MARKET OVERVIEW

Argentina Factory Automation and Industrial Control Systems (ICS) market encapsulates a dynamic landscape where technological advancements meet the demands of a rapidly changing industrial sector. This market, synonymous with innovation and efficiency, plays a pivotal role in enhancing the productivity of Argentina’s industrial endeavors.

The Argentina Factory Automation and ICS market thrive at the intersection of cutting-edge technology and industrial processes. Within this industry, a symbiotic relationship emerges as automation technologies seamlessly integrate with manufacturing and control systems, redefining the operational landscape. Embracing this transformative wave, industries in Argentina find themselves on the cusp of a technological revolution that promises increased efficiency, reduced operational costs, and enhanced overall productivity.

In this vibrant market, diverse industries, ranging from automotive and aerospace to food and beverage, are adopting advanced automation solutions to streamline their operations. The synergy between factory automation and ICS in Argentina is palpable, as these technologies converge to orchestrate a harmonious dance of precision and reliability within manufacturing environments.

One of the defining characteristics of the Argentina Factory Automation and ICS market is its adaptability to the unique challenges faced by local industries. Tailoring automation solutions to address specific operational nuances, this market serves as a catalyst for innovation, fostering a conducive environment for growth and competitiveness. Industries, irrespective of their size, are

finding customized automation solutions that resonate with their individual needs, propelling them into a new era of operational excellence.

As Argentina navigates the landscape of factory automation and ICS, the emphasis on local talent and expertise becomes increasingly evident. The market is not merely a consumer of international technologies but an active participant in shaping the future of automation. Homegrown solutions and collaborations amplify the impact of the Argentina Factory Automation and ICS market, fostering a sense of ownership and pride in the country’s industrial technological advancements.

The Argentine industry's adoption of automation and control systems extends beyond mere modernization; it represents a strategic move towards sustainability. As industries embrace eco friendly practices and energy-efficient solutions, the Argentina Factory Automation and ICS market play a pivotal role in ushering in a new era of responsible industrialization. This emphasis on sustainability aligns with global trends, positioning Argentina as a conscientious player in the international industrial landscape.

The Argentina Factory Automation and ICS market emerge not only as a technological powerhouse but as a catalyst for transformative change within the country’s industrial sectors. Beyond the buzzwords and generic narratives, this market embodies a story of resilience, adaptability, and forward-thinking. As industries in Argentina continue to embrace the possibilities presented by factory automation and ICS, they chart a course towards a future where efficiency, innovation, and sustainability coalesce to define the essence of industrial progress.

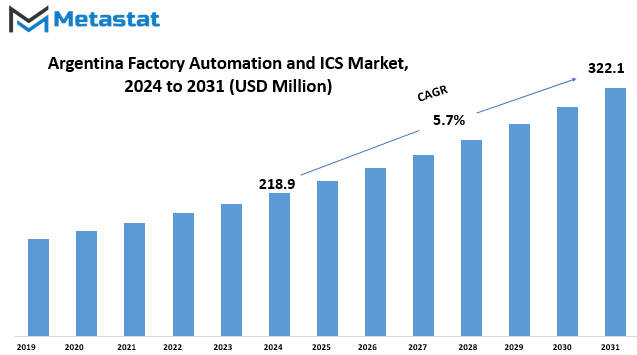

Argentina Factory Automation and ICS market is estimated to reach $322.1 Million by 2031; growing at a CAGR of 5.7% from 2024 to 2031.

GROWTH FACTORS

The Argentina Factory Automation and Industrial Control Systems (ICS) market is witnessing significant developments driven by various factors. One of the primary drivers propelling this market forward is the growing emphasis on operational efficiency and productivity improvements within the manufacturing sector. As industries strive to optimize their processes and enhance output, there's a natural inclination towards adopting automation technologies.

Moreover, there's a noticeable uptick in the adoption of Industry 4.0 and Internet of Things (IoT) technologies across industrial sectors in Argentina. These advancements facilitate connectivity, data exchange, and automation in manufacturing processes, thereby augmenting efficiency and enabling smarter decision-making.

However, amidst these advancements, certain challenges and restraints need to be addressed. One notable hurdle is the high initial investment costs associated with implementing automation technology and upgrading infrastructure. While the long-term benefits are evident, some businesses may find it daunting to allocate substantial resources upfront.

