MARKET OVERVIEW

The Global Chestnut Market within the agricultural sector, where the cultivation and trade of chestnuts have emerged as a significant economic force. Spanning diverse geographies and climates, this market encapsulates the intricate web of activities associated with the production, distribution, and consumption of chestnuts worldwide.

From the sprawling chestnut orchards in Europe to the burgeoning plantations in Asia and the Americas, each locale contributes its unique flavor profile to the global chestnut tapestry. The market's fabric is woven not only with the distinct varieties of chestnuts but also with the cultural and culinary traditions that accompany them.

In recent years, the global chestnut market has witnessed a paradigm shift in consumer preferences and buying patterns. The demand for chestnuts, once primarily seasonal, has evolved into a year-round phenomenon. This shift is driven by the increasing recognition of chestnuts as a versatile and healthy ingredient in various cuisines. As consumers become more health-conscious, chestnuts, with their nutritional benefits and culinary adaptability, have carved a niche for themselves in the contemporary gastronomic landscape.

The market dynamics are further influenced by the intricate supply chain mechanisms that ensure a steady flow of chestnuts from the orchards to the end consumers. Logistics, storage, and transportation play pivotal roles in maintaining the freshness and quality of chestnuts, especially given their perishable nature. Producers and distributors must navigate the challenges posed by seasonality, ensuring a seamless transition from harvest to market shelves.

In addition to direct consumption, the global chestnut market finds itself entwined with various secondary industries. Processed chestnut products, ranging from chestnut flour to purees and extracts, cater to a diverse array of food and beverage applications. This diversification adds value to chestnuts and contributes to the market's sustainability by minimizing waste and optimizing resource utilization.

Furthermore, the global chestnut market is not isolated from external factors such as climate change and sustainability concerns. As weather patterns become increasingly unpredictable, chestnut growers face challenges in maintaining consistent yields. Sustainable farming practices are gaining traction, with an emphasis on environmentally friendly cultivation methods and ethical labor practices.

The Global Chestnut Market is a multifaceted domain that mirrors the rich tapestry of agricultural practices, culinary traditions, and economic forces worldwide. As the demand for chestnuts continues to rise, the market's evolution is marked by adaptability, sustainability, and a deep-rooted connection to cultural and culinary heritage.

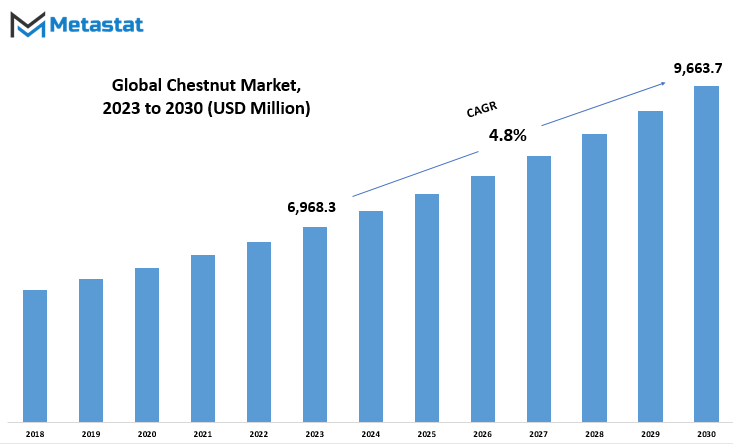

Global Chestnut market is estimated to reach $9,663.7 Million by 2030; growing at a CAGR of 4.8% from 2023 to 2030.

GROWTH FACTORS

The Global Chestnut Market is currently experiencing significant growth, driven primarily by factors such as increasing consumer demand and the rising awareness of the nutritional benefits associated with chestnuts. These factors contribute to a positive trajectory for the market.

Consumers' growing interest in healthy eating habits and the nutritional value of chestnuts propel the market forward. Chestnuts are gaining popularity as a nutritious snack and a versatile ingredient in various culinary applications. This increasing demand aligns with a broader trend of health-conscious consumer choices, driving the market's upward momentum.

Moreover, the awareness of chestnuts being gluten-free and rich in fiber and antioxidants further adds to their appeal. This nutritional profile positions chestnuts as a favorable option for individuals seeking healthier food alternatives. As a result, the market benefits from this shift in consumer preferences toward wholesome and nutritious options.

However, like any market, challenges exist that could impede its growth. Factors such as changing climatic conditions and potential supply chain disruptions may pose obstacles to the smooth progression of the chestnut market. These challenges emphasize the vulnerability of agricultural markets to external factors, highlighting the need for adaptive strategies within the industry.

