MARKET OVERVIEW

The Global BIM in Construction Market is lead-running globally to become one of the most disruptive construction marketplaces for how a construction project will be conceptualized, designed, and delivered across the world. Building Information Modeling in Construction lacks paradigmatic change with its technology-driven implementation of digital technologies that enable collaboration, effectiveness, and accuracy in the delivery of construction life cycles.

BIM in Construction redefines traditional approaches through the process of creating digital representations of physical and functional characteristics of structures. It enables architects, engineers, contractors, and owners to work collaboratively on one platform. By integrating the data in a number of dimensions, such as geometry, spatial relationships, geographic information, and quantities, BIM allows for a holistic view of construction projects. Therefore, it makes the process less erroneous, with reduced rework and optimal use of resources during a project's lifecycle.

In the next few years, the Global BIM in Construction market is likely to grow manifold. Due to its potential for transforming industries, companies started realizing its same. Continual enhancement in technologies refines capabilities offered by BIM. Its application spectrum is also broadening beyond traditional construction sectors. BIM integrated with AR/VR and AI has opened new avenues for innovation. These developments promise better visualization, simulation, and analysis for Stakeholders to have greater confidence in making any informed decision. Besides, it is the regulatory mandates and sustainability imperatives that are creating a wide diffusion of BIM use in Construction. Governments worldwide are encouraging BIM for use as a way to accomplish better quality infrastructure, develop more efficient project delivery, and reduce environmental impacts. The fact that concerns for sustainability are on the rise makes BIM an extremely critical tool toward green building certifications and stringent regulatory requirements by being able to simulate energy performance, lifecycle costs, and environmental impacts.

The future landscape of the Global BIM in Construction market is likely to be one of continued development in interoperability and data integration. Again, OpenBIM initiatives and cloud-based collaboration platforms further enable seamless information exchange across disciplines and project phases. This evolution promises to break down silos and streamline workflows for enhanced productivity across the construction ecosystem.

Furthermore, with the arrival of BIM 4D and 5D—through the integration of the processes of scheduling and cost estimation with 3D BIM models—the capabilities in project planning and control will be taken to entirely new heights. These developments, embracing industry trends toward lean construction methodologies and agile project management practices, ensure the timely and non-exceeding-budget delivery of various projects.

A surge in dynamic growth and innovative activities is about to characterize the global BIM in the construction market. With radical changes hitting the industry embracing digitization, the role that can be played by BIM as a catalyst to enhance collaboration, efficiency, and sustainability can only shoot through the roof. Against this reality, every stakeholder seeking to leverage the full potential of BIM stands at a vantage point toward gaining competitive advantage in superior construction outcome delivery through the years.

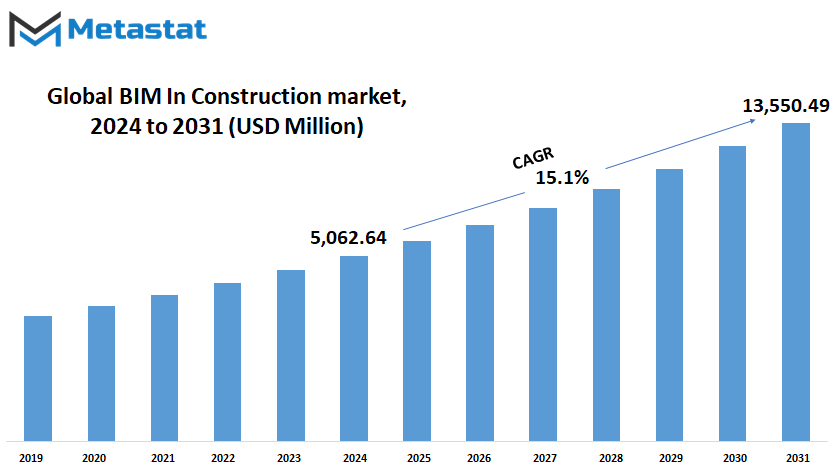

Global BIM In Construction market is estimated to reach $13,550.49 Million by 2031; growing at a CAGR of 15.1% from 2024 to 2031.

GROWTH FACTORS

Building information modeling (BIM) is the trending technology in changing how projects are planned and constructed in the construction industry across the world. BIM merges the different dimensions of construction processes into one digital model and enables increased collaboration among practitioners, hence improving efficiency in the project life cycle.

