MARKET OVERVIEW

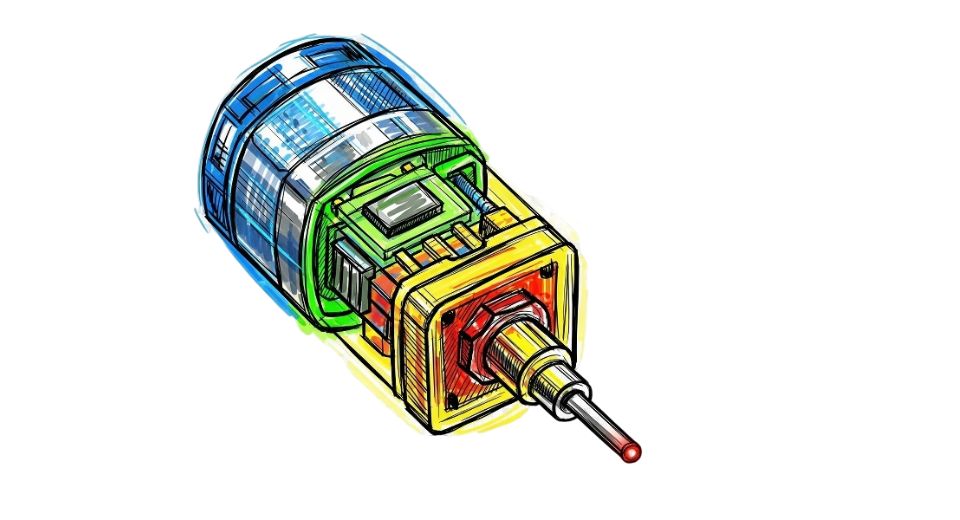

The global cables and connector market acts as a link, connecting various sectors with its indispensable components in the ever-dynamic technology industry. This industry embraces production, distribution, and usage of cables and connectors for data, power, and signal transmission for different applications.

The global cables and connector market will see the request of modern connectivity that includes modern telecommunication, IT infrastructure, automotive, aerospace, healthcare, and consumer electronics. The technology provides everything from fiber-optic cables for high-speed internet networks to advanced connectors used in next-generation electronic devices; all set up as a combination of innovation with development to fulfill the changing demands of consumers.

In telecommunication, it is clear that the global cables and connector market has a bright future going forward. The need for high-bandwidth cables and connectors will only surge with the introduction of the 5G technology and the increasing number of IoT devices. Fiber-optic cables will especially drive a new era wherein it will create a very easy link between data transfer at ultra-data transfer rates and low latency communication over long distances, thus effecting an almost revolutionized connect across the world.

Another opportunity is seen in the global cables and connector market-the automotive industry. As vehicles become electric and autonomous, the demand for specialized cables and connectors for electric powertrains, infotainment systems, and sensor network systems will increase. EV has its own opportunities and challenges, which would enforce innovations in present and new designs in cables and connectors-high voltage power distribution and rapid charging infrastructure.

The healthcare sector will soon be witnessing enormous growth for the global cables and connector market emanating from advancements in medical technology and the rise of digital solutions in health care. The increase will require and demand reliable and high-performance cables and connectors, which are the systems for the seamless transfer of important patient data and diagnostic information, and cover equipment ranging from medical imaging machines right through to wearable health monitors.

Apart from consumer electronics, the global cables and connector market continues to garner more audience. Because of smartphones, tablets, laptops, and other devices that are dependant on being connected to the Internet, there will always be great demand for small, tough, speedy cables and connectors that will allow easy connection for peripherals and accessories.

This would mean that the global cables and connector market is part of the dynamic, within a fast-expanding field, diverse markets. It promises itself exponential growth in multiple sectors. As technology advances its way into the reshaping of our world, so does the need for any innovative cables and connectors to enable reliable connectivity rise to its paramount level greatly.

