MARKET OVERVIEW

The Asia Pacific Dried Distillers Grain Solids (DDGS) Feed market is a vast niche in the animal feed industry, accounting for the rising demand for high-nutrition feed products across the region. Essentially, Dried Distillers Grain Solids (DDGS) is a by-product resulting from the production of ethanol, mainly being sourced from grains, including corn. Being made up of high protein and energy content, it is mainly used as a major feed for livestock. This makes it a source of more sustainable and less costly feed for farmers. Agriculture practice in the Asia Pacific region is changing; hence the demand of the feed options like DDGS is expected to improve in this market. It would be one of the high facilitators in fulfilling the nutritional requirement of the livestock population of the region.

Asia Pacific Dried Distillers Grain Solids (DDGS) Feed market is dominated by practice diversity in the forms of livestock in countries such as China, India, Japan, and Australia, which are among the strongest consumers of animal feed. The use of DDGS in improving animal health and productivity plays a crucial role in its meaning to most Asian Pacific regions where livestock farming contributes a large part of the country's economics. In particular, it provides a high concentration of digestible fiber and protein that enhances weight gain as well as milk production in cattle and general livestock performance. As the farmer continues with his quest of cutting down feed costs but at the same time maintaining nutrient balance in his animals, DDGS is going to be in increasing demand in the formulation of feeding practices.

The Asia Pacific Dried Distillers Grain Solids (DDGS) Feed supply chain involved an active network of ethanol producers, feed manufacturers, and distributors. Ethanol plants produced DDGS as a co-product, which was then processed and distributed to feed manufacturers who then blended it into various feed formulations. It would strengthen DDGS by its ability to be used in a wide range of feed formulations because it serves as an additive or replacement for feed ingredients. Its wide adoption within many sectors of livestock, such as poultry, swine, and aquaculture, may be inspired by the intrinsic need to ascertain a high nutritional value while achieving cost efficiency.

Also, in the Asia Pacific region, the regions are interested in sustainability and a decrease in reliance on sources of feed, such as soybeans and corn. It is true that most producers in this region will increasingly rely on DDGS as this presents a method of recycling precious nutrients away from waste. This has resulted in greater DDGS production as part of waste reduction in ethanol production. This sustainable approach will be particularly well aligned with the rising interest in eco-friendly farming practices, which is a theme that has garnered significant attention in the future of animal feed in the Asia Pacific region.

Advances in technology about feed formulation and processing also can affect the Asia Pacific Dried Distillers Grain Solids (DDGS) Feed market. Improved production and better distribution networks are expected to increase the availability of DDGS to farmers, reaching into even more distant areas. Moreover, research to optimize DDGS for various livestock species will further expand its use in the next years. As the agricultural sector in the region continues to modernize and demand for meats and dairy products increases, DDGS shall remain a key player in the Asia Pacific animal feed landscape. This will evolve as the preference of consumers changes, environmental considerations develop, and the livestock industry in that region continues to evolve.

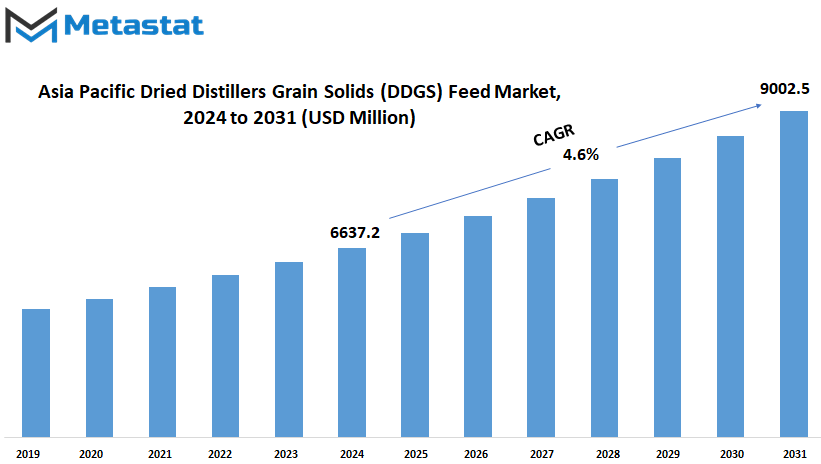

Asia Pacific Dried Distillers Grain Solids (DDGS) Feed Market is estimated to reach $9002.5 Million by 2031; growing at a CAGR of 4.6% from 2024 to 2031.

