MARKET OVERVIEW

The Global Automotive Parts Aluminium Die Casting market represents a dynamic sector within the automotive industry, offering crucial components essential for the production of vehicles worldwide. Aluminium die casting plays a significant role in the manufacturing process, providing lightweight and durable parts that contribute to the performance, efficiency, and safety of modern automobiles.

In recent years, the demand for aluminium die-cast automotive parts has surged owing to the growing emphasis on lightweighting in the automotive sector. As manufacturers strive to meet stringent fuel efficiency and emission standards, they increasingly turn to aluminium die casting for its ability to produce complex shapes with thin walls while maintaining structural integrity. This trend has propelled the expansion of the global market, with key players continually innovating to enhance production processes and meet evolving industry requirements.

One of the primary drivers of the market is the rising adoption of electric and hybrid vehicles (EVs and HEVs), which require lightweight components to maximize range and efficiency. Aluminium die casting offers a viable solution for producing lightweight parts such as powertrain components, battery enclosures, and structural elements in electric vehicles. Additionally, the growing consumer demand for advanced safety features and enhanced driving experience has led to an increased integration of aluminium die-cast parts in automotive chassis, transmission systems, and suspension components.

Moreover, the automotive industry's shift towards autonomous vehicles and connected technologies is fueling the demand for sophisticated aluminium die-cast parts that support advanced sensor systems, electronic components, and vehicle connectivity infrastructure. As automakers continue to invest in research and development to bring autonomous and connected vehicles to market, the demand for high-precision aluminium die casting is expected to rise further.

The global automotive parts aluminium die casting market is characterized by intense competition and rapid technological advancements. Key market players are focusing on strategic initiatives such as mergers and acquisitions, partnerships, and investments in research and development to gain a competitive edge and expand their market presence. Furthermore, advancements in die casting technology, including the integration of automation, robotics, and digital manufacturing solutions, are driving efficiency improvements and enabling manufacturers to meet the increasing demand for aluminium die-cast parts with shorter lead times and higher quality standards.

The Global Automotive Parts Aluminium Die Casting market is a vital segment of the automotive industry, providing lightweight, durable, and high-performance components essential for modern vehicles. With the ongoing evolution of automotive technologies and the growing demand for electric, autonomous, and connected vehicles, the market is poised for sustained growth and innovation, presenting opportunities for manufacturers to thrive in an ever-changing landscape.

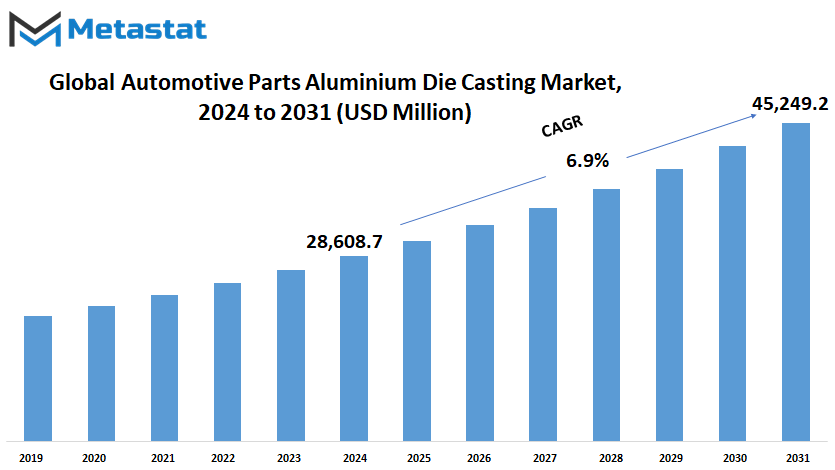

Global Automotive Parts Aluminium Die Casting market is estimated to reach $45,249.2 Million by 2031; growing at a CAGR of 6.9% from 2024 to 2031.

GROWTH FACTORS

The Global Automotive Parts Aluminium Die Casting market experiences growth due to several key factors. One significant driver is the increasing demand for lightweight automotive components. This demand stems from the desire to enhance fuel efficiency in vehicles. Consumers and manufacturers alike seek solutions that can reduce the overall weight of vehicles, thereby improving their fuel economy. This emphasis on lightweighting has propelled the use of aluminium die casting in automotive parts production.

Another factor contributing to market growth is the expanding automotive production in emerging economies. As these regions witness economic growth and increased urbanization, the demand for automobiles rises. To meet this demand, manufacturers seek cost-effective manufacturing solutions. Aluminium die casting presents itself as a viable option due to its efficiency and versatility in producing complex automotive parts.

