MARKET OVERVIEW

The Global Baby Tableware market revolves around the production and distribution of specialized tableware designed exclusively for infants and toddlers. These miniature dining essentials go beyond mere functionality, intertwining safety, aesthetics, and innovation to meet the distinctive requirements of the little ones.

The Global Baby Tableware market centers on creating a harmonious blend of practicality and child-friendly design. Manufacturers invest significant resources in crafting products that align with stringent safety standards. From BPA-free materials to ergonomic shapes that facilitate independent feeding, the market focuses on providing parents with peace of mind regarding the health and well-being of their little ones.

Diversity is a hallmark of the Global Baby Tableware market. The array of products spans from vibrant, whimsical designs that captivate a child’s imagination to minimalist, functional pieces that prioritize ease of use. Plates, bowls, utensils, and sippy cups form the cornerstone of this market, each item meticulously designed to encourage self-feeding and enhance the overall dining experience for toddlers transitioning from infancy to early childhood.

In response to the ever-changing landscape of parenting preferences and societal trends, the Global Baby Tableware market is marked by continuous innovation. Manufacturers engage in extensive research and development to introduce novel materials, designs, and features that not only capture the attention of parents but also address emerging concerns related to child development.

The market's global nature is evident in its ability to adapt to cultural nuances and preferences. Localized variations in design and functionality cater to the unique needs of diverse markets, reflecting a nuanced understanding of parenting practices and societal norms. This adaptability ensures that the Global Baby Tableware market remains a relevant and integral part of the parenting journey on a worldwide scale.

Moreover, the market is characterized by a symbiotic relationship between functionality and aesthetics. While the primary purpose is to provide practical solutions for parents, the visual appeal of baby tableware has become increasingly significant. Designs that resonate with both parents and children contribute to the market's success, transforming essential items into cherished components of early childhood memories.

The Global Baby Tableware market is a vibrant and responsive industry, constantly evolving to meet the distinctive needs of its young consumers. From safety-focused designs to culturally nuanced variations, this market plays a pivotal role in enhancing the dining experiences of infants and toddlers around the world. As parenting preferences continue to shift, the Global Baby Tableware market remains a cornerstone of the childcare industry, embodying a commitment to innovation, safety, and the joyous journey of early childhood.

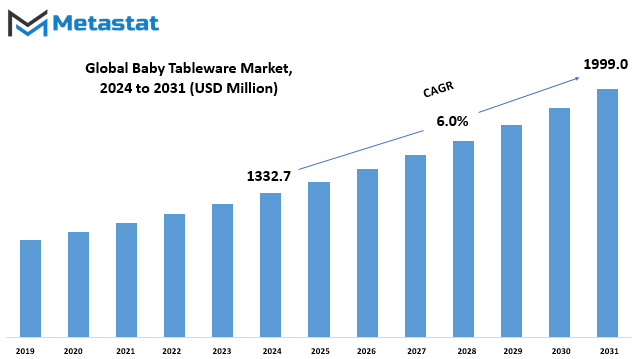

Global Baby Tableware market is estimated to reach $1999.0 Million by 2031; growing at a CAGR of 6.0% from 2024 to 2031.

GROWTH FACTORS

The growth of the Global Baby Tableware market is influenced by various factors. Key drivers propel its expansion, while certain challenges pose potential hindrances. Despite these challenges, there exist promising opportunities for market growth in the foreseeable future.

Numerous factors contribute to the upward trajectory of the Baby Tableware market. Factors such as increasing demand, changing consumer preferences, and advancements in manufacturing techniques play pivotal roles in driving the market forward. These elements collectively contribute to the market's positive momentum and expansion.

However, it is essential to acknowledge the challenges that might impede the market's growth. Factors like economic fluctuations and regulatory constraints can pose hurdles, creating a complex landscape for market players. Navigating through these challenges requires strategic planning and adaptability.

Amidst the challenges, there are opportunities waiting to be explored. Innovations in materials, product design, and marketing strategies can create lucrative openings for market players. Adapting to emerging trends and addressing consumer needs effectively can position businesses to capitalize on these opportunities.

