MARKET OVERVIEW

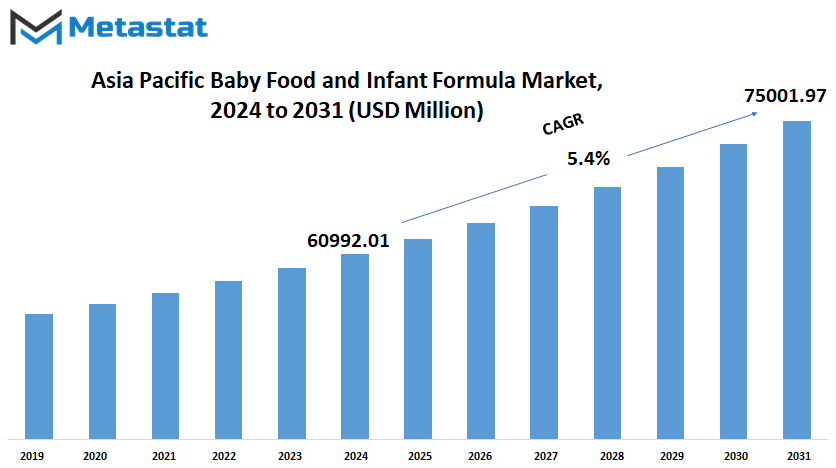

Asia Pacific Baby Food and Infant Formula market is estimated to reach $75001.97 Million by 2031; growing at a CAGR of 5.4% from 2024 to 2031.

The Asia Pacific Baby Food and Infant Formula market stands as a testament to the profound evolution and significance of the infant nutrition industry within the region. Spanning diverse nations with varying socio-economic landscapes, cultural nuances, and regulatory frameworks, this market epitomizes the complexities inherent in catering to the nutritional needs of the youngest members of society.

The Asia Pacific Baby Food and Infant Formula industry revolves around the provision of essential nourishment to infants and young children, aiming to support their healthy growth and development during the crucial early stages of life. However, beneath this overarching objective lies a multifaceted landscape characterized by dynamic market forces, consumer preferences, and regulatory dynamics.

One of the defining features of the Asia Pacific market is its sheer diversity, both in terms of geography and consumer demographics. From densely populated urban centers to remote rural communities, the demand for baby food and infant formula varies significantly across different regions. Factors such as income levels, cultural practices, and awareness of nutritional requirements shape consumer preferences and purchasing patterns, presenting a unique set of challenges and opportunities for industry stakeholders.

Moreover, the Asia Pacific region is witnessing a gradual shift in dietary habits and lifestyle choices, influenced by factors such as urbanization, changing family structures, and increased health consciousness. As a result, there is a growing demand for convenient, nutritious, and safe infant food products that cater to modern lifestyles while meeting traditional nutritional expectations.

Navigating the regulatory landscape poses another layer of complexity for market players operating in the Asia Pacific region. With each country having its own set of regulations governing the production, labeling, and marketing of baby food and infant formula, ensuring compliance becomes paramount. Moreover, regulatory frameworks are subject to constant review and updates, adding an element of uncertainty to the operating environment.

In recent years, the Asia Pacific Baby Food and Infant Formula market has also witnessed the emergence of new trends and product innovations driven by evolving consumer preferences and advancements in nutritional science. From organic and natural ingredients to hypoallergenic formulations, manufacturers are continuously exploring novel approaches to meet the diverse needs of consumers while maintaining product safety and quality standards.

Furthermore, the competitive landscape of the industry is characterized by the presence of both multinational corporations and local players vying for market share. While established brands leverage their global presence and extensive distribution networks, local manufacturers often possess a deeper understanding of regional preferences and market dynamics, giving them a competitive edge in certain segments.

The Asia Pacific Baby Food and Infant Formula market encapsulates a dynamic and diverse industry landscape shaped by evolving consumer trends, regulatory dynamics, and technological advancements. Despite the inherent challenges, the region offers immense growth potential for companies that can navigate the complexities and tailor their offerings to meet the unique needs of consumers across different markets.