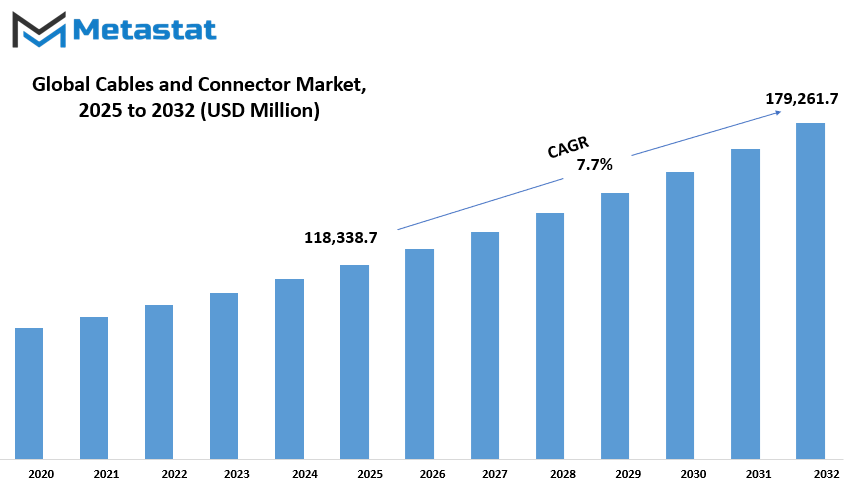

global cables and connector market is estimated to reach $179,261.7 Million by 2032; growing at a CAGR of 7.7% from 2025 to 2032.

GROWTH FACTORS

Having varied activities like data transmission and connectivity foments demand for cables and connector market in the Industrial segment. This increase in demand generates the worldwide uptake of modern types of cables and connectors. In addition, progress in electronic and telecommunication markets further drives demand for interconnect solutions that are reliable and efficient for their processes.

Nevertheless, with fierce competition and price pressures come many challenges harmful to the manufacturers' margins. Evolution of technologies and fast-changing standards compel frequent product upgrading along with hefty investments in research and development. These elements constitute possible roadblocks to the market growth, since they impose demands on companies to remain updated with the newest happenings in the industry and constantly innovate in order to compete in the market.

On the brighter side, with the rise of IoT and smart devices, many opportunities will open up for the cables and connectors market. The Internet of Things is heavily founded on device interconnectivity and communication; hence, the demand for new cables and connectors made for IoT applications and edge computing environments. The market will continue to take advantage of the IoT adoption by producing specialized solutions addressing the peculiarities of IoT infrastructure.

In the coming times, increased technological innovation will spur innovation in cables and connectors for faster data transmission rates, increased breeding width, and more reliability. Manufacturers must invest their energy in product development with the foresight of not just current industry standards but also future requirements.

On the other hand, as industries rely more and more on interconnected systems to streamline their operations and enhance their efficiencies, the demand for rugged cables and connectors will continue to pass. From automotive and aerospace to healthcare and energy, virtually every sector needs dependable interconnect solutions to drive their digital transformation programs.

Stiff competition and rapid technological advancement have posed some challenges for the global cables and connector market; however, opportunities abound toward growing demand for high-speed connectivity, expansion of IoT, and smart devices. By leveraging and embracing innovations and being cognizant of market trends, manufacturers will prosper in this fast-paced and innovative industry.

MARKET SEGMENTATION

By Type

The global cables and connector market is dynamic with even more growth and innovations. It has a variety of products involved in connecting or transmitting signals and data. A core partition of this market is its segmentation by type, which is necessary to delineate the different types of cables and connectors available.