The Global Baby Tableware market experiences growth driven by various factors, facing challenges that demand resilience and strategic planning. Despite potential obstacles, the market holds promising opportunities for those who can navigate through the complexities and adapt to changing dynamics. The interplay of these factors shapes the trajectory of the market, emphasizing the importance of a holistic understanding for sustainable success.

MARKET SEGMENTATION

By Product Type

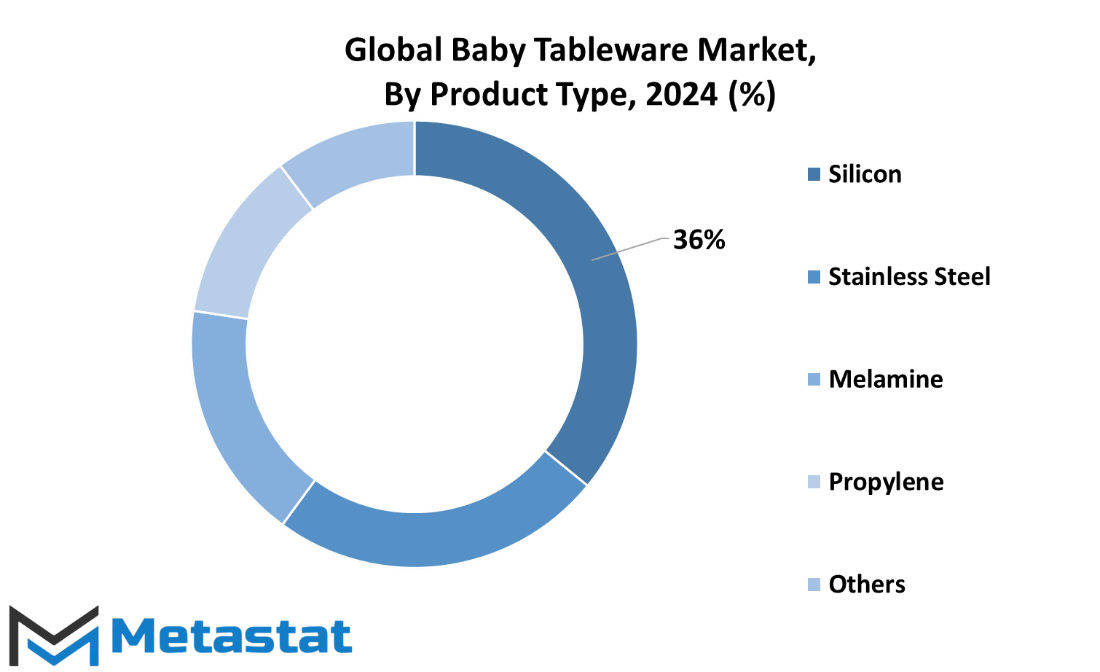

The worldwide market for baby tableware, categorized by product type, is divided into various materials, including silicon, stainless steel, melamine, propylene, and others. This segmentation enables a closer look at the diverse options available for parents in choosing tableware suitable for their infants.

Silicon, known for its flexibility and durability, is a popular choice among parents seeking reliable and safe options for their babies. Its soft texture and resistance to breakage make it a practical material for baby tableware, ensuring a hassle-free experience during mealtimes.

Stainless steel, recognized for its sturdiness and longevity, is another noteworthy category. This material provides a robust solution, ideal for parents who prioritize durability and longevity in their baby’s tableware. Its resistance to corrosion adds to the appeal, ensuring a longer lifespan for the products.

Melamine, a type of plastic, is valued for its lightweight and unbreakable nature. This option combines practicality with vibrant designs, catering to parents who seek both functionality and aesthetics in their baby’s tableware.

Propylene, a versatile and safe plastic material, is also part of the market’s offerings. Its suitability for baby tableware lies in its non-toxic properties, providing a secure choice for parents concerned about the materials their infants met.

The category labeled as Others encompasses a variety of materials not specifically outlined. This inclusive segment allows for innovation and diversity in baby tableware, presenting parents with alternative options beyond the predefined categories.

