MARKET OVERVIEW

The Global Baby Disposable Diapers market, a vital segment of the baby care industry, has undergone substantial transformation and growth over the past few decades. This market focuses on the production, distribution, and sale of disposable diapers designed for infants and young children. Disposable diapers, known for their convenience and hygiene benefits, have become an essential item for parents worldwide, driving the market's expansion and innovation.

The Baby Disposable Diapers market operates within a dynamic landscape influenced by various factors such as demographic changes, consumer preferences, and technological advancements. With the global population rising and urbanization increasing, the demand for convenient baby care products has surged. Disposable diapers offer a practical solution for busy parents, providing ease of use and effective moisture absorption, which keeps babies dry and comfortable. This convenience is a significant driver of the market's popularity.

Innovation plays a crucial role in the development of the Global Baby Disposable Diapers market. Manufacturers continually strive to enhance the performance and comfort of their products. Advances in materials and manufacturing techniques have led to the creation of diapers that are more absorbent, thinner, and environmentally friendly. Biodegradable and eco-friendly diapers are gaining traction as sustainability becomes a growing concern among consumers. These innovations not only improve the product's functionality but also address environmental challenges, positioning the market for further growth.

Consumer preferences are also evolving, influencing the Baby Disposable Diapers market. Parents today are more informed and selective about the products they choose for their children. They seek diapers that offer superior comfort, skin protection, and a snug fit. Additionally, there is a rising demand for hypoallergenic and chemical-free diapers due to the increasing awareness of skin sensitivities and allergies in infants. This shift in consumer preferences drives manufacturers to focus on quality and safety in their product offerings.

The competitive landscape of the Global Baby Disposable Diapers market is marked by the presence of numerous key players striving to capture market share. Companies invest heavily in research and development to introduce innovative products and gain a competitive edge. Marketing strategies, such as branding and packaging, also play a significant role in attracting consumers. Brand loyalty is a crucial factor, with parents often sticking to trusted brands once they find a product that meets their expectations.

Emerging markets present significant opportunities for the Baby Disposable Diapers market. Regions such as Asia-Pacific, Latin America, and Africa exhibit high birth rates and increasing disposable incomes, leading to a growing demand for baby care products. As these regions continue to develop economically, the market for disposable diapers is expected to expand, offering substantial growth potential for manufacturers.

Technological advancements and digitalization are reshaping the Baby Disposable Diapers market. Online retail channels have become increasingly popular, allowing consumers to purchase diapers conveniently from the comfort of their homes. E-commerce platforms offer a wide range of products and competitive pricing, contributing to the market's growth. Furthermore, the integration of smart technologies, such as sensor-enabled diapers that monitor a baby’s health and wellbeing, is anticipated to revolutionize the market in the coming years.

The Global Baby Disposable Diapers market is a dynamic and evolving industry driven by innovation, consumer preferences, and technological advancements. As manufacturers continue to develop more efficient, comfortable, and eco-friendly products, the market is poised for continued growth. With emerging markets offering new opportunities and digitalization transforming retail channels, the future of the Baby Disposable Diapers market looks promising and full of potential.

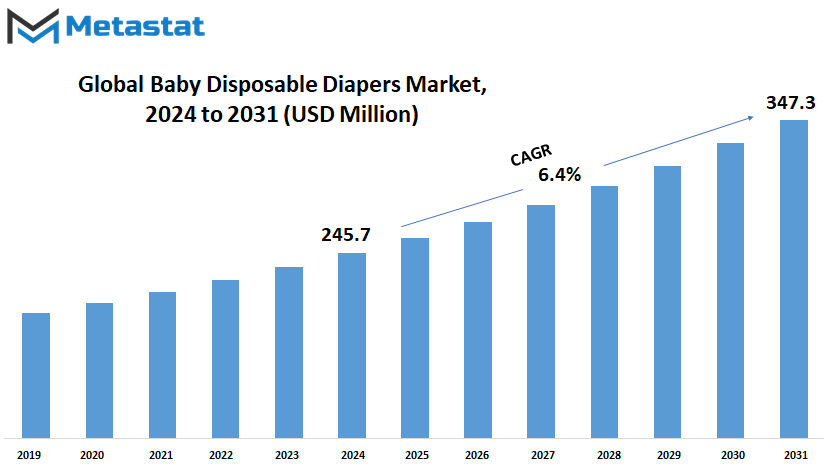

Global Baby Disposable Diapers market is estimated to reach $347.3 Million by 2031; growing at a CAGR of 6.4% from 2024 to 2031.

