MARKET OVERVIEW

The Global Automated Storage & Retrieval System market will expand as the companies seek efficiency and accuracy in their operations. Challenges related to space use and labor attrition running deep into activities have characterized the conventional methods of storage, explaining the embrace of automation in industries that allow retrieval at an accelerated rate with lower levels of error and improvement of tracking in stock. In future, improvements in the capabilities of systems will be necessitated by a greater requirement for storage, and thus automation will be a cornerstone of warehouse management strategies.

It accounts for a substantial part of the standards in the material handling and logistics sectors, giving high-end solutions for effective inventory stocking and warehouse exchanges. This exclusively advances automated technologies involved in the storage and retrieval of goods in favor of the automatic nature rather than manual with increased efficiency.

This is a trend being adopted by organizations across several sectors, including manufacturing, retail, pharmaceuticals, and e-commerce, in their investment in these systems, which promise better storage capacity optimization and increased efficiency in supply chain workflows. The automated storage and retrieval systems operate as a collection of robotic actions, software, and control solutions that enable continuous processing of materials in warehouses and distribution centers.

Global Automated Storage & Retrieval System will be defined by integration of technologies, including innovations in artificial intelligence, machine learning, and sensor technologies in future developments. Smart analytics should enhance optimization in moving and storing inventory in an organization to allow improved decision making on such practices with the possibility of predicting changes in demand patterns and adjusting accordingly to enhance efficiency along the entire supply chain. Certainly, modern logistics and warehousing will see automated storage and retrieval systems as the basic structure of operations.

The Customization of the system would subject the Global Automated Storage & Retrieval System market because the businesses need custom solutions to fit different operation types. Whether storage and retrieval pertain to small, high-value items in pharmaceutical stores or larger inventories managed in retail distribution centers, automation will provide solutions that are clearly industry-specific. Flexibility in storage will enable modular design and improve systems and buildings to meet requirements on demand. Without research and development of technology in the future, this market would remain dependent solely on automation as an alternative to conventional storage.

The Global Automated Storage and Retrieval System Market will be motivated by the collaboration of the providers with end-users because the businesses in this regard are looking for answers specific to their own storage concerns. It will be expected to see strategic partnerships further facilitating innovations that will mean the development of the systems having improved precision, energy efficiency as well as real-time monitoring capabilities. With the automation providers focusing on making the systems faster, more accurate, and more adaptable, the solution is sought to anticipate all the dynamic changes that arise from various industries.

Currently, the trend that is being observed among industries is the automation of storage and retrieval processes and therefore it is expected that the Global Automated Storage and Retrieval System market is going to continue as a core part of modern supply chain management in the future. Further redefinitions of warehouse efficiency by more advanced automation will allow businesses to save space, transfer time, and improve general productivity. Progressive reliance on intelligent storage solutions has been attributed to the consistent high-speed developments in automation such that they remain at the frontier of warehouse operations.

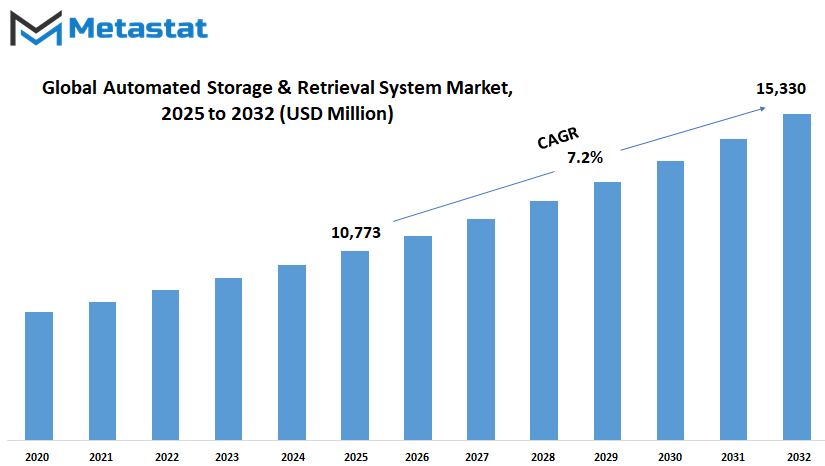

Global Automated Storage & Retrieval System market is estimated to reach $15,330 Million by 2032; growing at a CAGR of 7.2% from 2025 to 2032.

