Global Ceramic Adhesives Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global ceramic adhesives market will be an interesting experience from the start to the years that come. Its start goes back to the early twentieth century when rudimentary ceramic adhesives were found to withstand the extreme heat of production ovens as well as engine components. Initial formulations were largely made of naturally occurring clays and simple silicate materials, offering limited strength and thermal resistance. Over the decades, there has been testing with synthetic materials and refractory chemicals which enabled the adhesives to withstand severer conditions, reaching major milestones that would ultimately determine the character of the market. In the mid-20th century, the automotive and aerospace sectors had started looking at ceramic adhesives as a possible tool for application in precision thermal insulation and structural applications, and this was an industrial application change and research shift.

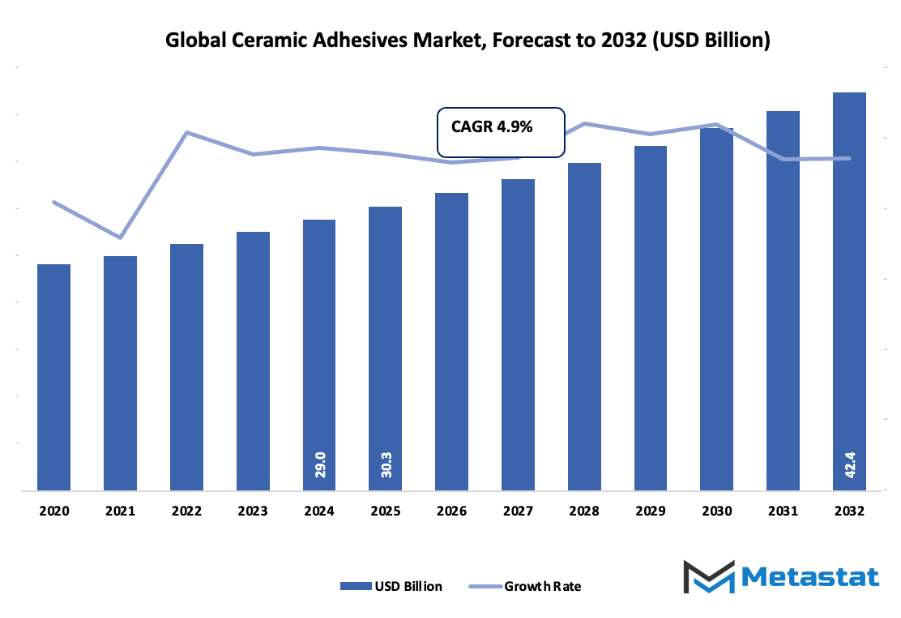

- Global ceramic adhesives market size of approximately USD 30.3 Billion in the year 2025, growing at a rate of approximately 4.9% during 2032, with a potential to reach more than USD 42.4 Billion.

- Cement-Based hold around 40.0% market share and are driving innovation and greater utilization through intense research.

- Growth drivers: Rise in demand for high-temperature resistant adhesives in industrial applications, growth in the electronics and automotive industries with applications of ceramic-based materials

- Opportunities are: Development of nanotechnology-based ceramic adhesives for extra strength and durability

- Key insight: The market will grow exponentially in value over the next ten years, with scope for high growth.

As the business developed, so did that of consumers and business. Higher-temperature resistance, chemical resistance, and adhesion to varied substrates were demanded by sophisticated machinery, electronics, and manufacturing processes.

This necessitated manufacturers to experiment, adding inorganic polymers and high-performance ceramics to their recipes. Advances in nanomaterials technology and surface treatment processes also further improved adhesive performance to make possible its use in industries previously incompatible with ceramic bonding technology. Advances in workplace and environmental protection further shaped product development towards eliminating toxic solvents and substitution with "green" alternatives. Worldwide awareness of sustainability will continue to affect the market in subsequent years. Adhesive manufacturers will aim to make adhesives that use less energy during curing and emit fewer emissions when used. Growing demands for electronics, medical devices, and clean-energy transportation systems will also stimulate demand for advanced ceramic adhesives in untapped markets.

Strategic alliances between industry partners and research institutions will push the development of specialized products that can address stringent future requirements. From humble origins with simple clay-based products to the high-tech materials currently manufactured, the world market for ceramic adhesives will continue to evolve, driven by emerging technology, changing industry demand, and changing environmental requirements. The market not only will increase in size but also change in terms of complexity and usage, writing the next chapter on industrial bonding solutions.