GROWTH FACTORS

The global market for baby disposable diapers is poised for significant growth due to a variety of factors that are shaping consumer behavior and product development. One of the primary drivers of this market expansion is the increasing awareness among parents about the benefits of disposable diapers. Parents today are more informed about the importance of hygiene and the convenience that disposable diapers offer. These products save time, which is especially valuable for busy families, making them a popular choice.

Urbanization and lifestyle changes are also contributing to the growing demand for disposable diapers. As more people move to urban areas and lifestyles become busier, the convenience of disposable diapers becomes even more attractive. In urban settings, where parents often juggle work and family responsibilities, the ease of use that disposable diapers provide is a significant advantage. This shift towards urban living has led to an increased adoption of disposable diapers, further driving market growth.

However, the market is not without its challenges. Environmental concerns are becoming more prominent among consumers. Many people are worried about the impact of disposable diapers on the environment, particularly in terms of waste generation and landfill pollution. These concerns are causing some parents to reconsider their use of disposable diapers in favor of more environmentally friendly options. Additionally, the cost of disposable diapers can be a barrier for some families. While they offer convenience, disposable diapers can be more expensive in the long run compared to cloth diapers, which can be a significant consideration for low-income households.

Despite these challenges, there are promising opportunities for growth in the market. One of the most exciting prospects is the development of sustainable diapers. Manufacturers have the chance to innovate by creating eco-friendly disposable diapers that use biodegradable materials. These products could significantly reduce the environmental impact of disposable diapers and appeal to consumers who are conscious of their ecological footprint. By focusing on sustainability, companies can tap into a growing market of environmentally conscious parents and potentially transform the industry.

Looking ahead, the global baby disposable diapers market is likely to see continued growth. As parental awareness increases and urbanization continues, the demand for convenient and hygienic diaper solutions will rise. At the same time, addressing environmental concerns and cost issues will be crucial for sustaining this growth. Innovations in biodegradable and cost-effective products will not only meet consumer needs but also ensure the market adapts to future trends. With these factors in play, the baby disposable diapers market holds substantial promise for the coming years, offering opportunities for both manufacturers and consumers to benefit from improved products and practices.

