MARKET OVERVIEW

In the diverse landscape of consumer goods, the Canada Hair Care market stands as a testament to the ever-changing preferences and needs of the populace. This dynamic sector is not merely a collection of products but a reflection of the socio-cultural and economic fabric that weaves through the country. From the vibrant streets of Vancouver to the historic charm of Quebec City, the nuances of the Canadian Hair Care market are as diverse as the nation itself.

The industry has transcended beyond traditional norms, adapting to the multicultural tapestry of the nation, where various ethnicities coalesce into a mosaic of hair care needs. From the sleek and sophisticated styles favored in urban centers to the natural and textured looks celebrated in indigenous communities, the Canadian Hair Care market is a harmonious blend of tradition and modernity.

Market players in this arena are not just purveyors of shampoos and conditioners; they are curators of confidence and expressions. In understanding the needs of a diverse consumer base, the market has witnessed a surge in innovative products that cater to a spectrum of hair types, ensuring inclusivity and representation. The Canadian Hair Care market, therefore, is a living organism, adapting and evolving to embrace the uniqueness of every individual, irrespective of their hair's texture, color, or origin.

Moreover, the sustainability wave has not left this market untouched. Canadian consumers, known for their environmental consciousness, have propelled the industry towards eco-friendly formulations and packaging. The market is now characterized by a surge in demand for organic, cruelty-free, and biodegradable products, reflecting a collective commitment to both personal well-being and environmental stewardship.

The e-commerce revolution has also cast its influence on the Canadian Hair Care market, offering consumers a convenient avenue to explore and purchase products tailored to their specific needs. With the rise of online influencers and beauty communities, consumers are more informed and discerning than ever before, shaping the market through their preferences and feedback.

The Canada Hair Care market is not a static entity but a vibrant ecosystem that mirrors the cultural, environmental, and technological shifts within the nation. From the pristine landscapes of the Rockies to the bustling urban centers, the hair care industry in Canada is a celebration of diversity and an embodiment of the nation's dynamic spirit. In its continual evolution, the market stands as a testament to the resilience and adaptability of an industry that goes beyond aesthetics, embracing the essence of individuality and self-expression.

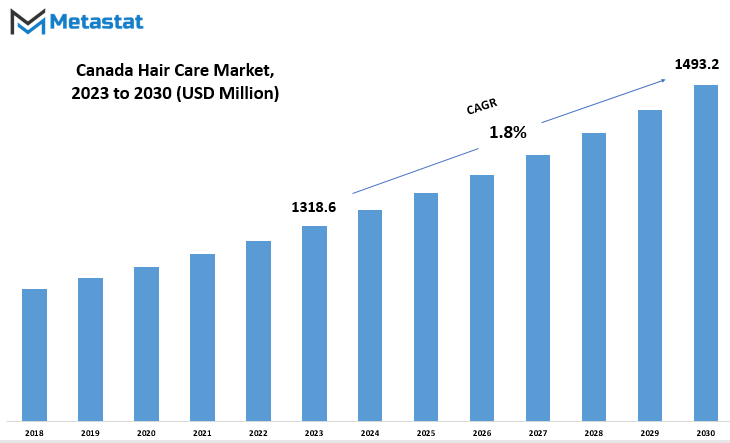

Canada Hair Care market is estimated to reach $1493.2 Million by 2030; growing at a CAGR of 1.8% from 2023 to 2030.

GROWTH FACTORS

The Canadian hair care market is experiencing notable growth, driven by several factors that shape the dynamics of this industry. One of the primary drivers contributing to this upward trend is the increasing awareness among consumers about the benefits of natural and organic hair care products. As people become more conscious of the ingredients they apply to their hair, there is a growing inclination towards products that boast natural formulations. This shift in consumer preference has propelled the demand for hair care items that prioritize health and environmental consciousness.

Furthermore, the aging population in Canada has emerged as another significant driver influencing the hair care market. With an aging demographic comes an amplified concern for maintaining hair health. This has resulted in an increased demand for specialized products addressing the unique needs and challenges associated with aging hair. As individuals seek solutions to address issues such as hair thinning and loss, the market has responded with products tailored to cater to this specific demographic.

However, amid the promising growth, the Canadian hair care market faces certain challenges. One notable restraint is the highly competitive nature of the market. Numerous brands vie for consumer attention, making it crucial for companies to distinguish themselves through innovation and effective marketing strategies. The intense competition also exerts pressure on pricing, impacting profit margins and necessitating a constant drive for differentiation.

