MARKET OVERVIEW

The Global Climbing Shoes Market stands as a dynamic reflection of the niche industry catering to the specific needs of climbing enthusiasts worldwide. As individuals increasingly seek adventure and fitness in unconventional ways, the climbing shoes market has emerged as a pivotal segment within the broader sports and outdoor gear industry.

In essence, the climbing shoes market is a distinctive sector dedicated to the design, production, and distribution of specialized footwear tailored to the unique demands of rock climbing and other related activities. This niche industry transcends mere commercial transactions; it embodies a fusion of technical innovation and the adventurous spirit of those who scale vertical heights.

Climbing shoes, a cornerstone of this market, are not just ordinary footwear; they are precision-engineered tools crafted to provide climbers with the necessary grip, support, and flexibility required to navigate challenging terrains. The industry’s essence lies in its commitment to pushing the boundaries of footwear technology to enhance climbers’ performance and safety.

The global nature of this market underscores its widespread impact, reaching enthusiasts from the towering cliffs of Yosemite to the rugged terrains of the Dolomites. Climbing, once confined to a select group of daredevils, has evolved into a global phenomenon, and the climbing shoes market mirrors this cultural shift.

Manufacturers within this industry are not mere suppliers; they are architects of adventure, constantly innovating to meet the evolving demands of climbers. Materials science, biomechanics, and design aesthetics converge in the laboratories of these companies, giving rise to products that seamlessly marry form and function.

The climbing shoes market thrives on the symbiotic relationship between manufacturers, retailers, and the climbing community. Retailers act as conduits, connecting the innovations of manufacturers with the aspirations of climbers. This interconnected ecosystem ensures that cutting-edge advancements in climbing shoe technology are not isolated developments but rather accessible tools for enthusiasts worldwide.

As the climbing shoes market continues to evolve, it remains inherently tied to the narrative of exploration and self-discovery. Climbers aren’t merely consumers; they are ambassadors of the brand, traversing landscapes and pushing the limits of human capability. Consequently, the market is not just about buying and selling; it’s about crafting narratives of triumph and resilience.

The Global Climbing Shoes Market is more than an industry; it’s a manifestation of human ambition and the pursuit of adventure. Through its specialized products and commitment to innovation, this market plays a crucial role in supporting and propelling the global climbing community forward, one ascent at a time.

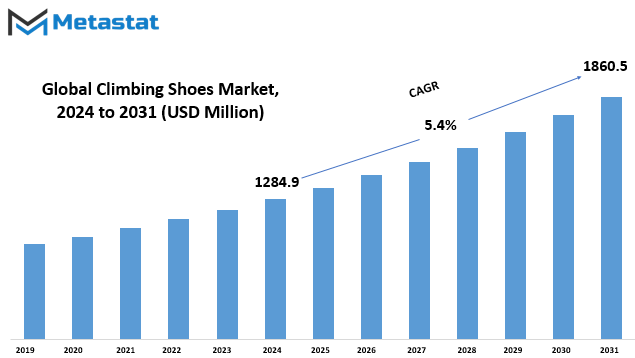

Global Climbing Shoes market is estimated to reach $1860.5 Million by 2031; growing at a CAGR of 5.4% from 2024 to 2031.

GROWTH FACTORS

The Global Climbing Shoes market is influenced by various factors that contribute to its growth. Key driving forces in this market include factors like consumer demand and technological advancements. As more individuals engage in climbing activities, the demand for climbing shoes rises, propelling market growth. Additionally, advancements in shoe technology enhance performance, attracting enthusiasts.

Nevertheless, challenges such as economic fluctuations and environmental concerns can impede the market's growth trajectory. Economic uncertainties may impact consumers' purchasing power, affecting their decision to invest in climbing shoes. Furthermore, environmental issues, like sustainability concerns in manufacturing processes, could pose challenges for market players.

Despite these hurdles, there exist promising opportunities that could fuel the market in the foreseeable future. Innovations in materials and designs, coupled with a growing awareness of fitness and outdoor activities, present lucrative prospects for the climbing shoe market. The evolving preferences of consumers towards adventure sports and fitness contribute to a positive outlook for the industry.