MARKET SEGMENTATION

By Type

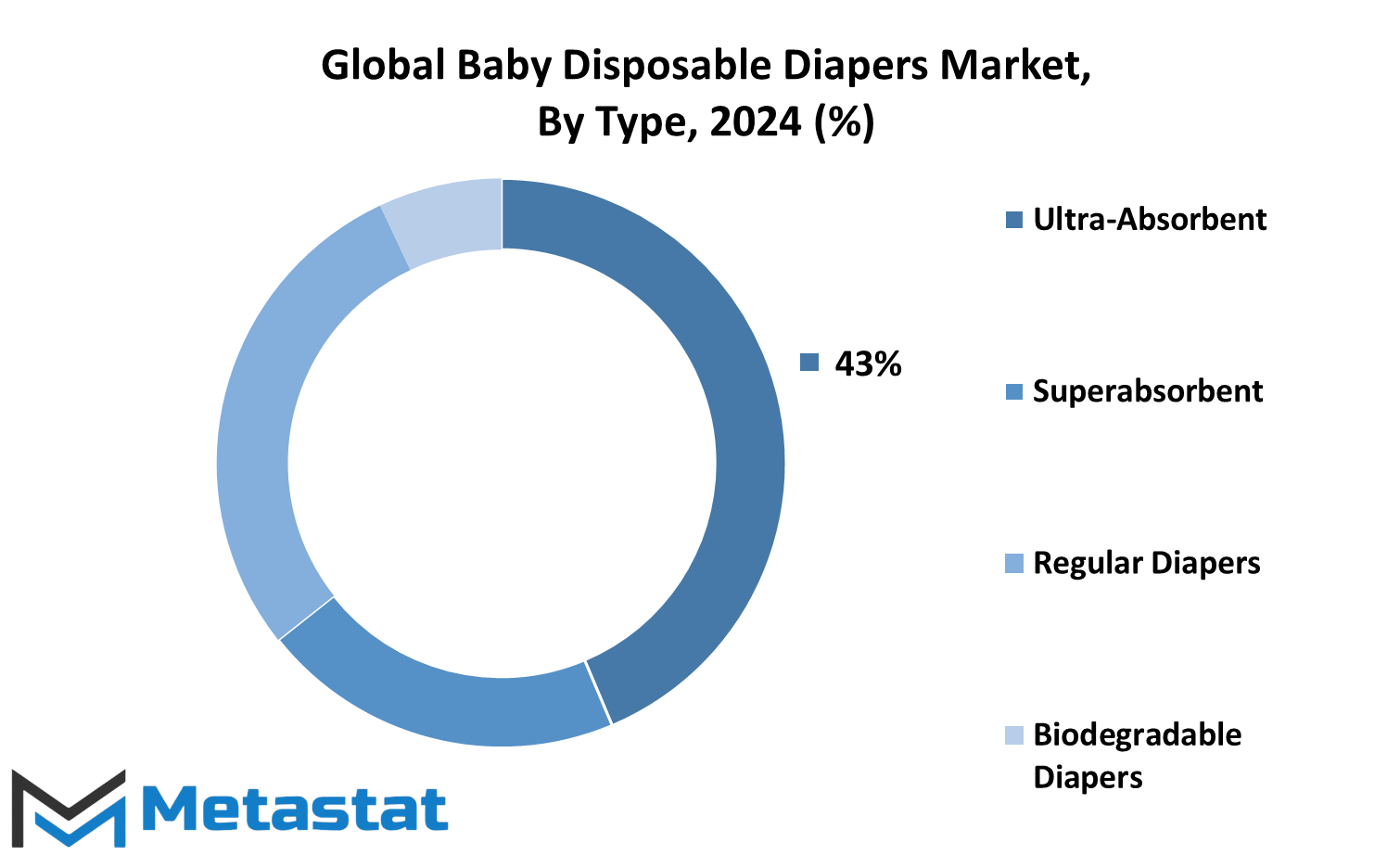

The global baby disposable diapers market is expected to experience significant growth in the coming years. The market, segmented by type, includes ultra-absorbent, superabsorbent, regular, and biodegradable diapers. Each type caters to different needs and preferences of parents, promising advancements that will shape the future of childcare.

Ultra-absorbent diapers, designed to provide maximum dryness, are becoming increasingly popular among parents. These diapers use advanced materials that can hold large quantities of liquid, ensuring that babies stay dry for longer periods. This not only enhances the comfort of the baby but also reduces the frequency of diaper changes, making it convenient for parents. As technology progresses, we can anticipate even more efficient absorption capabilities, making ultra-absorbent diapers a staple in households worldwide.

Superabsorbent diapers, known for their exceptional liquid retention, are also gaining traction. They incorporate specialized gels that trap moisture and prevent leaks, offering superior protection. This feature is particularly beneficial during the night or long trips, where changing diapers frequently is not always feasible. Future innovations in this category might include thinner designs with even greater absorbency, providing a better fit and more freedom of movement for babies.

Regular diapers, which offer a balance between cost and performance, remain a reliable choice for many families. They provide adequate absorbency and comfort without the added expense of advanced features. As manufacturing processes improve and materials become more efficient, regular diapers will likely see enhancements in their performance and sustainability, making them a more attractive option for budget-conscious parents.

Biodegradable diapers are becoming a key focus area due to the growing environmental concerns. These diapers are made from natural, compostable materials, reducing the environmental impact compared to traditional disposable diapers. With the increasing emphasis on sustainability, the market for biodegradable diapers is set to expand. Innovations in this segment will likely lead to more durable and effective products that decompose quickly, offering a greener alternative for environmentally-conscious families.

The future of the baby disposable diapers market will be shaped by technological advancements and shifting consumer preferences. Parents will look for products that offer superior performance, convenience, and environmental benefits. Manufacturers will need to keep pace with these demands by developing diapers that are not only highly functional but also eco-friendly. As we move forward, the market will see a blend of high-tech solutions and sustainable practices, ensuring that the needs of both babies and the planet are met.

By Category

The global baby disposable diapers market is poised for substantial growth in the coming years, driven by changing lifestyles and increasing awareness of baby hygiene. The market is divided into two primary categories: pant-style diapers and taped diapers. Each category caters to specific needs and preferences of parents, making it essential to understand their unique features and benefits.

Pant-style diapers, often referred to as pull-up diapers, are designed to be worn like underwear. They offer convenience, particularly for active toddlers who are transitioning from diapers to regular underwear. The ease of pulling them up and down makes them an attractive option for parents aiming to teach their children independence in using the toilet. In the future, the demand for pant-style diapers is expected to rise as more parents look for practical solutions that align with their busy schedules. Manufacturers are likely to innovate further, incorporating advanced materials that provide better absorption and comfort while maintaining a snug fit. Additionally, we may see an increase in eco-friendly options as environmental concerns become more prominent among consumers.

On the other hand, taped diapers remain a popular choice, especially for younger infants who require frequent diaper changes. These diapers are equipped with adhesive strips on the sides, allowing for a secure fit that can be adjusted as needed. Taped diapers are known for their excellent leakage protection and are often preferred for overnight use. As we move forward, the taped diaper segment is expected to benefit from technological advancements that enhance absorbency and skin protection. There will likely be a greater emphasis on hypoallergenic materials to cater to babies with sensitive skin, addressing parents' growing concerns about allergies and rashes.