Market Segments

The global ceramic adhesives market is mainly classified based on Chemistry-Type, Application, , .

By Chemistry-Type is further segmented into:

- Cement-Based: Cement-based adhesives find extensive application for bonding materials in construction and repair work. Cement-based adhesives possess great bonding, extended durability, and ability to survive intense weather conditions. Cement-based adhesives are ideally used where stability and long durability are issues. Worldwide Ceramic Adhesives market finds consistent demand for cement-based ones because they are reliable and affordable.

- Epoxy: Adhesives made from epoxy are chemically and heat-resistant with high strength. Adhesives based on epoxy are applied in applications that require strong and permanent bonding. In the international Ceramic Adhesives market, epoxy types are in demand in precision and performance-based applications requiring ceramic substrate adhesives.

- Acrylic: Acrylic adhesives offer rapid curing and high bonding strength to a variety of surfaces. They are used due to their capability to bond difficult-to-bond materials and perform in other conditions. The Ceramic Adhesives market across the world is favorably impacted by acrylic adhesives when rapid setting and multi-use functions are necessary.

- Silicone: Silicone adhesives are temperature-stable, flexible, and moisture- and UV-resistant. They are employed widely where elasticity and longevity are needed. The world Ceramic Adhesives market employs silicon-based adhesives for wherever endurance and flexibility over a long period are needed.

- Cyanoacrylate: Cyanoacrylate adhesives set fast and are extremely accurate. They are most suitably applied for small or fragile ceramic usage where instant adhesion is required. In the international market of Ceramic Adhesives, cyanoacrylate forms are a serious consideration wherein speed and efficiency are paramount.

- Other: Specialty types of chemistry are specialty adhesives which have special or unusual applications. They have niche applications which are not served by generic adhesives. global ceramic adhesives market encompasses such options to meet special needs and increase the options for bonding ceramics.

By Application the market is divided into:

- Building & Construction: Mechanical and building construction is the largest generator of demand for ceramic adhesives. They are used in flooring, tiling, and structural applications to form robust, durable bonds. The world Ceramic Adhesives market depends on this industry to create consistent growth and regular product usage in bulk application.

- Dental: Dental employs ceramic adhesives to cement crowns, prosthetics, and dental restorations. Adhesives have to be biocompatible, tough, and reliable. The world Ceramic Adhesives market has greater consumption of dental-specific adhesives owing to growing demand for dental services and improved restorative care.

- Other: Other uses include industries such as consumer goods, automotive, and electronics. These adhesives are used for specific applications, adding strength, accuracy, and performance to different materials. global ceramic adhesives market grows with these other uses, providing solutions outside the traditional building and dental sectors.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$30.3 Billion |

|

Market Size by 2032 |

$42.4 Billion |

|

Growth Rate from 2025 to 2032 |

4.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

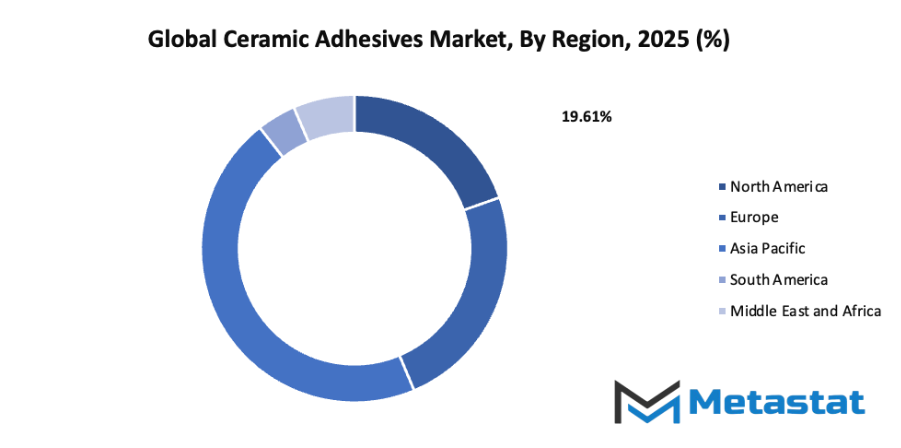

By Region:

- Based on geography, the global ceramic adhesives market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising demand for high-temperature resistant adhesives in industrial applications: The global ceramic adhesives market will grow as industries increasingly require adhesives that can withstand high temperatures. Applications in manufacturing, aerospace, and heavy machinery rely on these adhesives for reliable performance, ensuring safety and efficiency in demanding conditions.