Environmental concerns and the push for sustainability represent additional restraints for the Canadian hair care market. As consumers increasingly prioritize eco-friendly choices, companies are compelled to adopt sustainable practices in their production processes and packaging. Meeting these expectations can pose a challenge for some businesses, requiring them to invest in eco-conscious initiatives to align with evolving consumer values.

Amidst these challenges, an opportunity arises with the expansion of e-commerce in the hair care sector. The digital landscape provides a platform for companies to reach a broader audience and facilitate convenient product access. The growth of online retail channels opens avenues for market players to adapt to changing consumer shopping behaviors and enhance their market presence.

The Canadian hair care market is witnessing growth propelled by factors such as the rising awareness of natural products and the influence of an aging population. However, challenges like market competition and environmental concerns persist. The expansion of e-commerce presents a promising opportunity for companies to navigate these challenges and further capitalize on the evolving landscape of the Canadian hair care industry.

MARKET SEGMENTATION/REPORT SCOPE

By Type

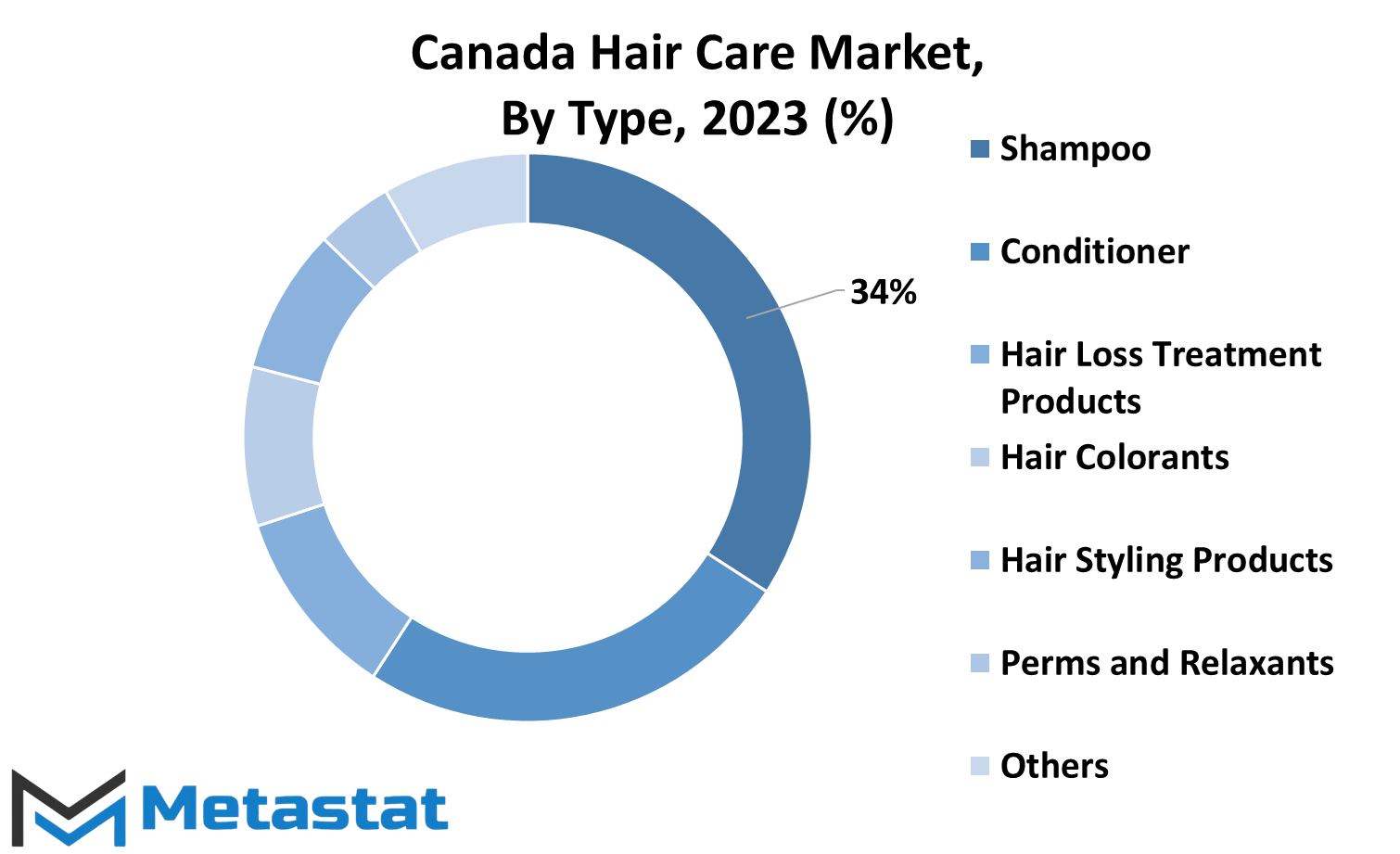

The Canadian hair care market is a diverse landscape, catering to various needs and preferences of consumers. When delving into its nuances, one can observe a multifaceted segmentation based on product types. These include shampoo, conditioner, hair loss treatment products, hair colorants, hair styling products, perms and relaxants, and others.

Shampoo holds a significant place in the market, serving as a fundamental component of regular hair care routines. It is formulated to cleanse the hair and scalp, removing dirt and excess oils. Conditioners, on the other hand, play a complementary role by moisturizing and nourishing the hair, promoting smoothness and manageability.

Hair loss treatment products address a prevalent concern among consumers. With various formulations and approaches, these products aim to mitigate hair loss and promote hair regrowth, reflecting the market's responsiveness to individual needs.

Hair colorants cater to those seeking a change in hair aesthetics. Whether for covering gray hair or experimenting with vibrant hues, this segment contributes to the market's diversity, reflecting the dynamic nature of consumer preferences.

Hair styling products encompass a range of items designed to help individuals achieve their desired hairstyles. From gels and mousses to sprays and waxes, these products contribute to the expressive aspect of personal grooming.

Perms and relaxants provide a means for individuals to alter their hair's natural texture. This segment addresses the demand for diverse styling options, allowing consumers to express their individuality through their hair.

The category labeled as 'Others' encompasses a variety of products that may not fall into the categories but contribute to the overall spectrum of hair care. This segment embodies the adaptability of the market, accommodating emerging trends and innovations.

