Global Bio Based Organic Acids Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global bio based organic acids market is a firm that evolved backstage from margin experimentation with green chemistry to an established industry of new manufacturing. It started when initial worries about petroleum reliance and waste disposal led researchers to seek out natural processes for industrial acid production. By the later twentieth century, fermentation technology based on renewable resources like corn, sugarcane, and biomass had opened up new possibilities. The production levels in the early phase were low and expensive, which restricted the industry to research and pilot plants. But this phase created the base for what will be an expanded commercial wave. From humble laboratory beginnings to an international industry at the nexus of science, policy, and consumer culture, the global bio based organic acids market will see it through to wider acceptance and industrial use.

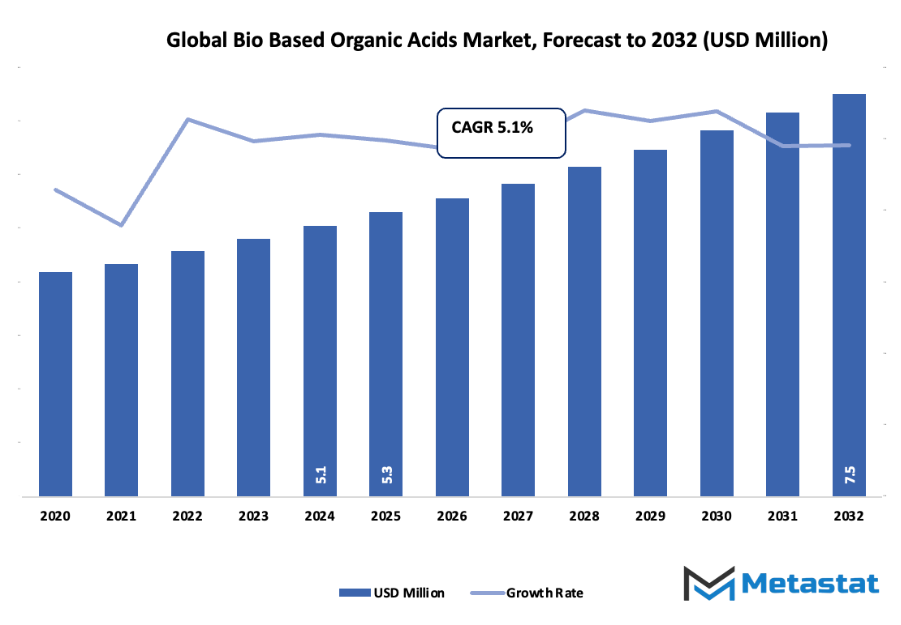

- Global bio based organic acids market size of around USD 5.3 million in 2025, growing with a CAGR of around 5.1% from 2032, with the possibility to grow above USD 7.5 million.

- Lactic Acid accounted for almost 24.1% market share, fueling research and increasing usage through systematic research.

- Principal trends fueling growth: Increasing use of environmentally friendly and sustainable chemical alternatives, Increased food, pharmaceutical, and polymer applications for bio-based acids

- Opportunities include: Advances in biotechnology and fermentation processes that allow for cost-effective large-scale manufacturing

- Principal insight: The market will grow exponentially in value over the next decade, highlighting principal growth opportunities.

- It was a turning point when biotechnological research had advanced to the level at which microbes could be engineered for greater yield and greater stability.

This was the transition from theoretical possibility to deployable scale. The global market for bio-based organic acids took off as packaging, textile, and food industries started welcoming options that lowered fossil inputs. North American and European regulatory systems then gave the prod, forcing companies to invest in cleaner production lines. Asian economies trailed behind at least as a consumer base, but as prime producers with surplus agricultural resources. Consumer taste also redefined the trajectory of this market. As concern for sustainable sourcing and green material increased, purchasing markets tilted towards products containing quantifiable environmental advantage. This was not merely idealistic but also a result of competitive advantage in terms of greener credentials. The market will keep evolving since customers demand supply chain transparency and evidence of lower carbon footprints. Technology has been an overbearing influence in determining the trajectory of the industry. New fermentation platforms, computer tracking of microbial processes, and integrated biorefineries will take efficiency to the next level. In the short term, prices will go down, availability will increase, and bio-based acids will shift from substitutes to being high-value inputs for industries from plastics to pharmaceuticals.

Market Segments

The global bio based organic acids market is mainly classified based on Type, Raw Material, Application, .

By Type is further segmented into:

- Lactic Acid: Lactic acid will continue to encounter increasing demand as it is extensively utilized in food, drinks, and biodegradable plastics. Production methods will become more efficient, driving down the cost of lactic acid and making it environmentally friendly, pushing its application in industries that are moving towards sustainable and renewable sources.

- Succinic Acid: Succinic acid will be the center of attention due to its uses in bioplastics, solvents, and pharma intermediates. Microbial fermentation will see improvements for commercial production, eliminating the need to depend on petrochemical sources. More eco-friendly alternatives will seek more integration by industries, propelling the entire global bio based organic acids market.