However, the market faces challenges as well. Volatility in aluminium prices can significantly impact production costs for automotive parts manufacturers. Fluctuations in the price of aluminium can disrupt production planning and strain profit margins, affecting the overall competitiveness of companies in the market.

Furthermore, stringent environmental regulations concerning aluminium production and waste disposal pose challenges for market players. Compliance with these regulations necessitates investments in environmentally friendly processes and waste management systems, which can add to operational costs.

Despite these challenges, the market presents promising opportunities for growth. One such opportunity lies in the adoption of aluminium die casting in electric vehicle (EV) manufacturing. Electric vehicles rely on lightweight materials to maximize battery efficiency and range. Aluminium's lightweight nature and recyclable properties make it an attractive choice for EV components, such as chassis and structural parts. As the demand for electric vehicles continues to rise, the adoption of aluminium die casting in EV manufacturing is expected to increase, driving further growth in the market.

The Global Automotive Parts Aluminium Die Casting market is influenced by various factors that contribute to its growth and development. While challenges such as aluminium price volatility and environmental regulations exist, opportunities in lightweight automotive components and electric vehicle manufacturing offer avenues for market expansion. By navigating these factors effectively, stakeholders can capitalize on the market's potential and drive innovation in automotive parts production.

MARKET SEGMENTATION

By Production Process

The market for automotive parts made from aluminum die casting processes is a dynamic and diverse landscape. These processes are crucial in the manufacturing of various components used in vehicles, ranging from engine parts to structural components. Understanding the different production processes is essential in comprehending the market dynamics and trends.

One of the primary segmentation criteria for the Global Automotive Parts Aluminium Die Casting market is the production process. This segmentation categorizes the market based on how the aluminum parts are cast. The main production processes include Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, and Gravity Die Casting.

Pressure Die Casting stands out as one of the prominent methods employed in the industry. This process involves injecting molten aluminum into a steel mold cavity at high pressure. The molten metal is forced into the mold, resulting in precise and intricate shapes. In 2021, the Pressure Die Casting segment was valued at 12478.9 USD Million, underlining its significant contribution to the market.

Vacuum Die Casting is another notable production process in the automotive parts aluminum die casting market. In this method, a vacuum is applied to the mold cavity before the molten aluminum is injected. This helps in reducing air and gas porosity in the final product, resulting in higher quality parts. The Vacuum Die Casting segment was valued at 3390.4 USD Million in 2021, indicating its considerable market share.

Squeeze Die Casting is characterized by applying additional pressure to the mold after the initial injection of molten aluminum. This process helps in further compacting the metal and improving the mechanical properties of the final product. The Squeeze Die Casting segment accounted for a value of 2690 USD Million in 2021, showcasing its significance in the market.

Gravity Die Casting, while not as widely used as the aforementioned methods, still holds its place in certain applications. Unlike other processes that rely on high pressure, Gravity Die Casting utilizes gravity to fill the mold cavity with molten aluminum. Although it may not offer the same level of intricacy as other methods, it remains a cost-effective solution for producing certain automotive parts.

The Global Automotive Parts Aluminium Die Casting market is diversified based on production processes, with Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, and Gravity Die Casting being the primary methods. Each process has its advantages and applications, contributing to the overall growth and development of the automotive industry. Understanding these processes is vital for stakeholders to make informed decisions and capitalize on emerging opportunities in the market.