By Age Group

The Global Baby Disposable Diapers market is poised for significant growth in the coming years. This market, divided into age groups of 0-6 months, 7-12 months, and above 1 year, will experience various trends and developments driven by changes in consumer preferences and advancements in diaper technology.

For newborns aged 0-6 months, the demand for disposable diapers is particularly high due to the frequent need for diaper changes. Parents seek diapers that offer superior absorbency and comfort to protect their babies' sensitive skin. In the future, we will likely see more innovations focusing on skin-friendly materials and eco-friendly options. Companies will invest in research to develop diapers that not only keep the baby dry but also minimize the risk of diaper rash and other skin irritations.

As babies grow into the 7-12 months age group, their mobility increases, requiring diapers that can accommodate more movement without compromising on leakage protection. Diapers for this age group will likely see enhancements in fit and flexibility, ensuring that babies can explore their environment comfortably. The future will bring more diapers designed with ergonomic features, allowing for better freedom of movement while maintaining a snug fit. Additionally, there will be an emphasis on creating diapers that are easy for parents to change, with features like resealable tabs and wetness indicators

For children above 1 year, the diaper market will shift towards products that aid in the transition to potty training. Parents will look for diapers that are not only absorbent but also help in teaching children about toilet use. Training pants will become more sophisticated, with features that encourage toddlers to recognize the sensation of needing to use the bathroom. We will see more focus on pull-up style diapers that are easy for toddlers to use independently, promoting a sense of autonomy.

In all age groups, there is a growing trend towards sustainability. The environmental impact of disposable diapers is a significant concern for many parents. The future will see an increase in biodegradable and compostable diaper options, as well as innovations in reducing the overall carbon footprint of diaper production. Companies will explore materials that are both effective and environmentally friendly, responding to the rising demand for sustainable products.

By Distribution Channel

The global market for baby disposable diapers is a dynamic landscape, shaped by various distribution channels that cater to different consumer needs and preferences. Supermarkets and hypermarkets are among the most prominent outlets for these products. These large retail spaces offer a wide variety of diaper brands and sizes, providing parents with the convenience of one-stop shopping. The availability of bulk purchase options and frequent promotions in these stores also attract budget-conscious consumers.

Convenience and grocery stores play a significant role in the market as well. While they may not offer the same extensive range of products as supermarkets, they provide easy access to diapers for families on the go. These stores are particularly useful for last-minute purchases and are typically located in residential areas, making them a handy option for busy parents.

Pharmacy and drug stores are another key segment in the distribution of baby disposable diapers. These outlets often carry specialized diaper products, such as those designed for sensitive skin or with added health benefits. Parents may prefer buying diapers from pharmacies due to the professional advice available from pharmacists, who can guide them in choosing the right product for their baby’s needs.

Online retail channels have seen significant growth in recent years and are expected to continue expanding. The convenience of shopping from home, coupled with the ability to compare prices and read reviews, makes online platforms an attractive option for many parents. Additionally, the rise of subscription services for baby products ensures that parents can have diapers delivered to their doorsteps regularly, eliminating the hassle of frequent shopping trips.

Other distribution channels, such as specialty baby stores and direct sales from manufacturers, also contribute to the market. These channels often focus on niche products and offer a personalized shopping experience. Specialty stores might provide a curated selection of eco-friendly or premium diaper brands, appealing to environmentally conscious or high-end consumers.

Looking to the future, the global baby disposable diapers market is poised for further innovation and diversification. As technology advances, we may see the development of more sustainable and smart diapers, incorporating features such as wetness indicators or biodegradable materials. The integration of digital technologies into retail, such as augmented reality for product demonstrations or enhanced online customer service, could revolutionize how parents shop for diapers.

REGIONAL ANALYSIS

The global Baby Disposable Diapers market is expanding across various regions, each with its own unique characteristics and demands. This market is geographically divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each region presents different opportunities and challenges, influenced by local demographics, economic conditions, and cultural practices.

In North America, the market is primarily driven by the U.S., Canada, and Mexico. This region has a high adoption rate of baby disposable diapers due to the convenience they offer to busy parents. The presence of major market players and a high standard of living contribute to the robust demand in this region. As the population continues to grow and urbanize, the demand for baby disposable diapers will likely remain strong.