- Acetic Acid: Acetic acid will continue to be prominent as a result of applications in chemical synthesis, food preservation, and manufacturing. New bio-based manufacturing technology will enhance yield efficiency, making it more competitive with respect to synthetic acetic acid. Advances in future production based on sustainable processes will improve its standing in a number of industries.

- Fumaric Acid: Fumaric acid will see greater use in food, drinks, and resins. Improved fermentation technology and the use of renewable raw materials will lower production costs, which makes adoption of interest. This will enable companies to migrate to sustainable versions without compromise to performance parameters, saving the global bio based organic acids market.

- Itaconic Acid: Itaconic acid will find more application in adhesives, coatings, and specialty chemicals. More efficient biotechnological processes will increase productivity, with less reliance on petroleum products. More usage in green products in the future will position it as the main growth driver in the global bio based organic acids market.

- Citric Acid: Citric acid will remain the market leader as it is widely used in foods, soft drinks, drugs, and detergents. Advances in fermentation technology will make for higher production at reduced environmental expense, thus promoting sustainable production. Citric acid will be a bio-based organic acid of paramount significance in industrial applications of the future.

- Others: Other organic bio-based acids like malic and tartaric acids will experience slow use in niche markets. Ongoing research and development will result in lower production costs, allowing space for eco-friendly alternatives to conventional chemical acids. The trend will also consolidate the global bio based organic acids market.

By Raw Material the market is divided into:

- Corn: Corn will remain a primary source for bio-based acids due to its high carbohydrate content and availability. Future innovations in corn processing and fermentation will increase efficiency, reduce costs, and meet rising demand, ensuring a steady supply for the global bio based organic acids market.

- Sugarcane: Sugarcane will be a key renewable feedstock for producing various organic acids. Improvements in extraction and fermentation methods will make production more sustainable. Industries will increasingly use sugarcane-based acids as environmental regulations and consumer preference for greener products rise.

- Cassava: Cassava will gain popularity as a raw material due to its adaptability and starch-rich composition. Enhanced biotechnological techniques will improve conversion rates into organic acids, supporting cost-effective production. This will enable broader adoption of cassava in the global bio based organic acids market.

- Biomass: Biomass from agricultural and forestry residues will offer a sustainable alternative for organic acid production. Emerging technologies will optimize conversion processes, reducing environmental impact and lowering costs. Biomass-based acids will play a significant role in meeting global demand for greener chemical solutions.

- Algae: Algae will provide a promising feedstock for bio-based acids because of rapid growth rates and minimal land use. Future developments in bioprocessing will enhance productivity and scalability. Algae-derived acids will contribute to sustainability efforts and expansion in the global bio based organic acids market.

- Other: Other raw materials, including whey and fruit waste, will support diversified production of organic acids. Advances in bioconversion techniques will unlock potential from underutilized resources. Incorporating these raw materials will reduce waste and enhance sustainability, driving growth in the global bio based organic acids market.

By Application the market is further divided into:

- Petrochemicals: The use of bio-based organic acids in petrochemicals will increase as industries shift toward greener alternatives. Future production improvements will allow bio-based acids to replace traditional petrochemical inputs, reducing environmental impact and supporting sustainable chemical manufacturing practices.

- Polymers: Polymers will benefit from bio-based acids for producing biodegradable and sustainable materials. Ongoing innovations will improve performance and lower production costs, encouraging adoption in packaging, construction, and industrial products. This will drive long-term growth in the global bio based organic acids market.

- Pharmaceuticals: Pharmaceuticals will continue using bio-based acids as intermediates and excipients. Advanced bio-manufacturing techniques will enhance purity and consistency, meeting strict regulatory standards. The growing preference for eco-friendly solutions in healthcare will strengthen the role of bio-based acids in the industry.

- Coatings: Coatings and resins will increasingly rely on bio-based organic acids to reduce environmental footprint. Future improvements in formulation and production will enable higher performance while maintaining sustainability, supporting broader adoption in construction, automotive, and industrial coatings.

- Other: Other applications, including food additives, detergents, and personal care products, will expand use of bio-based acids. Continued research will enhance efficiency and cost-effectiveness, allowing diverse industries to integrate these acids into sustainable product development, driving growth in the global bio based organic acids market.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$5.3 Million |