By Application

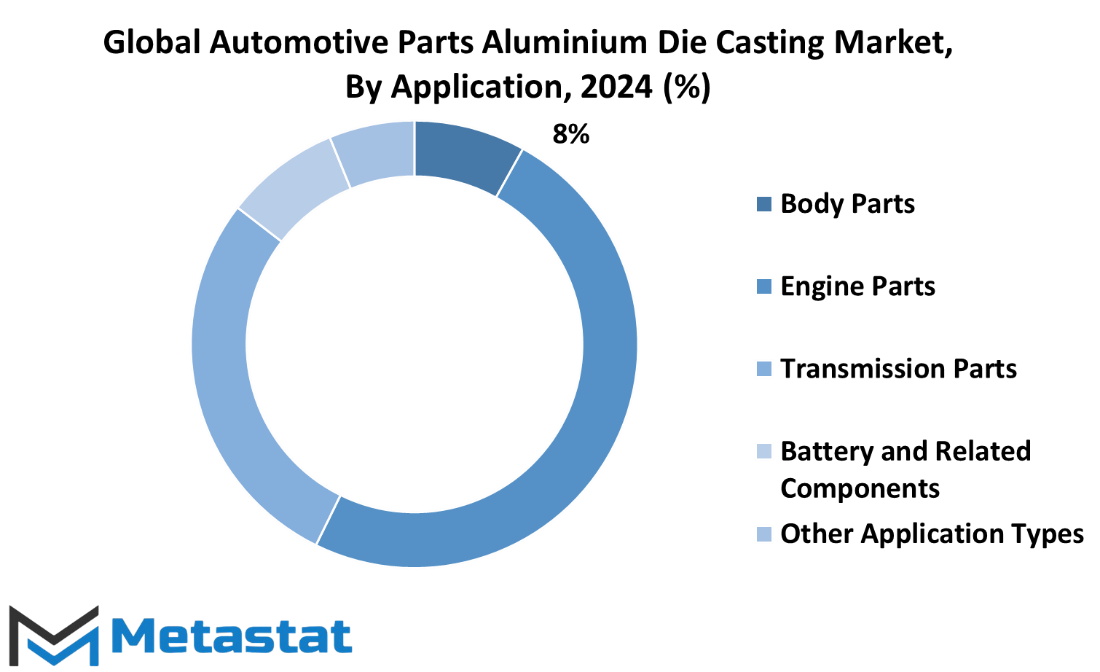

In the global automotive industry, aluminum die casting plays a crucial role in the manufacturing of various components. These components are categorized into different applications, including body parts, engine parts, transmission parts, battery, and related components, as well as other application types.

The body parts segment encompasses a wide array of components essential for the structural integrity and aesthetic appeal of automobiles. These include body panels, chassis components, and exterior trim pieces. In 2021, the body parts segment was valued at 1914.8 USD million, indicating its significant contribution to the market.

Engine parts are vital for the functioning of the vehicle’s powertrain system. These components include engine blocks, cylinder heads, pistons, and intake manifolds, among others. Engine parts undergo high levels of stress and heat, necessitating materials like aluminum die castings known for their strength and thermal conductivity.

Transmission parts are critical for the smooth operation of the vehicle’s gearbox and drivetrain system. These components include transmission housings, gears, shafts, and clutch assemblies. The transmission parts segment accounted for a substantial share of the market, valued at 6607.4 USD million in 2021, reflecting its importance in the automotive industry.

Battery and related components encompass various parts essential for the electrical system of vehicles, including battery housings, terminals, and connectors. With the growing demand for electric vehicles, the importance of these components is increasing, driving the demand for aluminum die castings in this segment.

Apart from the aforementioned applications, there are other types of applications for aluminum die castings in the automotive industry. These may include components for suspension systems, steering mechanisms, heating and cooling systems, and safety features like airbag housings and seat frames. The versatility of aluminum die castings makes them suitable for a wide range of automotive applications, contributing to their widespread adoption in the industry.

The global automotive parts aluminum die casting market is segmented based on various applications, each playing a crucial role in the manufacturing and functioning of vehicles. From body parts to engine and transmission components, battery-related parts, and other applications, aluminum die castings are integral to the automotive industry’s continued growth and innovation. As demand for lightweight, durable, and cost-effective components continues to rise, the importance of aluminum die castings is expected to further escalate in the coming years.

REGIONAL ANALYSIS

The Global Automotive Parts Aluminum Die Casting market can be analyzed regionally to understand its dynamics across different areas. Geographically, it's segmented into North America, Europe, Asia-Pacific, and the rest of the world. Each region has its own unique characteristics and influences on the market.

Starting with North America, it's a significant player in the Automotive Parts Aluminum Die Casting market. The region has a mature automotive industry with established manufacturers and suppliers. Factors such as technological advancements, stringent regulations, and consumer preferences drive the market here. Additionally, North America's focus on sustainability and fuel efficiency plays a crucial role in shaping the demand for aluminum die casting in automotive parts.

Moving on to Europe, it's another key region in the market. Like North America, Europe has a well-developed automotive sector with leading manufacturers and suppliers. The region is known for its emphasis on innovation, quality, and design in automotive manufacturing. Environmental regulations, consumer preferences for lightweight materials, and the adoption of electric vehicles contribute to the demand for aluminum die casting in automotive parts across Europe.