Additionally, cybersecurity risks pose a significant concern, particularly concerning industrial control systems. With the increasing integration of digital technologies, there's a corresponding rise in vulnerabilities, making these systems potential targets for cyber threats. Safeguarding critical infrastructure against such risks requires robust cybersecurity measures and constant vigilance.

Despite these challenges, there exist ample opportunities for growth and development in the Argentina Factory Automation and ICS market. The expansion of smart factories and ongoing digitalization initiatives in the industrial sector present promising avenues for businesses. Embracing these trends not only enhances operational efficiency but also fosters innovation and competitiveness in the global market landscape.

While the Argentina Factory Automation and ICS market face obstacles such as high costs and cybersecurity risks, the prospects for growth are promising. By leveraging emerging technologies and addressing challenges proactively, businesses can unlock new opportunities and propel the industry towards greater efficiency and sustainability.

MARKET SEGMENTATION

By Product

In the Argentine Factory Automation and Industrial Control Systems (ICS) market, the various components play a crucial role in shaping its dynamics. One integral aspect is the segmentation based on products, where we observe a distinct breakdown into Field Devices and Industrial Control Systems (ICS).

Field Devices, a pivotal element in this market, held a valuation of 141.4 USD Million in 2023. These devices are fundamental in facilitating automation processes within factories, contributing significantly to the overall efficiency and functionality. Their importance lies in their ability to interact directly with the physical processes on the factory floor, bridging the gap between the digital and tangible realms.

On the other hand, the Industrial Control Systems (ICS) segment also holds substantial significance, with a valuation of 67.7 USD Million in 2023. This segment encompasses a broader spectrum of control mechanisms that regulate and monitor industrial processes. The ICS is instrumental in ensuring seamless coordination and management of various components within a factory, enhancing operational control.

The Field Devices and ICS segments, while distinct, form an intricate web of interconnected technologies. Field Devices, operating at the ground level, capture and transmit real-time data, providing valuable inputs to the overarching Industrial Control Systems. This symbiotic relationship between the two segments underscores the synergy required for optimal factory automation.

Beyond the market numbers, the story here is one of technological innovation meeting the practical needs of industries. Field Devices are not just numbers on a balance sheet; they are the hands and eyes of automation, seamlessly integrating with the day-to-day operations of factories. Similarly, Industrial Control Systems are the orchestral conductors, ensuring a harmonious interplay of various components to produce the desired outcomes.

Moreover, the valuation figures for 2023 provide a snapshot of the economic impact of these technologies. The significant monetary values attached to both Field Devices and ICS underscore their substantial contribution to the Argentine economy. It goes beyond mere investments; it signifies the value placed on the transformative power of automation in enhancing industrial processes.

The Argentine Factory Automation and ICS market, delineated through the lens of product segmentation, reveal a vibrant landscape where Field Devices and Industrial Control Systems play pivotal roles. Their symbiotic relationship, economic significance, and role in shaping the future of industrial processes highlight the dynamic nature of this market, where innovation meets practical application for the benefit of industries and the overall economy.

