MARKET OVERVIEW

The global beef market is the one in charge of defining the food industry, economies, trade policies, and consumption habits worldwide. It is one of the most consumed meats worldwide; therefore, beef has a huge stake in agriculture, food processing, and retail. The industry has moved from the old-fashioned mode of farming to those that are tech-savvy and sustainable, to cater better to the demand for a growing population. With growing concerns about food security, changing climate, and ethical sourcing, producers and suppliers need to be oriented toward changing consumer behavior and regulation policies across the countries.

The global beef market has evolved to be consumer-behavior-driven and science-based changes that have taken place recently. Demand for higher-value cuts of meat, organic beef, and alternative proteins has shown a need for producers to invest in innovation and refinement. The superpowers in beef production-Domestically and internationally-continue to outpace other nations in beef: the United States, Brazil, and Australia. But most markets are rapidly reinforcing their presence. The growth of e-commerce and digital supply chains is further changing the parameter under which beef products reach consumers, making them accessible and safe.

Producers in the global beef market are now allowing their production in ways that reduce their effects on the environment. Governments and international bodies adopt increasingly stringent policies to track emissions from cattle production concerning greenhouse gases. It is expected that the most popular initiatives, such as methane-reducing feed additives and regenerative grazing techniques, will gain a foothold as they will never fail to align the industry with global climate goals. There is also the potential of laboratory-grown beef and plant protein substitutes changing the normal marketplace game, providing people with a wider scope of alternatives in proteins.

The global beef market is bound within the boundaries of trade policy and changes in geopolitical environment, both of which affect production costs, export regulations, and access to markets. Beef trading countries must work their way through tariffs, import limitations, import costs and sanitary regulations, all of which contribute to price fluctuations. The carrying forward of blockchain technology may improve transparency in beef supply chains so that beef consumers can accurately trace the origins of their products. This is the idea that the growing traceability of products will enhance their credibility, especially when marketed as ethically sourced and for high-quality beef, thereby elevating consumer trust in well-established brands.

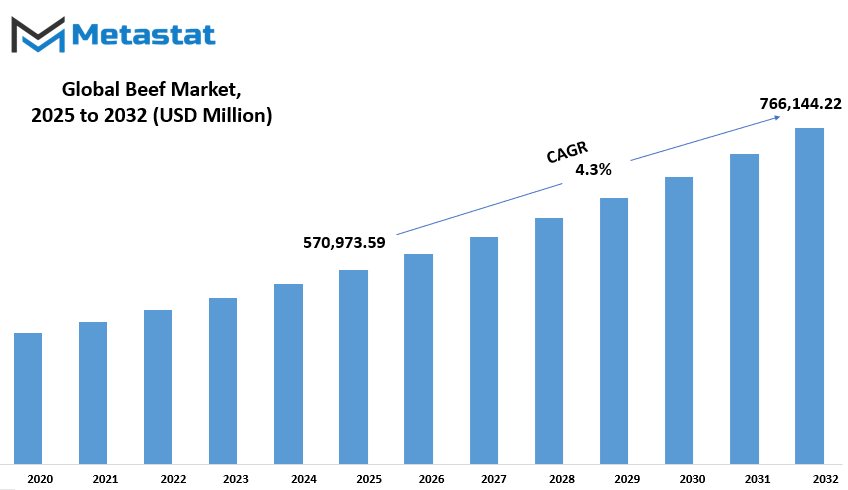

global beef market is estimated to reach $766,144.22 Million by 2032; growing at a CAGR of 4.3% from 2025 to 2032.

GROWTH FACTORS

Changes are occurring in the global beef market arising from changing consumer preferences and innovations in the industry. While market growth has been spurred by increasing demands for protein diets and high-quality meat products in various continents, consumer choices have gravitated toward more nutritious foods. Beef has remained key due to its high protein content and provision of other essential nutrients. Growth through QSRs and processed beef products has been on the rise, both of which fit the fast-paced lifestyle of consumers today. Ready-to-eat and frozen beef meal options have the added convenience factor to encourage increased consumption, especially in urban areas that need time-efficient meal solutions.