Asia-Pacific emerges as a dominant force in the Automotive Parts Aluminum Die Casting market. The region is home to some of the largest automotive markets in the world, including China, Japan, and India. Rapid industrialization, urbanization, and rising disposable incomes drive the demand for automobiles in Asia-Pacific. As a result, there's a growing need for lightweight and durable materials like aluminum in automotive manufacturing. Moreover, government initiatives to promote electric mobility and reduce emissions further boost the market for aluminum die casting in the region.

The rest of the world also plays a significant role in the Automotive Parts Aluminum Die Casting market, albeit to a lesser extent compared to the aforementioned regions. Countries in Latin America, the Middle East, and Africa have their own automotive industries with varying levels of development and demand for aluminum die casting.

The regional analysis of the Global Automotive Parts Aluminum Die Casting market highlights the diverse factors influencing its growth and demand across different parts of the world. Factors such as technological advancements, regulatory frameworks, consumer preferences, and government initiatives shape the market dynamics in each region. Understanding these regional nuances is essential for stakeholders to make informed decisions and capitalize on emerging opportunities in the Automotive Parts Aluminum Die Casting market.

COMPETITIVE PLAYERS

The global automotive parts aluminum die casting market is highly competitive, with several key players vying for market share. These players include Dynacast International Inc., Nemak SAB De CV, Endurance Technologies Limited, Sundaram-Clayton Limited, Shiloh Industries, Inc., Georg Fischer Ltd, Gibbs Die Casting Corp., Bocar, S.A. de C.V., Koch Enterprises, Rockman Industries, Ryobi Die Casting, Linamar Corporation, Sandhar Technologies Limited, Indian Diecasting Industries, Inventive Alloy Cast Pvt Ltd, Joyson Safety Systems, Pace Industries, LLC, LTH Castings, and ATA Casting Technology Co., Ltd. Each of these companies brings its own strengths and capabilities to the table, contributing to the overall competitiveness of the market.

Dynacast International Inc. is known for its expertise in precision die casting and value-added services, while Nemak SAB De CV is recognized for its innovative solutions and global presence. Endurance Technologies Limited has a strong focus on research and development, continually striving to enhance its product offerings and meet evolving customer needs. Sundaram-Clayton Limited is renowned for its commitment to quality and customer satisfaction, maintaining long-standing relationships with leading automotive manufacturers.

Shiloh Industries, Inc. stands out for its advanced manufacturing capabilities and focus on lightweighting solutions, catering to the growing demand for fuel-efficient vehicles. Georg Fischer Ltd specializes in complex aluminum components, serving diverse industries including automotive, aerospace, and industrial sectors. Gibbs Die Casting Corp. is known for its extensive experience and technical expertise, delivering high-quality die cast components to customers worldwide.

Bocar, S.A. de C.V. has a strong presence in the North American market, offering a wide range of aluminum die casting solutions to automotive OEMs. Koch Enterprises is recognized for its commitment to sustainability and environmental stewardship, implementing eco-friendly practices throughout its manufacturing processes. Rockman Industries is a leading supplier of aluminum die cast components for motorcycles, expanding its presence in the automotive sector.

Ryobi Die Casting, Linamar Corporation, Sandhar Technologies Limited, Indian Diecasting Industries, Inventive Alloy Cast Pvt Ltd, Joyson Safety Systems, Pace Industries, LLC, LTH Castings, and ATA Casting Technology Co., Ltd also play significant roles in the automotive parts aluminum die casting market, contributing to its competitiveness through innovation, quality, and customer-centric approaches.

Automotive Parts Aluminium Die Casting Market Key Segments:

By Production Process

- Pressure Die Casting

- Vacuum Die Casting

- Squeeze Die Casting

- Gravity Die Casting

By Application

- Body Parts

- Engine Parts

- Transmission Parts

- Battery And Related Components

- Other Application Types

Key Global Automotive Parts Aluminium Die Casting Industry Players

- Dynacast International Inc.

- Nemak SAB De CV

- Endurance Technologies Limited

- Sundaram-Clayton Limited

- Shiloh Industries, Inc.

- Georg Fischer Ltd

- Gibbs Die Casting Corp.

- Bocar, S.A. de C.V.

- Koch Enterprises

- Rockman Industries

- Ryobi Die Casting

- Linamar Corporation

- Sandhar Technologies Limited

- Indian Diecasting Industries

- Inventive Alloy Cast Pvt Ltd

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383