GROWTH FACTORS

the Global Automated Storage & Retrieval System market, each directed toward addressing different needs in various industries. Unit Load Cranes will most likely receive applications in handling very large as well as extremely heavy pallets, thus rendering them most applicable in large-scale manufacturing and distribution centers. Those systems will be enhanced with several artificial intelligence and predictive analytics improvements that would ultimately facilitate movement while minimizing downtime. Mini Load Cranes are mainly intended for lighter loads and will offer effective handling of smaller items within very high-density storage environments, with added value by virtue of their speed and precision making them inevitable in industries that require frequent ordering, like pharmaceuticals and retail.

The world is shifting towards more advanced ways to manage storage and retrieval operations within companies, leaving the market for Global Automated Storage and Retrieval System in a state of change. Shoppers are finding convenient ways of ordering goods from wherever and again shopping through various channels. Businesses will, therefore, feel severe pressure to rethink their logistics and warehouse management processes in the near future. That is what makes businesses want to improve the already limited space utilization, increase inventory accuracy, and reduce the speed of order fulfillment. As automated storage and retrieval systems come into play as a major part of modern warehouse operations, organizations work hard to keep pace with the demands of the consumer for faster and more accurate deliveries.

One of the drivers of this market has been emphasis placed on labor efficiency and overall enhanced productivity in warehouses or manufacturing facilities. They are constantly on the lookout for ways to reduce manual errors, dip operational cost, and increase output. AS/RS technology is an answer that addresses these problems because it takes automation of storage and retrieval processes, minimizes human intervention, as well as smoothens movement of inventory. More effective allocation of human resources leading to better workforce utilization arises from freeing the company's tasks from those labor intensive. Further, automation mitigates problems associated with the workforce while improving operational efficiency, a concept that is especially valuable for areas with labor shortages or high labor costs.

A challenge that can slow down the expansion of this market is the high initial investment needed for implementing AS/RS solutions, even with all the benefits. In addition, many costs are incurred as a result of infrastructure innovations, the integration of the software, and employee training, thus making the adoption of these technologies extremely difficult for small and mid-sized enterprises. Integrating such automated systems into existing layouts of warehouses would necessarily require a further in-depth understanding as well as careful planning and customization. Many warehouses were not originally designed to accommodate advanced automation; thus, they now need investment in structural modifications or complete redesign of their facilities to fully benefit from the technology offered by AS/RS.

From the perspective of the future, the advancement in technology is supposed to help the market in overcoming some of those challenges. Developments in hybrid AS/RS solutions, which juxtapose automated technology with various manual handling techniques, are turning out to be a feasible option. These hybrid systems allow flexibility so the warehouse may gradually proceed to full automation while avoiding any large capital investment outlaid on an overhaul of the system. In accommodating a wider spectrum of warehouse sizes and operational needs, such solutions allow automation to become much more attainable for businesses of all shapes and sizes. As industries budget for increased efficiency, accuracy, and speed in their logistics, the AS/RS technology is likely to become an integral part of the warehousing strategy of tomorrow otherwise more complex grain and adaptable storage solutions.

MARKET SEGMENTATION

By Type

The Global Automated Storage & Retrieval System market will be advanced significantly under rapid technological development and growing demand for efficiency in the processes of storage and retrieval. This makes automation imperative in industries that are looking to enhance operations, limit labor, and improve accuracy in the operations. Increasingly, as companies grow, their demand for an intelligent warehousing solution will increase, necessitating connecting those systems to intelligent systems to help manage inventories.

In the future, several technologies will define Robotic Shuttle Technologies will keep moving toward being more dynamic in the management of products having different dimensions and weight specifications. Such systems will provide real-time adjustment for better efficiency, which is possible thanks to demand patterns. Carousel systems will also continue to be valuable in applications that require speedy retrieval of stored materials. Speed in retrieval is often a priority determinant in an industry. Hence, in these instances, the vertical lift modules will be at the forefront of busily enhancing software integration for improving such spaces and cutting operational costs.