The Global Climbing Shoes market experiences growth driven by factors like increasing consumer interest and technological advancements. However, challenges such as economic fluctuations and environmental concerns can hinder this growth. Despite these obstacles, opportunities arise from innovations and a rising awareness of fitness trends, promising a potential upswing in the market in the coming years.

MARKET SEGMENTATION

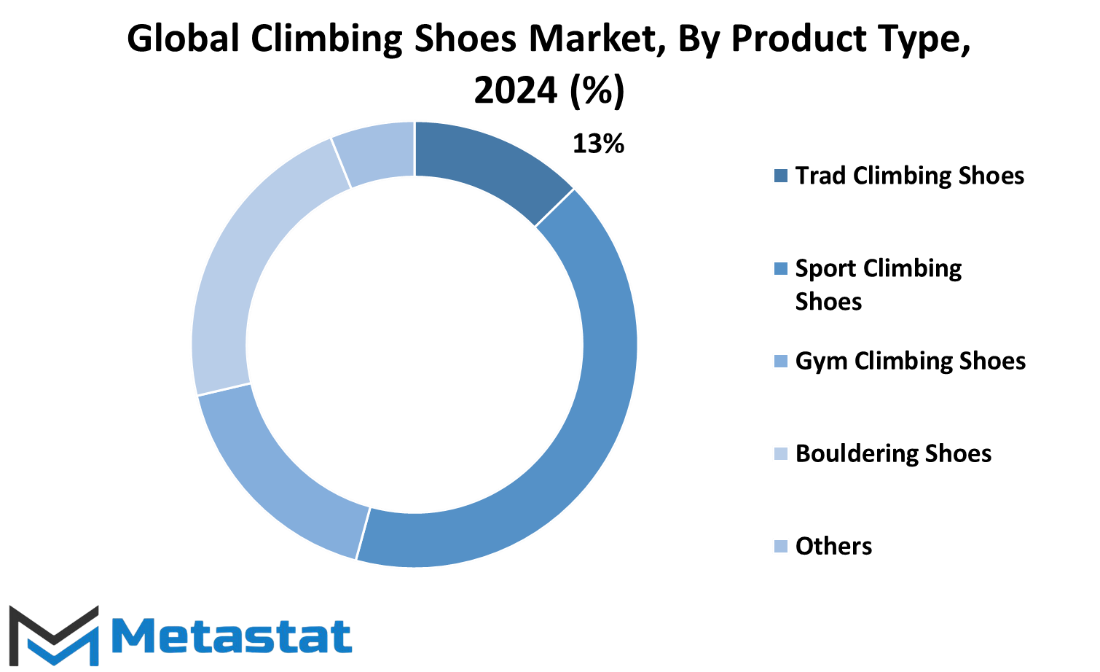

By Product Type

The global climbing shoes market, categorized by product types, includes Trad Climbing Shoes, Sport Climbing Shoes, Gym Climbing Shoes, Bouldering Shoes, and Others. This segmentation allows us to explore the diverse offerings within the climbing shoe market, catering to different preferences and needs of climbers.

Trad Climbing Shoes are designed for traditional climbing, emphasizing durability and support for various terrains. On the other hand, Sport Climbing Shoes are tailored for performance, offering a balance between comfort and precision for more dynamic climbing activities. Gym Climbing Shoes focus on indoor climbing, providing grip and comfort suitable for artificial walls.

Bouldering Shoes, designed for short yet intense climbs, prioritize sensitivity and traction. The category Others encompasses a range of specialized climbing shoes that may not fit precisely into the types, showcasing the innovation and versatility within the market.

This segmentation reflects the industry’s responsiveness to the diverse demands of climbers worldwide. As climbers seek specific attributes in their footwear, the market adapts by offering a variety of options, enhancing the overall climbing experience. Whether it’s the rugged outdoors or the controlled environment of a climbing gym, the market ensures that climbers can find the perfect footwear for their preferred climbing activity.

By Material

The global climbing shoes market is categorized based on the material used, with three primary segments: Leather, Synthetic, and Others.