GROWTH FACTORS

The Asia Pacific Baby Food and Infant Formula market is witnessing significant growth driven by increasing urbanization and evolving lifestyles. People today are seeking more convenient and ready-to-eat options for baby food due to their busy schedules. This shift in consumer preferences towards hassle-free solutions is propelling the demand for such products.

Moreover, there is a growing awareness about the significance of nutrition during early childhood. Parents are becoming increasingly conscious about providing high-quality infant formulas to ensure proper growth and development of their children. This heightened awareness about nutrition is further fueling the demand for infant formulas in the market.

However, the market growth is not without its challenges. Regulatory constraints and stringent standards for the production and labeling of infant food products pose obstacles for market players. Compliance with these regulations requires investment in research and development, as well as adherence to strict manufacturing processes.

Additionally, cultural preferences and societal norms in certain regions favor breastfeeding over formula feeding. Despite the availability of infant formulas, many parents still opt for breastfeeding due to cultural beliefs and societal pressure. This preference for breastfeeding presents a challenge for the market, as it limits the potential consumer base for infant formula products.

Despite these challenges, the market holds promising opportunities for growth. Expansion into emerging markets with rising middle-class populations and increasing disposable incomes presents lucrative opportunities for market players. These emerging markets offer untapped potential for the baby food and infant formula sectors, providing avenues for expansion and increased market penetration.

The Asia Pacific Baby Food and Infant Formula market is witnessing steady growth driven by factors such as increasing urbanization, changing lifestyles, and rising awareness about nutrition. While regulatory constraints and cultural preferences pose challenges, the market is poised for expansion in emerging markets, offering opportunities for growth in the coming years.

MARKET SEGMENTATION

By Type

In the vast expanse of the Asia Pacific region, the market for baby food and infant formula is witnessing notable segmentation. This segmentation, which delineates various types of products, serves to cater to the diverse needs of infants and young children.

The segmentation of the Asia Pacific Baby Food and Infant Formula market by type encompasses a range of products, each designed to meet specific nutritional requirements and developmental stages. Firstly, there is Infant Milk, formulated to provide essential nutrients to newborns who are not breastfed or require supplementary feeding. Following this, Follow-on Milk is tailored for infants transitioning from breastfeeding or Infant Milk to a more varied diet.

Specialty Baby Milk constitutes another category, addressing the nutritional needs of infants with specific dietary requirements or health conditions. This specialized formula ensures that infants receive adequate nourishment while accommodating any dietary restrictions or sensitivities.

Growing-up Milk is positioned for toddlers and young children, providing them with the necessary nutrients to support healthy growth and development during their formative years. Milk Formula, on the other hand, offers a convenient alternative to fresh milk, particularly in regions where access to quality dairy products may be limited.

In addition to liquid formulas, the market also encompasses Dried Baby Food, which includes powdered mixes that can be reconstituted with water to create nutritious meals for infants and toddlers. Prepared Baby Food, comprising ready-to-eat or ready-to-heat meals, offers convenience to busy parents while ensuring their children receive balanced nutrition.

The category of Other Types encompasses a variety of products that may include organic or natural baby food options, fortified snacks, or nutritional supplements designed specifically for infants and young children.

The segmentation of the Asia Pacific Baby Food and Infant Formula market by type reflects a nuanced understanding of the nutritional needs and developmental stages of infants and young children. Through a diverse array of products, this market strives to provide parents with choices that align with their preferences, values, and the well-being of their children.