By Field Devices Type

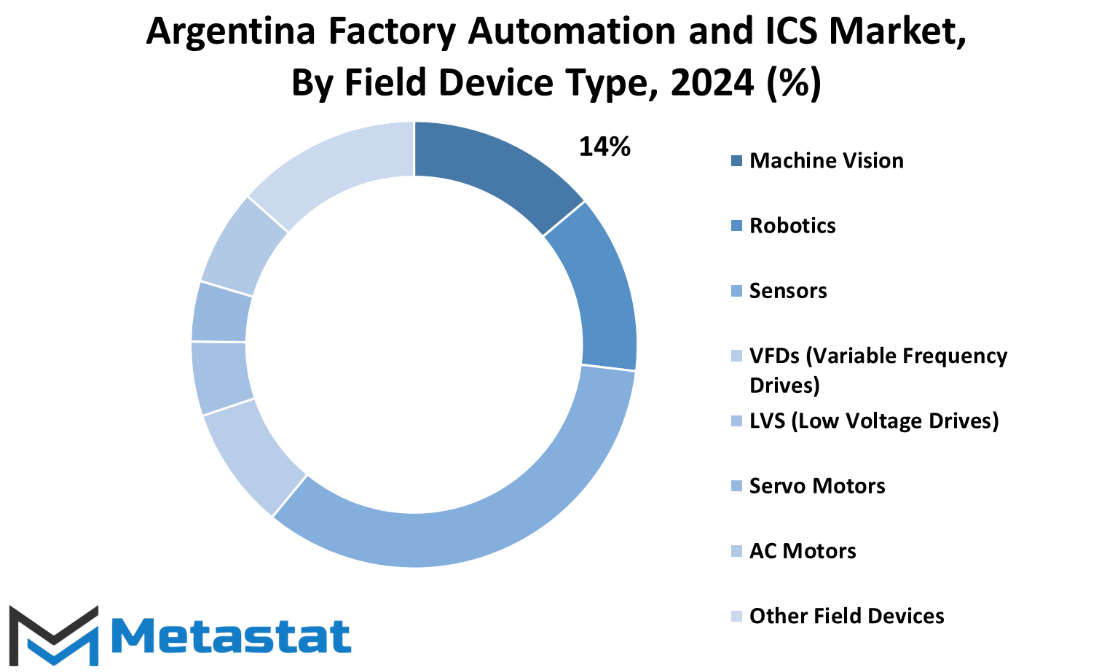

In Argentina’s Factory Automation and Industrial Control Systems (ICS) market, various Field Devices play a pivotal role, each contributing to the overall growth and functionality. Among these devices, Machine Vision, Robotics, Sensors, Variable Frequency Drives (VFDs), Low Voltage Drives (LVS), Servo Motors, AC Motors, and Other Field Devices collectively shape the industry's trajectory.

Starting with Machine Vision, this segment commanded a value of 19.5 million USD in 2023, showcasing its significance in the market. Machine Vision, with its advanced imaging capabilities, facilitates precise automation, enhancing quality control and operational efficiency within manufacturing processes.

The Robotics segment closely follows, boasting a value of 18.3 million USD in 2023. Robotics has emerged as a cornerstone of factory automation, bringing precision and speed to various tasks. The adoption of robotics not only streamlines production but also contributes to workforce safety by handling repetitive or hazardous tasks.

Sensors, another crucial component, achieved a market value of 48.2 million USD in 2023. Sensors act as the sensory nerves of industrial processes, collecting and transmitting data for real-time monitoring and control. Their versatile applications make them indispensable for optimizing operations across diverse industries.

Variable Frequency Drives (VFDs), valued at 12.6 million USD in 2023, are instrumental in regulating the speed and power consumption of electric motors. This technology ensures energy efficiency and allows for adaptable control, aligning with the growing demand for sustainable practices in manufacturing.

Low Voltage Drives (LVS) contribute significantly to the market with a valuation of 7.64 million USD in 2023. These drives play a vital role in controlling and optimizing the speed and torque of electric motors, catering to a broad spectrum of industrial applications.

Servo Motors and AC Motors, both essential field devices, complement each other in their functions. Servo Motors provide precise control of position and speed, while AC Motors deliver robust power for various industrial processes. Together, they form an integral part of the Factory Automation and ICS ecosystem.

The category of Other Field Devices encompasses a diverse range of technologies contributing to the overall landscape. While specific details about these devices may vary, their collective impact is noteworthy, enriching the breadth of solutions available in the market.

The Argentina Factory Automation and ICS market present a tapestry of Field Devices, each weaving its unique contribution to the industry’s fabric. From the precision of Machine Vision to the agility of Robotics, and the data-driven capabilities of Sensors, these devices collectively define the technological prowess of the market. The continuous evolution of Variable Frequency Drives, Low Voltage Drives, Servo Motors, AC Motors, and other field devices underscores the industry’s commitment to innovation and efficiency, promising a future where automation seamlessly integrates with industrial processes.

By ICS Type

The factory automation and industrial control systems (ICS) market in Argentina is a dynamic sector driving efficiency and productivity in manufacturing processes. This market encompasses various technologies aimed at automating and controlling industrial operations. Within the realm of ICS, different types of systems play crucial roles in streamlining production and enhancing operational performance.

