Global asthma and COPD drugs market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global asthma and COPD drugs market will continue to be at the forefront as one of the most important areas of respiratory medicine. The history of the market began several decades ago with the introduction of the first corticosteroids and bronchodilators into the market, providing new opportunities for patients with chronic respiratory diseases. In its early stages, the treatment was limited and very experimental in character, and the majority of the patients were compelled to depend on plain inhalation treatment that in effect only pushed away the condition temporarily rather than regulating it in the long run. The 1960s and 1970s were the first benchmarks to the growing use of inhaled corticosteroids, and this set the stage for more ordered management of asthma and COPD.

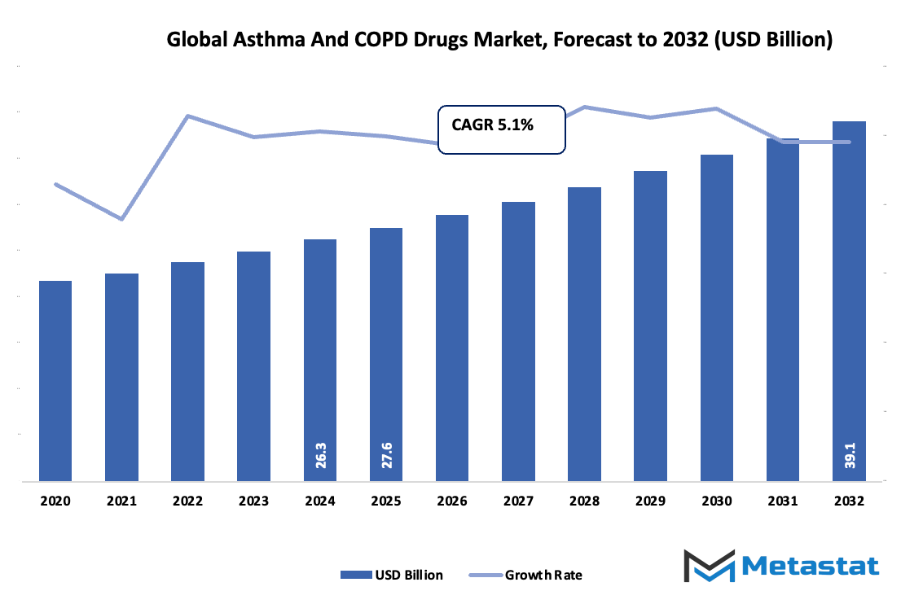

- Global asthma and COPD drugs market valued approximately USD 27.6 Billion in 2025, growing with a CAGR of approximately 5.1% from 2032, with the potential to surpass USD 39.1 Billion.

- Bronchodilators occupy nearly 31.3% of the market share, which creates innovation and rising applications through ruthless research.

- Key trends driving growth: Increasing incidence of respiratory diseases across the globe, Increased awareness for the importance of early diagnosis and treatment of asthma and COPD

- Opportunities are: creation of biologic drugs targeting distinct pathways for personalized therapy

- Key insight: The market will double its value during the next decade, identifying immense opportunities for growth.

As studies increased in the 1980s, the market began to lure pharma interest with drug demands that perhaps have fewer side effects and longer-lasting relief. During this time, it was also found that combination inhalers were developed, which would later be employed as definitive therapy in the treatment of asthma and COPD. Regulatory agencies' standards also evolved during this time and affected drug prescribing, approval, and testing. 1990s also witnessed the release of other innovations like long-acting beta-agonists and newer corticosteroid products, which indicated a growing awareness of individualized care in the market. Recent years have witnessed the global asthma and COPD drugs market undergo transformation with shifting patient expectations and convergence of technology. Patients will demand more from a medicine that not only works but is also convenient, and intelligent inhalers and digital products for adherence will transform patient interaction.

Clinical trials will have more sophisticated biomarkers and precision medicine strategies, with treatments more and more directed at the specific needs of individual patients. Regulatory agencies will continue to create guidance, focusing on safety, effectiveness, and real-world data to support approval and use. Trends in this market will also reflect health care trends as a whole, including green delivery systems and expanded access in emerging markets. Biotech alliances and enhanced formulation technologies will be called upon to broaden the therapeutic horizon, bringing new hope to refractory or severe patients. In its journey to become, the Asthma and COPD Drugs industry globally will continue to blend scientific advancement with patient-focused care to generate an industry that attempts to satisfy medical demand as much as it satisfies social need.