By Age

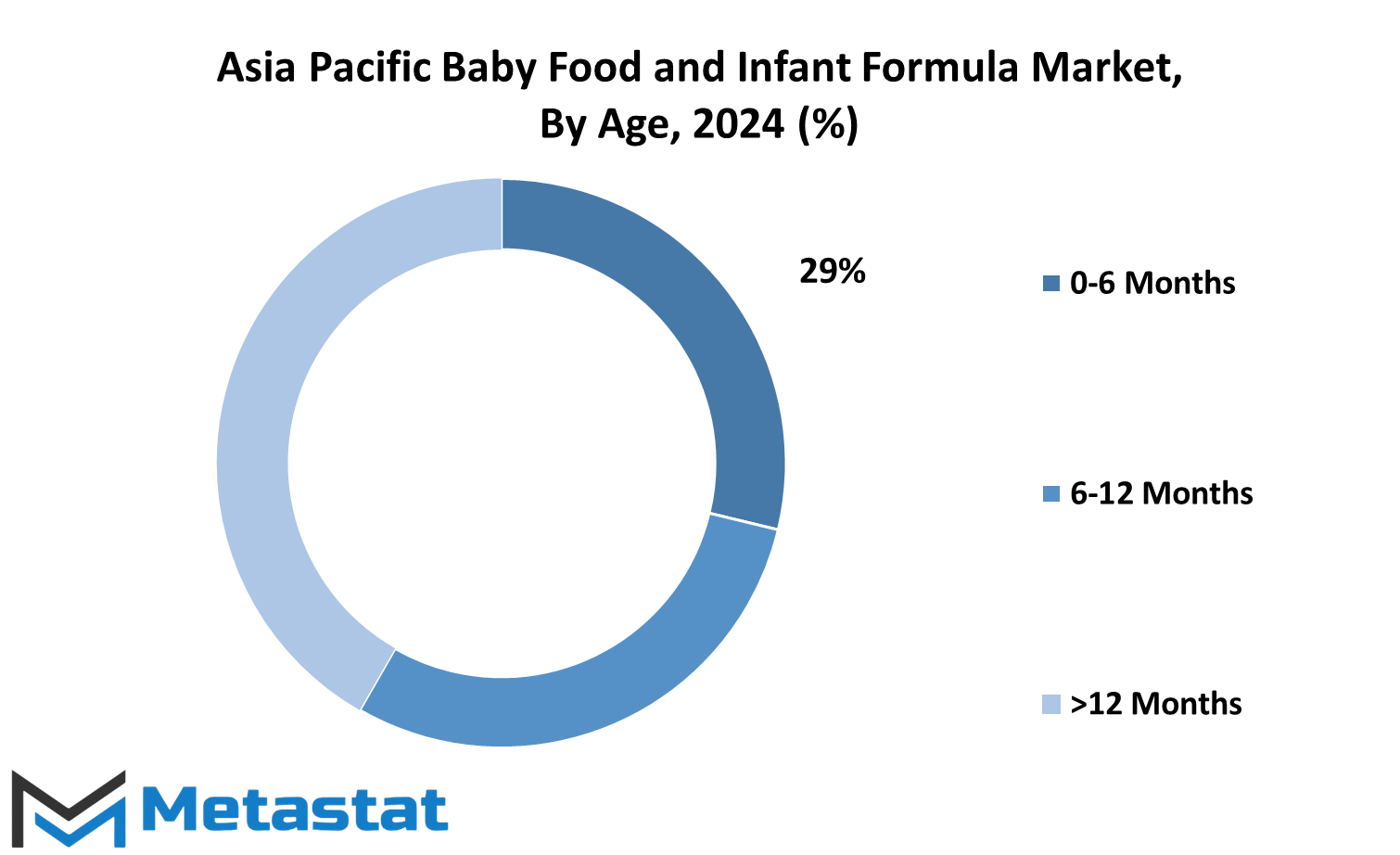

The Asia Pacific Baby Food and Infant Formula market can be divided by age into three segments: 0-6 months, 6-12 months, and over 12 months. This categorization allows for a more focused analysis of the market dynamics and consumer preferences within each age group.

In the 0-6 months category, baby food and infant formula products cater to the nutritional needs of newborns and infants. These products are specially formulated to provide essential nutrients such as proteins, carbohydrates, fats, vitamins, and minerals required for healthy growth and development during the early stages of life. Manufacturers often emphasize the inclusion of ingredients that mimic the composition of breast milk, ensuring optimal nourishment for infants who may not be exclusively breastfed.

As infants transition into the 6-12 months age range, their nutritional requirements evolve to support their growing bodies and expanding diets. Baby food products in this segment typically introduce a variety of flavors and textures to encourage the development of taste preferences and chewing skills. Additionally, infant formula options may include specialized formulations to address specific dietary needs or concerns, such as lactose intolerance or allergies to certain ingredients.