Automated warehouse solutions, with high automation levels and maximum storage density, will be critical for the future of Robotic Cube-Based Storage. Order fulfillment would be increased in these systems, whilst errors would significantly be minimized through machine learning. As industries focus on sustainable development, the energy-efficient automatons are emerging as the choice energy consumption parameters for reducing power use without affecting productivity. Within this technology-scape, many more exciting new solutions will come into play to address diverse specific issues regarding the industry and help keep storage and retrieval systems up-to-date with developments in the market.

The speed of digital transformation means that automated solutions will increasingly be required by businesses to achieve competitive advantage. The outcomes, which are data analysis, robotics, and artificial intelligence, are intended to change how storage and retrieval functions are performed by making the systems smart and responsive. Most of the Global Automated Storage & Retrieval System base will be continuous innovations defining how industries manage their inventories and how they optimize their supply chains for the future.

By Function

The future of the world market for Automated Storage & Retrieval Systems is about to experience vast transformations on account of the various industries embracing automation to seek efficiency and accuracy in their operations. These systems are meant to automatically store and retrieve an item with an integral role to play in functions like assembly, distribution, kitting, order picking, and storage.

Automated Storage & Retrieval Systems are aiding the assembly operations in the transport of components to production lines. By serving the right parts at the right time, they minimize all associated downtimes, thereby increasing production efficiency. Hence, with the growing complexity of manufacturing, the dependence on such automated solutions will equally grow to effect synchronized and leaner production workflows.

Distribution center operations are breaking movement patterns of goods by Automated Storage & Retrieval Systems. By automating retrieval and dispatch, companies can reduce their lead times and get to the market faster-reacting with the degree of agility being crucial for areas where timely delivery becomes a competitive advantage.

Kitting operations assemble various combinations of components into kits for shipment options. The precision of Automated Storage & Retrieval Systems comes into play. The systems thereby ensure greater accuracy in kit assembly, which ensures that every kit has the right items. This kind of accuracy increases customer satisfaction, reducing expenses arising from error and return cases.

Order picking, usually the most labor-intensive task in warehouses, is now being automated. Faster and more accurate order fulfillment is now possible through Automated Storage & Retrieval Systems, thus compensating human error further with sped-up processes. This effectively enhances order fulfillment, a very imperative characteristic in e-commerce, where consumers expect swift and reliable deliveries.

Through Automated Storage & Retrieval Systems, storage functions are also improved. Space is maximized so companies can store more inventory in that footprint. In this manner, with the systematic storing and efficient retrieval of goods, companies can better utilize this capability to lower their inventory levels, thereby reducing their holding costs.

Such Advanced technologies are further boosting the functionality of Automated Storage & Retrieval Systems: AI and machine learning will allow systems to keep up with the dynamic environment of changeable demands and change storage strategies while predicting maintenance requirements for reducing downtime and prolonging the life of equipment.

With the continuing search for solutions offering efficiency and any scalabilities by industries, the adoption of Automatic Storage and Retrieval Systems is expected to scale up for the foreseeable future. Companies with the foresight to adopt these systems will be well-positioned to meet the evolving demands of their respective markets, maintain competitive advantage, and reach operational excellence.

By End User

The Global (AS/RS) Automated Storage and Retrieval System market is all set for its change, given the continued developments in automation and the demand for efficiency among different industries. As efficiency is being emphasized in industrial operations, AS/RS technologies are increasingly becoming the backbone for streamlining processes and enhancing productivity.

In the automotive arena, manufacturers are deploying AS/RS to maximize throughput and storage capacity. These systems facilitate efficient material handling so that components remain in the production line for minimum downtimes while maximizing throughput. Advanced AS/RS solutions are helping realize just-in-time manufacturing, a major consideration in current automotive production.

The metals-heavy machinery industry profits from AS/RS by accurately managing bulky and heavy components. Automated systems greatly reduce manual labor and associated risks in safely and properly storing and retrieving heavy loads. Occupation safety is significantly improved, thus enhancing the efficiency of operations in essentially handling heavy machinery parts.

