MARKET OVERVIEW

The Global Automotive Filters Market would be one of the key shaping forces in the future of the automotive industry, as vehicle manufacturers continue to emphasize the efficiency, lifespan, and performance of their vehicles. In fact, automotive filters will continue to be an indispensable part of achieving these characteristics in vehicles. The filtration industry in the automobile industry serves the purpose of filtering fluids and air moving through all the components of a car, from the engine and transmission to the cabin. Eco-friendliness and energy efficiency are gaining increasing acceptance for future vehicle production; this is an essential reason that filtration is likely to remain one of the prime areas in the automobile supply chain.

With increasing environmental concerns and stricter regulations on emissions, automotive filters will undergo significant transformations to meet future standards. They will be enhanced in their ability to trap finer particles, reduce emissions, and improve air quality within the cabin. Manufacturers will work towards compliance with emerging global regulations, and filters will evolve to offer higher levels of performance and sustainability, addressing both consumer and environmental needs. This urge for compliance will give way to innovation, fostering filter designs that can withstand extreme operating conditions with a minimum impact on the environment.

Automotive filters will also see drastic innovations. The electric and hybrid vehicles revolution will necessitate special filters designed for new types of systems and components that may be involved. Filters that are specifically designed with longevity for electric powertrains will be the most prevalent, and they would reduce maintenance needs within such vehicles. Filtration materials will be advanced such that future designs use advanced synthetic fibers as well as carbon-based solutions for more efficient filters. The global demand for more durable, efficient, and sustainable filters will lead to the collaboration of manufacturers with research institutions, accelerating the development of new materials and technologies.

Consumer preferences will shift as awareness of vehicle maintenance and performance increases. Demand for filters that provide better durability, longer lifespans, and better fuel efficiency will gain momentum. The more environmentally conscious the consumers become, the more they will demand eco-friendly filter options that reduce waste and improve the efficiency of vehicles. Manufacturers will be pushed to innovate and produce filters that meet industry standards but also align with consumer preferences for sustainable automotive solutions.

Apart from the above, the global economic factors are going to drive the Global Automotive Filters Market. As economies are developing, there will be a higher demand for automobiles, and thereby, the demand for effective filtration solutions would increase. Emerging markets, where ownership of vehicles is growing at an unprecedented rate, will have more demand for affordable high-performance filters that will drive market dynamics. The growing size of the middle-class population in developing nations will lead to the increased sales of cars worldwide, increasing the demand for different vehicles and price lines from the manufacturers.

The future of the Global Automotive Filters Market will thus be defined by the interplay of the availability of cutting-edge technology, consumer demand, and regulatory pressures. With a sustained push toward improvement of vehicle efficiency, sustainability, and performance, many developments can be expected for this market with all the dynamic transformations in need at the behest of the auto industry. Once new types of automobiles and the toughest environmental conditions get introduced to market, there are going to be even bigger critical roles from these automotive filters.

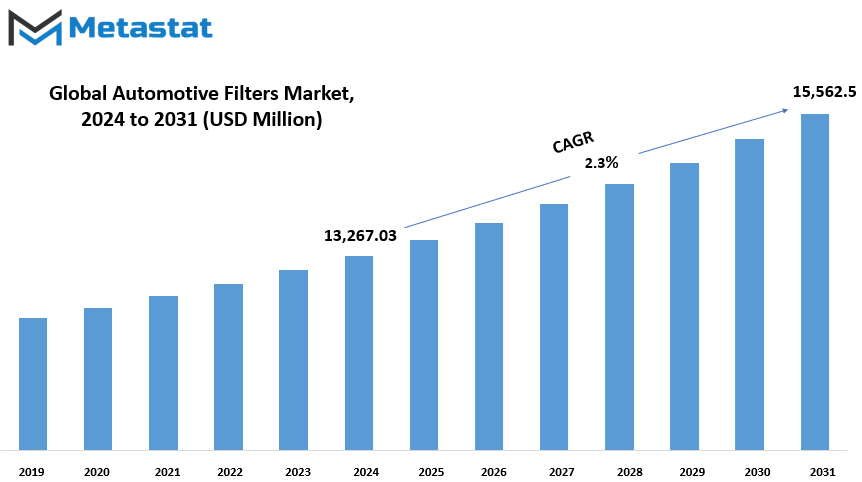

Global Automotive Filters market is estimated to reach $15,562.59 Million by 2031; growing at a CAGR of 2.3% from 2024 to 2031.