While the complimentary basking in the limelight may be merited, it is concurrent with quite serious hindrances and deterrents to the growth and development of the beef industry. The environmental problems of beef production-on greenhouse gas emissions, deforestation, and water usage-have given rise to different sustainability discourses. The livestock sector, especially cattle raising, has been blamed for climate change, which has made regulators and NGOs call for tougher laws. Also, health- and morally-concerned consumers are increasingly moving or considering moving to plant- and alternative-protein sources. Plant-based substitutes for regular meat are gaining ground, hence competing with beef, prompting a few stakeholders to take up diversification.

On the other hand, the ideas behind sustainable beef and lab-grown beef production are the doors to the possibilities out there. Given the traction cellular agriculture and alternative meat technologies have gained in the past few years, they provide promising pathways toward addressing environmental concerns while simultaneously satisfying consumer demand. The future of lab-grown meat or cultured beef is one that could become a realistic option to replace conventional beef that tastes and feels the same, without requiring any extensive livestock farming activity. Development such as this has attracted investments from leading food companies and research institutions, indicating a moment of market transformation.

In the transitions ahead, maintaining equilibrium between sustainability and consumer demands will be the key to future growth. It seems that only companies that invest in environmentally friendly production and can adapt to changing dietary trends may survive within the emergent scenario. Although conventional beef may still be consumed, the mergers of sustainability and innovations in meat alternatives will directly impact the industry's future prospects. The global beef market stands at a watershed moment, with technological advances and evolving consumer expectations poised to chart its terrain in the years ahead.

MARKET SEGMENTATION

By Type

The global beef market has received much attention in the food industry due to a rising consumer appetite and changing eating patterns. Globally, beef remains one of the most consumed sources of protein by individuals. The market growth of beef is affected by demographic factors like population increase, increasing disposable income, and change in consumption patterns. As development proceeds, the diet changes towards more protein-rich foods, including beef in high quantities.

The global beef market segments can be fresh beef and processed beef, which have different consumer needs and preferences. Fresh beef would bring in revenues, like $376,582.45 million, and monumental market shares mainly generated by demand in households, restaurants, and food service establishments. However, consumed as cured, frozen, or canned beef items, they add considerably to available markets because they appeal to people with the cravings for convenience foods, capable of a much longer shelf life.

Rippling along the food industry in the world is the global beef market attracting much notice particularly because of constantly increasing consumer willingness to adopt new diets. Altogether from bulls, cows, or other heifers, beef remains the most consumed protein in the world. The important factor of population growth, increasing disposable income, and changing consumption pattern of population will create the market for beef. Beef becomes heavier and heavier with the development of the protein-rich diet. That market segment divided into fresh and processed beef, each serving different demands and consumer preferences. Fresh beef would create revenues of $376,582.45 million and boast quite a market share because demand comes from all households, restaurants, and food service establishments. Though again consumed as cured, frozen, or canned beef items, they contribute quite a bit to available markets for people craving convenience foods that enjoy a much longer shelf life.

The global beef market has drawn much interest in the food industry as a factor caused by increasing consumer readiness to adopt some new diets. Globally, altogether from bulls, cows or more, heifers, beef remains the most consumed source of protein. Some important factors, population growth, increasing disposable income, and changing trend in consumption pattern, will eventually create the marketplace for beef. The protein-rich diet gets stronger with the advancement of people's development. Segmentation in the market would be possible into fresh and processed beef, having each serving different demands and meeting consumer preferences. Fresh beef would create revenues of $376,582.45 million and boast quite the global beef market share because demand comes from all households, restaurants, and food service establishments. However, these consumed as cured, frozen, and canned beef items contribute significantly to the available markets because they appeal to people craving convenience foods, capable of a much longer shelf life.

A plethora of economic, environmental, and regulatory factors shape the global beef market. Trade policies, import and export regulations, and government interventions have a direct bearing in determining prices and availability of beef in various countries. Countries with strong domestic production would ensure that their supply chains remain stable, whereas countries relying on imports would be largely affected by fluctuations of the international market. Also, very recent concerns about environmental issues are making waves in this industry, where sustainable farming and ethical practice are being put to scrutiny. The very fact that the beef industry is contributing to land use, water use, and greenhouse gas emissions has raised questions as to which practices are truly sustainable; thus, producers are now undertaking initiatives en route for eco-friendly.

Consumer preferences stand as another major influencing variable behind the market trends. While conventional beef consumption continues to thrive, there is emerging interest among consumers for organic, grass-fed, and ethically sourced meat. Health-conscious consumers are putting greater emphasis on how production methods align with their respective values. Advancement of food technology along the timeline will certainly be a game-changer for the industry, innovations are improving meat quality, preservation, and distribution efficiency along the way.