The segmentation of the Global Baby Tableware market by product type into silicon, stainless steel, melamine, propylene, and others offers parents a comprehensive array of choices. Each material brings its own set of advantages, catering to the diverse needs and preferences of parents as they select the most suitable tableware for their babies. This segmentation enhances the understanding of the available options in the market, empowering parents to make informed decisions based on the unique characteristics of each material.

By Price Point

The Global Baby Tableware market can be dissected based on price points, namely Premium, Medium, and Economy segments. In 2023, the Premium segment clocked in at a valuation of 312.9 USD Million, the Medium segment followed suit with 556.6 USD Million, and the Economy segment held its ground with a valuation of 388.5 USD Million.

This segmentation sheds light on the diverse consumer preferences within the baby tableware market. The Premium segment, with its 312.9 USD Million valuation, signifies a consumer base that is willing to invest in high-quality and perhaps more specialized baby tableware products. This could include items with unique designs, materials, or additional features that cater to a more discerning clientele.

On the other end of the spectrum, the Economy segment, valued at 388.5 USD Million, reflects a market for those who prioritize affordability without compromising basic functionality. This segment likely caters to a broader audience, encompassing consumers who seek practicality and budget-friendly options for baby tableware.

Nestled in between these extremes is the Medium segment, which, at 556.6 USD Million, suggests a considerable market for those seeking a balance between quality and cost. This segment could appeal to consumers who desire reliable and well-made baby tableware without venturing into the high-end price range.

The segmentation by price points in the Global Baby Tableware market is a snapshot of the varied consumer landscape. From those who prioritize prestige and uniqueness to those who seek economical yet functional options, this market encapsulates a spectrum of preferences, thereby offering a range of choices for parents and caregivers worldwide. The numerical values attached to each segment serve as not just figures but as indicators of the dynamic nature of consumer behavior and market trends within the realm of baby tableware.

By End user

In the Global Baby Tableware market, segmentation by end user plays a pivotal role in understanding the industry's dynamics. This categorization, comprising the Baby, Toddlers, and Kids segments, sheds light on the market's diverse consumer base.

The Baby segment, with a valuation of 655.3 USD Million in 2023, stands as a significant contributor to the market. This consumer group's needs and preferences shape the demand for baby tableware, reflecting the market's responsiveness to the unique requirements of caregivers and parents of infants.

Moving on to the Toddlers segment, valued at 331.3 USD Million in 2023, it represents another crucial facet of the market. Toddlers, being in a transitional stage between infancy and childhood, necessitate specific tableware characteristics. The market, recognizing this, tailors its offerings to cater to the developmental stage and preferences of toddlers, thereby sustaining a market niche. The Kids segment completes the triad of end-user segments. While not bound by the particularities of infancy or toddlerhood, kids exhibit distinct preferences and requirements. The market recognizes and addresses these needs, fostering a consumer-centric approach that spans the entire spectrum of childhood.

The market's segmentation by end user, encompassing Baby, Toddlers, and Kids, underscores its adaptability to the varying demands of different age groups. This segmentation not only reflects the market's economic dimensions but also serves as a testament to its commitment to meeting the diverse needs of families and caregivers worldwide. As we navigate the intricate landscape of the Global Baby Tableware market, understanding these end-user segments proves essential in comprehending the market's nuances and trends.

By Distribution Channel

The global baby tableware market is characterized by its distribution channels, primarily B2B (business-to-business) and B2C (business-to-consumer). This distinction in distribution channels plays a crucial role in how baby tableware reaches the end consumer.

The B2B segment involves transactions between businesses. Manufacturers and suppliers engage in this channel, supplying baby tableware to retailers and other businesses involved in the baby products market. The objective is to establish a seamless supply chain that ensures a steady flow of baby tableware from production facilities to retail shelves.

However, the B2C distribution channel involves the direct sale of baby tableware to consumers. In this scenario, manufacturers and retailers aim to connect directly with parents and caregivers, offering them a convenient and accessible means of acquiring essential tableware for their infants. This approach allows for a more personalized interaction with the end consumer, catering to their specific needs and preferences.

The significance of these distribution channels lies in the diverse ways they cater to the market. B2B transactions contribute to the efficient flow of products through the supply chain, ensuring a consistent availability of baby tableware in various retail outlets. This approach streamlines the process from production to the hands of businesses that, in turn, make these products accessible to consumers.