GROWTH FACTORS

The global automotive filters market has grown remarkably because of the increase in automobile manufacturing and sales volumes. The production and sale of a higher volume of vehicles escalate the demand for automotive filters. Filters are instrumental in the efficacy and longevity of the vehicle as they prevent harmful particulate matter in engines and other components from choking it. One of the key growth drivers of the automotive filters market is the increasing automobile demand, especially in emerging economies.

The other factor driving the market is the strict emission regulations set by governments across the globe. With increasing emphasis on the environmental impact of vehicles, manufacturers are compelled to adopt better filtration systems so that their vehicles can meet the requirements. This leads to a higher demand for high-quality automotive filters, especially those that reduce harmful emissions and maintain the efficiency of the engine.

Despite these positive driving factors, some challenges may stand in the way of the expansion of the market for automotive filters. The cost of replacing the filters is highly expensive. The filter is part of the vehicle. When the owner decides to change it, a huge amount may be spent in both the vehicles and the car industries. It sometimes takes too long before such filters are changed. Eventually, it affects the performance of the vehicle.

MARKET SEGMENTATION

By Filter Type

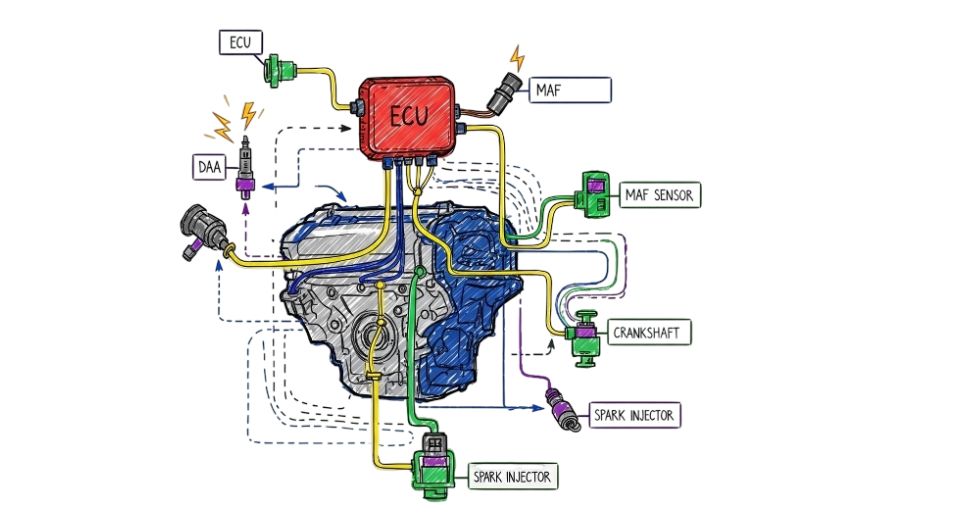

The market of global automotive filters is growing gradually, and filter types are in great demand so that a vehicle can ensure the performance and safety of a vehicle. Out of all such categories, Air Filter is considered one of the major segments. The value for this segment was around $3,991.41 million. These filters basically trap dirt and debris and hence prevent them from entering the engine and causing any damage. Air filters also improve fuel efficiency because they ensure that clean air reaches the engine, which is an important requirement for the combustion process.

The second important segment of the automotive filter market is Oil Filters, which accounts for $3,509.46 million. Oil filters are an important element in removing impurities and contaminants in the engine oil to maintain it clean and lubricating the engine parts. The removal of contaminants will prolong the lifespan of the engine, enhance efficiency, and prevent damage caused by dirty oil to the engine.

Fuel Filters are also important in the automotive filter market. These prevent dirt and debris from entering the engine, thereby avoiding clogging the vital parts such as fuel injectors. Hence, a clean fuel system provides for smooth operation of the engine, good fuel economy, and lower emissions.