The global BIM in Construction market is expected to exhibit high growth in the near future. One of the major driving factors is the increasing adoption of BIM technology by construction firms around the world. BIM enables visualization of the end-to-end construction process—from design to maintenance—in a virtual space. This capability reduces errors, improves coordination among different teams working on any particular project, and saves time, thereby reducing costs as well.

Another driving factor is government initiatives to popularize the use of BIM in construction projects. Many countries are now adopting policies that require all public infrastructure projects to use BIM, since they believe it is able to deliver better outcomes and sustainability for projects. These regulations will increase the demand for BIM software and services in the construction industry

However, high upfront costs for the implementation of BIM and integration complexity with existing workflows may challenge market growth. Construction firms generally resist any kind of change, and it needs large investments in training and infrastructure for construction companies to exploit the whole potential of BIM.

It is cloud-based solutions and interoperability across different platforms that are most likely to dictate the future scenario. Cloud-based BIM solutions would offer flexibility and accessibility. This will be done by providing real-time collaboration among project project participants on different geographies. Better interoperability enables easy and smooth exchange of data between different BIM software, thereby improving project efficiency and decreasing challenges in compatibility.

Further, the growing smart cities and sustainable construction practices are going to provide huge opportunities to the BIM market. BIM helps developers and architects develop energy-efficient and eco-friendly buildings by simulating and analyzing the performance of buildings with accuracies. In the future, as concerns toward sustainability continue to rise in construction projects, the ability associated with BIM to optimize resource use and minimize environmental impacts is further going to drive the adoption rate of the product.

Though there are challenges to be overcome, such as those around cost and integration complexities, the global market for BIM in construction is expected to grow phenomenally. Government support and technological developments, as well as greater focus on sustainability, will thus outline the future growth prospects of this market by making BIM an important tool in the transformation process of the construction industry towards efficiency and sustainability.

MARKET SEGMENTATION

By Type

BIM is revolutionizing the construction industry through the invention of novel methods for design, construction, and building management. It creates a digital model of both the physical and functional characteristics of a building and allows the different stakeholders to collaborate much more effectively, improving efficiency and reducing errors.

In the construction phase, BIM helps develop detailed 3D models indicating an overview of how the project would look before laying the foundation. Done preconstruction planning vision, architects, engineers, and contractors are able to plan and coordinate tasks more effectively. Such problems can be detected and rectified in the model itself without wasting cost and time on the same. Moreover, BIM helps in material estimation and cost management by providing accurate data to the user so that he may maintain his budget.

During the operation phase, BIM continues to return important advantages. At the end of a construction project, a BIM model becomes useful in managing the building and its maintenance. Facility managers can use such a model to gain access to crucial information regarding a building's structure, systems, and components. This will provide information necessary for effective maintenance and even assist in planning renovations or upgrades.

The role of BIM in construction is expected to further increase in the times to come. These BIM models will be empowered by enabling technologies like integration with IoT devices. For example, considers sensors integrated into a building that are continuously monitoring several parameters like energy use, structural health, and occupancy. This information can then be fed back into the BIM model to establish a dynamic and consistently up-to-date representation of the building. Moreover, artificial intelligence, AI, and BIM can be used in an integrated manner to provide smarter decision-making. The AI algorithms are capable of interpreting the enormous quantity of data that BIM models generate to give insight and prediction into the optimization process of construction and building performance. AI, for example, can predict when maintenance will be needed before a problem arises or provide design modifications to reduce energy consumption.

By Deployment

The global BIM in construction market is witnessing significant growth, driven by advancements in technology and increasing adoption across the industry. Looking ahead, the future of BIM in construction appears promising, particularly when considering its deployment methods: on-premise and cloud-based solutions.

On-premise BIM systems are traditionally installed and run on local computers within an organization. These systems offer control and security, which can be crucial for firms handling sensitive data. As technology progresses, on-premise BIM systems will likely evolve to become more efficient, integrating advanced features that enhance collaboration and data processing. Despite the shift towards cloud solutions, on-premise systems will remain relevant for companies prioritizing data control and security.

Cloud-based BIM, on the other hand, represents the future of construction technology. These systems allow users to access data from anywhere, facilitating real-time collaboration and seamless information sharing. The flexibility and scalability of cloud-based BIM make it an attractive option for large-scale projects and geographically dispersed teams. As internet connectivity improves globally, more construction companies will likely adopt cloud-based BIM to leverage its benefits, such as reduced IT infrastructure costs and enhanced accessibility.

