Global Beverage Cans Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global beverage cans market has experienced a journey of transformation over the decades where major influencing factors were evolving consumer behavior, packing innovations, and the growing awareness of the environment. The beverage can industry originated in the early 1900s when the idea of storing liquid in metal containers was first thought of. Heavily built steel cans were used at first, often with complex openers, which made their utility limited. It was not until the advent of aluminum cans in the 1950s that the market started to discover its modern self. The combination of lightness, recyclability, and easy handling collectively made aluminum the only available material of choice, establishing a new era of convenience and preservation.

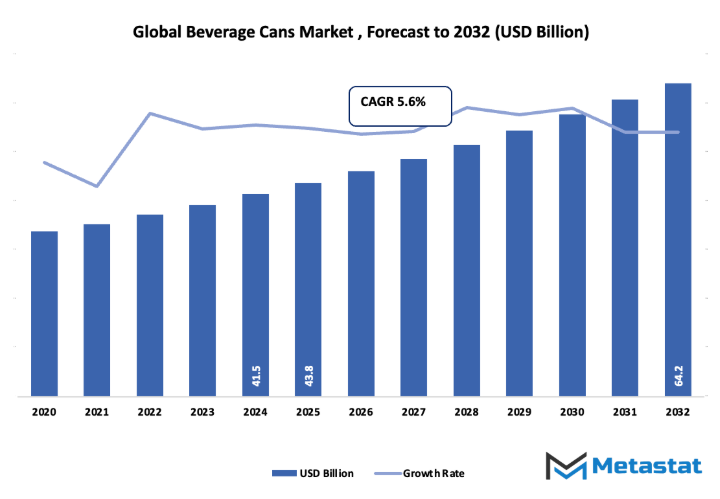

- Global beverage cans market valued at approximately USD 43.8 Billion in 2025, growing at a CAGR of around 5.6% through 2032, with potential to exceed USD 64.2 Billion.

- Aluminum account for nearly 87.5% market share, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising demand for sustainable and recyclable packaging solutions, Increasing consumption of ready-to-drink and carbonated beverages

- Opportunities include: Growing adoption of eco-friendly and lightweight can designs for reduced carbon footprint

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

The latter part of the century witnessed the booming global trade and the beverage companies started to look for the packaging that would last the longest through the long transport routes and keeping the contents fresh. Cans offered that answer, and non-alcoholic drinks, beers, and energy drinks were able to cross borders without hazards like spoilage. Further, the introduction of the pull-tab in the 1960s brought another change that replaced can openers and allowed users to carry their drinks during outdoor activities. This modest yet powerful innovation determined to a large extent the course of packaging history, thereby identifying cans as being both user-friendly and portable.

Eventually, consumer demand started to change. Sustainability and overall brand image were among the traits, which consumers considered important in the first place, therefore, manufacturers had to find new ways to combine different materials and design. The global beverage cans market was about to see a slew of technological advances that included digital printing, the use of lighter alloys, and the development of barrier coatings that were good at retaining flavor and at the same time reducing waste. Manufacturers were also experimenting with textural finishes and custom embossing that would help brands to have visibility even on very crowded shelves.

Environmental regulations in various regions started encouraging recycling initiatives, pushing the industry toward circular production systems. As recycling technology became more advanced, aluminum recovery rates rose, proving that metal packaging could be both profitable and environmentally responsible. The present market reflects decades of innovation, cultural change, and consumer dialogue. In the years ahead, the global beverage cans market will continue to evolve, not just as a packaging solution but as a symbol of how technology, sustainability, and design can merge to meet global demand in an ever-conscious world.

Market Segments

The global beverage cans market is mainly classified based on Material, Application, , .

By Material is further segmented into:

- Aluminum: Aluminum cans hold a significant share in the global beverage cans market due to their lightweight nature and high recyclability. The material helps maintain the flavor and quality of beverages for longer periods. Manufacturers prefer aluminum because it reduces transportation costs and offers an attractive appearance for branding. The high recycling rate of aluminum also supports sustainability goals, making it a favored option for beverage packaging.

- Steel: Steel cans are used in the global beverage cans market for specific beverage categories where strength and durability are required. The material offers strong protection against external damage and light exposure, preserving the beverage content. Steel cans are heavier than aluminum but provide a cost-effective option for bulk packaging needs. The recyclability and long shelf life associated with steel make it a reliable choice in certain regions and applications.