The beef industry is, however, facing many challenges, including volatile feed costs, disease outbreaks, and competition with alternative protein sources. The increasing presence of competing plant-based and lab-grown meat alternatives has prompted a mild disruption in the protein market, impacting consumer actions and forcing the beef industry to change accordingly. Besides, disruptions in the supply chain, labor shortages, and climate factors also come together to influence the course of production and distribution and, thereby, the market itself.

Going forward, the global beef market would still have some opportunities as consumer trends, technology, and sustainability initiatives change rapidly. Stakeholders and producers in the industry must, therefore, find their way through those trends toward continual growth while dealing with environmental and ethical issues.

By Product Type

In the food business, beef is a massive consideration, while some markets are very focused on other preferences and diets of consumers. This huge sector employs farmers and impacts the global economy thanks to the supply chains and businesses involved in beef production and transit. The equally growing demand for protein means that beef is still one of the major household, food, service, and commercial ingredients for consumers. The global beef market is put into some worldwide categories owing to the demographic factors of the population, changes in consumption patterns, and issues that have arisen from health awareness and ethical concerns. To the modifications and changes in consumer preferences, producers have focused on providing different types of beef to fulfill market demand.

With the advent of differentiation within the global beef market based on product types affecting one consumer demand or the other, grass-fed beef naturally attracted and favored the consumers who were searching for something that appeared more natural yet would be on the leaner side. Cattle are raised on pasture and are not allowed to consume any grain-based feed. The general thought is that the grass-fed beef has a healthier nutritional profile and taste. In direct opposition, grain-fed beef provides premium marbling and tenderness characteristics which are favored by the high-end culinary experience.

The good carcass quality and flavor characteristics of grain-fed beef result from supplementing the feed with grains. Organic beef also satisfies the need of health-conscious consumers. Organic beef production must follow regulations that maintain that cattle must not be given synthetic hormones, antibiotics, or GMO feed. Here, one sees emerging trends towards clean label consumption. Conventional beef, on the other hand, remains the most commonly available cutoff point as an economically viable mass-market-end product.

The need for increased consumer awareness and demand for transparency has initiated the shift in meat sourcing and marketing. Animal welfare, sustainability, and environmental consequences are the kinds of information people are interested in. Such pressures have led to an increased sense of responsibility and ethics on the part of the producer, culminating in certification and labeling of meat within the quality and sourcing information for the buyer. Entering into meat production technology was meant to improve the efficiency and quality of their products while addressing food safety issues, and it has done just that.

The beef industry is undergoing these changes to meet consumer demand by ensuring economy without compromising on quality. The openness for investigation of various kinds of beef allows consumers to make their own choice with respect to items which correspond to their preferences, dietary needs, and value systems-forming a basis for the continuous growth and expansion.

By Distribution Channel

The global beef market continues to expand, given rising demand for quality meat in other areas of the world. The variety of distribution channels in the industry is thus able to cater to both large-scale and small consumers. Supermarkets and hypermarkets are the main outlets, giving consumers the convenience of accessing a large variety of different cuts of beef. These stores are an important link in the availability of fresh and packaged beef to consumers, ensuring that one can conveniently purchase the desired meat. The very large retail environment provides the convenience of being able to have all that choice under one roof, and, of course, discounts and promotional offers entice the buyers.

Butcher shops also form a major sector of the market, especially in regions where consumers prefer fresh cuts along with the personal touch afforded by a butcher. These shops tend to be respected for their expertise and customer service, allowing buyers to describe in detail their needs for certain fresh cuts of meat. But many butcher shops emphasize the quality and source of their beef, attracting consumers who care about freshness and traceability. Unlike supermarkets, they encourage a much closer relationship between sellers and buyers, in many cases leaving the customers to be loyal to them on an implicit basis of trust and service.

The move to online retailers for beef purchasing has put convenience and accessibility attendant with just a click. Detailed product descriptions complemented with reviews and home delivery services make e-commerce widely accepted by those wanting quality meat without having to visit physical stores. The online segment has been prominent in carving out niches for organic and premium beef selections, which alternately are not always present in other retail avenues. Subscription-based services and doorstep delivery have also contributed greatly to the online preference.