Additionally, fluctuations in market prices and the need for proper storage and handling of chestnuts may present hurdles for market players. Ensuring the quality and freshness of chestnuts throughout the supply chain becomes crucial in maintaining consumer satisfaction and market stability.

Despite these challenges, there remain promising opportunities for the Global Chestnut Market. Innovations in processing and packaging technologies, coupled with strategic marketing efforts, can open new avenues for market growth. Exploring diverse applications for chestnuts in the food industry, such as in gluten-free products or as a sustainable alternative in various recipes, holds potential for expanding market reach.

Furthermore, the growing trend of plant-based diets provides a substantial opportunity for the chestnut market. As more consumers opt for plant-based alternatives, incorporating chestnuts into plant-based products or marketing them as a nutritious plant-based snack can attract a broader consumer base.

The Global Chestnut Market is propelled by increasing consumer awareness of the nutritional benefits of chestnuts and a broader shift toward healthier food choices. While challenges like climate-related uncertainties and supply chain disruptions exist, opportunities arise through technological innovations and the growing demand for plant-based and nutritious food options. The market's trajectory depends on the industry's ability to navigate challenges and leverage opportunities effectively.

MARKET SEGMENTATION

By Product Type

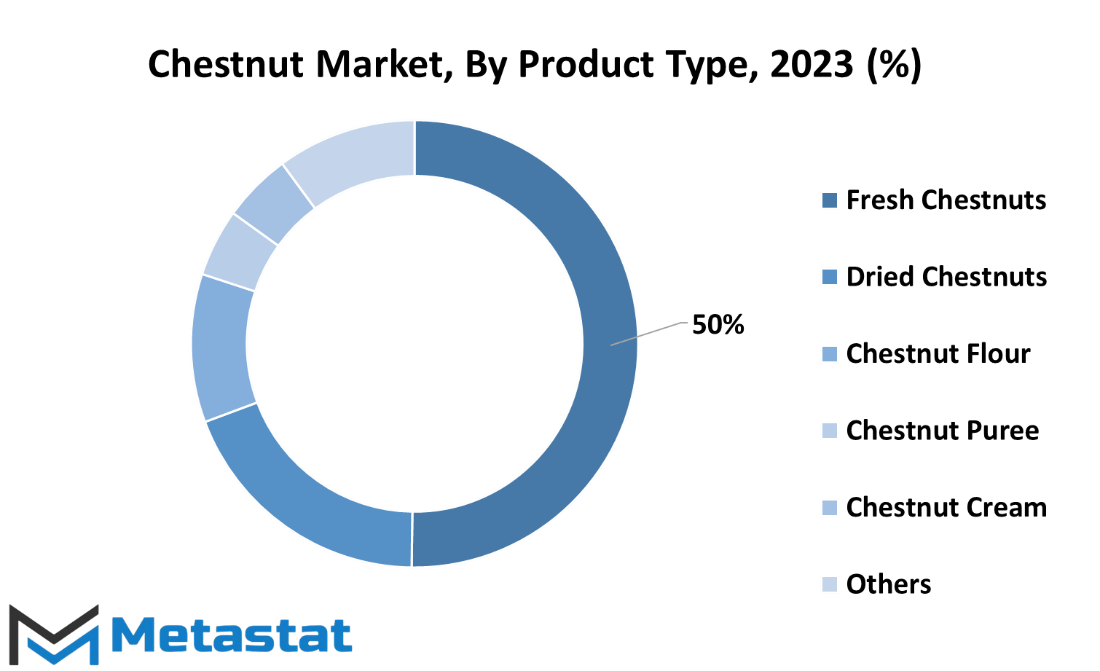

The global chestnut market is divided by product type into various segments, catering to different consumer preferences and culinary applications. These segments encompass Fresh Chestnuts, Dried Chestnuts, Chestnut Flour, Chestnut Puree, Chestnut Cream, and a category labeled as Others.

Fresh Chestnuts represent the unprocessed, raw form of this nut, offering a natural and wholesome option for those who prefer the authentic taste and texture. Dried Chestnuts, on the other hand, undergo a dehydration process, resulting in a product with an extended shelf life and concentrated flavor.

Chestnut Flour caters to culinary enthusiasts who seek a versatile ingredient for baking and cooking. It adds a unique flavor profile to various dishes, making it a popular choice in different cuisines. Chestnut Puree, derived from the pulpy consistency of the nut, serves as a convenient option for those looking to incorporate chestnut essence into their recipes without the hassle of processing the nuts themselves.