The market for baby food and infant formula for children over 12 months encompasses a diverse range of products tailored to the needs of toddlers and young children. At this stage, children may begin to consume a wider array of solid foods while still relying on formula or supplementary nutrition for certain nutrients. Manufacturers may offer products that emphasize convenience, portability, and suitability for on-the-go consumption to accommodate the busy lifestyles of parents and caregivers.

In each age category, factors such as nutritional content, ingredient sourcing, packaging design, and brand reputation can influence consumer purchasing decisions. Additionally, cultural preferences, economic factors, and regulatory considerations may shape market trends and product offerings across different countries and regions within the Asia Pacific region.

By Ingredient

The Asia Pacific Baby Food and Infant Formula market is a dynamic arena with various key players vying for attention. One crucial aspect of this market is its segmentation by ingredients, which includes carbohydrates, fats, proteins, minerals, vitamins, and other essential components. This segmentation provides insights into the nutritional content and preferences of consumers in the region.

Carbohydrates are a vital source of energy for infants, providing the fuel needed for their growth and development. These include sugars, starches, and fibers, which are essential for maintaining proper bodily functions.

Fats play a crucial role in brain development and are necessary for the absorption of fat-soluble vitamins. They also provide a concentrated source of energy, helping infants meet their high energy requirements for growth and development.

Proteins are the building blocks of the body, essential for the growth and repair of tissues. They also play a significant role in the development of muscles, organs, and the immune system.

Minerals are essential for various physiological functions, including bone development, nerve function, and fluid balance. Key minerals such as calcium, iron, and zinc are crucial for supporting overall health and development in infants.

Vitamins are essential micronutrients that play diverse roles in the body, including immune function, vision, and metabolism. They are crucial for maintaining overall health and supporting various physiological processes.

Other ingredients encompass a wide range of essential nutrients and bioactive compounds necessary for infant health and development. These may include prebiotics, probiotics, nucleotides, and antioxidants, which play various roles in supporting digestive health, immune function, and overall well-being.

By Distribution Channel

The Asia Pacific Baby Food and Infant Formula market is segmented based on Distribution Channels, which are avenues through which these products reach consumers. These channels play a crucial role in determining accessibility and availability to customers across the region.

Hypermarkets are large retail stores that offer a wide range of products under one roof, including baby food and infant formula. Their extensive selection and competitive pricing make them popular choices for many shoppers.

Supermarkets, on the other hand, are smaller than hypermarkets but still offer a diverse array of goods. They are conveniently located in various neighborhoods, providing easy access to baby products for local residents.

Pharmacy/Medical Stores are establishments where consumers can purchase not only medicines but also baby essentials like formula and food. These stores are trusted sources of healthcare products, making them a reliable option for parents seeking quality items for their infants.

Specialty Stores cater specifically to baby products, offering a curated selection of items tailored to the needs of infants and toddlers. These stores often provide personalized service and expert advice to parents, enhancing the shopping experience.

Hard Discounter Stores are known for their low prices and no-frills approach to retailing. While they may not offer the same level of variety as larger stores, they are favored by budget-conscious consumers looking for affordable baby products.

E-commerce platforms have gained significant traction in recent years, offering the convenience of shopping from home or on the go. With just a few clicks, parents can browse a wide range of baby food and formula options and have them delivered straight to their doorstep.

The category labeled as Others encompasses various distribution channels not explicitly mentioned above. These may include convenience stores, wholesale outlets, or direct-to-consumer sales channels.

In the future, these distribution channels are likely to continue evolving to meet the changing needs and preferences of consumers. Technological advancements will further streamline the shopping process, with innovations such as drone delivery and virtual reality shopping experiences reshaping the retail landscape.

The Asia Pacific Baby Food and Infant Formula market is served by a diverse range of distribution channels, each offering unique advantages to consumers. From traditional brick-and-mortar stores to cutting-edge e-commerce platforms, these channels play a vital role in ensuring that parents have access to the products they need to nourish and care for their infants..

REGIONAL ANALYSIS

The Asia Pacific Baby Food and Infant Formula market analysis focuses on the region's various submarkets. Geographically, it encompasses North America, Europe, Asia-Pacific, South America, and Middle East & Africa. Each of these regions further delineates into specific countries or areas.