Hotels, restaurants, and cafés as a whole form yet another important distribution channel, catering to the food service industry. The food service sector requires quality beef on a regular basis for their menu offerings. Such establishments, along with their sourcing preferences, create a requirement where beef meets their customer specifications. With increasing interest from consumers to dine out, this segment continues to cause much demand, which makes it yet another crucial segment in the beef supply chain.

Altogether, all these channels serve in their own special way to define the global beef market and give consumers an alternative to obtaining meat in accordance with their choices and lifestyle. Keeping in mind that consumers' habits are constantly changing, companies in the industry evolve to accommodate their ever-changing expectations; hence, this dynamic and responsive market exists to fulfill global demand.

By End-Users

Important to the food industry, the global beef market deals with various consumers and businesses. Beef, being a crucial protein source, nourishes millions across the world. Finding expression through several industry segments, each of which generates demand or contributes to the supply chain, The global beef market can also be segmented depending on its end-users into retail consumers, the food service industry, and the food processing industry. Each segment has its consumption patterns and preferences.

In the retail segment, consumers come heavily into play, purchasing beef cuts for home-cooked meals. Different cuts of meat, processed meat products, organic beef, and the like produce consumer trends. However, when buying beef in supermarkets, butcheries, or even online, consumers look more into quality, price, and convenience as the primary factors. Changing dietary scenarios and trends then shape this segment because of people's beliefs about healthy eating and therefore will tend to lean toward cuts of meat that have been derived from pasture-raised or grass-fed animals.

The restaurant, fast food, and catered food service industries demand a very large portion of the whole beef demand. The supply needs to be continuous so that chefs and all other food business personnel can create their wide-ranging dishes to appeal to customers with differing tastes. The ever-increasing acceptance of hamburgers, steaks, and beef dishes guarantees steady consumption by this sector. Besides, international cuisines have imbued non-beef ways of cooking with a lot more beef, from grilling to slow-cooking. The other two drivers driving innovation in the menu offerings are—companies' increasing preference for gourmet experiences and premium cuts.

The importance of beef processing. From this sector manufactured beef products reach the consumer in ready-to-eat or packaged condition. For consumers who seek convenience, processed beef products such as sausages, patties, frozen food, and canned good are excellent. Innovations in preservation and packaging methods have assured the shelf-life of meat products by making them accessible in distant regions. Improvements in processing methods have also dealt with food safety, nutritional value, and sustainable procurement, which are the primary factors in the consumers' mind.

The global beef market has grown at varied rates in line with the changing consumer preferences. Factors such as quality, price, and efficiency of the supply chain vary from region to region, leading to different market dynamics. With an increasing emphasis on sustainability and ethical sourcing, their adaptation to these and other changing demands, including alternative dietary options, is required so that the industry remains a significant food source globally.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$766,144.22 million |

|

Market Size by 2032 |

$570,973.59 Million |

|

Growth Rate from 2025 to 2032 |

4.3% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

These geographical divisions have defined the global beef market into production, consumption, and trade patterns. Such simple and straightforward sentences, with such clear meanings that any one of them can be understood in any language. Different regions have different values, typical for the market, as a result of differing farming practices, feeding patterns, and even economics. Most of North America is characterized by beef production and exports, especially the trifold of the US, Canada, and Mexico. Other benefits include advanced practices of livestock management, stringent quality requirements, and a huge domestic market for beef products.

Although the beef industry is matured in Europe, some of the key players include the UK, Germany, France, and Italy. This region also command a high measure on the quality of meat or carcasses, animal wellbeing, as well as environmental sustainability, which could eventually influence consumer preferences. By charging a premium price for beef, organic meat, and ethical sourcing, the dynamics of the beef industry in Europe are founded upon these types of beef. Regulations and consumer education demand that beef be packaged traceably and produced sustainably.

Higher income, rapid urbanization, and changing food habits drive the emerging beef market in the Asia-Pacific region. India, People Republic of China, Japan, and South Korea play significant roles in this region, each contributing uniquely to the industry. The Chinese consume almost all kinds of beef, and it is one of the largest importers of beef in the world, reflecting the growing demand for rich-protein diets. Furthermore, Japan has a special type of beef, called Wagyu, and it sells at very high prices in the international market. Although large cattle populations exist in India, consumption is limited by culture and religion, whereas the country is a major exporter of buffalo meat.