Market Segments

The global asthma and COPD drugs market is mainly classified based on Drug Class, Type of Asthma or COPD, Route of Administration, Distribution Channel.

By Drug Class is further segmented into:

- Bronchodilators: Bronchodilators will continue to be a central component in the treatment of asthma and COPD. Advances in formulation and delivery technology will enhance lung function and provide rapid relief. The market will see advancements in long-acting products and patient-friendly devices with longer therapeutic action and fewer side effects.

- Inhaled Corticosteroids (ICS): Inhaled corticosteroids will remain a central drug for control of airway inflammation in COPD and asthma. Future development will aim at more targeted action on lung tissues to enhance efficacy and minimize systemic exposure. Improved patient compliance and customized dosing for different levels of respiratory disease will be delivered through new drug formulations.

- Combination Therapies (ICS/LABA, LABA/LAMA): Combination therapy will gain importance as they have bronchodilation and anti-inflammatory properties. New combinations will offer targeted treatment with reduction of flare-ups and hospital admissions. Dual-acting inhalers and flexibility in dosing will simplify regimen in complex respiratory patients.

- Leukotriene Receptor Antagonists (LTRAs): LTRAs will remain a first-line treatment in mildly to moderately asthmatic patients. Studies will focus on maximal oral bioavailability and minimizing long-term side effects. New therapy will aim at treating resistant asthma and better management of inflammation and allergic response within the lungs.

- Monoclonal Antibodies: Monoclonal antibodies will drive the market toward precision medicine aimed therapies for individual inflammatory pathways. Therapy will be new in adult severe asthma and difficult-to-treat COPD patients and to provide more personalized treatment regimens. Today, research is being conducted to discover cost-saving manufacturing and delivery techniques to provide these treatments to a wider population.

- Others: New drug classes will include new therapies to complement existing treatment. Future products will be designed to reduce fewer hospitalizations and improve quality of life for patients. New drugs will include newer technology to deliver enhanced symptom control and tailored treatment for varied asthma and COPD conditions.

By Type of Asthma or COPD the market is divided into:

- Allergic Asthma: Treatment for individual underlying allergens of allergic asthma will become the standard. The market will expand with early diagnosis technology and therapies that reduce dependence on general anti-inflammatories. Tailored care programs will gain increasingly dominance, improving patient outcomes and reducing long-term healthcare costs.

- Non-Allergic Asthma: Management in non-allergic asthma is with drugs for the correction of airway dysfunction. Molecular therapy and improved inhalation devices to increase delivery to site of action will take precedence in the future. Prevention of exacerbations and long-term disease control maintenance in heterogeneous patient populations will be the treatment strategy.

- Chronic Bronchitis (COPD): Chronic bronchitis will be treated more with treatments to manage symptoms and enhance lung function. The global asthma and COPD drugs market worldwide will introduce drugs that inhibit mucus secretion and inflammation, and new inhalation devices optimize adherence and long-term respiratory health outcomes.

- Emphysema (COPD): Therapy for emphysema will change with drugs to concentrate on alveolar injury and airway obstruction specifically. New developments will be regenerative therapy and inhalation agents that optimize deposition in the lung. Markets will aim at areas of maximal retardation of disease worsening and enhancement of quality of life in advanced COPD.

- Asthma-COPD Overlap Syndrome (ACOS): ACOS management will be improved through dual therapies that treat the asthma and COPD aspects. Combination treatments and precision dosing regimes will be the focus of the overall global asthma and COPD drugs market Future trends will be in monitoring devices having the ability for dynamic adjustment of the therapy in order to improve patient outcomes.

By Route of Administration the market is further divided into:

- Inhalation (Metered-dose inhalers, Dry powder inhalers, Nebulizers): Inhalation will continue as the preferred route, ensuring direct delivery to the lungs. Advances in device technology will improve ease of use, dosing accuracy, and patient adherence. Future inhalers will include smart sensors and connected features for real-time monitoring and optimized therapy management.