Europe, encompassing the UK, Germany, France, Italy, and the Rest of Europe, also represents a significant portion of the market. European consumers are increasingly looking for eco-friendly and sustainable diaper options, prompting manufacturers to innovate and offer biodegradable or reusable alternatives. The rising awareness about environmental issues and the push for greener products will continue to shape the market in this region.

The Asia-Pacific region, including India, China, Japan, South Korea, and the Rest of Asia-Pacific, is expected to witness substantial growth. Rapid urbanization, increasing disposable incomes, and a growing middle class are key factors driving the market. Additionally, the high birth rates in countries like India and China contribute to a large consumer base. The market in this region is highly competitive, with both local and international players vying for market share. Innovations tailored to the needs of consumers in this region, such as affordability and comfort, will be crucial for success.

South America, with Brazil, Argentina, and the Rest of South America, presents a growing market for baby disposable diapers. Economic improvements and rising living standards are leading to greater adoption of these products. However, the market growth may be influenced by economic fluctuations and varying levels of consumer spending power across different countries.

The Middle East & Africa, categorized into GCC Countries, Egypt, South Africa, and the Rest of the region, is another area with potential growth. The market here is driven by increasing birth rates and a gradual improvement in economic conditions. However, cultural factors and economic disparities within the region can impact market penetration and growth rates.

Overall, the global Baby Disposable Diapers market is set to grow as manufacturers adapt to regional demands and innovate to meet consumer needs. The focus on sustainability, affordability, and comfort will be key drivers of future growth, ensuring that products remain appealing to a diverse and expanding customer base.

COMPETITIVE PLAYERS

The global market for baby disposable diapers is shaped by a diverse array of competitive players who continually innovate to meet the evolving needs of parents and caregivers. This market includes well-established companies such as Procter & Gamble (P&G), which is renowned for its Pampers brand, and Kimberly Clark, known for Huggies. These giants have long set the standards for quality and reliability in baby care products, investing heavily in research and development to introduce new features like enhanced absorbency and skin-friendly materials.

Emerging companies like Chiaus and DaddyBaby are making significant strides, particularly in Asian markets, by offering high-quality products at competitive prices. Their growth reflects a broader trend where regional players are gaining prominence by catering to local preferences and price sensitivities. Similarly, Japanese companies like Kao and Unicharm (Mamypoko) are leveraging their technological expertise to create diapers that prioritize both comfort and environmental sustainability, appealing to a growing segment of eco-conscious consumers.

In Europe, companies like Ontex and Drylock Technologies NV are focusing on innovation and sustainability. Ontex, for example, has made substantial investments in creating diapers with biodegradable components, aligning with the increasing demand for environmentally responsible products. Drylock Technologies NV is known for its advanced production techniques that minimize waste and improve efficiency, setting a benchmark for sustainable manufacturing practices in the industry.

North American companies are also significant players in this market. First Quality Enterprises, Inc., with its Cuties brand, emphasizes affordability without compromising on quality, targeting value-conscious consumers. Seventh Generation, Inc. and The Honest Company are at the forefront of the movement towards natural and eco-friendly diapers. These companies prioritize the use of plant-based materials and avoid harmful chemicals, appealing to parents who are increasingly concerned about the health implications of traditional diaper materials.

Fujian Hengan Group Co., Ltd. and MEGA, operating primarily in the Middle East and Africa, are expanding their reach by offering products that cater to the specific needs and preferences of these regions. Their strategies often include localized marketing and distribution channels, ensuring that their products are accessible to a broader audience.

As we look to the future, the baby disposable diapers market is poised for further growth and transformation. Innovations in materials science and sustainable manufacturing practices will likely dominate the industry, driven by both consumer demand and regulatory pressures. Companies that can balance affordability, quality, and environmental responsibility will emerge as leaders in this competitive landscape. The ongoing evolution of this market underscores the dynamic interplay between consumer preferences and technological advancements, promising a future where baby care products are safer, more effective, and environmentally friendly.

Baby Disposable Diapers Market Key Segments:

By Type

- Ultra-Absorbent

- Superabsorbent

- Regular Diapers

- Biodegradable Diapers

By Category

- Pant

- Taped

By Age Group

- 0-6 Months

- 7-12 months

- Above 1 Year

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Pharmacy/Drug Stores

- Online Retail Channels

- Other Distribution Channels

Key Global Baby Disposable Diapers Industry Players

- P&G

- Chiaus

- DaddyBaby

- Daio

- Fuburg

- Kao

- Kimberly Clark

- MEGA

- Nuggles Designs Canada

- Ontex

- Unicharm (Mamypoko)

- First Quality Enterprises, Inc.

- Fujian Hengan Group Co., Ltd.

- Seventh Generation, Inc.

- The Honest Company

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383