With Brazil and Argentina being top exporters, South America is an important player in beef production. The advantages of the region include extensive grazing land, a good climate for cattle raising, and cheap production. Brazilian beef, among them, is extensively exported to markets in Asia, Europe, and the Middle East. Though Argentina is renowned for high-quality beef with much domestic consumption, it exports as well.

In the Middle East and Africa, the beef market is a broad, diverse landscape. Countries under the GCC umbrella - Saudi Arabia, UAE - greatly rely on imports to meet local demand. Egypt and South Africa are key players in regional beef production and trade. While several African countries claim to have beef being grown locally, challenges such as infrastructural challenges, disease control issues, and regulation barriers inhibited the industry's growth.

Every geographical segment in the N. worldwide beef industry possesses a unique set of strengths and weaknesses, together with consumer preferences. For trade agreements, food safety laws, and sustainability initiatives share competitive capacity to steer the industry's future.

COMPETITIVE PLAYERS

With the potential of becoming the most critical protein corner in millions of lives across the globe, the global beef market is directly involved in the food industry. Instructions given describe the factors that will lead to increased demand for beef, referring to population increase, new food preferences, and raising disposable income in different areas. These are well described under different kinds of production technology, levels of supply chain efficiency, trading policies, and finally consumer movements. Certain countries produce beef significantly whereas others depend on imports to satisfy their domestic needs.

The global beef market players that command the trend and price in the market. JBS S.A., Tyson Foods Inc., Cargill Meat Solutions Corp., Marfrig Global Foods S.A., and Minerva Foods S.A. are a few of the leading companies-both producers and exporters of beef products. To achieve the productivity with high quality standards, these corporations invest in advanced processing technologies as well as sustaining farming methods. Some of their competitors include Hormel Foods Corporation, Conagra Brands Inc., NH Foods Ltd., Clemens Food Group, Smithfield Foods Inc., Perdue Farms Inc., OSI Group LLC, and Keystone Foods LLC.

Another sector, namely, international trade, trade regulations, and policies, has also been important in framing the global beef market. There are many private as well as local tariffs and sanitary quota which are imposed on cross-border flows of bovine products in many countries. The US, Brazil, Australia, and Argentina form some of the leading producers and exporters of beef which all have good agricultural infrastructures and favorable climate conditions. Other countries like Japan and South Korea do not have strong domestic production systems, which is the reason why they rely mostly on imports to meet their consumers' demands.

Another factor that will hasten changes in the industry is the demand from consumers. Health, nutrition, and sustainability are raising demands for organic and grass-fed beef products. Consumers are becoming more and more aware of the environmental effects of beef production, compelling companies to source their meat from ethical means, as well as developing eco-friendly practices. In turn, this translates to increased investment in sustainable agriculture, reduced greenhouse gas emissions, and improved animal welfare standards, among other benefits that businesses must meet with expectations of the market.

Therefore, the industry has various dynamics, such as changing feed prices, outbreaks of diseases, and production competition from alternative protein research. Rising costs of cattle feed, tamed by ammunition of unpredictable weather conditions and revelations of global trade politics, greatly reduce profitability for producers. Strict health protocols require attention to continue maintaining consumer confidence, and the ever-present dangers posed by diseases to livestock, such as foot-and-mouth disease and bovine spongiform encephalopathy (BSE), fall are others that the producers are facing. The market dynamics are dramatically changing because of increases in alternative meat-producing plants, thus pushing traditional beef producers to innovate.

Beef Market Key Segments:

By Type

- Fresh Beef

- Processed Beef

By Product Type

- Grass-Fed Beef

- Grain-Fed Beef

- Organic Beef

- Conventional Beef

By Distribution Channel

- Supermarkets and Hypermarkets

- Butcher Shops

- Online Retailers

- HoReCa (Hotels, Restaurants, and Cafés)

By End-Users

- Retail Consumers

- Food Service Industry

- Food Processing Industry

Key Global Beef Industry Players

- JBS S.A.

- Tyson Foods Inc.

- Cargill Meat Solutions Corp.

- Marfrig Global Foods S.A.

- Minerva Foods S.A.

- Hormel Foods Corporation

- Conagra Brands Inc.

- NH Foods Ltd.

- Clemens Food Group

- Smithfield Foods Inc.

- Perdue Farms Inc.

- OSI Group LLC

- Keystone Foods LLC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252