- Oral: Oral medications will remain important for systemic treatment of asthma and COPD. Innovations will focus on improved absorption, reduced side effects, and simplified dosing schedules. The market will explore combination oral therapies and patient-friendly formulations that enhance compliance and overall disease management.

- Injectable: Injectable therapies, particularly monoclonal antibodies, will gain traction for severe or resistant cases. Future developments will emphasize long-acting injections and less frequent dosing schedules. The global asthma and COPD drugs market will prioritize accessibility and ease of administration, making advanced therapies available to a wider patient population.

By Distribution Channel the global asthma and COPD drugs market is divided as:

- Retail Pharmacies: Retail pharmacies will remain a key distribution point, offering convenience and accessibility. Future trends will integrate digital platforms for prescription management and patient education. Expanded product ranges and improved supply chains will support the growing demand for asthma and COPD treatments across diverse regions.

- Hospital Pharmacies: Hospital pharmacies will continue to provide specialized care and advanced therapies. Future strategies will include integration with electronic health records and streamlined drug delivery systems. These channels will play a critical role in managing severe cases and ensuring timely access to the latest treatments in the global asthma and COPD drugs market.

- Online Pharmacies: Online pharmacies will expand rapidly, offering convenience and broader reach. The global asthma and COPD drugs market will benefit from digital prescriptions, home delivery services, and telemedicine integration. Future developments will enhance patient engagement, improve medication adherence, and support continuous monitoring of chronic respiratory conditions.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$27.6 Billion |

|

Market Size by 2032 |

$39.1 Billion |

|

Growth Rate from 2025 to 2032 |

5.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

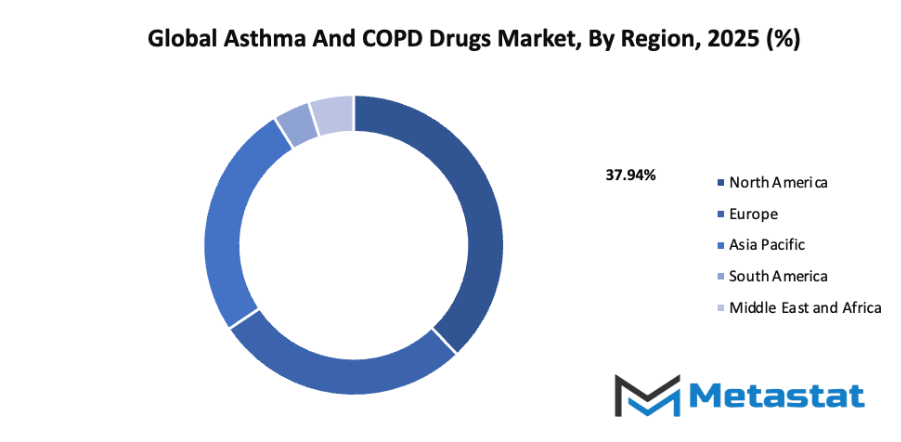

- Based on geography, the global asthma and COPD drugs market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing prevalence of respiratory diseases globally: The number of people affected by asthma and COPD is steadily rising worldwide. Factors such as urbanization, pollution, and lifestyle changes will contribute to higher respiratory disease rates. This trend will increase the need for new drugs and improved treatment options, supporting growth in the global asthma and COPD drugs market.

- Growing awareness about the importance of early diagnosis and treatment of asthma and COPD: Awareness campaigns and improved healthcare access will highlight the benefits of early detection and treatment. Timely diagnosis will help prevent severe complications, encouraging more patients to seek medications. As a result, demand for Asthma and COPD Drugs will continue to grow steadily

Challenges and Opportunities

- Stringent regulatory requirements for drug approval: Approval processes for new drugs are rigorous and require extensive clinical trials. Meeting these regulations ensures safety but can delay market entry. Companies will need to plan development timelines carefully to succeed in the global asthma and COPD drugs market despite these strict standards.