By Application the market is divided into:

- Carbonated Soft Drinks: Carbonated soft drinks form one of the largest segments in the global beverage cans market. The packaging keeps the carbonation intact, ensuring product freshness and taste. Beverage companies use cans because they are convenient, stackable, and suitable for mass distribution. The growing popularity of soft drinks among younger consumers further supports the market demand for metal cans in this category.

- Alcoholic Beverages: Alcoholic beverages, including beer and ready-to-drink cocktails, contribute significantly to the global beverage cans market. Cans are ideal for preserving the quality and flavor of alcoholic drinks while preventing light exposure. Their portability and easy-chill feature make them suitable for outdoor events and retail sales. The rise in canned craft beers and cocktails continues to expand this segment globally.

- Fruits & Vegetable Juices: The global beverage cans market for fruit and vegetable juices is growing steadily due to consumer preference for healthy and convenient options. Cans protect juices from contamination and oxidation, keeping them fresh for longer durations. The lightweight design also makes transportation and storage easier. Increased awareness of nutrient-rich beverages further supports the use of cans for packaging natural and organic juice products.

- Other Applications: Other applications in the global beverage cans market include energy drinks, flavored water, and dairy-based beverages. The versatility of cans allows for a wide range of liquid products to be safely packaged and distributed. The trend toward portable and on-the-go packaging continues to enhance the use of cans in these categories. Manufacturers are focusing on improving can designs to attract consumers and promote brand recognition.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$43.8 Billion |

|

Market Size by 2032 |

$64.2 Billion |

|

Growth Rate from 2025 to 2032 |

5.6% |

|

Base Year |

2024 |

|

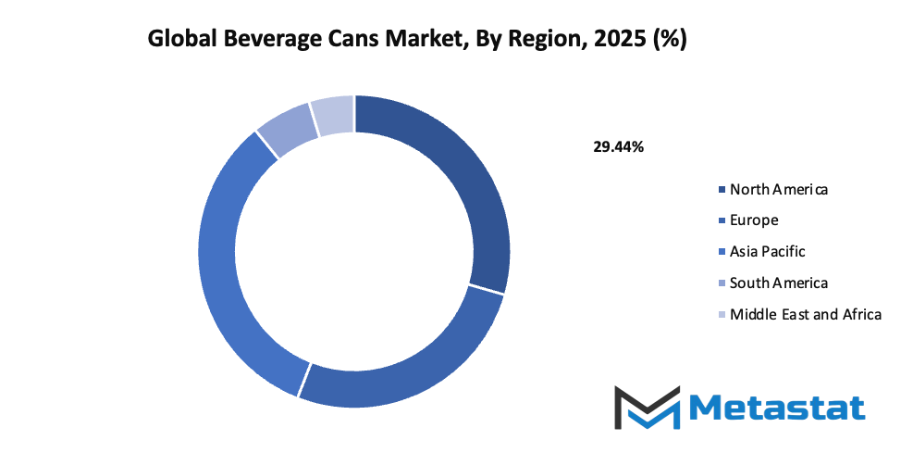

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

- Based on geography, the global beverage cans market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising demand for sustainable and recyclable packaging solutions: The growing shift toward products that can be recycled or reused is creating new possibilities for manufacturers. Packaging made from metals like aluminum is gaining popularity due to its ability to be recycled without losing quality. This change will lead to reduced waste generation and support the global effort toward greener production systems.

- Increasing consumption of ready-to-drink and carbonated beverages: Urbanization and changing lifestyles are driving higher demand for ready-to-drink and carbonated beverages. Easy availability and convenience will continue to attract consumers who seek quick refreshment options. As beverage consumption increases, metal cans will remain a preferred choice due to their ability to preserve flavor and extend shelf life.

Challenges and Opportunities

- Fluctuating raw material prices of aluminum and steel: The changing prices of metals such as aluminum and steel will influence the overall cost of production. When prices rise, profit margins become narrow, forcing companies to find cost-effective alternatives or optimize processes. Long-term strategies that include stable sourcing and recycling will help minimize the impact of price fluctuations.

- Environmental concerns over energy-intensive metal production: Metal production requires high energy consumption, leading to significant carbon emissions. Addressing these concerns will be vital for reducing environmental damage. Transitioning to cleaner energy sources and adopting modern technologies that use less power will support sustainability and help industries lower their ecological footprint.