GROWTH FACTORS

The Asia Pacific dried distillers grain solids (DDGS) feed market is expected to grow impressively in the coming years. Several growth factors contribute to the growth in this market. One of those factors is rising demand for affordable animal feed. More livestock farming is practiced in this region, and the input demand for efficient and affordable feed sources will increase. DDGS is gaining acceptance due to the presence of high proteins and cost-effective advantages. Awareness regarding the nutrient value of DDGS among the farmers is also rising and, therefore, can boost the market.

Ethanol Production in Asia Pacific Region: This is another growth factor for this market as the demand for ethanol productions is increasing in this region. Other countries are also raising their production of ethanol to meet the minimum renewable energy targets, such as China and India. With an increase in the rate of ethanol production, more DDGS are produced, which would further increase the market share since greater quantities would be used in animal feed. Furthermore, sustainability-issues in the use of by-products such as DDGS have become a trend that many industries have considered working on; the positive influence this might have on the market is considerable.

However, the Asia Pacific Dried Distillers Grain Solids (DDGS) Feed market growth may be hindered by a few factors. One of these is how raw materials prices vary in the production of ethanol, which may affect cost and availability of DDGS. Thus, a cost of significantly high production may impact, through affecting the price, the desirability of DDGS compared to the other available feed options. However, the lack of awareness or proper understanding of the benefits associated with DDGS in some regions may discourage or reduce the growth of this market.

This area still poses various challenges. Despite these, the Asia Pacific region offers a growing market for the DDGS feed. This is because research in animal nutrition and feed development would keep changing; with such enhancements, there will be a greater demand for more protein in feeds, which in this case includes DDGS. With population growth in the region, consumption of meat and dairy products is bound to increase as well, which means demand for quality livestock feed.

In the future, new production technologies could open the Asia Pacific DDGS feed market to being even more accessible and affordable. Since the consumption of livestock and ethanol is sure to increase, then the market will go progressively and blend into the region's agricultural economy. Rising demand for sustainable feed options and growth of ethanol production would fuel the development of the Asia Pacific DDGS feed market.

