Global Cardiovascular Devices Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global cardiovascular devices market progressed from modest beginnings to become one of the most dynamic areas of medical technology. During the early decades of modern medicine, cardiovascular therapy was largely characterized by primitive surgical instruments and manual diagnostic devices. It wasn't until after the mid-twentieth century that innovations like pacemakers, heart valves, and angioplasty catheters began revolutionizing patient therapies. These innovations saved lives but also laid the groundwork for a market that would keep growing in terms of size and complexity.

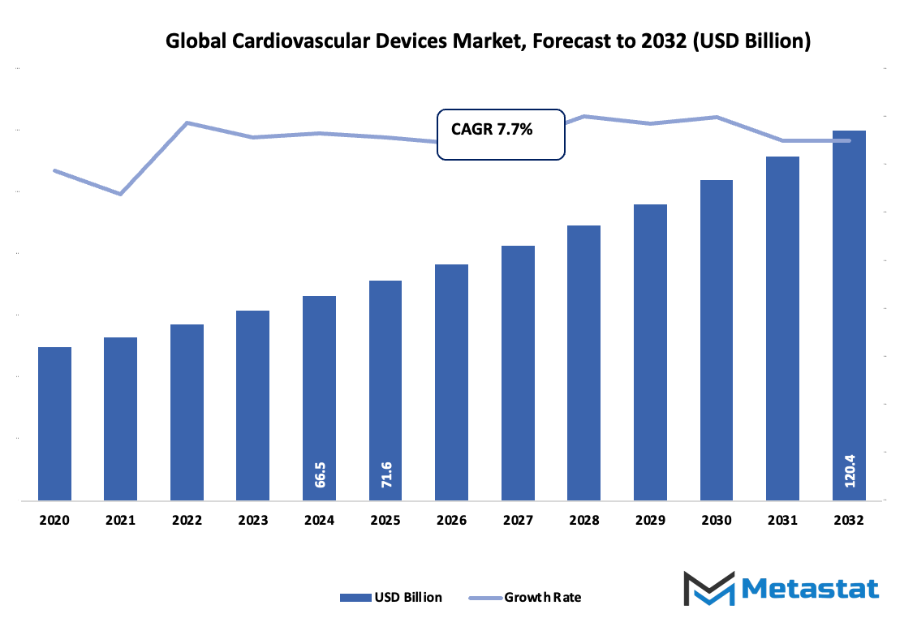

- Global cardiovascular devices market worth about USD 71.6 billion in 2025, growing at a CAGR of about 7.7% between the period 2032 with the potential to reach over USD 120.4 billion.

- ECG hold about 25.2% market share, fueling innovation and advanced uses through vigorous research.

- Key growth drivers: Increasing incidence of cardiovascular disease and ageing population, Technological innovation in minimally invasive and implantable devices

- Key opportunities: Broader uptake of remote monitoring and artificial intelligence-based cardiac care solutions

- Key insight: The market will grow exponentially in value over the next decade, demonstrating great opportunities for expansion.

- With growing populations and healthcare infrastructures, the demand for improved heart treatments spurred producers to test new designs, materials, and miniaturization.

Development of drug-eluting stents was one of the first significant milestones, revolutionizing the treatments employed by doctors treating coronary artery disease. Subsequently, availability of implantable cardioverter defibrillators and ventricular assist devices altered treatment routines further, bringing sophisticated cardiac support even nearer reach. What started as an invasive surgery-dominated trend will now be transformed into less invasive, patient-focussed options that offer faster recovery with reduced complications. Regulatory environments also had a pivotal role in determining the configuration of the global cardiovascular devices market. Regulation initially targeted product quality and safety, but in the future, approval mechanisms will be flexible enough to enable innovation to thrive, especially for AI and digital technology. This change will provide quicker development without jeopardizing patient safety. Consumer demand has also drastically altered. Physicians and patients will continue to favor devices with data tracking, remote integration, and predictive diagnosis. Hospitals will increasingly depend on intelligent systems that along with wearable devices will keep an eye on heart health around the clock outside the clinic. The market will increasingly blend software brains and medical engineering to create devices that not only cure but also foretell ailments before it is too late.

