MARKET OVERVIEW

Benelux will be abuzz with change in the construction industry to make infrastructure projects change the face of execution in Belgium, the Netherlands, and Luxembourg. As new technologies mature, tremendous uptake in drones is expected to change this paradigm for site management, surveying, and project monitoring practices.

In the future, it could be said that drones are going to become an integral part of the construction projects in the Benelux. Their applications will reach beyond mere aerial photography and video recording. These drones will be used to collect real-time data by creating 3D mapping and thorough site inspection. The adoption of drone technology is expected to simplify all these processes, ensure accuracy, and save time in a complex task.

Development in the underlying drone technology would be the growth driver for the Benelux Construction Drone market. Future drones would come improved with sensors, increased battery life, and high-level data-processing capability, which would mean they could perform a wider range of functions more accurately and resourcefully. The construction companies within the Benelux region will rely more on the advanced drones in carrying out site surveys, monitoring the construction, and also ensuring that the accepted safety and quality standards are met in construction projects.

Regulators about the use of drones will also have a critical say in the market. The more regulatory definitions that are set and standardized will pave the way for construction companies to build workflows around using drones. In this regard, regulatory compliance ensures that drones can be used safely and effectively, hence mitigating the risks associated with the use of drones on construction sites. This clarity about regulatory frameworks will facilitate a deeper understanding and adoption of drone technology by the fraternity of construction.

Drones' integration into construction projects in the Benelux region will benefit many aspects of project management. Drones will give real-time data for precise plans and actual project implementation. Drones will also make it easy to monitor how the construction is going, which means that project managers can easily take appropriate decisions timely and promptly to resolve any issue at hand. It is also because of drones that better safety within construction areas would be attributed to them, as they allow for the remoteness of location inspection into areas that would otherwise remain inaccessible, thus having fewer personnel being exposed to hazardous conditions.

In developing the Benelux Construction Drone market, there is a need for higher cooperation from technology providers and construction firms. It is through partnerships that customized drone solutions to various needs in the construction sector will be developed. Partnerships will continue to spur innovation and see to it that technology grows according to the needs of the sector.

Looking forward, the construction drone market in Benelux will take on an important role in the construction sector. Advanced drones will revolutionize how construction projects are conceived, executed, and monitored. Continuous advancements in technology, coupled with regulatory conditions in an ever-changing environment, will deeply change the way drones will be used in construction.

The Benelux Construction Drone market is to be very prospective when it comes to wide technological growth and high uptake in constructions. Drones are going to play a significant role in bringing accuracy, efficiency, and safety to the construction site. In the developmental course of the market, the interaction between technology developers and construction professionals will drive innovation to meet industry standards and completely exploit the possibilities that drones have in technology.

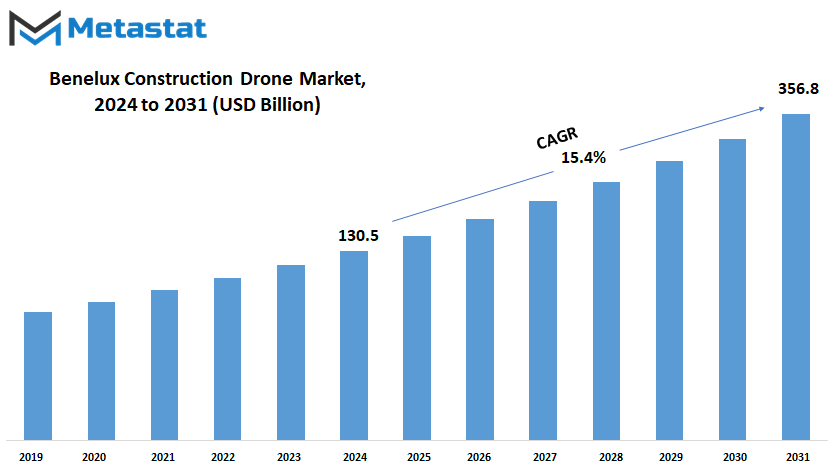

Benelux Construction Drone market is estimated to reach $356.8 Million by 2031; growing at a CAGR of 15.4% from 2024 to 2031.

GROWTH FACTORS

The Benelux Construction Drone market will grow rapidly by continuous technological changes in the sectors of the industry. Improvement in the adoption of drones in Benelux region, which comprises Belgium, the Netherlands, and Luxembourg, construction projects has been driven by several critical factors, including efficiency, cost cutting, and improved safety, that are essentially an integral part of this very dynamic construction industry.

The upward growth trend of the Benelux Construction Drone market is primarily attributed to the promotion of efficiency in building projects. Drones are very common for aerial data gathering and the consequent monitoring of progress while assessing site conditions more accurately than traditional methods. This significantly enables construction companies to facilitate and streamline their operations with less delay, thereby achieving better outcomes in projects. This is a reduction in the time to be used for surveying and mapping processes by use of drones, which means quicker project delivery, therefore lower labor costs.