One of the key components of the Argentina Factory Automation and ICS market is Supervisory Control and Data Acquisition (SCADA) systems. SCADA systems provide real-

time monitoring and control of industrial processes, allowing operators to remotely supervise and manage operations from a central location. These systems help improve efficiency, reduce downtime, and enhance overall operational visibility.

Another significant segment within the ICS market is Distributed Control Systems (DCS). DCS are centralized systems used to control and monitor complex industrial processes, such as those found in chemical plants, power generation facilities, and oil refineries. DCS enable seamless communication between various components of a manufacturing process, facilitating efficient control and optimization of operations.

Programmable Logic Controllers (PLC) form another essential component of the Argentina Factory Automation and ICS market. PLCs are ruggedized computers used to automate electromechanical processes in manufacturing environments. They are programmable and can be configured to perform specific tasks, such as controlling machinery, monitoring sensors, and executing logic functions.

Manufacturing Execution Systems (MES) play a vital role in integrating production planning, scheduling, and execution in manufacturing environments. MES provide real-time visibility into production processes, enabling better decision-making and resource allocation. These systems help optimize production workflows, improve product quality, and reduce cycle times.

Product Lifecycle Management (PLM) systems are crucial for managing the entire lifecycle of a product, from conception and design to manufacturing and disposal. PLM systems enable collaboration among different departments involved in product development, ensuring seamless integration of processes and data throughout the product lifecycle.

Enterprise Resource Planning (ERP) systems are integrated software solutions used to manage core business processes, such as accounting, procurement, inventory management, and human resources. In the context of factory automation, ERP systems help synchronize production activities with overall business operations, enabling better resource allocation and decision-making.

Human Machine Interface (HMI) systems serve as the interface between human operators and machines in industrial environments. HMIs provide visualizations of process data, enabling operators to monitor operations, diagnose issues, and make adjustments as needed. These systems enhance operator efficiency and effectiveness in managing industrial processes.

Additionally, the Argentina Factory Automation and ICS market include other control systems tailored to specific industry requirements. These systems may include advanced technologies such as robotics, motion control, and asset management systems, aimed at further enhancing automation and control in manufacturing environments.

The Argentina Factory Automation and ICS market encompass a diverse range of technologies aimed at automating and optimizing industrial processes. From SCADA and DCS to PLCs, MES, PLM, ERP, HMI, and other specialized control systems, these technologies play critical roles in driving efficiency, productivity, and competitiveness in manufacturing industries.

By End-user Industry

The Argentine factory automation and industrial control system (ICS) market is segmented by end-user industries. These industries encompass automotive, chemical and petrochemical, utility, pharmaceutical, food and beverage, oil and gas, electronics, mining, water, and other sectors. This division provides a comprehensive overview of the market’s scope and potential.

The automotive sector plays a pivotal role in driving the demand for factory automation and ICS solutions in Argentina. With the increasing need for efficiency and precision in manufacturing processes, automation technologies are widely adopted to streamline production and enhance overall productivity.

In the chemical and petrochemical industry, stringent safety regulations and the need for precise control over manufacturing processes drive the adoption of automation and ICS solutions. These technologies enable real-time monitoring and control of various production parameters, ensuring compliance with industry standards and optimizing operational efficiency.

The utility sector relies heavily on automation and ICS solutions to manage critical infrastructure such as power generation, transmission, and distribution. These technologies help utilities enhance grid reliability, reduce downtime, and improve overall system performance.

In the pharmaceutical industry, stringent regulatory requirements and the need for precision and accuracy in manufacturing processes are driving the adoption of automation and ICS solutions. These technologies enable pharmaceutical companies to maintain high quality standards, ensure product consistency, and comply with regulatory guidelines.

The food and beverage industry in Argentina is experiencing rapid growth, driven by changing consumer preferences and increasing demand for processed and packaged foods. Automation and ICS solutions play a crucial role in optimizing production processes, ensuring food safety, and meeting quality standards.

The oil and gas sector in Argentina relies on automation and ICS solutions to optimize exploration, production, and refining processes. These technologies enable oil and gas companies to improve operational efficiency, enhance safety, and reduce environmental impact.

In the electronics industry, automation and ICS solutions are essential for managing complex manufacturing processes and ensuring product quality. These technologies enable electronics manufacturers to increase production throughput, reduce defects, and meet customer demand effectively.