From its initial contraptions to the present networked technologies, the international Cardiovascular Devices market will continue to be a reflection of the way in which science, regulation, and patient need will continue to leave their mark upon the development of cardiovascular therapy—an evolution characterized not by velocity but by degree and by humanity.

Market Segments

The global cardiovascular devices market is mainly classified based on Diagnostic and Monitoring Devices, Surgical Devices, Application.

By Diagnostic and Monitoring Devices is further segmented into:

- ECG: ECG will continue to be one of the most prevalent diagnostic devices utilized in monitoring heart rhythm and detecting abnormalities. The device aids in identifying abnormal patterns that can cause serious conditions. Advances in technology and portable versions have boosted accessibility and ease of ECG testing among patients in different healthcare centers.

- Implantable Loop Recorders: Implantable Loop Recorders will be continuously observing heart activity for extended periods of time. They assist physicians in diagnosing unexplained syncope or an abnormal heart rhythm. They are small and advanced in design, thus capable of offering reliable information to enable timely intervention and enhanced patient outcome.

- Echocardiogram: Echocardiogram machines will be central to testing the structure and functioning of the heart through the use of ultrasound machines. The machines aid in measuring heart defects, valve status, and other abnormalities. Ongoing technological improvement in the level of image clarity has eased the simplicity of efficacy in echocardiograms and made them yet more crucial for early diagnosis.

- Holter Monitors: Holter Monitors will be used to capture heart rhythm for 24 to 48 hours to monitor constantly. The devices are worth their while to identify abnormalities not revealed by standard ECG tests. Improved light weight and wearable technology has made themearable for patients without compromising their precision.

- Event Monitors: Event Monitors will be utilized for individuals with intermittent heart symptoms. They don't monitor all the time like the Holter Monitor but instead at the moment that something is abnormal. They assist in giving accurate analysis and aid physicians in eliminating or confirming certain cardiovascular diseases with precise monitoring of information.

- PET Scan: PET Scan will aid in visualizing blood circulation and identifying impaired heart tissue. It uses high-resolution images to help measure the success of intervention and disease advancement. Increasing use of PET scans has improved their usefulness in cardiac diagnosis and patient management.

- MRI: MRI will provide unique images of the heart with high resolution, which will assist in comprehensive evaluation without radiation exposure. It gives important information about the function of the heart muscle, structural disease, and flow. MRI technologies continuously advance, and MRI systems become more efficient with safer and faster results.

- Others: Other diagnostic and monitoring technologies will encompass technologies that aid in the evaluation of cardiac health through improved data analysis and imaging. Further development of digital healthcare has improved these technologies to be more precise and accessible, resulting in better diagnosis and improved monitoring of patients.

By Surgical Devices the market is divided into:

- Pacemakers: Pacemakers will be employed to regulate heart rhythm in bradycardia patients. The device provides electrical impulses that promote a consistent rate of heartbeats. Contemporary pacemakers are smaller, dependable, and offer remote monitoring to guarantee enhanced patient safety and care.

- Stents: Stents will be a crucial component of maintaining open arteries for good blood supply following occlusion. Made from metal or polymer, stents are employed in the treatment of coronary artery diseases. Improvements in technology have led to the development of drug-eluting and bioresorbable stents for better recovery.

- Guidewires: Guidewires will help surgeons through blood vessels during surgery. These will aid in the exact placement of other tools such as stents or catheters. Ongoing developments in flexibility and coating materials improve their performance, and surgeries become safer and less time-consuming.

- Catheters and Accessories: Catheters and Accessories will find application in different procedures of the heart like angioplasty and diagnosis. They assist in the delivery of fluids or the measurement of the functions of the heart. Enhanced material and design of catheters have extended their shelf life, minimized chances of infection, and provided better accuracy during procedure.