On the contrary, the B2C channel emphasizes a more direct and customer-centric approach. By selling baby tableware directly to consumers, businesses can establish a connection with the end user. This connection enables them to understand consumer preferences better and adapt their offerings accordingly. Additionally, it provides an avenue for marketing and brand building, as businesses can communicate directly with the target audience.

The distribution channels of B2B and B2C in the global baby tableware market represent distinct yet interconnected pathways through which these essential products navigate from production to consumption. The collaborative efforts of manufacturers, suppliers, retailers, and end consumers contribute to the dynamic and evolving landscape of the baby tableware market. Understanding the nuances of these distribution channels is pivotal for businesses to navigate and thrive in this competitive market, ensuring that baby tableware continues to meet the needs of parents and caregivers worldwide.

REGIONAL ANALYSIS

The global market for baby tableware is categorized by geography into North America, Europe, and Asia-Pacific. This segmentation enables a more focused analysis of the market's regional dynamics and consumer preferences.

Understanding the geographical distribution of the market is essential for businesses aiming to tailor their products to specific regions. In North America, for instance, consumer behaviors and preferences may differ from those in Europe or Asia-Pacific. This diversity prompts companies to adapt their marketing strategies and product offerings to cater to the distinct needs of each region.

In North America, where lifestyle and cultural influences play a significant role in consumer choices, businesses may find opportunities to introduce innovative baby tableware designs that resonate with the local lifestyle. Meanwhile, in Europe, a market known for its diverse cultural landscapes, companies may need to consider adapting their products to suit various cultural preferences.

On the other hand, the Asia-Pacific region, with its vast and diverse consumer base, presents its own set of opportunities and challenges. Companies operating in this market segment may need to navigate cultural nuances and preferences across countries within the region.

By recognizing the regional distinctions within the global baby tableware market, businesses can effectively tailor their marketing approaches, ensuring that products align with local preferences. This strategic adaptation to regional differences enhances the overall market appeal of baby tableware, contributing to the industry's growth and success.

COMPETITIVE PLAYERS

The Baby Tableware industry is marked by the presence of several key players, each contributing to the competitive landscape in their unique way. Artsana USA Inc., known for its Chicco brand, stands out as one of these significant contributors. Similarly, Carter's, Inc., recognized under the Skip Hop banner, plays a noteworthy role in shaping the market dynamics.

KINTO CO., Ltd, Lässig GmbH, and Mayborn USA Inc., the company behind Tommee Tippee, are additional influential entities within this space. Their diverse offerings and market presence further add to the competitive mix. Munchkin Inc. is another key player making its mark in the industry, contributing to the array of choices available for consumers.

The participation of Pigeon Corporation, Tupperware Brands Corp, Bumkins Finer Baby Products, and Luv n' care, Ltd. (Nuby) reinforces the industry's competitive nature. These companies bring a variety of baby tableware products to the market, creating a dynamic environment where consumer preferences and choices play a pivotal role in shaping the industry's trajectory.

The Baby Tableware market is shaped by the active involvement of these key players, each contributing to the diversity and competitiveness of the industry. From Artsana USA Inc. and Carter's, Inc. to KINTO CO., Ltd and Munchkin Inc., the market showcases a range of offerings, providing consumers with ample choices and ensuring a vibrant and competitive landscape.

Baby Tableware Market Key Segments:

By Product Type

- Silicon

- Stainless Steel

- Melamine

- Propylene

- Others

By Price Point

- Premium

- Medium

- Economy

By End user

- Baby

- Toddlers

- Kids

By Distribution Channel

- B2B

- B2C

Key Global Baby Tableware Industry Players

- Artsana USA Inc. (Chicco)

- Carter's, Inc. (Skip Hop)

- KINTO CO., Ltd

- Lässig GmbH

- Mayborn USA Inc. (Tommee Tippee)

- Munchkin Inc.

- Pigeon Corporation

- Tupperware Brands Corp

- Bumkins Finer Baby Products

- Luv n' care, Ltd. (Nuby)

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383