Cabin Filters is another major category within the automobile filter market. The filters shall purify the air inside the cabin by trapping dust, pollen, and other harmful agents. They not only save passengers from cabin air cabin air pollution but also guard against allergic reactions and other respiratory ailments triggered by poor air quality in a car. Heightened awareness about the quality of air inhaled is going to increase cabin filters demand in the immediate future.

With these main types of filters, several other specialized filters that cater to special requirements have been identified. Such transmission filters, fuel-water separators, and other similar variants support optimizing vehicle performance while ensuring that a range of components are given an extended lifespan in the engine. Growth in the automotive sector would call for good-quality filters of all varieties to spur on growth in the global market for automobile filters.

By Vehicle Type

The automotive filters market globally has been segmented based on different types of vehicles, like passenger cars, light commercial vehicles, heavy commercial vehicles, and two-wheelers. The part comprising the maintenance of performance and life is regarded as filter, which is composed of various systems, like an engine, transmission, and air conditioning, working correctly. The demand for filters varies from one vehicle to another because of the different purposes for which they are used and their different needs.

The most common type of vehicle is the passenger car, which accounts for a large share of the market. Passenger cars need filters for their engines, air conditioning systems, fuel systems, and other components. The demand for automotive filters in passenger cars is fueled by more drivers and increased vehicle production. The need for better air quality and fuel efficiency has led to passengers also having considerable demand for automotive filters in passenger cars. As a response, there is growing consumer awareness about the requirement for regular maintenance that keeps the car running efficiently while minimizing the harmful effects on the environment.

Light commercial vehicles consist of vans and small trucks; they are significant in the market. They can be used mainly in transportation and logistics, but the need for reliable filters would be more compelling. LCVs usually spend more time, and the numerous systems are prone to frequent stress, thus generating a higher demand for durable filters that can keep up with challenging operating conditions for vehicle performance to be maintained.

The demand in HCVs like trucks and buses is much higher and very exigent. Such vehicles cover a far distance and carry heavy loads. The extreme and rigorous conditions need filters. Emissions and fuel efficiency for HCVs are much stricter than others, hence demanding more quality filters.

Two-wheelers, including motorcycles and scooters, also make up an important segment of the market for automotive filters. Like their four-wheeled brethren, two-wheelers make use of an assortment of filters to maximize their engines: air, oil, and fuel filters. As two-wheelers continue to grow in popularity in urban areas around the globe, the market for two-wheeler filters has stabilized in absolute terms.

The global automotive filters market is broadly influenced by different vehicle types and their needs. With the advancements in the automobile industry, a demand for performance filters across various vehicle categories would be experienced on the grounds of efficiency in vehicle performance, environmental factors, and the durability of long-term use.

By Sales Channel

OEMs are expected to continue to be a leading force in the competitive landscape of the automotive filters market. The need for high-performance OEM filters will grow as the automotive industry continues its march towards increased fuel efficiency and reduced emissions. As manufacturers focus on producing vehicles that meet the environmental requirements of the country and customer expectations, the demand for high-quality filters installed during the time of production is only going to increase more. This trend underlines the fact that OEM filters play a significant role in ensuring that vehicles can operate at their peak and for a longer time.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$13,267.03 million |