- Cannulae: Cannulae will be of utmost importance during cardiac and lung-supported operations. The devices ensure the continuation of blood flow during intricate operations. As a result of the enhancement in biocompatible materials and meticulous designs, the cannulae have improved to become safer and more efficient during cardiovascular interventions.

- Others: Other surgical tools will be other ancillary devices that support cardiovascular surgery. They are designed to increase precision, reduce complications, and reduce recovery time. Their ongoing development guarantees improved surgical results and more dependability in cardiac therapy.

By Application the market is further divided into:

- Hospital: Hospitals will remain the leading users of Cardiovascular Devices due to advanced facilities and skilled professionals. These settings offer complete care from diagnosis to surgery. Growing adoption of modern devices in hospitals ensures accurate results, improved treatment methods, and faster patient recovery.

- Clinic: Clinics will contribute significantly to the market through regular screenings and follow-ups. These centers focus on early detection and prevention of heart diseases. Availability of compact diagnostic devices has enabled clinics to offer effective cardiac monitoring and management services at accessible costs.

- Ambulatory Surgical Centers: Ambulatory Surgical Centers will witness increased use of Cardiovascular Devices due to cost-effective and efficient treatment setups. These centers provide outpatient surgical services, reducing hospital stays. The use of advanced surgical devices ensures safety, precision, and faster recovery for patients undergoing cardiac procedures.

- Others: Other healthcare facilities, including diagnostic centers and research institutes, will continue using Cardiovascular Devices for various applications. These setups play a supportive role in testing new devices, conducting studies, and improving treatment efficiency through innovative healthcare solutions.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$71.6 Billion |

|

Market Size by 2032 |

$120.4 Billion |

|

Growth Rate from 2025 to 2032 |

7.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

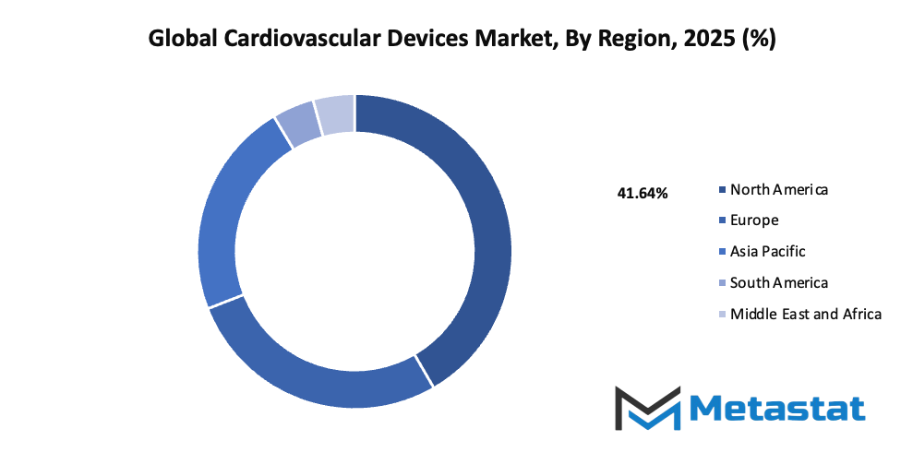

By Region:

- Based on geography, the global cardiovascular devices market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing prevalence of cardiovascular diseases and aging population: The rising number of individuals affected by cardiovascular diseases has significantly increased the need for advanced medical devices. The aging population further adds to this demand, as older adults are more prone to heart-related conditions. This trend encourages healthcare systems to invest in effective diagnostic and treatment equipment to enhance patient outcomes and reduce mortality rates.

- Technological advancements in minimally invasive and implantable devices: Continuous progress in medical technology has transformed the design and performance of Cardiovascular Devices. Minimally invasive and implantable solutions allow faster recovery, lower complication risks, and improved patient comfort. The introduction of smart stents, enhanced pacemakers, and bioresorbable materials has strengthened the global cardiovascular devices market, promoting better treatment accessibility and efficiency.