Leather, a traditional material, has been a longstanding choice for climbing shoe manufacturing. Its durability and natural flexibility make it a reliable option for climbers seeking comfort and resilience during their ventures. Climbing shoes crafted from leather provide a combination of breathability and robustness, catering to the demands of both beginners and seasoned climbers.

Synthetic materials have gained prominence in the climbing shoe market. Offering a different set of advantages, synthetic shoes are often lighter and dry faster than their leather counterparts. This appeals to climbers who prioritize agility and quick-drying features in varying weather conditions. Additionally, synthetic shoes can be more cost-effective, making them an accessible choice for those entering the climbing scene.

The category labeled as ‘Others’ encompasses a range of innovative materials that have entered the climbing shoe market. These could include blends of various materials or novel substances designed to enhance specific aspects of performance. Climbing shoes falling under this category often target niche preferences, providing unique features that cater to specific climbing styles or terrains.

As climbers explore their material preferences, the market reflects a diverse array of options to accommodate different needs and preferences. Whether opting for the classic reliability of leather, the lightweight attributes of synthetic materials, or the innovative features offered by other materials, climbers can find suitable choices in the ever-evolving landscape of the global climbing shoes market.

By Category

The worldwide market for climbing shoes exhibits distinct categories, with a focus on age groups. These categories are broadly classified into Kids and Adults. In 2022, the Kids segment garnered a valuation of 939.8 USD Million, while the Adults segment closely followed with a value of 228.3 USD Million.

This segmentation provides a comprehensive view of the climbing shoes market, highlighting the economic significance within specific age demographics. The Kids category, accounting for a substantial portion of the market, signifies the demand for specialized footwear tailored to the younger generation. Meanwhile, the Adults segment, though valued slightly less, showcases a considerable market share, indicating a robust market for climbing shoes among adults.

By examining the market through the lens of age-based categories, businesses and consumers gain valuable insights into the nuanced preferences and requirements within distinct age groups. This segmentation not only aids in strategic business decisions but also enhances the consumer’s understanding of the climbing shoe market landscape.

By Distribution Channel

The global Climbing Shoes market is categorized based on its distribution channels, with two primary segments – Online and Offline. In 2022, the Online segment held a value of 481.4 USD Million, while the Offline segment was valued at 686.8 USD Million. These channels play a crucial role in determining the accessibility of climbing shoes to consumers.

The Online segment, with its valuation of 481.4 USD Million in 2022, represents the digital avenue through which climbing shoes are made available to consumers. This encompasses various online platforms and e-commerce websites where individuals can browse, select, and purchase climbing shoes conveniently from the comfort of their homes. This channel's significance lies in providing a wide array of options to consumers, enhancing their accessibility to different brands and models.

On the other hand, the Offline segment, valued at 686.8 USD Million in 2022, pertains to the traditional brick-and-mortar retail outlets. These include physical stores, specialty climbing shops, and sporting goods retailers. The Offline distribution channel continues to be a substantial contributor to the Climbing Shoes market, catering to consumers who prefer a hands-on shopping experience. It allows customers to physically try on shoes, seek expert advice, and make informed decisions before making a purchase.

The division between Online and Offline channels reflects the diverse preferences of consumers when it comes to acquiring climbing shoes. While some opt for the convenience and extensive options offered by online platforms, others find assurance and satisfaction in the tangible experience provided by physical stores. This segmentation highlights the adaptability of the Climbing Shoes market, accommodating the varied shopping behaviors of consumers in the ever-changing retail landscape.

The distribution channels of the global Climbing Shoes market, namely Online and Offline, play a pivotal role in shaping the accessibility and purchasing experience for consumers. The market thrives on the dynamic interplay between digital convenience and traditional in-store exploration, reflecting the diverse needs and preferences of climbing enthusiasts worldwide.