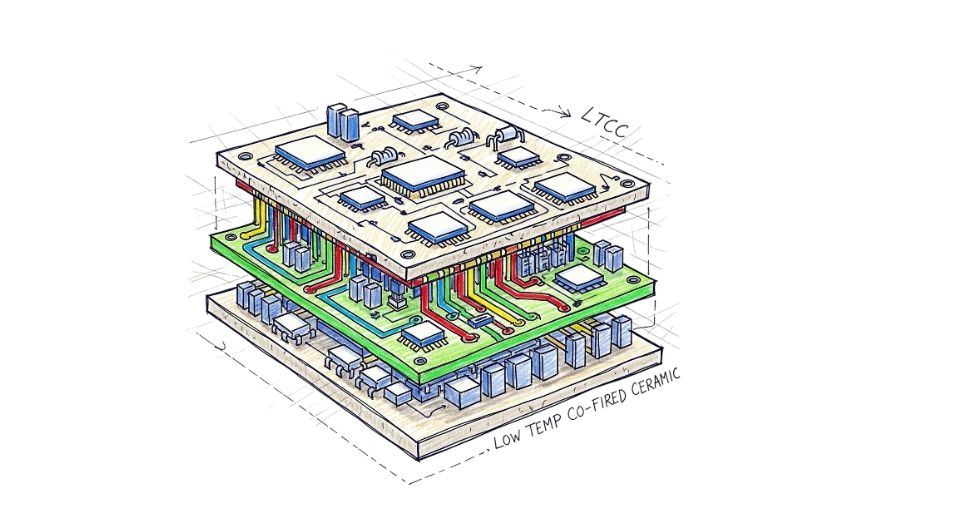

PCB Connectors. They are connected into the connectors important for the connection of printed circuit boards with the various electronic devices or components. With the rising requirement for smaller and compact electronic devices, it is PCB connectors that extremely aid in supporting efficient connectivity within the devices or systems.

Another major segment is Circular/Rectangular Connectors. These make highly versatile and robust connectors used in aerospace, automotive industries, and telecommunications. Their applications include when spaces are limited; circular connectors serve as highly robust and secure connections, while rectangular connectors are most commonly used for compactness and convenience of integration into various systems.

Fiber Optic Connectors represent another important segment within the market. Fibre optic connectors are greatly exerted on the increasing adoption of fibre optic technology within cities that are striding over high-speed data transfer. These connectors seamlessly transmit data for very long distances with minimal signal losses, making it ideal for telecommunications, data centers, and high-speed internet connections.

Another important segment in global cables and connector market is the IO Connectors or Input/Output connectors. These connectors function as interfaces between electronic equipment and external peripherals for data, power, and signal transfer. Due to an increasing number of connected devices and IoT, this sector is going to rocket in terms of demand in the future.

There is also a section called Others wherein the various types of connectors are included and may not fit into the aforementioned segments clearly. This includes specialty connectors intended for specific applications or found to be newly developed technologies that are yet to be categorized exhaustively.

The global cables and connector market is heterogeneous and continues to be dynamic as it responds to the needs of technological growth in this modern world. Connectivity and data transmission are improving, and innovation should continue to trend upward in the coming years.

By Product

The global cables and connector market is, in fact, a dynamic one where products serve different purposes and applications. The market encompasses various classifications such as Coaxial Cable/Electronic Wire, Fiber Optics Cable, Power Cable, Signal and Control Cable, Telecom and Data Cable, and Others, which show the wide range of requirements of industries and consumers worldwide.

Coaxial Cable/Electronic Wire are significant components of so many electronics and will continue to be significant in signal transmission that is devoid of interferences. These cables would improve their performance and efficiency along with the evolving technology.

Fiber optics cables are muscular in speed data transmission and have expectedly greater demand due to the world becoming more digitally interlinked. Dependence on cloud computing, streaming, and high-bandwidth applications will place fiber optics at the forefront of supporting this technology.

Power cable-for obvious reasons-the distribution of electricity-will remain among the frontiers of infrastructure underpinning modern-day societies. The interconnections that renewable energy creates within the energy grid require the other side: power cables that are robust and efficient to transport electricity over long distances.

With the spread of automation and Internet of Things (IoT) technologies, Signal-and-Control Cables that impart control signals with data will see steady demand growth in pertinent industrial applications. These cables play an important role in making communication between different devices and systems possible, thus ensuring seamless functioning and monitoring.

