- Embolectomy Balloon Catheters

- Catheter-Directed Thrombolysis Devices

- Mechanical/Percutaneous Thrombectomy Devices

- Inferior Vena Cava (IVC) Filters

- Neurovascular Embolectomy/Thrombectomy Devices

By Percutaneous Thrombectomy Devices Type

- Aspiration Thrombectomy Devices

- Percutaneous Mechanical Thrombectomy Devices

By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

Key Global Clot Management Devices Industry Players

- Medtronic Plc

- Boston Scientific Corporation

- Penumbra Inc

- Stryker Corporation

- Terumo Corporation

- Edwards Lifesciences

- Teleflex Incorporated

- Johnson & Johnson

- LeMaitre Vascular Inc

- AngioDynamics, Inc

- Inari Medical

- Cook Group Incorporated

- Cardinal Health

- iVascular SLU

- Strub Medical GmbH & Co KG

- Abbott Laboratories

- Terumo Aortic

- BD (Becton, Dickinson and Company)

- Thrombolex Inc

- Penumbra (Indigo)

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383