Cost-cutting is one of the prominent reasons why the drone market is expanding so rapidly. Drones can carry out site inspection and progress monitoring more economically than traditional methods. Drones save construction companies from costly mistakes by providing real-time data with fine aerial views, thus, offering improved resource management. This cost efficiency will be very important in a competitive market where profit margins have to be maximized.

Advancement in safety is another driving factor of growth in this market. Drones can reach dangerous areas without exposing human laborers. They can monitor structures from above and create high-resolution images and data which helps one find out potential safety issues before it becomes critical. This approach to safety proactively guards the workers and consequently helps in compliance with strict regulations.

However, there are challenges that could arrest market growth. Regulatory hurdles and concerns about privacy can hold back drones from spreading their wings into large-scale construction. The uncompromising regulations and bureaucratic obstacles may lead to a significant deceleration in its implementation. Data security and issues related to privacy are also factors that need to be sorted out before the drones enter freely onto a construction site.

Despite such challenges, the Benelux Construction Drone market offers promising growth scopes. With technological advancements and changes in regulations, the scope of applications for drones in construction will continue to evolve further. Increasing emphasis on sustainable building practices and smart construction technology will open more scenarios for the application of drones in construction. Companies that better negotiate the regulatory environment and address the growing concern of privacy will be better placed to lead the charge on this growing space.

In short, the future of the Benelux Construction Drone market promises to be bright. Increased efficiency and cost cuts combined with enhanced safety will continue to drive levels of adoption, and technological advancements and regulatory adjustments will create new growth opportunities.

MARKET SEGMENTATION

By Type

Over the last few years, the Benelux Construction Drone market has developed with great strength along with advancements in technology as well as higher adoption of construction practices. The drone-related market of this region was divided into three major categories: Fixed-Wing, Rotary-Wing, and Hybrid. These markets depicted different kinds of growth and applications in these successive years.

In 2023, Fixed Wing Drones were at the top of the market with 61.2 million USD. These drones offer a flight duration and area coverage capability, which facilitates them to be used in large construction sites. They are an efficient and important model of long-distance travel offered by their fixed wing design, which is paramount when surveying large construction areas. Fixed-Wing Drones will certainly remain popular in this market as the need for total overhead site analysis continues to grow. With their abilities to give defined, high-resolution images over large areas, they are an indispensable tool in construction management.

Rotary-wing Drones are the second largest market segment, with a valuation of 33.8 million USD in 2023. They are known for being quadcopters or multi-rotors that make them highly maneuverable and hover-capable of enabling their use in tasks requiring high precision and closeness in data collection. Their vast applications include tracking the progress of construction, Inspecting structures, and managing site logistics. Increasing functionalities that make construction operations much more efficient and precise are going to drive the Rotary-Wing Drones market forward in the future.

Hybrid Drones’ Market Size: The market size of Hybrid Drones is 21.8 million USD in 2023. Hybrid Drones essentially amalgamate both the Fixed-Wing and Rotary-Wing designs. This segment is gaining momentum because hybrid drones can provide both types of drone benefits —long flight durations and stability of Fixed-Wing Drones as well as versatility and accuracy of Rotary-Wing Drones. They are adaptable to all types of work ranging from large-scale surveys to meticulous inspections and offer a well-balanced solution to many construction needs. With developments in technology, the Hybrid Drones segment will continue to increase with innovations that add functionality and cut costs.

With further growth in technological advancements and expanding applications of drones in construction, the Benelux Construction Drone market will continue to evolve. These drones will see more pivotal roles in the construction industry as the industry continues to optimize its processes to ensure good site management and accuracy in project work.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$130.5 Billion |

|

Market Size by 2031 |

$356.8 Billion |

|

Growth Rate from 2024 to 2031 |

15.4% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

By Application

As the construction sector is increasingly adopting advanced technology, the Benelux Construction Drone market can be expected to boom. The sector, consisting of the region of Belgium, the Netherlands, and Luxembourg, has drastically changed because of adopting drones for different applications. Among them, surveying land constitutes an important feature of the market.

The segment of land surveying accounted for $45.2 million in 2023, thus constituting a share of 38.7% of the overall construction drone market. This is an extremely high percentage that indicates how essential these drones are when it comes to holding accurate and efficient surveys of the land. There are various reasons why people prefer drones over traditional methods for land surveying. For one, with drones, one can collect information in a very short period. They also avoid human error and produce a high-resolution image of the area, which increases the accuracy of the surveys.

As technology develops, drones are likely to survey much more land. More advanced developments will come in the form of more advanced drones with better sensors and imaging technologies. This would further refine the quality of data gathered and allow for the making of even more accurate plans and better decision-making in construction projects.