In the food and beverage industry, AS/RS has important applications related to ensuring product integrity and safety. These systems assist in storing perishable products under the most optimal conditions to maintain their freshness and long shelf life. Automated storage systems allow them to better manage their inventories, reduce wastage, and ensure strong compliance to stringent food safety regulations.

Chemical industries use AS/RS to guarantee the utmost safety and accuracy in handling hazardous materials. Automated systems minimize human exposure to dangerous materials, guaranteeing the proper storage conditions, which is very important for chemical stability and safety standards. This use case presents yet another reason why automation is invaluable in controlling sensitive materials.

Benefits derived from AS/RS for the healthcare industry include better storage and management of medical supplies and pharma. Automated systems allow for accurate tracking and retrieval of items, timely patient delivery, and a reduction in errors. Better inventory control ensures that medical supplies are on hand whenever needed, thus improving health outcomes.

The semiconductor and electronics industry is primarily dependent on AS/RS for the handling of fragile components. The automated systems greatly reduce any chance of causing damage during storage and retrieval, thus assuring gentle handling of sensitive electronic parts. This artificial precision is the prime consideration for maintaining the quality and reliability of electronic products.

Every retail business and e-commerce is adding a substantial share of AS/RS to work with inventory in time and complete the order on schedule. Automated systems allow fast retrieval of goods in retail operations and enhance customer satisfaction with timely deliveries.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$10,773 million |