REGIONAL ANALYSIS

The global market for climbing shoes can be examined through a geographical lens, with distinctions drawn between North America and Europe. These regions play crucial roles in shaping the landscape of climbing shoe preferences and trends. Understanding the nuances of the North American market reveals a distinct set of preferences and demands, reflective of the diverse recreational and professional climbing scenes present in the continent. On the other side of the Atlantic, Europe presents its own unique dynamics, where factors like terrain diversity and cultural inclinations influence the choices, climbers make in their footwear.

Exploring the North American segment of the climbing shoes market unveils a spectrum of preferences driven by the diverse landscapes and climbing environments across the continent. From the granite walls of Yosemite to the ice-covered challenges in Alaska, climbers' needs vary significantly. This diversity translates into a market that embraces a wide range of climbing shoe designs and features. In regions with a strong tradition of outdoor activities, the demand for durable, all-terrain climbing shoes is prominent. Meanwhile, in urban hubs with climbing gyms, there's a surge in interest for specialized indoor climbing shoes that prioritize comfort and grip.

Across the Atlantic, the European market for climbing shoes showcases a different set of influences. The rich history of mountaineering in the Alps and the prevalence of climbing as a recreational activity contribute to a market where technical performance meets traditional craftsmanship. Climbing shoes designed for alpine ascents may find a niche market, while those catering to the climbing gym culture gain traction in urban centers. Moreover, cultural factors, such as local climbing traditions and the prominence of certain climbing disciplines, further shape the landscape of climbing shoe preferences in Europe.

The global climbing shoes market is intricately tied to geographical distinctions, notably in North America and Europe. The unique landscapes, climbing cultures, and recreational preferences in these regions contribute to a dynamic market where a variety of climbing shoe designs and features find their place. Recognizing these regional nuances is essential for manufacturers and retailers aiming to cater to the diverse needs of climbers across the globe.

COMPETITIVE PLAYERS

In today's dynamic market, the global climbing shoes sector is marked by the presence of key players driving innovation and competition. Noteworthy companies shaping the climbing shoes industry include La Sportiva Spa, Adidas AG, Tenaya, Butora, Black Diamond Equipment, Ltd, Evolv, Scarpa S.P.A., Boreal, So iLL, Mad Rock Climbing, and EDELRID GmbH & Co. KG (Red Chili Climbing).

These companies play a pivotal role in shaping the landscape of climbing footwear. La Sportiva Spa, for instance, has demonstrated its commitment to quality and performance, contributing significantly to the industry's advancements. Adidas AG, a prominent name in the global market, brings its expertise to the climbing shoes arena, ensuring a diverse and competitive market environment.

Tenaya, Butora, and Black Diamond Equipment Ltd each contribute their unique strengths, adding depth and variety to the available climbing shoe options. Evolv, Scarpa S.P.A., and Boreal also play integral roles, catering to different preferences and needs within the climbing community.

The inclusion of So iLL, Mad Rock Climbing, and EDELRID GmbH & Co. KG (Red Chili Climbing) further enriches the market, showcasing a wide array of styles and functionalities. The collaboration and competition among these key players foster a climate of continuous improvement, benefiting climbers worldwide.

The global climbing shoes market is vibrant and diverse, thanks to the significant contributions of key players such as La Sportiva Spa, Adidas AG, Tenaya, Butora, Black Diamond Equipment, Ltd, Evolv, Scarpa S.P.A., Boreal, So iLL, Mad Rock Climbing, and EDELRID GmbH & Co. KG (Red Chili Climbing). Their collective impact ensures that climbers have access to a range of high-quality options, ultimately enhancing the overall climbing experience.

Climbing Shoes Market Key Segments:

By Product Type

- Trad Climbing Shoes

- Sport Climbing Shoes

- Gym Climbing Shoes

- Bouldering Shoes

- Others

By Material

- Leather

- Synthetic

- Others

By Category

- Kids

- Adults

By Distribution Channel

- Online

- Offline

Key Global Climbing Shoes Industry Players

- La Sportiva Spa

- Adidas AG

- Tenaya

- Butora

- Black Diamond Equipment, Ltd

- Evolv

- Scarpa S.P.A.

- Boreal

- So iLL

- Mad Rock Climbing

- EDELRID GmbH & Co. KG (Red Chili Climbing)

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252