In addition to land surveying, drones are now increasingly being used for infrastructure inspection. This is a crucial application in as much as checking the condition of bridges, roads, and buildings requires maintaining and evaluating its state. If specialized cameras and sensors are mounted on them, drones can inspect inaccessible areas and collect data much better than earlier methods. The ability to quickly and accurately assess infrastructure conditions will be critical for safety purposes and for planning maintenance activities.

One of the important applications is security and surveillance. Drones are useful for monitoring sites at construction sites and ensuring safety procedures. They offer real time surveillance to complement measures on extended areas that cannot possibly be covered by manual monitoring.

Land surveying is the largest application. However, other applications such as infrastructure inspection and security and surveillance are also emerging. As technology advances, these applications will also be more advanced and will continue to fuel the growth of the Benelux Construction Drone market.

The Benelux Construction Drone market will continue to grow with increasing applications in surveying land, infrastructure inspection, and security. In the future, there will likely be further advances made in drone technology to improve their capabilities and solidify their role in the construction industry.

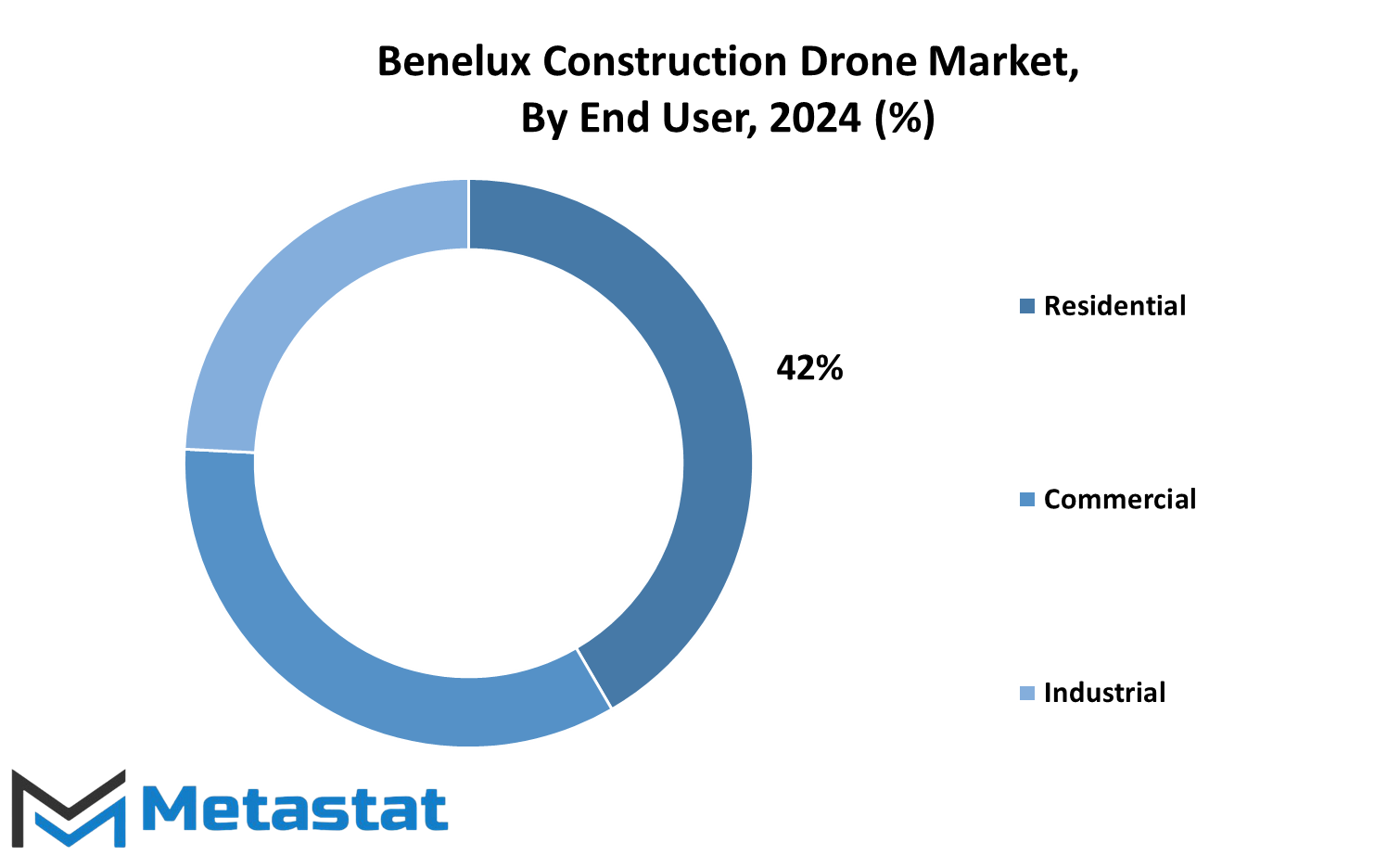

By End User

The Benelux Construction Drone market is highly expected to gain momentum amid tremendous technological changes sweeping the industry. There are basically three kinds of end-users: residential, commercial, and industrial. Each of these end-user types carries its specific requirements or potential applications that will help the market expand.