Telecom and Data Cable will constantly be in demand because of telecommunication networks and data centers' ever-increasing need for reliable and high-speed connectivity. The surge of smartphones, IoT devices, and cloud-based services will find telecom and data cables supporting the digital infrastructure required by modern communication networks.

The Others category includes a wide range of cables and connectors serving the niche markets and specialized applications that would sprout innovation and development in response to specific industry needs, which could be of emerging technological trends.

Lastly, the global cables and connector market has innovation and growth potential in each product segment. With advancing technology and changing industries, there will be an increasing need for cables and connectors that are efficient, reliable, and specifically designed for certain applications. Companies in this emerging industry will have to adapt to these shifting demands and adopt new technologies.

By Application

The global cables and connector market is a dynamic landscape with an assortment of applications driving its growth. By realizing the market segmentation by application, one can comprehend the variability in its use across various industries.

An essential industry for the demand for cables and connectors is the automobile industry. As technology rapidly progresses in cars, the demand for robust electrical connections is increasing. In essence, cables and connectors guarantee the readiness for use of different components of a car: from engine control units to infotainment units. As automotive technology continues to advance, the cable and connector firms will have to accelerate the development of higher-performance products to keep up with the shifting demands of the industry.

The commercial sector also consumes a large quantity of cables and connectors for several purposes. From office blocks to retail arenas, these components power lighting systems, HVAC units, and myriad electrical equipment. As businesses move into more ICT-related areas, including Internet of Things (IoT) devices and smart building solutions, demand for specialized cables and connectors will further develop.

Cables and connectors are major in the oil and gas industries to guarantee communication and power transmission under severe environmental conditions. These sectors typically work in hard-to-reach areas, where the most urgent criterion is durability and reliability. With the oil and gas industry ushering in new fronts with improved drilling and extraction methodologies, demand for ruggedized cables and connectors will also heighten, able to withstand extreme environments.

The military & defense represent another still very important market for the cables and connectors, where reliability and security are the most required characteristics. Applications range from communication systems, surveillance equipment, to weapon systems. With the ongoing revolution of defense technologies, the demand for specially designed cables and connectors meeting stringent military specifications will increase.

In the energy & power sector, cables and connectors ensure the transmission of electricity from power plants to homes, commercial establishments, and industrial facilities. As we move toward renewable energy sources of solar energy and wind power, demand for cables and connectors will continue to grow to efficiently evacuate electricity from much cleaner sources into the grid.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$118,338.7 million |