|

Market Size by 2031 |

$15,562.59 Million |

|

Growth Rate from 2024 to 2031 |

2.3% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

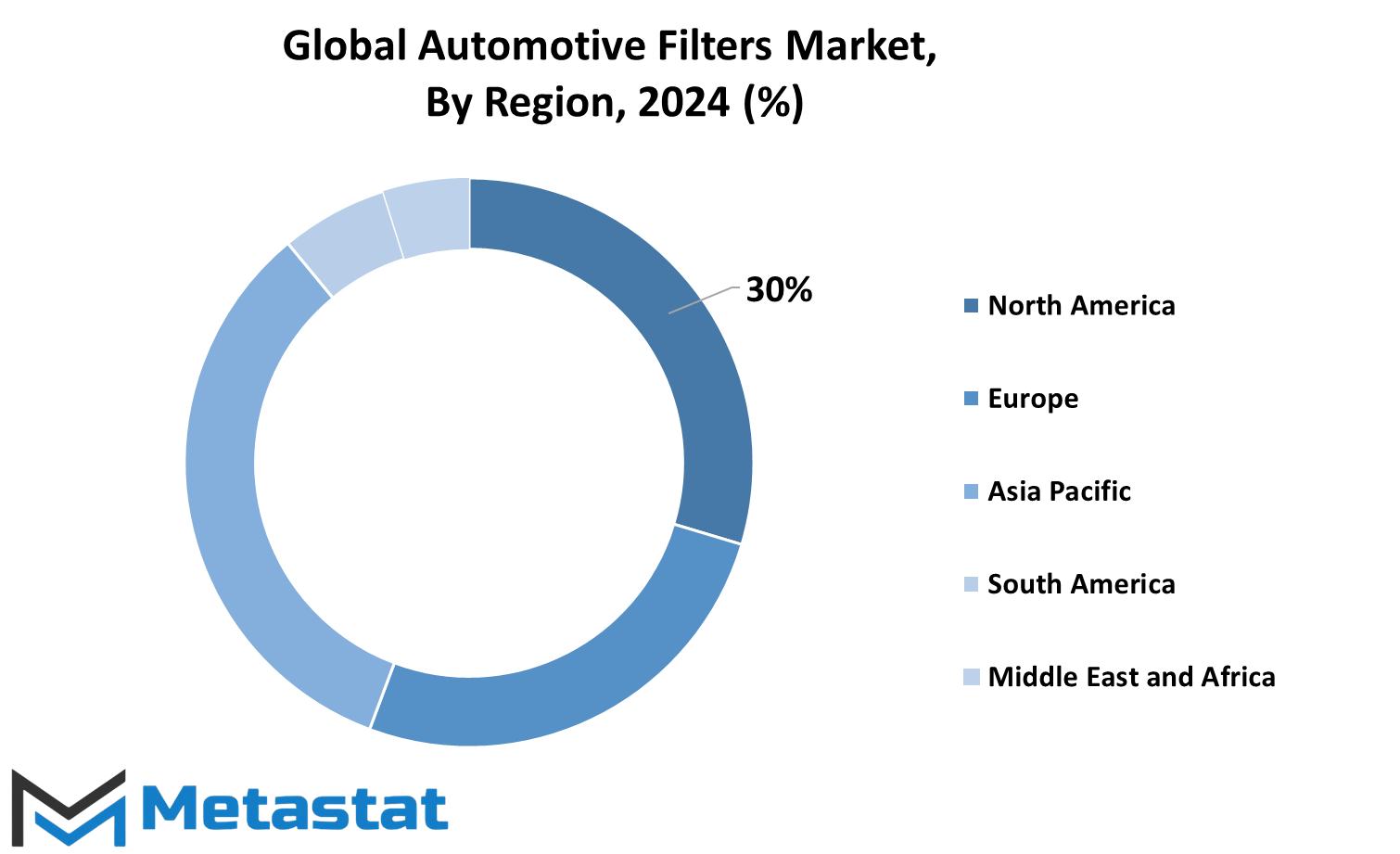

The global automotive filters market is categorized by geographical regions. These are North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Under North America, the market has further been split into the United States, Canada, and Mexico. Europe is further segmented by major countries in the United Kingdom, Germany, France, Italy, and the rest of Europe not covered in these countries. Asia-Pacific comprises large markets such as India, China, Japan, and South Korea along with the rest of the region. South America comprises countries such as Brazil and Argentina, as well as all other countries in the region, not individually named. The Middle East & Africa region comprises GCC countries, Egypt, South Africa, and the rest of the Middle East and Africa.

Each of these regions has a different demand and market structure for automotive filters. North America is the most developed region in terms of the automotive industry, where there is much emphasis on technological innovation and stringent environmental regulations that affect the demand for high-quality filters. The U.S. is the largest market in this region, followed by Canada and Mexico, which also have growing automotive markets due to increasing vehicle production and sales.