MARKET SEGMENTATION

By Source

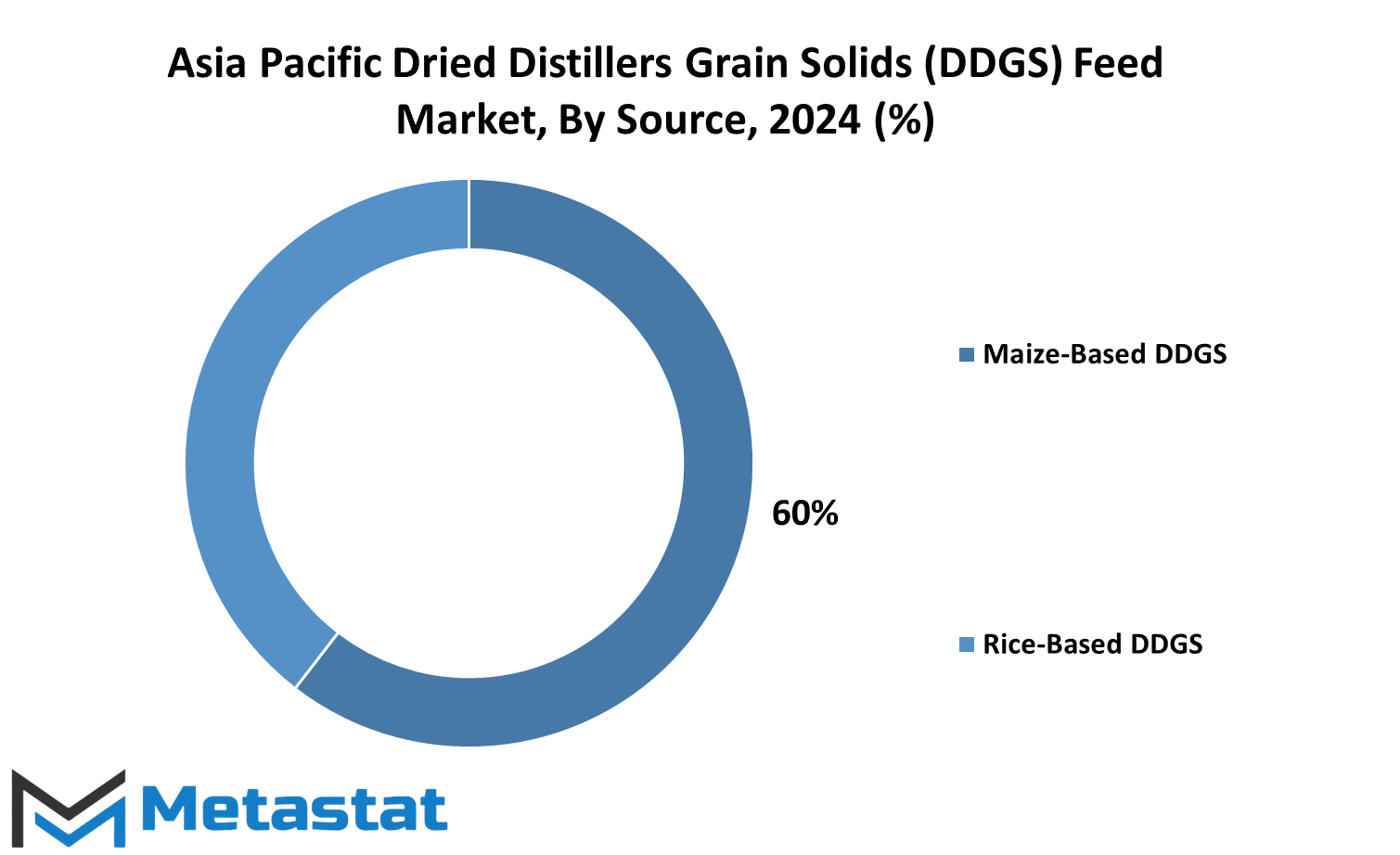

The Asia Pacific dried distillers’ grains solubles (DDGS) feed market is expected to grow steadily in the next few years, as demand for livestock feed will increase with meat consumption levels in the region. This feed material is a by-product from ethanol production that remains rich in protein, fiber, and fat. Since the demand for cheap and high-protein feed continues to be pursued among farmers and livestock producers, DDGS has emerged as a likely candidate. Furthermore, the market is divided into two chief sub-categories: Maize-Based DDGS and Rice-Based DDGS.

As it is closely connected with a higher share of protein, the former is still more in use and is mainly used in big maize-producing countries, including China and India. On the other hand, rice-based DDGS, despite its minimal production, is also on the rise in regions with heavier rice production, like Southeast Asia. The two sources have advantages; however, its use mainly depends on the agricultural practices in a certain region and on what raw materials are available.

By Application

The Asia Pacific Dried Distillers Grain Solids (DDGS) Feed market will grow more in the coming years, owing to the increasing demand across various sectors, of which DDGS is a by-product of ethanol production, which has gained much attention from people as an affordable and nutritious feed option for animals and pets. Given the agricultural and livestock sectors that are constantly in an expansion stage, the demand for alternative, cost-efficient feed systems that dissipate little cost can increasingly involve DDGS. The fertile land for this market growth is likely to be Asia Pacific with a growing population increasing the consumption of animal products.

The Asia Pacific DDGS Feed market finds classification based on the application into animal feed, pet food, and other livestock feeds. Animal feed is the largest category owing to the growing demand for sources of proteins such as poultry, beef, and pork. With farmers looking for solutions which are both viable and sustainable in increasing production with low costs, DDGS offers a practical and workable solution. Its high protein content and digestibility ensure the availability of all the nutrients necessary for animal growth, thus making it a must-feed ingredient in livestock feed. It reduces feeding costs with no compromise in the quality, thereby ensuring the trend of adopting it.

With pet food, DDGS is also gaining popularity. The pet care industry in that region has grown significantly, especially in countries like China and India, and owners seek more nutrition for pets without excess cost. DDGS satisfies the protein and fiber content required by pets and is thus viable for pet food manufacturers.

Other livestock feed includes aquaculture, poultry, and swine feed, among others. As consumption of seafood and other animal-based products picks up across the region, more farmers are searching for a high-performance feed solution that maximizes productivity. High-energy DDGS stands out as a natural alternative feed ingredient because of its ability to foster health and growth in livestock while staying cost-effective.

Looking ahead, the Asia Pacific Dried Distillers Grain Solids (DDGS) Feed market will only continue on a ride of technological advancements that would further enhance the quality of production and nutritional value of DDGS. This will also augur well for increasing the focus on sustainable and efficient feed solutions, thereby suggesting that this demand for DDGS will grow in the coming years and offer benefits for the sake of the producers as well as consumers in this region.

By Protein Content

In the coming years, the Asia Pacific Dried Distillers Grain Solids feed market is expected to rise enormously. Since the requirement for livestock feed is on the rise, DDGS has established itself as one of the top options since it is highly rich in nutrient values and at the same time cost-effective. DDGS is a byproduct of the ethanol manufacturing process; it mainly comes from corn, which is rich in protein and, hence, is the ideal supplement to feed animals. This is particularly relevant to Asia Pacific, wherein is prompted by rapid urbanization and the increase in per capita disposable incomes to higher demand for meat and dairy products as well as, therefore, animal feed.