|

Market Size by 2032 |

$179,261.7 Million |

|

Growth Rate from 2024 to 2031 |

7.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

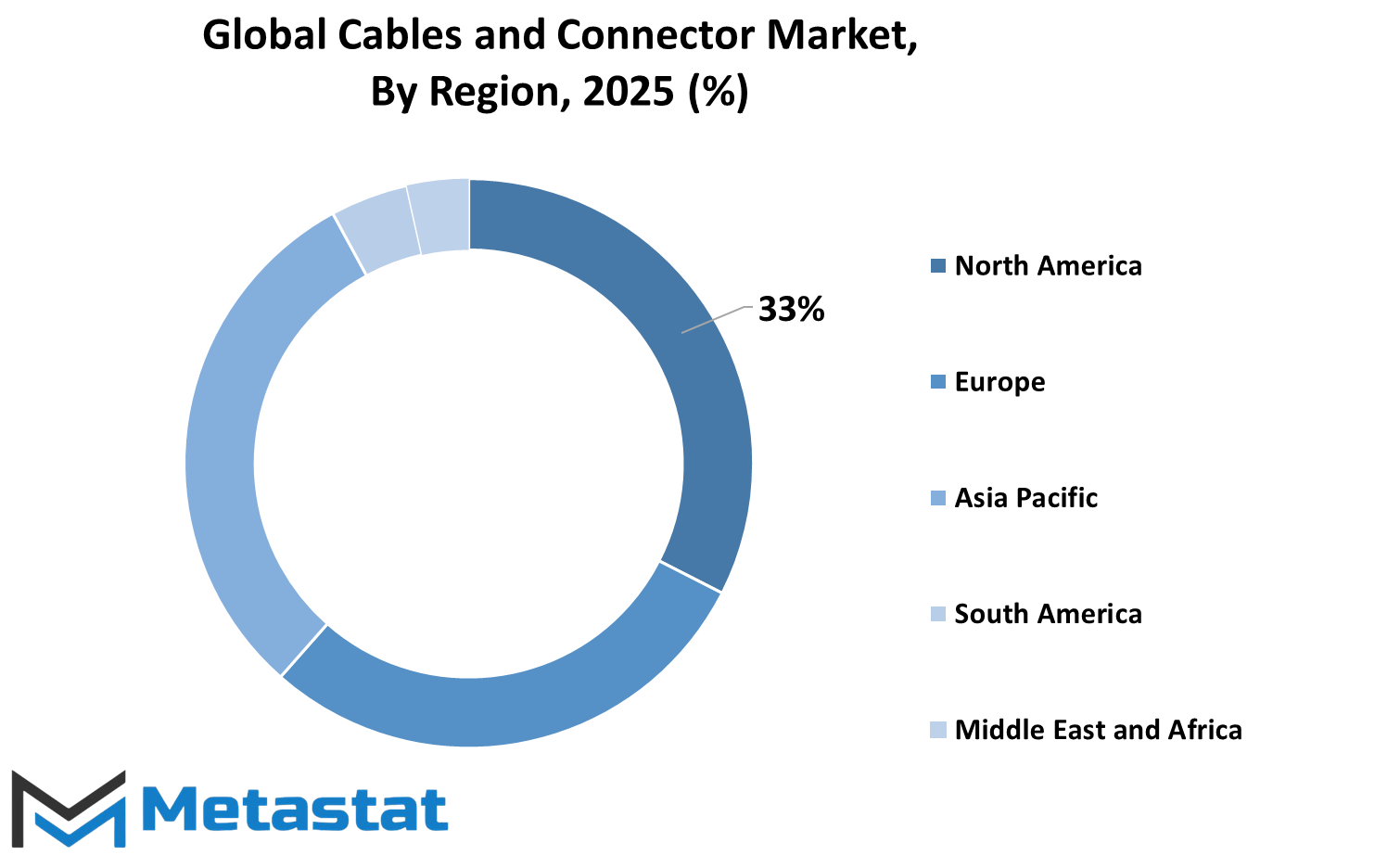

Research on the wires and connectors market, it concentrates and segments the world market geographically throughout the important regions defined as North America, Europe, Asia, South America, and the Middle East & Africa.

Alongside the United States, Canada, and Mexico, the cables and connectors market of North America was highly valued at 23439.6 USD million as of 2019. Gradual growth in adopting technologies and the increasing demand for electronic devices across several applications, including IT, telecommunications, and automotive led to the above projection for the North American cables and connectors market.

In the past years, the cables and connectors market in Europe has matured and subsisted at steady levels. The value of the market in the year 2019 was USD 21481.4 million. Countries like Germany, France, and the UK already possess infrastructures for cables and connectors and thus hold considerable market share. The region is expected to continue on this growth path, led by sustainable innovation and adherence to modern technologies.

The most prominent phase is the Asia Pacific region, with countries like China, Japan, India, and South Korea showing growth for the cables and connectors market. Rapid urbanization, industrialization, and spurring investments in infrastructure development push demands for cables and connectors within this region. Thus, the region is predicted to experience tremendous growth in the coming years, with emerging economies acting as speed boosters and technological advancements driving innovations.