|

Market Size by 2032 |

$15,330 Million |

|

Growth Rate from 2025 to 2032 |

7.2% |

|

Base Year |

2024 |

|

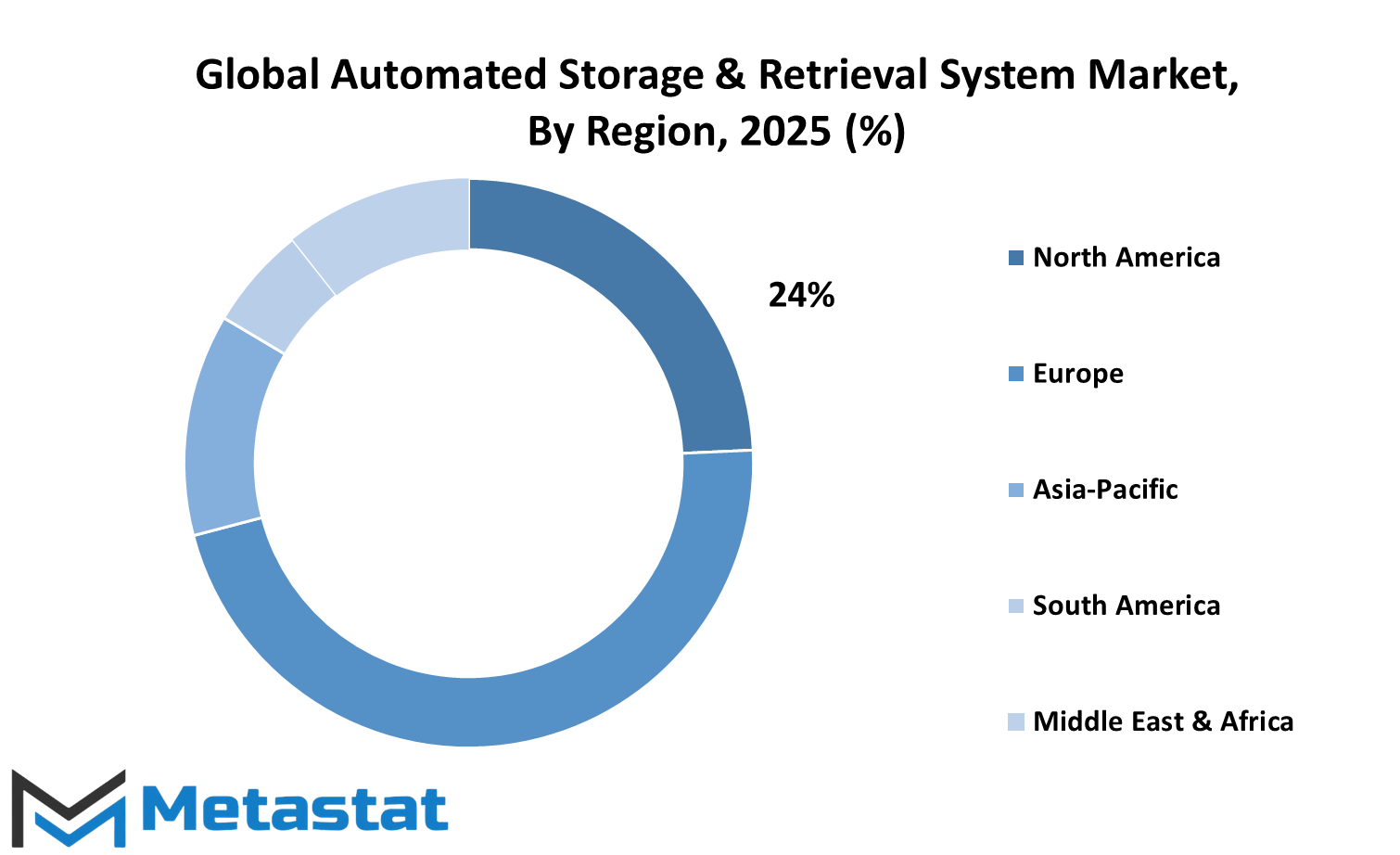

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The automated storage and retrieval system are growing significantly in all the areas worldwide, mainly because of the challenges brought about by technological advancement in inventory management. There is a strong need for businesses to integrate automation solutions to optimize storage and retrieval processes as this requirement is known to differ from region to region. It, however, depends on the economic conditions, industrial expansion, and technological infrastructure associated with different locations.

North America remains one of the important participants of this, mainly because of the demand coming from different industries such as e-commerce, health care, and automotive. The existence of already-established technology providence, plus the focus on warehouse automation, causes the rise in adoption. The U.S.'s influence on innovation through investment in robotics and AI-enabled solutions aimed at logistics efficiency is significant. In addition, Canada and Mexico are also moving toward smart warehousing solutions to improve supply chain management.

Europe is yet another major contributor with countries such as Germany, the UK, and France being the leading adopters of automated storage and retrieval systems in this region. The adoption of these systems is favored as a result of very strict regulations regarding workplace safety and labor efficiency, which are forcing companies to be automated. E-commerce growth and the increasing need to fulfill orders speedily also push for the adaption of these systems. More European manufacturers are inclined toward automating their processes because it helps them remain competitive.

Asia-Pacific, especially in the wake of rapid industrialization, urbanization, and the growth of e-commerce, is turning out to be a high-growth region. With China and Japan leading the way in the automated process, both countries hope to use their push toward automation to improve logistics and warehouse efficiency. South Korea is also racing ahead, with industries devoted to integrating advanced robotics into companies for better operations. As India's economy grows and its manufacturing sector expands, more automated techniques will be adopted to enhance supply chain management. Also, as its businesses grow, so will its need for automation in storage and retrieval.

In South America, Brazil and Argentina are eyes on the potential market as it grows mainly in their manufacture and retail sector. Like the rest of the regions, this adoption has slowed down, but awareness regarding improvements in efficiency and cost savings have contributed to luring businesses towards the solution. Automated systems are now being integrated gradually in logistics to boost productivity and cut operational costs.

The Middle East and Africa are beginning to understand the benefits that automated storage and retrieval systems can offer. Member countries in the GCC, including the UAE and Saudi Arabia, are getting into smart logistics and warehouse automation as part of their wider economic change strategies. South Africa is yet another key market where industries are focusing on automation for inventory management optimization and supply chain efficiency improvement. The demand for these systems in the region is expected to rise as infrastructure and technology adoption continue to move forward.

AI, machine learning, and robotics shall greatly advance how various industries introduce automated storage and retrieval systems in the different regions. The key focus for any business will be on efficient operations, lower employability costs, and enhanced accuracy in inventory management. With ever-increasing investments into automation and the development of smarter and more flexible storage solutions, the global market is set to witness extraordinary growth in the years to come.