The Canadian hair care market reflects a rich tapestry of products, each catering to distinct aspects of personal care and styling. The segmentation by product type ensures consumers have many options to choose from, aligning with their unique preferences and requirements. The dynamism of this market mirrors the ever-changing landscape of consumer demands and preferences in the realm of hair care.

By Distribution Channel

The Canadian hair care market is segmented by distribution channels, reflecting the diverse ways consumers access and purchase hair care products. These channels play a crucial role in determining the availability and accessibility of hair care items across the country.

One of the primary distribution channels is Hypermarket/Supermarket. This channel, which includes large retail outlets, emerged as a substantial player, accounting for a noteworthy 683.2 USD Million in 2022. Consumers often find a variety of hair care products conveniently stocked in these hypermarkets and supermarkets, making it a popular choice for many.

Another significant distribution channel is Specialty Stores. These establishments, which focus on specific product categories like hair care, had a market value of 272.6 USD Million in 2022. Specialty stores offer a curated selection of hair care items, attracting consumers seeking a more tailored shopping experience.

The Online Stores segment has also gained prominence, representing the shift towards digital platforms in the hair care market. Valued at 255.2 USD Million in 2022, online stores provide the convenience of browsing and purchasing hair care products from the comfort of one's home. This channel's growth reflects the increasing trend of online shopping in the beauty and personal care industry.

In addition to the major channels, the market includes Pharmacies/Drug Stores and Convenience Stores. These outlets contribute to the distribution landscape by offering hair care products in easily accessible locations. Consumers often find a selection of popular brands and essentials in these stores, contributing to their significance in the overall market. There are other distribution channels that play a role in the Canadian hair care market. While not explicitly specified, these channels add diversity to the market by catering to unique consumer preferences or niche markets.

The distribution channels in the Canadian hair care market are varied, each offering distinct advantages and meeting the diverse needs of consumers. From the convenience of hypermarkets and specialty stores to the growing influence of online platforms, the market dynamics underscore the importance of accessibility and choice in the ever-evolving landscape of hair care products.

By Price Point

The Canadian hair care market is a diverse landscape, offering a range of products catering to different consumer preferences and budgets. A notable aspect of this market is its segmentation based on price points, which helps consumers navigate through a variety of options tailored to their financial considerations.

The Mass segment encompasses products that are generally more affordable and widely accessible to a broader consumer base. These products are designed to meet the basic hair care needs of the masses without imposing a significant strain on their wallets. Shampoo, conditioners, and styling products within this category are formulated to deliver effective results at a budget-friendly price.