- Growth of the electronics and automotive sectors utilizing ceramic-based materials: Expansion in electronics and automotive industries will drive the global ceramic adhesives market. Ceramic-based materials are preferred for their heat resistance and stability, making them essential in electronic components and automotive parts that face extreme operational conditions.

Challenges and Opportunities

- High cost of raw materials and processing: The high cost of raw materials and processing will limit widespread adoption in some sectors. Manufacturing ceramic adhesives involves complex procedures and expensive components, which increases overall production costs and affects pricing strategies in the global ceramic adhesives market.

- Limited flexibility and potential brittleness under mechanical stress: Ceramic adhesives often face challenges due to brittleness and limited flexibility. Under mechanical stress, the adhesives may crack or fail, which creates difficulties in applications requiring both strength and adaptability, impacting the growth potential of the global ceramic adhesives market.

Opportunities

- Advancement in nanotechnology-based ceramic adhesives for enhanced strength and durability: Development of nanotechnology-based ceramic adhesives will create opportunities in the global ceramic adhesives market. These adhesives will offer improved strength, durability, and performance under extreme conditions, making them suitable for advanced industrial, electronic, and automotive applications.

Competitive Landscape & Strategic Insights

The global ceramic adhesives market is expected to grow significantly in the coming years, driven by a combination of innovation, increasing construction activities, and rising demand for durable materials. The industry is a mix of both international industry leaders and emerging regional competitors, which ensures a dynamic and competitive environment. Important competitors include 3M Company, Saint-Gobain Weber, Bostik, Terraco Holdings Limited, Sika AG, Fosroc, Inc., Accumet Materials Co., Laticrete International, BASF SE, Aremco Products, Inc., Mapei S.p.A., Norcros Adhesives, ARDEX GmbH, H.B. Fuller Construction Products, Cotronics Corp, and Toagosei America, Inc. These companies will continue to shape the market through innovative product offerings, advanced adhesive technologies, and strategic expansions.

Looking toward the future, the ceramic adhesives market will see an increased focus on environmentally friendly and high-performance products. Companies are likely to invest in research and development to produce adhesives that are stronger, longer-lasting, and easier to apply, while meeting stricter environmental standards. Regional competitors will continue to emerge, bringing tailored solutions to local markets and challenging established players with cost-effective and specialized offerings. The industry will also benefit from growing urbanization and infrastructure projects, which will raise the demand for reliable adhesives in both residential and commercial construction.

Technological advancements will play a major role in the evolution of the market. Innovations in chemical formulations and nanotechnology will allow adhesives to perform under extreme conditions, resist wear and tear, and maintain adhesion over time. Companies such as Sika AG and BASF SE will likely lead in integrating smart materials that respond to environmental changes, enhancing durability and efficiency. Additionally, strategic partnerships and collaborations between global leaders and regional players will help expand market reach, accelerate product development, and provide competitive advantages in emerging markets.

Market size is forecast to rise from USD 30.3 Billion in 2025 to over USD 42.4 Billion by 2032. Ceramic Adhesives will maintain dominance but face growing competition from emerging formats.

Overall, the future of the global ceramic adhesives market will be marked by growth, innovation, and collaboration. Both international leaders and regional competitors will contribute to advancements in product performance, sustainability, and market expansion. The combination of technological progress, increasing construction demand, and a competitive landscape will ensure that ceramic adhesives remain essential in the construction and industrial sectors for years to come.

Report Coverage

This research report categorizes the global ceramic adhesives market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global ceramic adhesives market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global global ceramic adhesives market.

Ceramic Adhesives Market Key Segments:

By Chemistry-Type

- Cement-Based

- Epoxy

- Acrylic

- Silicone

- Cyanoacrylate

- Other

By Application

- Building & Construction

- Dental

- Other

Key Global Ceramic Adhesives Industry Players

- 3M Company

- Saint-Gobain Weber

- Bostik

- Terraco Holdings Limited

- Sika AG

- Fosroc, Inc.

- Accumet Materials Co.

- Laticrete International

- BASF SE

- Aremco Products, Inc.

- Mapei S.p.A.

- Norcros Adhesives

- ARDEX GmbH

- H.B. Fuller Construction Products

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383