Chestnut Cream, another product variant, provides a smooth and spreadable texture, suitable for both sweet and savory applications. Its versatility makes it an appealing choice for consumers who desire a ready-to-use chestnut-based product. Lastly, the category labeled as Others encompasses a range of chestnut-derived products that may not fit neatly into the aforementioned categories, presenting an opportunity for innovation and diverse culinary experiences.

This segmentation not only caters to varying consumer preferences but also reflects the adaptability of chestnuts in different culinary contexts. Whether one prefers the unaltered freshness of the nut or the convenience of pre-processed forms, the global chestnut market ensures a diverse array of options for consumers to explore and enjoy.

By Application

The global chestnut market exhibits a distinct trend in its segmentation based on application, primarily categorized into online sales and offline sales. In 2022, the online sales segment held a value of 570.4 USD million, while the offline sales segment boasted a valuation of 5997.3 USD million.

This market division underscores the diverse channels through which chestnuts reach consumers. Online sales, with their 570.4 USD million valuation, represent the transactions conducted through digital platforms. In contrast, offline sales, valued at 5997.3 USD million, encapsulate the traditional brick-and-mortar retail landscape.

The dichotomy between online and offline sales reflects the evolving dynamics of consumer behavior. Online platforms offer convenience, enabling consumers to make chestnut purchases from the comfort of their homes. On the other hand, offline sales maintain a substantial presence, highlighting the enduring appeal of physical stores and the traditional shopping experience.

Analyzing the market in this manner provides valuable insights for businesses and stakeholders, allowing them to adapt strategies based on the distinct characteristics of each segment. It is evident that the chestnut market is shaped by the interplay of online and offline channels, emphasizing the importance of a comprehensive approach to meet the diverse preferences of consumers.

The global chestnut market’s segmentation by application into online and offline sales delineates the dual avenues through which chestnuts are made available to consumers. The 570.4 USD million valuation for online sales and the 5997.3 USD million valuation for offline sales underscore the coexistence of digital and traditional retail channels in the ever-changing landscape of consumer preferences and market dynamics. This nuanced understanding is crucial for stakeholders seeking to navigate the complexities of the chestnut market and tailor their strategies accordingly.

By Distribution Channel

The Global Chestnut Market is segmented based on its distribution channels, providing insights into the various avenues through which chestnuts reach consumers. In 2022, the market exhibited a diverse landscape with distinct values associated with different distribution channels.

Supermarkets and hypermarkets stand out as major players, accounting for a significant portion of the market share. This segment boasted a valuation of 3995.6 USD Million in 2022. These large-scale retail outlets serve as go-to destinations for a wide array of consumers, offering convenience and variety under one roof.

Convenience stores also play a noteworthy role in the chestnut market, contributing to its overall economic significance. Valued at 1292.5 USD Million in 2022, these smaller, easily accessible stores cater to consumers seeking a quick and hassle-free shopping experience.

Specialty stores, with their focus on specific product categories, form another integral part of the chestnut distribution network. In 2022, this segment was valued at 708.2 USD Million. These stores, often known for their expertise and curated selections, attract consumers looking for a more specialized shopping environment.

The rise of digital platforms has significantly impacted various markets, including chestnuts. The online retail segment, valued at 571.4 USD Million in 2022, has gained prominence as an accessible and convenient channel for consumers. This trend reflects a shift in consumer behavior towards embracing the convenience of online shopping for chestnut products.

The Global Chestnut Market exhibits a dynamic distribution channel landscape, with supermarkets/hypermarkets, convenience stores, specialty stores, and online retail contributing significantly to its overall valuation. This segmentation provides a comprehensive understanding of how chestnuts are made available to consumers, catering to diverse preferences and shopping behaviors in the market.

By End User

The global chestnut market is segmented based on end users into three categories: households, food services, and industrial. This division allows us to better understand and analyze the various sectors that contribute to the overall chestnut market dynamics.

Households, as a significant end user, represent the individual consumers who purchase chestnuts for personal consumption. This category encompasses a wide range of people, from families seeking nutritious and flavorful additions to their meals to individuals incorporating chestnuts into their regular diet. The demand from households is influenced by factors such as taste preferences, nutritional awareness, and cultural practices related to chestnut consumption.

Food services constitute another crucial segment of the chestnut market. This category involves businesses and establishments in the food industry, such as restaurants, cafes, and catering services, that integrate chestnuts into their culinary offerings. The demand from food services is influenced by trends in gastronomy, consumer preferences for unique and diverse menu options, and the overall appeal of chestnuts in various cuisines.