The DDGS feed market is divided, depending upon the protein content present in it into low and high protein content types. Low-protein DDGS is usually intended for feeding livestock species with lower protein requirements, like poultry or swine of specific species. High-protein DDGS is much better suited to cattle, which have higher demands in growth and milk production. With the presence of these categories, feed manufacturers can provide nutrients that are much more in line with specific needs, therefore enhancing animal farming efficiency.

Toward the future, the Asia Pacific DDGS feed market will encounter greater efficiency in the evolution of a better production technique. It may lead to feed of even higher quality, with protein content being closer to the target due to the realisation that livestock requirements are being met better than before. Increased environmental awareness would also bring in sustainability concerns with the use of DDGS in feed. A byproduct from the ethanol production process is already applied in DDGS production. Therefore, further gains in this process can make it more environmentally friendly.

The increased demand for DDGS feed is also expected to be influenced by alterations in global policies on trade and domestic agricultural practices in the Asia Pacific region. Countries here are to increase their consumption and production of different DDGS-associated trading activities due to the growing need for higher quality feed for livestock. Continued technological advancements with an increased focus on this region’s ecological use in agriculture will have a positive impact on the Asia Pacific Dried Distillers Grain Solids (DDGS) feed market, which will lead to a hike in more variety-based feed solutions that can be applied to this very diversified agricultural climate.

The Asia Pacific DDGS feed market-by protein content is promising and has tremendous growth potential. Being of the very nature, it can respond to the diverse needs of livestock and also possible future technological advancements regarding the feed.

By Region

The Asia Pacific Dried Distillers Grain Solids (DDGS) feed market will grow appreciably in the near future. As economies in that region continue to evolve, the demand for efficient and sustainable animal feed continues to rise. DDGS, being one of the byproducts of ethanol, contains high protein and fiber intake, thus more economical and nutritional for livestock feed. There is a great necessity for optimizing agricultural outputs, and in recent times, most countries in the Asia Pacific have looked towards DDGS as a proven feed source. This is based on the expansion required for their livestock industries.

From a geographical standpoint, the Asia Pacific DDGS feed market can be segmented as follows: China, Japan, India, South Korea, Australia, Indonesia, Malaysia, Thailand, Vietnam, and the Rest of Asia Pacific. Every country has a unique market dynamic influenced by the rates of population growth and economic development as well as agricultural practices. For example, China and India both are very large in populations with rapidly growing middle classes. They increasingly demand meat and dairy products, thus increasing demand for quality animal feed such as DDGS. Advanced technology and efficient techniques for farming make Japan and South Korea probable leaders in the development of the DDGS feed market in the future. These countries emphasize improved productivity in their livestock, and the addition of DDGS to feed is likely to help achieve this by providing well-balanced and nutrient-rich feed alternatives for farmers.

Southeast Asia has countries like Indonesia, Malaysia, Thailand, and Vietnam, which are also witnessing the upsurge in demand for products from livestock. Since most of these countries’ economies are still at the developing stage and the process of urbanization is widespread, productive and sustainable feeding needs have to be satisfied immediately. That’s where DDGS comes in as a viable option for grabbing this emerging demand while managing cost.

Another important market player has been Australia, with its large agricultural sector. Interest in alternative feed options such as DDGS has arisen largely because of emphasis on sustainability in farming, reducing impact from the environmental end.

Advances in technology combined with improvements in supply chain and increasing awareness of the benefits from DDGS for animal feed will significantly help the Asia Pacific DDGS feed market going forward. The rapid growth of the livestock industries in the region as a response to rising demand is, however likely to raise further the usage of DDGS as a major feed component, making agriculture more efficient and sustainable.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$6637.2 million |

|

Market Size by 2031 |

$9002.5 Million |

|

Growth Rate from 2024 to 2031 |

4.6% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The Asia Pacific Dried Distillers Grain Solids (DDGS) Feed market would be highly growth-focused over the next few years. This market was mainly supported by cost-effective and nutrient-rich feed demand. As other countries in the Asia Pacific region gain and continue to grow, it is expected that modernization within agriculture will remain a fact. This might also increase feed demand for it is also quality-related. DDGS feed is a byproduct of ethanol production. It provides an affordable nutrimental feed source different from the traditional ones, hence, an attractive source for livestock producers when the latter tries to optimize cost as well as production efficiency.