Opportunities

- Growing adoption of eco-friendly and lightweight can designs for reduced carbon footprint: Manufacturers are exploring lightweight can designs that use fewer materials without compromising strength or quality. This approach will help lower emissions during transport and production. By adopting eco-friendly designs, the industry will contribute to carbon reduction efforts while meeting increasing consumer demand for sustainable packaging.

Competitive Landscape & Strategic Insights

The global beverage cans market is moving toward a future shaped by both technological progress and shifting consumer expectations. The industry is a mix of well-established international corporations and dynamic regional competitors, each contributing to the rapid development of packaging solutions that focus on sustainability, convenience, and efficiency. Major competitors such as Crown Holdings Inc., Ardagh Group S.A., CPMC Holdings Limited, Toyo Seikan Group Holdings Ltd., Can-One Berhad, Can-Pack S.A., Ball Corporation, Envases Universales, Universal Can Corporation, Interpack Group Inc., GZ Industries, Showa Denko K.K., Nampak Bevcan Limited, The Olayan Group, Mahmood Saeed Can and End Industry Company Limited (MSCANCO), Kian Joo Can Factory Berhad, SWAN Industries (Thailand) Company Limited, Envases Group, CANPACK, Bangkok Can Manufacturing, Orora Packaging Australia Pty. Ltd., and Nampak Ltd. continue to influence the competitive structure of this global market.

As sustainability becomes a defining factor in packaging choices, companies are increasingly focusing on materials that reduce environmental impact. Aluminum, with its high recyclability rate, continues to dominate the production of beverage cans. Future trends point toward lighter can designs, improved coating technologies, and enhanced recycling systems to minimize waste. Such efforts not only meet global environmental goals but also attract consumers who value responsible manufacturing practices.

The global beverage cans market will continue to evolve as automation and digital technology reshape manufacturing processes. Smart production systems that improve energy efficiency and reduce material waste are becoming central to large-scale operations. Artificial intelligence and data-driven insights will help companies predict demand more accurately, manage supply chains efficiently, and optimize distribution networks. As a result, production will become faster, more flexible, and more sustainable, allowing businesses to remain competitive in a changing global landscape.

Regional competitors are also beginning to gain ground by focusing on affordability, customization, and regional brand partnerships. Emerging players are targeting niche markets, such as craft beverages and health-focused drinks, which require smaller batch production and innovative packaging. These companies often respond more quickly to local market needs, making them strong contenders against established global firms.

The future of the global beverage cans market will likely be defined by collaboration between international leaders and regional manufacturers. Such cooperation can lead to shared technological development, improved material sourcing, and wider market access. While competition remains strong, mutual innovation and shared sustainability goals can push the entire industry toward higher efficiency and environmental responsibility.

Market size is forecast to rise from USD 43.8 Billion in 2025 to over USD 64.2 Billion by 2032. Beverage Cans will maintain dominance but face growing competition from emerging formats.

Looking ahead, the global beverage cans market will continue to adapt to global consumption patterns and regulatory changes. As governments strengthen environmental policies and consumers demand greener packaging, manufacturers will need to stay flexible and forward-thinking. By integrating sustainable materials, embracing technology, and understanding consumer trends, the industry can secure steady growth while contributing positively to the environment and the global economy.

Report Coverage

This research report categorizes the global beverage cans market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global beverage cans market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global beverage cans market.

Beverage Cans Market Key Segments:

By Material

- Aluminum

- Steel

By Application

- Carbonated Soft Drinks

- Alcoholic Beverages

- Fruits & Vegetable Juices

- Other Applications

Key Global Beverage Cans Industry Players

- Crown Holdings Inc.

- Ardagh Group S.A.

- CPMC Holdings Limited

- Toyo Seikan Group Holdings Ltd.

- Can-One Berhad

- Can-Pack S.A.

- Ball Corporation

- Envases Universales

- Universal Can Corporation

- Interpack Group Inc.

- GZ Industries

- Showa Denko K.K.

- Nampak Bevcan Limited

- The Olayan Group

- Mahmood Saeed Can and End Industry Company Limited (MSCANCO)

- Kian Joo Can Factory Berhad

- SWAN Industries (Thailand) Company Limited

- Envases Group

- CANPACK

- Bangkok Can Manufacturing

- Orora Packaging Australia Pty. Ltd.

- Nampak Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252