The industrial segment in the chestnut market involves the use of chestnuts as ingredients in the production of various food products and derivatives. This includes the manufacturing of chestnut flour, purees, and extracts for use in different food items. The industrial sector utilizes chestnuts as a raw material to create processed goods that find their way to consumers through various distribution channels.

Understanding the distribution of the chestnut market among these end users provides valuable insights into the diverse ways in which chestnuts are integrated into different aspects of our lives. From individual households seeking a healthy snack to restaurants experimenting with innovative recipes, and industrial processes transforming chestnuts into versatile food products, the end user segmentation sheds light on the varied dimensions of the global chestnut market. This segmentation is crucial for stakeholders, allowing them to tailor their approaches and offers to meet the specific needs and preferences of each end user category.

REGIONAL ANALYSIS

The global chestnut market exhibits a diverse landscape, shaped by geographical distinctions. Geographically, the market is segmented into North America and Europe. These regions play pivotal roles in influencing the dynamics of the chestnut market, each with its unique characteristics and contributions.

In North America, the chestnut market reflects the preferences and demands of consumers in this region. Factors such as local culinary traditions, dietary habits, and economic considerations all come into play, shaping how chestnuts are perceived and utilized. The market in North America is a dynamic interplay of supply and demand, responding to the needs and tastes of the population.

Similarly, Europe stands as a distinct player in the global chestnut market. Here, the cultural significance of chestnuts often intertwines with historical culinary practices. The market dynamics in Europe are influenced by traditions, seasonal preferences, and the integration of chestnuts into various regional cuisines. Understanding these regional nuances is crucial for businesses and stakeholders involved in the chestnut market in Europe.

The geographical division serves as a practical framework for understanding and navigating the chestnut market on a global scale. It acknowledges the regional variations in consumption patterns, market trends, and cultural associations with chestnuts. The North American and European segments, while part of the same global market, represent microcosms of diverse consumer behaviors and market dynamics.

Ultimately, the global chestnut market's segmentation into North America and Europe offers a nuanced perspective, allowing stakeholders to tailor their strategies to the unique characteristics of each region. By recognizing the distinct influences of North American and European markets, businesses can better navigate the multifaceted world of chestnut consumption, meeting the specific needs and expectations of consumers in each geographical domain.

COMPETITIVE PLAYERS

The global chestnut market is a vibrant arena, and pivotal players contribute significantly to its dynamics. Among the key players in the chestnut industry are Chestnut Growers, Inc., and the Royal Nut Company. These entities play a crucial role in shaping the landscape of the chestnut market, each bringing its unique strengths and contributions.

Chestnut Growers, Inc. stands as a prominent force in the industry, recognized for its expertise in chestnut cultivation. With a focus on quality and sustainable practices, the company has earned a reputation for providing premium chestnuts to the market. Their commitment to excellence resonates with consumers and contributes to the overall growth of the chestnut sector.

On the other hand, the Royal Nut Company adds its own flavor to the market dynamics. Renowned for its extensive experience and a commitment to innovation, this key player brings a fresh perspective to chestnut processing and distribution. The Royal Nut Company's presence in the industry signifies a dedication to meeting the diverse demands of consumers and ensuring a steady supply of chestnuts worldwide.

Together, Chestnut Growers, Inc., and the Royal Nut Company showcase the collaborative and competitive spirit within the global chestnut market. Their operations extend across various facets of the chestnut industry, from cultivation to processing and distribution. This synergy contributes to the overall resilience and growth of the chestnut market, providing consumers with a consistent and diverse supply of this beloved nut.

These key players exemplify the dynamic nature of the global chestnut market. Their roles extend beyond mere participation; they are integral contributors shaping the industry's trajectory. As the chestnut market continues to evolve, the influence of key players like Chestnut Growers, Inc., and the Royal Nut Company becomes increasingly vital, driving innovation, ensuring quality, and meeting the ever-changing demands of consumers worldwide.

Chestnut Market Key Segments:

By Product Type

- Fresh Chestnuts

- Dried Chestnuts

- Chestnut Flour

- Chestnut Puree

- Chestnut Cream

- Others

By Application

- Online Sales

- Offline Sales

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

By End User

- Households

- Food Services

- Industrial

Key Global Chestnut Industry Players

- Chestnut Growers, Inc.

- Royal Nut Company

- Route 9 Cooperative

- Roland Foods, LLC.

- SupHerb Farms

- Voyou (M'Lord)

- Conagra Foodservice, Inc. (LA Choy)

- Kingfisher Foods Limited

- Windmill Organics Ltd (Amisa)

- Battistini Vivai

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252