- Availability of generic alternatives impacting brand sales: The presence of affordable generic drugs will create competition for branded products. While generics provide cost-effective options for patients, they may reduce revenue for original manufacturers. Strategic marketing and innovation will help maintain a strong position in the global asthma and COPD drugs market.

Opportunities

Development of biologic therapies targeting specific pathways for personalized treatment:- There is growing potential for developing biologic therapies that target specific pathways for personalized treatment. These therapies will provide more effective management for patients with severe or treatment-resistant asthma and COPD. By focusing on precision medicine, companies can drive growth and meet future demand in the global asthma and COPD drugs market.

Competitive Landscape & Strategic Insights

The global asthma and COPD drugs market will continue to be shaped by a combination of established international leaders and emerging regional players. Companies such as GlaxoSmithKline plc, AstraZeneca plc, Novartis AG, Boehringer Ingelheim International GmbH, Teva Pharmaceutical Industries Ltd., Merck & Co., Inc., Sanofi S.A., Theravance Biopharma, Inc., Pfizer Inc., Mylan N.V., Abbott Laboratories, Sunovion Pharmaceuticals Inc., Cipla Limited, Circassia Pharmaceuticals plc, and Glenmark Pharmaceuticals Ltd. will maintain significant influence on the market. These companies will compete by introducing innovative therapies, expanding their product pipelines, and exploring untapped regional markets. The competitive landscape will drive investment in research and development, focusing on more effective treatment options with fewer side effects and better patient compliance.

Strategic insights indicate that companies will increasingly adopt precision medicine approaches, targeting therapies to specific patient populations to enhance treatment outcomes. Collaboration between multinational corporations and local manufacturers will become a common strategy to improve market access and production efficiency. Technological advancements in drug delivery systems and digital health tools will also shape market dynamics, allowing better monitoring of patient responses and adherence. The growth of the market will encourage both large and small companies to explore partnerships, licensing agreements, and acquisitions to strengthen their position and broaden their product offerings. In the near future, the competitive environment will be influenced not only by new drug approvals but also by the ability to integrate advanced technologies and patient-centered strategies into core business operations.

Market size is forecast to rise from USD 27.6 Billion in 2025 to over USD 39.1 Billion by 2032. Asthma and COPD Drugs will maintain dominance but face growing competition from emerging formats.

The market will experience continuous shifts as emerging players introduce cost-effective alternatives and innovative solutions that challenge the dominance of long-standing industry leaders. Companies will need to anticipate changes in regulatory policies, patient needs, and technological trends to remain competitive. Strategic planning, efficient resource allocation, and a focus on sustainable growth will guide the success of key market participants. Overall, the Asthma and COPD Drugs sector will continue to evolve, shaped by competition, innovation, and forward-looking strategies that respond to both global and regional demands.

Report Coverage

This research report categorizes the global asthma and COPD drugs market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global asthma and COPD drugs market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global asthma and COPD drugs market.

Asthma and COPD Drugs Market Key Segments:

By Drug Class

- Bronchodilators

- Inhaled Corticosteroids (ICS)

- Combination Therapies (ICS/LABA, LABA/LAMA)

- Leukotriene Receptor Antagonists (LTRAs)

- Monoclonal Antibodies

- Others

By Type of Asthma or COPD

- Allergic Asthma

- Non-Allergic Asthma

- Chronic Bronchitis (COPD)

- Emphysema (COPD)

- Asthma-COPD Overlap Syndrome (ACOS)

By Route of Administration

- Inhalation (Metered-dose inhalers, Dry powder inhalers, Nebulizers)

- Oral

- Injectable

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

Key Global Asthma and COPD Drugs Industry Players

- GlaxoSmithKline plc

- AstraZeneca plc

- Novartis AG

- Boehringer Ingelheim International GmbH

- Teva Pharmaceutical Industries Ltd.

- Merck & Co., Inc.

- Sanofi S.A.

- Theravance Biopharma, Inc.

- Pfizer Inc.

- Mylan N.V.

- Abbott Laboratories

- Sunovion Pharmaceuticals Inc.

- Cipla Limited

- Circassia Pharmaceuticals plc

- Glenmark Pharmaceuticals Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383