Automotive filters demand in Europe is influenced by increasing vehicle production, stringent standards for emissions regulation, and increased consumer demand for eco-friendly vehicles. Some of the biggest markets are in the UK, Germany, and France. Other countries, including Italy, significantly contribute to the overall demand for automotive filters.

The Asia-Pacific region, fuelled by the highly rapid growth of the automotive industry in China, India, Japan, and South Korea, holds the major share in the global market for automotive filters. China is the world's greatest automobile manufacturer and consumer market, and it stands out as a very powerful force driving the demand for automotive filters. India and South Korea also observe fast growth in this sector due to their rapidly increasing abilities in automotive manufacturing.

South America, though a smaller market compared to others, is growing steadily, especially in countries like Brazil and Argentina. The demand for automotive filters in this region is influenced by factors such as increased car ownership and automotive production. The Middle East & Africa, with countries like South Africa and Egypt, also shows potential, driven by infrastructure development and expanding automotive sectors. This division of the market by geography allows for a better understanding of regional demand and opportunities for growth in the automotive filters industry.

COMPETITIVE PLAYERS

The global automotive filters market is driven by a number of major players that have already emerged as industry leaders. Such companies are Robert Bosch GmbH, Mann+Hummel Group, Donaldson Company, Inc., Sogefi S.p.A., Mahle GmbH, Ahlstrom-Munksjö, Denso Corporation, Cummins Inc., Parker Hannifin Corp, Hengst SE, K&N Engineering, Inc., Toyota Boshoku Corporation, Zhejiang Universe Filter Co., Ltd., Champion Laboratories, Inc., Freudenberg Filtration Technologies, ALCO Filters Ltd., ACDelco, Baldwin Filters, and Valeo S.A.

All these companies play a vital role in the manufacturing and development of filters that ensure the proper functioning and longevity of automotive engines and other essential systems. Robert Bosch GmbH, for instance, is renowned for its innovative approach and high-quality products catering to various automotive needs. Mann+Hummel Group and Mahle GmbH have also gained a reputation for their comprehensive range of filtration solutions that meet the evolving demands of the automotive industry.

Donaldson Company, Inc. and Sogefi S.p.A. also play an important role in the automotive filters market with their latest technology in filtration, which enhances engine performance and reduces emissions. Denso Corporation and Cummins Inc. take a bigger role in the development of filters that are a part of integrated functions within automotive systems, especially in air and fuel filtration.

Parker Hannifin Corp and Hengst SE are leading firms in terms of high-performance filters, which are considered to give high protection to the automotive engine. Such filters prevent dirt and debris from entering the system, keep the engine at peak efficiency, and allow for a smoother drive for longer durations. Companies like K&N Engineering, Inc. and Toyota Boshoku Corporation specialize in giving premium filtration solutions that both satisfy performance requirements and environmental expectations.

Companies like Zhejiang Universe Filter Co., Ltd. and Champion Laboratories, Inc. offer many different filters and can fit several different vehicles, including passenger and commercial cars and trucks. The main growth for Freudenberg Filtration Technologies and ALCO Filters Ltd., and other such producers of filtration technology, lies in their superior product offerings, appealing to the wide commercial and consumer base. Valeo S.A. also does this.

With time, these companies will be leading the automotive filters market because of their innovations in the industry, and thus, the automotive engines and systems will remain efficient and environmentally friendly.

Automotive Filters Market Key Segments:

By Filter Type

- Air Filters

- Oil Filters

- Fuel Filters

- Cabin Filters

- Other

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Two-Wheelers

By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

Key Global Automotive Filters Industry Players

- Robert Bosch GmbH

- Mann+Hummel Group

- Donaldson Company, Inc.

- Sogefi S.p.A.

- Mahle GmbH

- Ahlstrom-Munksjö

- Denso Corporation

- Cummins Inc.

- Parker Hannifin Corp

- Hengst SE

- K&N Engineering, Inc.

- Toyota Boshoku Corporation

- Zhejiang Universe Filter Co., Ltd.

- Champion Laboratories, Inc.

- Freudenberg Filtration Technologies

- ALCO Filters Ltd.

- ACDelco

- Baldwin Filters

- Valeo S.A.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252