Factors such as rapid population growth, rising income, and an increased need for sustainable agricultural practices will shape the Asia Pacific DDGS feed market in the future. The present population of this region, mainly emerging economies such as India, China, and Southeast Asia, would ensure significant demand for meat and other animal products. This will call for higher demand for livestock feeds. However, it is the very high levels of protein and energy in the DDGS feed that has positioned the product well to confront the constantly growing needs in the face of balancing its productivity and health-giving solutions for the livestock.

Besides greater demand, sustainability has turned out to be an important concern in agriculture. DDGS feed is a more sustainable feed as ethanol production provides co-product, utilizing materials that otherwise would become waste. Increasing adoption of DDGS feed is anticipated as governments in the Asia Pacific region start enforcing policies that are stimulating more environmentally friendly agricultural practices. In addition, this trend towards sustainability will also serve as a further catalyst for market expansion, because producers need to find means of reducing their negative impacts and have to address this increasing demand for livestock products.

Technological development along with enhancement in the production processes of ethanol would also influence the growth in the Asia Pacific region DDGS feed market. In the long run, when the production process becomes more efficient, quality as well as availability of the DDGS feed improve and thus enhance its appeal as an alternate feed for livestock producers.

The Asia Pacific DDGS feed market would gain a significant growth trend as demand for animal products increases, rises in the sense of sustainability, and production shows technological advancements. Thus, this would determine the future of the market as it forms an integral part of the region’s agriculture.

COMPETITIVE PLAYERS

The Asia Pacific Dried Distillers Grain Solids (DDGS) Feed market is seen to be one of the rapidly growing sectors. In this regard, increased demand for feed across many countries in the region is the basis of the development of this sector. Indeed, DDGS has become one of the essential feed ingredients because of their high nutritional value that complements the diet of livestock such as cattle, poultry, and swine. Additionally, increasing growth in livestock farming has provided an added demand, due to growing meat and dairy consumption in the Asia Pacific, especially in countries such as China, India, and Japan.

More and more Asia Pacific-based industries continue to embrace the use of DDGS as an animal feed component. Leaders in this market have therefore been emphasizing strategies to strengthen their position. Currently, the companies such as Archer Daniels Midland Company, Green Plains Inc., and POET LLC are focused on increasing their output and also enhancing their channels of distribution. With feed production innovations and better ways of storing, these companies will conveniently make DDGS affordable to the farmers in the area.

Technological advancement and the increasing emphasis of sustainable farming practices are going to drive Asia Pacific DDGS Feed market growth in the years ahead. The pressure for sustainability is also promoting feed manufacturers such as CHS Inc., GrainCorp Limited, and Cargill Incorporated to invest in cleaner production processes and more efficient supply chains. Due to this and other factors, the DDGS feed market may be seen as a key enabler for future advancements toward more sustainable forms of animal farming.

More and more local feed manufacturers will partner with international companies to furnish feed solutions that would be more developed for their markets. This will ensure a quality supply chain-not only in terms of livestock feed but also in terms of having a steady supply chain that can potentially meet the growing region's demand for livestock. For this purpose, Globus Spirits Limited and Nutrigo Feeds Pvt Ltd are going to partner with international corporations to be able to give the market better feed solutions.

The Asia Pacific DDGS Feed market would most likely witness a surge in competition because the established companies as well as the emerging players would be more aggressive. Through continued research and innovation, the present major players of this market such as Manildra Group and Husky Energy would continue to push the market forward with a better product to keep livestock at the nutritional optimum while still aligning to sustainability goals by most of the global fraternity. This will ensure the Asia Pacific becomes a vital player in the global animal feed industry catering towards the ever-increasing demand for high-quality and sustainable solutions in livestock feed.

Asia Pacific Dried Distillers Grain Solids (DDGS) Feed Market Key Segments:

By Source

- Maize-Based DDGS

- Rice-Based DDGS

By Application

- Animal Feed

- Pet Food

- Other Livestock Feed

By Protein Content

- Low Protein Content

- High Protein Content

By Region

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Rest of Asia Pacific

Key Asia Pacific Dried Distillers Grain Solids (DDGS) Feed Industry Players

- Archer Daniels Midland Company

- Green Plains Inc.

- POET LLC

- CHS Inc.

- Grain Processing Corporation

- Globus Spirits Limited

- MGP Ingredients Inc.

- Husky Energy (Cenovus Energy)

- Manildra Group

- Envien Group

- GrainCorp Limited

- Nutrigo Feeds Pvt Ltd.

- Flint Hills Resources

- Cargill Incorporated

- Gulshan Polyols Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252