COMPETITIVE PLAYERS

The global automated storage and retrieval systems market is being determined by the competition for developing modern approaches in logistics and warehouse management. Major industry players continue innovating their technologies to promote corporate goals for efficiency, accuracy, and flexibility. Focused on automation in the operations of their business, leading companies continue to invest in innovations that will redefine the storage and retrieval of goods as they compete amongst themselves. In modern supply chains, these automated solutions have built efficiencies and become important requisites.

Daifuku Co., SSI Schäfer AG, and Murata Machinery are proving to be the frontrunners with research on systems that promote speed and accuracy inside the warehouse. Their automation solution employs combined robotics, artificial intelligence, and machine learning to develop optimal workflows. Further among the best in this trend are Knapp AG and TGW Logistics Group, who have been developing automated storage solutions that cater to industries requiring high-speed fulfillment. To remain competitive as e-commerce develops rapidly and demand grows for shorter delivery windows, businesses search for advanced automation.

Kardex Group and Swisslog Holding AG are progressing in flexible and modular storage systems that would prove their worth in scaling warehouse operations efficiency. While Mecalux S.A. and Vanderlande Industries B.V. concentrate on warehouse optimization through reducing manpower requirements while increasing storage capabilities by robotics, System Logistics Corporation and Green Automated Solutions innovate software-driven automation for real-time inventory visibility and seamless integration with legacy supply chain management systems.

And the eye to improvement in sensor technology and artificial intelligence would also lead the way into their strategies as it pertains to BEUMER Group GmbH & Co. KG, Dematic GmbH & Co. KG, and Hänel GmbH & Co. KG. The intelligent storage and retrieval solutions being developed by these companies are, however, empowered with predictive analytics using which warehouses will be able to anticipate future demand changes and adjust their operations accordingly. Westfalia Technologies, Inc. and Toyota Industries Corporation are operating regarding sustainability while making systems burdened with less energy to operate while maximizing throughput efficiencies.

Some new players are Opex Corporation, Exotec, and Hairobotics, and the solutions they give are next-gen automation based on compact and highly adaptable systems. Such systems are quite favorable in particular for businesses that want to make the most out of little spaces in a warehouse at a zero compromise on efficiency. Meanwhile, Honeywell International Inc. and Autostore Holdings Ltd. are enhancing robotic systems enabled by artificial intelligence to have the possibility of automated complex work with minimal human intervention in warehouses. Bastian Solutions, LLC is also contemplates entering the market with its tailored solutions addressing specific industry needs.

The Global Automated Storage & Retrieval System market is getting more competitive with automation and will thus push the companies toward developing more advanced and intelligent solutions. Those firms investing in technologies will certainly be in a better position to enjoy faster and more reliable operations in the future of warehouse management.

Automated Storage & Retrieval System Market Key Segments:

By Type

- Unit Load Cranes

- Mini Load Cranes

- Robotic Shuttle-based

- Carousel-based

- Vertical Lift Module

- Robotic Cube-Based

- Others

By Function

- Assembly

- Distribution

- Kitting

- Order Picking

- Storage

- Others

By End User

- Automotive

- Metals and heavy machinery

- Food & Beverages

- Chemicals

- Healthcare

- Semiconductors & Electronics

- Retail

- Aviation

- E-Commerce

- Others

Key Global Automated Storage & Retrieval System Industry Players

- Daifuku Co.

- SSI Schäfer AG

- Murata Machinery

- Knapp AG

- TGW Logistics Group

- Kardex Group

- Swisslog Holding AG

- Mecalux S.A.

- Vanderlande Industries B.V.

- System Logistics Corporation

- Green Automated Solutions

- BEUMER Group GmbH & Co. KG

- Dematic GmbH & Co. KG

- Hänel GmbH & Co. KG

- Westfalia Technologies, Inc

- Toyota Industries Corporation

- Opex Corporation

- Exotec

- Hairobotics

- Honeywell International Inc

- Autostore Holdings Ltd.

- Bastian Solutions, LLC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252