The use of drones is growing to make residential construction projects more efficient. Drones offer many advantages, such as highly accurate site surveys and real-time monitoring of the rate of progress in construction. With residential projects seeking cost savings and accuracy, demand will rise for drones that can take pictures and collect high-resolution data and support faster decision-making and better management of a project.

The commercial segment is also a healthy percentage of the Benelux Construction Drone market. Drones can be used in many areas of applying to commercial construction, including site inspection and surveying as well as the advance of its progress. It can quickly cover large areas as well as provide detailed aerial views in order to ensure a complex commercial project can be efficiently managed. With a growing quest by business houses to optimize their operations and eliminate wasteful delays, adoption of drones is expected to increase in the market. Not only will this technology streamline workflows but also make the workplace a bit safer by reducing the risks of workers undertaking hazardous jobs at great heights.

Different needs and opportunities are presented in the industrial segment of the market. Some industrial construction activities that involve the use of drones include conducting inspections on bridges, power lines, and large facilities. These require accuracy and reliability, which the use of drones can provide. The use of drone's aids in the right maintenance and management of infrastructure to offer clear data based on proper readings. Industries are expected to increase their activities when using drones to monitor and manage assets in the most advanced manner possible.

Moving ahead, the Benelux Construction Drone market will most likely keep moving on its advancement and acceptance within the three distinctive types. Each residential, commercial, and industrial category develops at a larger advancement through drones within the overall capability to increase prospects of market growth. The more advanced the technology is, the greater their sophistication will be, with far more beneficial features and applications. With the integration of these aerial devices into the construction practices, effectiveness and precision will improve, and how such construction projects are planned and executed would be redefined. The future for the market of Benelux Construction Drone holds very promising opportunities with vast scopes of development and growth between each of the categories of end-users.

COMPETITIVE PLAYERS

A look into the Benelux Construction Drone market reveals it to also be a large space vulnerable to fast changes, due to newly emerging technologies and new competitors. Major players in the Benelux construction drone market include well-established players such as DJI, Parrot Drone SAS, and Yuneec. Different strengths brings each one of them to the market. Innovation from DJI, with an extensive range of drones, has been able to assert its supremacy in the market. Parrot Drone SAS and Yuneec also come into the picture with high-end features and tough competition in terms of price. So, the competition ranges from a broad spectrum of needs that these industries place within construction.

There are also Aerialtronics DV B.V., Avular, and Dronevolt in the emerging firms. Aerialtronics is known to have some of the best aerial solutions while Avular specializes in robotics and automation at a high level. Dronevolt is doing its part in innovating drone technology that brings diversity and growth into the market.

DeltaQuad and C-Astral d.o.o. are highly valued for their involvement in the sector. The unique aspects of vertical take-off and landing drones of DeltaQuad and designing flexible high-performance unmanned aerial vehicles by C-Astral d.o.o. have been one of the significant contributions to the field. Wingtra AG has been on the list of another major contributor, with a focus on drones specialized in precise mapping and surveying.

In the future, competition for these players in the Benelux Construction Drone market will rise. Since technology is continuously developed and these drones are going to be an integral complement in construction projects, the development of capabilities such as improved imaging, data collection, and site analysis would be impressive. The provision of real-time information and comprehensive surveys that these drones can offer would be revolutionary for the management of construction sites and would involve much efficiency and savings.

Similarly, as the market size grows, demand for more specialized features and higher performance standards in drones will be substantially on the rise. Companies will have to be relatively innovative in ensuring they can always move ahead of others. This may include improving the battery life, updating camera quality, and integration of better sensors to ensure that the changes needed in construction are well accommodated by the drones.

The overall dynamics of the Benelux Construction Drone market will be high on movement due to constant innovations and increased competition. However, major and innovative companies will drive the forward movement of the market through their involvement in this sector, ensuring that construction projects avail of the latest developments in technology with improved operational efficiencies for such applications.

Benelux Construction Drone Market Key Segments:

By Type

- Fixed-Wing Drones

- Rotary-Wing Drones

- Hybrid Drones

By Application

- Surveying Land

- Infrastructure Inspection

- Security & surveillance

- Others

By End User

- Residential

- Commercial

- Industrial

Key Benelux Construction Drone Industry Players

- DJI

- Parrot Drone SAS

- Yuneec

- Aerialtronics DV B.V.

- Avular

- Dronevolt

- DeltaQuad

- C-Astral d.o.o.

- Wingtra AG

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383