|

Market Size by 2032 |

$7.5 Million |

|

Growth Rate from 2025 to 2032 |

5.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

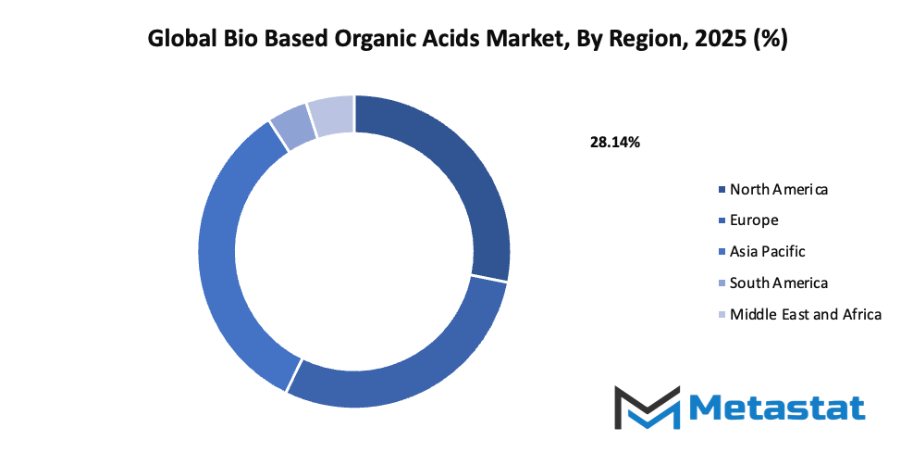

By Region:

- Based on geography, the global bio based organic acids market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Growing demand for sustainable and eco-friendly chemical alternatives: The global bio based organic acids market will see significant growth as industries seek environmentally friendly solutions. Traditional chemical acids contribute to pollution and carbon emissions, prompting manufacturers to adopt bio-based alternatives. This transition supports global sustainability goals and drives the adoption of greener chemical processes.

- Rising utilization of bio-based acids in food, pharmaceutical, and polymer industries: Bio-based acids are finding increasing use in food preservation, pharmaceutical formulations, and polymer production. The global bio based organic acids market will expand as these industries recognize their benefits in safety, performance, and environmental impact. Rising applications across multiple sectors will continue to strengthen market demand.

Challenges and Opportunities

- High production costs compared to petrochemical-based counterparts: Production of bio-based acids remains more expensive than traditional petrochemical options. This cost difference may limit adoption in price-sensitive markets. The global bio based organic acids market will require technological improvements and economies of scale to make bio-based acids more competitive and encourage wider industrial use.

- Limited availability of large-scale production infrastructure: The lack of sufficient large-scale production facilities restricts the global bio based organic acids market. Current infrastructure is often not equipped to meet rising demand. Expanding production capacities and developing efficient distribution channels will be critical for sustaining long-term growth and meeting global needs.

Opportunities

- Advancements in biotechnology and fermentation processes enabling cost-effective large-scale production: Innovations in biotechnology and fermentation will transform the global bio based organic acids market. These advances will reduce production costs and increase output, making bio-based acids more accessible to a wider range of industries. This progress will accelerate market growth and enhance competitiveness against traditional chemical acids.

Competitive Landscape & Strategic Insights

The global bio based organic acids market will continue to grow as both international leaders and emerging regional competitors push innovation and expand production capacities. Companies such as Reverdia, BASF SE, AFYREN, Mitsubishi Chemical Corporation, Novozymes A/S, Natureworks LLC, Corbion NV, Archer Daniels Midland Company, Tate & Lyle PLC, and Mitsui & Co. Ltd play significant roles in shaping the competitive landscape. These companies will focus on developing sustainable processes, reducing production costs, and introducing high-performance products to meet increasing demand from industries like food, pharmaceuticals, and chemicals.

The competitive landscape will become more intense as new regional players enter the market with cost-efficient solutions and localized production strategies. Established companies will need to enhance strategic partnerships, invest in research and development, and adopt advanced technologies to maintain their market positions. Strategic insights will show that collaboration between international and regional companies will drive innovation, enabling faster adoption of bio-based products. Additionally, companies that can balance production efficiency with environmental sustainability will gain a clear advantage in the coming years.

Market size is forecast to rise from USD 5.3 million in 2025 to over USD 7.5 million by 2032. Bio Based Organic Acids will maintain dominance but face growing competition from emerging formats.

Looking toward the future, the market will benefit from a shift toward greener production methods and the growing global emphasis on renewable resources. Companies that anticipate consumer demand for sustainable products and respond with innovative offerings will likely dominate. Strategic foresight will highlight that those able to integrate technological advancements and maintain flexibility in operations will outperform competitors. The combination of global experience and local agility will shape the future of the Bio Based Organic Acids industry, ensuring steady growth and a strong presence in international markets.

Report Coverage

This research report categorizes the global bio based organic acids market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global bio based organic acids market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global bio based organic acids market.

Bio Based Organic Acids Market Key Segments:

By Type

- Lactic Acid

- Succinic Acid

- Acetic Acid

- Fumaric Acid

- Itaconic Acid

- Citric Acid

- Other

By Raw Material

- Corn

- Sugarcane

- Cassava

- Biomass

- Algae

- Other

By Application

- Petrochemicals

- Polymers

- Pharmaceuticals

- Coatings

- Other

Key Global Bio Based Organic Acids Industry Players

- Reverdia

- BASF SE

- AFYREN

- Mitsubishi Chemical Corporation

- Novozymes A/S,

- Natureworks LLC

- Corbion NV

- Archer Daniels Midland Company

- Tate & Lyle PLC

- Mitsui & Co.Ltd

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252