In North America, the market comprises the United States, Canada, and Mexico. Meanwhile, Europe's market spans the United Kingdom, Germany, France, Italy, and the Rest of Europe. Turning to Asia-Pacific, it encompasses major players such as India, China, Japan, South Korea, and the Rest of Asia-Pacific. South America's market includes Brazil, Argentina, and the Rest of South America. Finally, the Middle East & Africa region covers GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa.

The segmentation enables a more nuanced understanding of market dynamics and consumer behavior across different regions. By analyzing each area separately, companies and stakeholders can tailor their strategies to local preferences, regulations, and economic conditions. For instance, what works in the United States may not necessarily be successful in India due to cultural differences, dietary habits, and purchasing power.

In the future, this regional analysis will continue to play a crucial role as markets evolve and new trends emerge. With advancements in technology and globalization, businesses will need to adapt their approaches to remain competitive in each geographic area. Moreover, as consumer preferences shift and regulations evolve, staying informed about regional nuances will be essential for market success.

Furthermore, the Asia Pacific region is poised for significant growth in the baby food and infant formula market due to several factors. Rapid urbanization, rising disposable incomes, and changing lifestyles are driving demand for convenient and nutritious baby food products. Additionally, increasing awareness about the importance of early childhood nutrition is fueling market expansion.

Overall, a detailed understanding of the Asia Pacific Baby Food and Infant Formula market's regional dynamics is essential for businesses to formulate effective strategies and capitalize on emerging opportunities. By analyzing each submarket's unique characteristics and challenges, companies can position themselves for long-term growth and success in this dynamic and competitive landscape.

COMPETITIVE PLAYERS

The Asia Pacific Baby Food and Infant Formula market is a dynamic landscape with several key players driving its growth. These players, including Abbott Laboratories, Arla Foods Amba, Bellamy's Organic, and others, play a crucial role in shaping the market's trajectory.

In the coming years, these companies will continue to innovate and introduce new products to meet the evolving needs of consumers. With a growing emphasis on health and nutrition, there will be a heightened focus on developing products that are not only convenient but also nutritious.

One of the trends that will likely shape the future of the market is the increasing demand for organic and natural baby food products. Consumers are becoming more conscious about the ingredients used in baby food, and as a result, companies will need to adapt by offering products that are free from artificial additives and preservatives.

Additionally, with the rise of e-commerce platforms, there will be greater accessibility to baby food products. This will allow companies to reach a wider audience and tap into new markets, particularly in remote areas where access to traditional brick-and-mortar stores may be limited.

Furthermore, as governments continue to implement stricter regulations surrounding food safety and labeling, companies will need to ensure compliance to maintain consumer trust. This will require investment in research and development as well as robust quality control measures throughout the supply chain.

Collaboration and partnerships will also play a key role in driving growth in the Asia Pacific Baby Food and Infant Formula market. By teaming up with other companies or organizations, companies can leverage their strengths and resources to develop innovative products and expand their market reach.

Overall, the future of the Asia Pacific Baby Food and Infant Formula market looks promising, with key players poised to capitalize on emerging trends and consumer preferences. By staying agile and responsive to market dynamics, these companies will continue to drive growth and innovation in the years to come.

Asia Pacific Baby Food and Infant Formula Market Key Segments:

By Type

- Infant Milk

- Follow-on Milk

- Specialty Baby Milk

- Growing-up Milk

- Milk Formula

- Dried Baby Food

- Prepared Baby Food

- Other Types

By Age

- 0-6 Months

- 6-12 Months

- >12 Months

By Ingredient

- Carbohydrate

- Fat

- Protein

- Minerals

- Vitamins

- Others

By Distribution Channel

- Hypermarket

- Supermarket

- Pharmacy/Medical Store

- Specialty Stores

- Hard Discounter Store

- E-commerce

- Others

Key Asia Pacific Baby Food and Infant Formula Industry Players

- Abbott Laboratories

- Arla Foods Amba

- Bellamy's Organic

- Danone

- Early Foods Private Limited

- FrieslandCampina

- Glico

- Gujarat Co-operative Milk Marketing Federation Ltd. (GCMMF)

- HiPP

- Holle

- Max Biocare

- Mead Johnson

- Meiji

- Nestle SA

- Nutrimed Healthcare Private Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383