The mining industry in Argentina utilizes automation and ICS solutions to improve operational efficiency, enhance worker safety, and optimize resource extraction processes. These technologies enable mining companies to monitor and control equipment remotely, optimize workflows, and minimize downtime.

The water sector in Argentina relies on automation and ICS solutions to ensure the efficient management of water resources, optimize water treatment processes, and enhance system reliability. These technologies enable water utilities to monitor water quality, detect leaks, and improve overall system performance.

The segmentation of the Argentine factory automation and ICS market by end-user industries provides valuable insights into the diverse applications and opportunities for automation technologies across various sectors. From automotive and pharmaceuticals to utilities and mining, automation and ICS solutions play a critical role in driving efficiency, productivity, and innovation in Argentina’s industrial landscape.

COMPETITIVE PLAYERS

In the Argentina Factory Automation and Industrial Control Systems (ICS) market, there are several key players making significant contributions. These companies play pivotal roles in shaping the landscape of factory automation and ICS in Argentina.

One of the prominent names in this sector is ABB Ltd. ABB Ltd is known for its innovative solutions and advanced technologies in the field of factory automation and industrial control systems. With a focus on efficiency and reliability, ABB Ltd has established itself as a leader in the market, providing cutting-edge solutions to meet the evolving needs of industries.

Another key player in the Argentina market is Emerson Electric Co. Emerson Electric Co. is renowned for its comprehensive range of automation solutions designed to enhance productivity and optimize performance. With a strong presence in Argentina, Emerson Electric Co. continues to leverage its expertise to deliver tailored solutions that drive operational excellence for its customers.

Endress+Hauser Group Services AG is also a significant player in the factory automation and ICS industry in Argentina. Known for its precision instrumentation and automation solutions, Endress+Hauser Group Services AG caters to a diverse range of industries, offering reliable and accurate solutions to address various automation challenges.

Honeywell International is another notable player in the Argentina market, offering a wide range of automation and control technologies. Honeywell International's solutions are characterized by their innovation and efficiency, helping businesses enhance productivity and achieve operational excellence.

Kuka AG is recognized for its expertise in robotics and automation solutions. With a focus on innovation and technology, Kuka AG delivers cutting-edge solutions that enable businesses to automate processes and improve efficiency. In Argentina, Kuka AG continues to be a key player in the factory automation and ICS market, providing advanced solutions to meet the evolving needs of industries.

Robert Bosch GmbH is also a significant player in the Argentina market, offering a diverse portfolio of automation and control solutions. With a strong emphasis on quality and reliability, Robert Bosch GmbH caters to various industries, providing tailored solutions to optimize processes and drive growth.

These key players in the Argentina Factory Automation and ICS market demonstrate a commitment to innovation, quality, and customer satisfaction. By offering advanced solutions and leveraging their expertise, these companies play crucial roles in driving growth and development in the factory automation and ICS industry in Argentina.

Factory Automation and ICS Market Key Segments:

By Product

- Field Devices

- Industrial Control Systems (ICS)

By Field Devices Type

- Machine Vision

- Robotics

- Sensors

- VFDs (Variable Frequency Drives)

- LVS (Low Voltage Drives)

- Servo Motors

- AC Motors

- Other Field Devices

By ICS Type

- Supervisory Control and Data Acquisition (SCADA)

- Distributed Control Systems (DCS)

- Programmable Logic Controllers (PLC)

- Manufacturing Execution System (MES)

- Product Lifecycle Management (PLM)

- Enterprise Resource Planning (ERP)

- Human Machine Interface (HMI)

- Other Control Systems

By End-user Industry

- Automotive

- Chemical and Petrochemical

- Utility

- Pharmaceutical

- Food and Beverage

- Oil and Gas

- Electronics

- Mining

- Water

- Other End-user Industries

Key Argentina Factory Automation and ICS Industry Players

- ABB Ltd

- Emerson Electric Co.

- Endress+Hauser Group Services AG

- Honeywell International

- Kuka AG

- Robert Bosch GmbH

- Rockwell Automation

- Schneider Electric

- Siemens AG

- Yokogawa Electric Corporation

- Mitsubishi Electric Corporation

- Chint Argentina

- Inovance Technology Europe GmbH

- FANUC America Corporation

- Delta Electronics, Inc

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383