This South American region presents potential for characterization from the perspective of the cables and connectors market and consists of Brazil, Argentina, and Chile. Demand for cables and connectors in the region is from industries involved in automotive manufacturing construction. In addition, some government-led initiatives aimed at enhancing connectivity and infrastructure development compel the rise of the South American market further.

Steady growth is noted in the cables and connectors market across the Middle East and Africa. The on-going investments from Saudi Arabia, the UAE, and South Africa in developing their telecommunication and power transmission networks will promote demand for cables and connectors.

In geographic terms, the cables and connectors market across the globe has grown at different rates depending upon technology, industrialization, and infrastructure development across the many regions. While stable growth rates characterize North America and Europe, the Asia-Pacific market emerges as a major growth driver by virtue of rapid economic development and continuing investments in infrastructure projects. Similarly, South America, along with the Middle East and Africa, will also create promising areas for establishing markets in the cables and connectors industries and enhancing them.

COMPETITIVE PLAYERS

A competitive market and a large amount of activity distinguish the global cables and connector market, in which numerous significant players interact with the industry landscape. To mention a few, key players include Amphenol Corporation, Molex Inc., Fujitsu Ltd., TE Connectivity Limited, Prysmian S.P.A., 3M Company and Nexans, Huawei Technologies Co. Ltd., Alcatel-Lucent (Nokia Corporation), Axon Cable S.A.S., AVX Corporation, AMETEK Inc., HARTING Technology Group, Leoni AG, Aptiv PLC, Yazaki Corporation, Huber+Suhner AG, Sumitomo Wiring Systems Ltd., ITT Interconnect Solutions, and Korea Electric Terminal Co., Ltd.

These players are expected to drive developments in the cables and connectors field in the years to come and thus will strive to bring growth and innovation using their experience, technology, and market presence. With the increasing demand for cables and connectors in almost all industries, including telecommunications, automotive, aerospace, and health care, these very players will continue to be the leaders in addressing their customers' needs worldwide.

A very important strategy that these competing players are following is to make an emphasis on research and development for innovative products and solutions with greater levels of performance, reliability, and efficiency. That culture of continuous innovation gives these players an edge over their competitors and the opportunity to cater to the dynamically changing needs of the market.

Additionally, strategic collaboration, partnerships, and acquisitions are also components of the growth strategies that these companies employ. Joining forces with other players in their industries or acquiring complementary businesses allows expansion of the companies' product lines and access into new markets, which allows them to strengthen their competitive positions within the global marketplace.

With the growing emphasis on sustainability and environment-friendly practices, many of these key players are also investing towards the development of eco-friendly cables and connectors that minimize energy consumption and carbon footprint. Such proactive initiatives not only align with the growing awareness concerning environmental issues but enhance their brand reputation and customer loyalty.

The market is envisaged as an arena of intense competition where a few hefty companies are fighting for the greatest market share and dominance. By means of innovation, strategic partnership, and a dedication to sustainability, these companies will continue to stimulate growth and define the fate of the industry, answering customer's varying needs in a progressively interconnected world.

Cables and Connector Market Key Segments:

By Type

- PCB Connectors

- Circular/Rectangular Connectors

- Fiber Optic Connectors

- IO Connectors

- Others

By Product

- Coaxial Cable/Electronic Wire

- Fiber Optics Cable

- Power Cable

- Signal and Control Cable

- Telecom and Data Cable

- Others

By Application

- Automotive

- Commercial

- Oil & Gas

- Military & Defense

- Energy & Power

- Others

Key Global Cables and Connector Industry Players

- Amphenol Corporation

- Molex Inc.

- Fujitsu Ltd.

- TE Connectivity Limited

- Prysmian S.P.A.

- 3M Company

- Nexans

- Huawei Technologies Co. Ltd.

- Alcatel-Lucent (Nokia Corporation)

- Axon Cable S.A.S

- AVX Corporation

- AMETEK Inc.

- HARTING Technology Group

- Leoni AG

- Aptiv PLC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252