By Application

The global BIM market for construction is gaining fast due to the existence of its applications in both residential and non-residential sectors. BIM technology is a game-changer in bringing forth efficiency and collaboration to all stakeholders in a construction project at the planning, designing, and execution stages.

BIM functions as a digital model representing the physical and functional characteristics of a building structure in the construction industry. It integrates a variety of components of a project—design, construction, and facility management—into one homogeneous system. This two-way integration enhances coordination and communication between different stakeholders in a construction project at different stages of the project lifecycle.

BIM in residential construction is going to alter the way homes are conceptualized and built. It helps a building architect or designer to visualize and optimize every part of a residential structure right from conceptualization to plans for detailing interior spaces. This not only smooths out the process of design but also refines cost estimation and scheduling for more efficient project delivery.

In the nonresidential sector, comprising commercial buildings, offices, and institutional facilities, BIM will play a key role in ensuring sustainable and cost-effective construction. Through a digital model that combines architectural, structural, mechanical, and electrical systems, BIM facilitates better coordination among multidisciplinary teams. This integration would reduce errors at construction, reduce rework, and in effect enhance overall quality in the built environment.

Also, with technological advancement, BIM will be adopted more. Furthermore, future trends demonstrate an increase in the application of BIM for infrastructure projects, bridges, tunnels, and transportation networks, hence its extended space within a constructor's workflow.

By End Users

The construction industry is taking off fast as BIM integrates and provides technology that redefines the way buildings can be designed, constructed, and managed. Basically, BIM is a digital tool supporting collaborative creation and management of building information by all the stakeholders of each construction project at all stages of the building life cycle.

BIM is revolutionizing the process of construction through enhanced visualization, coordination, and efficiency. Engineers use BIM to create detailed 3D models that simulate the entire process of building, thus enabling them to identify problems way ahead in advance during the design stage itself and work out the optimized design solution. This proactive approach drastically minimizes errors and related costs during a project's construction process.

It also facilitates implementation to a great extent for the contractors. They use BIM for process scheduling, resource allocation, and construction sequencing. With the availability of project information that is accurate, up-to-date, and near to hand, they can make exactly the right decisions at exactly the right time and thereby keep projects on track and within budget.

The worldwide market of BIM in construction is growing at a rapid rate in the backdrop of increasing adoption of digital technologies throughout the construction industry. Engineers and contractors form the principal end-users of BIM, deploying this technology to enhance project outcomes and operational efficiency. Engineers use the capabilities developed by BIM to create comprehensive designs and manage complicated projects in a better way. This enables them to pre-decide upon optimum building performance and sustainability criteria by putting the entire process of construction in a virtual environment.

On the other hand, BIM assists contractors in running a project through its run-through, managing subcontractors, and maintaining specifications of the project. The ability for seamless collaboration with the working architect, engineers, or any other owner enhances communication and coordination in the construction process.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$5,062.64 Million |

|

Market Size by 2031 |

$13,550.49 Million |

|

Growth Rate from 2024 to 2031 |

15.1% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

BIM is changing the face of construction across different regions of the world. One would, at a regional level, raise observations that clearly outline how different regions are at different levels of adoption and harnessing such technology. North America, Europe, Asia-Pacific, South America, and Middle East & Africa—each one presents a different scenario of opportunities and challenges for growth in BIM construction.

In North America, notably the United States, Canada, and Mexico, BIM diffuses strongly with a further expanding tendency. The technological infrastructure in the United States is well developed, and proper government policies are in place to back up this growth. Canada does not lag too far behind because of the benefits it realizes in terms of efficiency and collaboration in projects. Mexico is fast catching up as awareness of its benefits spreads. These countries intend to adopt BIM in their construction processes so that the accuracy in building constructions may be enhanced and the associated costs lowered. Europe, another key player of the BIM-based landscape, is likely to witness growth at a CAGR of 10.9%. It is countries like the UK, Germany, France, and Italy that are primarily driving the European region.

The UK government makes it mandatory for its public projects to adopt BIM, thereby boosting the overall adoption. The accuracy and integration possibilities that BIM offers are also benefitting Germany's powerful engineering sector. There is also strong interest in how to benefit from implementing BIM in France and Italy; however, each country has different ways of applying it. For the remainder of Europe, BIM adoption remains slow, along with patchy implementation depending on needs and requirements from the local industry and policy level. On the other side, the BIM market in the Asia-Pacific region is fast-growing, notably in countries like India, China, Japan, and South Korea. As the boom of construction takes over China, it has become a significant market for products related to building information modeling. Japan is very innovative and integrates BIM in an effort to meet its sophisticated construction needs. South Korea is on the frontline in the advanced technology sector, hence can support its fast-growing use of BIM. The vast infrastructure projects in India are also entering into the value of BIM; however, some challenges related to education and training have risen. The BIM adoption graph is rather gradual in South America, including Brazil and Argentina. The largest market in this region is Brazil, driven by its extensive construction activities, which require an integral need for efficient project management. Argentina has started tapping into the potential of BIM but is in a very nascent stage of mass adoption.