On the other end of the spectrum lies the Premium segment, where products are positioned at a higher price point. This category is characterized by a focus on premium ingredients, advanced formulations, and often, unique branding. Consumers who opt for premium hair care products may be seeking specialized solutions, luxurious experiences, or the assurance of using high-quality ingredients for their hair care routines.

The segmentation by Price Point in the Canadian hair care market provides consumers with a clear distinction between products based on their financial preferences and expectations. It allows individuals to make informed choices, aligning their purchases with their specific needs and budget constraints.

By Testing Type

The Canadian hair care market is a dynamic landscape that can be categorized by testing types, with notable segments being Cruelty-Free and Synthetic. In the year 2022, the Cruelty-Free Hair Care Products segment demonstrated a market value of 71.2 USD Million, while the Synthetic segment, referred to as the Others segment, boasted a valuation of 1207.8 USD Million.

The Cruelty-Free category encompasses products that are not tested on animals, reflecting a growing consumer awareness and preference for ethical and humane practices in the beauty industry. This segment, valued at 71.2 USD Million in 2022, underscores a shift in consumer behavior towards products that align with ethical values.

However, the Synthetic category, encompassed under the label Others, holds a substantial market value of 1207.8 USD Million in 2022. This segment includes a range of hair care products not classified as Cruelty-Free and may involve synthetic ingredients. The significant valuation of this segment indicates a robust market demand for hair care products that may not adhere to cruelty-free standards but still cater to diverse consumer needs and preferences.

The Canadian hair care market, when analyzed through the lens of testing types, showcases a nuanced landscape with distinct preferences among consumers. The Cruelty-Free segment reflects a burgeoning ethical consciousness, while the Synthetic segment, with its considerable market value, caters to a diverse consumer base with varied expectations and requirements in their hair care products. This segmentation provides insights into the evolving dynamics of the Canadian hair care market, driven by ethical considerations and diverse consumer choices.

COMPETITIVE PLAYERS

The Canadian hair care market is bustling with activity, featuring a lineup of prominent players vying for consumer attention. The industry is dominated by key players who have established themselves as leaders, each contributing to the competitive landscape in their unique way.

L'Oreal Group, a giant in the cosmetics and beauty sector, stands tall as one of the major players in Canada's hair care scene. Renowned for its diverse range of products, L'Oreal has earned a significant market share, offering consumers a wide array of choices to cater to their varying hair care needs. Johnson & Johnson Inc. is another noteworthy participant in the Canadian hair care market. Known for its commitment to health and wellness, the company extends its influence into the hair care domain, providing consumers with quality products that align with their overall well-being.

Procter & Gamble, a global consumer goods powerhouse, is a key contender in Canada's hair care sector. Leveraging its extensive portfolio of brands, P&G has secured a notable position in the market, with offerings that resonate with diverse consumer preferences.

Unilever PLC is a significant player contributing to the dynamism of the Canadian hair care market. With a focus on sustainability and innovation, Unilever brings forth products that not only meet consumer expectations but also align with the growing emphasis on eco-friendly choices.

Henkel AG & Co. KGaA is a formidable force in the hair care industry, bringing a blend of tradition and innovation to the Canadian market. The company's commitment to quality and continuous improvement is reflected in its diverse range of hair care solutions. Further, Tigi International, a player with a creative edge, brings a touch of innovation and style to the Canadian hair care market. Known for its salon-inspired products, Tigi caters to consumers seeking a blend of professional-grade solutions and creative flair.

The competitive players in Canada's hair care market bring a diverse array of products and approaches, catering to the varied needs and preferences of consumers. The industry thrives on the dynamism created by these key players, each contributing to the vibrant and competitive nature of the Canadian hair care market.

Canada Hair Care Market Key Segments:

By Type

- Shampoo

- Conditioner

- Hair Loss Treatment Products

- Hair Colorants

- Hair Styling Products

- Perms and Relaxants

- Others

By Distribution Channel

- Hypermarket/Supermarket

- Specialty Store

- Online Stores

- Pharmacies/Drug Stores

- Convenience Stores

- Other Distribution Channels

By Price Point

- Mass

- Premium

By Testing Type

- Cruelty Free

- Synthetic

Key Canada Hair Care Industry Players

- L'Oreal Group

- Johnson & Johnson Inc.

- Procter & Gamble

- Unilever PLC

- Henkel AG & Co. KGaA

- Kao Corporation

- Coty Inc

- Tigi International

- Marc Anthony Cosmetics, Inc

- Revlon Inc

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252