Challenges and Opportunities

- High cost of cardiovascular procedures and devices: The expensive nature of cardiovascular procedures limits access, particularly in developing regions with lower healthcare spending. High manufacturing and research costs make these devices less affordable for both hospitals and patients. This cost challenge affects the global cardiovascular devices market by slowing overall adoption and market penetration despite growing healthcare needs.

- Stringent regulatory approval processes for new device launches: Strict and lengthy approval procedures for Cardiovascular Devices create delays in product launches and increase development expenses. Manufacturers face challenges in meeting diverse regional standards and safety requirements. These regulations, although essential for patient safety, often hinder faster innovation, influencing the pace of growth within the global cardiovascular devices market.

Opportunities

- Growing adoption of remote monitoring and AI-integrated cardiac care solutions: The use of remote monitoring tools and AI-based cardiac care is expanding quickly. These technologies allow continuous tracking of patient health, early detection of complications, and personalized treatment approaches. Their integration into healthcare systems enhances efficiency, reduces hospital visits, and supports the advancement of the global cardiovascular devices market through smarter and more connected care solutions.

Competitive Landscape & Strategic Insights

The global cardiovascular devices market is expected to experience significant growth in the coming years, driven by rising demand for innovative medical technologies and the increasing prevalence of cardiovascular diseases. This industry is a mix of both international industry leaders and emerging regional competitors, creating a dynamic environment that encourages continuous innovation and improvement. Important competitors include Becton, Dickinson and Company, Medtronic, Boston Scientific Corporation, Abbott, B. Braun Melsungen AG, St. Jude Medical, Cook Medical, Inc., Cardinal Health, Inc., Philips Healthcare, Terumo Medical Corporation, Abiomed Inc., Edwards Lifesciences, and GE HealthCare. These companies are shaping the future of cardiovascular care by developing devices that improve diagnosis, treatment, and patient outcomes.

As technology advances, the market will see the introduction of more precise and minimally invasive devices that reduce recovery times and enhance patient safety. Companies are investing heavily in research and development to create solutions that integrate artificial intelligence, remote monitoring, and smart sensors, allowing for better tracking of heart health and early detection of potential complications. Emerging regional competitors are also contributing to this progress by offering innovative solutions that address local healthcare needs while gradually expanding into international markets.

The combination of established leaders and rising competitors will drive healthy competition, which will accelerate the introduction of next-generation devices and expand access to cardiovascular care worldwide. Market growth will also be supported by government initiatives and increasing healthcare spending in developing regions. With technological advancements, Cardiovascular Devices are expected to become more accessible, efficient, and personalized, shaping the way patients and healthcare providers approach heart health in the future.

Market size is forecast to rise from USD 71.6 billion in 2025 to over USD 120.4 billion by 2032. Cardiovascular Devices will maintain dominance but face growing competition from emerging formats.

Overall, the global cardiovascular devices market will continue to evolve as international leaders maintain their position while new players introduce fresh innovations. The collaboration and competition between these companies will ensure that the industry remains focused on improving patient outcomes, offering advanced treatment options, and pushing the boundaries of medical technology in cardiovascular care.

Report Coverage

This research report categorizes the global cardiovascular devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global cardiovascular devices market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global cardiovascular devices market.

Cardiovascular Devices Market Key Segments:

By Diagnostic and Monitoring Devices

- ECG

- Implantable Loop Recorders

- Echocardiogram

- Holter Monitors

- Event Monitors

- PET Scan

- MRI

- Others

By Surgical Devices

- Pacemakers

- Stents

- Guidewires

- Catheters and Accessories

- Cannulae

- Others

By Application

- Hospital

- Clinic

- Ambulatory Surgical Centers

- Others

Key Global Cardiovascular Devices Industry Players

- Becton, Dickinson and Company

- Medtronic

- Boston Scientific Corporation

- Abbott

- B. Braun Melsungen AG

- St. Jude Medical

- Cook Medical, Inc.

- Cardinal Health, Inc.

- Philips Healthcare

- Terumo Medical Corporation

- Abiomed Inc.

- Edwards Lifesciences

- GE HealthCare

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383