Other South American countries are slowly realizing the benefits but are inhibited by factors such as limited awareness and technological infrastructure. The GCC countries, together with Egypt and South Africa, drive the BIM adoption front in the Middle East & Africa. Indeed, with such ambitious construction projects and smart city initiatives, the GCC has no alternative but to be a prime market for BIM. This is being driven by leading countries like the UAE and Saudi Arabia, which are integrating BIM into their project delivery for sustainability.

In Egypt, progress is due to infrastructure development and modernization; likewise in South Africa. The future of BIM in construction hence seems to be bright across these regions. Every region is at a different stage of adoption, driven by various factors such as government policies, technological infrastructure, and industry awareness. As BIM continues to prove its case in improving construction efficiency and collaboration, it will surely see more adoption globally and will continue shaping the construction industry.

COMPETITIVE PLAYERS

Building Information Modeling is an innovative technology applied in construction, focusing on changing how projects are conceptualized, operated, and delivered. It digitizes the physical and functional characteristics of a building and allows for much more collaboration, efficiency, and accuracy throughout a project's life cycle. The major market players in the field have been exploring BIM to maintain their competitiveness and create more value.

One of the big frontrunners in this space is Autodesk Inc., which provides end-to-end BIM solutions to improve design and construction. Siemens Digital Industries Software makes available its extensive portfolio in conjunction with BIM for the smooth execution of projects and facility management. Hexagon AB offers modern solutions connecting BIM with reality capture technologies to provide minute details about a project.

Oracle Corporation utilizes BIM to extend construction and engineering solutions that focus on project delivery and cost management. Procore Technologies, Inc. incorporated the use of BIM into its construction management platform to allow access to data in real-time for better coordination across projects. Another major company in this market is Bentley Systems, which offers advanced BIM applications in support of infrastructure projects worldwide.

NEMETSCHEK and its subsidiary companies, like Allplan and Graphisoft, are very famous for their powerful BIM software, which can literally answer all construction works. Trimble, Inc. strengthens high accuracy in geospatial and project management tools so that its BIM offerings could turn out better in terms of project results. Vectorworks, Inc. and Vizerra SA provide clear, user-friendly BIM solutions for architects' and builders' needs.

Schneider Electric couples BIM with building management solutions to increase energy efficiency and improve operational performance. Archidata Inc. specializes in the use of BIM for facility management and optimization of building operation. Asite, a company that offers cloud-based BIM solutions, touts collaboration among project stakeholders.

Graphisoft, a company belonging to NEMETSCHEK, is specialized in BIM software for architectural design and construction. Tekla is another Trimble Company specialized in delivering leading-edge BIM solutions for structural engineering and construction. Dassault Systemes delivers the 3DEXPERIENCE platform with an embedded BIM capability to offer end-to-end project lifecycle management solutions. Arup is one of the leading engineering and design consultancies that uses BIM for the delivery of complex and innovative building projects.

Down the line, these players are most likely to hold on with their BIM offerings in the face of increasing construction industry demands. Interoperability, real-time collaboration, and other innovations such as artificial intelligence and the Internet of Things are going to take a front seat. Advancements are going to increase efficiency, sustainability, and innovation of construction projects, thus firming BIM up as one of the important underpinnings of modern construction practices.

BIM In Construction Market Key Segments:

By Type

- Construction

- Operation

By Deployment

- On-Premise

- Cloud-based

By Application

- Residential

- Non-Residential

By End Users

- Engineers

- Contractors

Key Global BIM In Construction Industry Players

- Autodesk Inc.

- Siemens Digital Industries Software

- Hexagon AB

- Oracle Corporation

- Procore Technologies, Inc.

- Bentley Systems

- NEMETSCHEK

- Trimble, Inc.

- Vectorworks, Inc

- Vizerra SA.

- Schneider Electric

- Archidata Inc.

- Asite.

- Graphisoft

- Tekla (Trimble)

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383