MARKET OVERVIEW

The Global Augmented Reality (AR) Waveguide Market, which has rapidly gained prominence represents a revolutionary leap forward in the way military forces perceive, analyze, and interact with their operational environments. This transformative innovation is set to redefine the landscape of military operations, offering unparalleled advantages and capabilities to armed forces across the world.

AR Waveguide technology, unlike its traditional counterparts, is not a mere improvement but rather a paradigm shifts in the way militaries employ augmented reality. It operates on the principles of overlaying digital information onto the real-world view, thereby enhancing situational awareness, decision-making, and mission execution. Unlike conventional augmented reality solutions that rely on cumbersome headsets, AR Waveguides offer a discreet and unobtrusive display mechanism. They do this through waveguides, which are optical components that transmit visual information directly into the wearer's field of view.

While AR Waveguide technology in the military sector holds immense promise, it is not without challenges. These include concerns about cybersecurity, power management, and integration with existing military systems. However, ongoing research and development efforts are expected to address these issues and further improve the technology's effectiveness.

In conclusion, the deployment of AR Waveguide technology in the military market is not merely an incremental development. It is a transformative leap that empowers armed forces with an array of capabilities, from enhanced situational awareness to streamlined mission execution. As technology continues to evolve, it is poised to become an indispensable tool for modern military operations, ensuring the safety and effectiveness of defense forces worldwide.

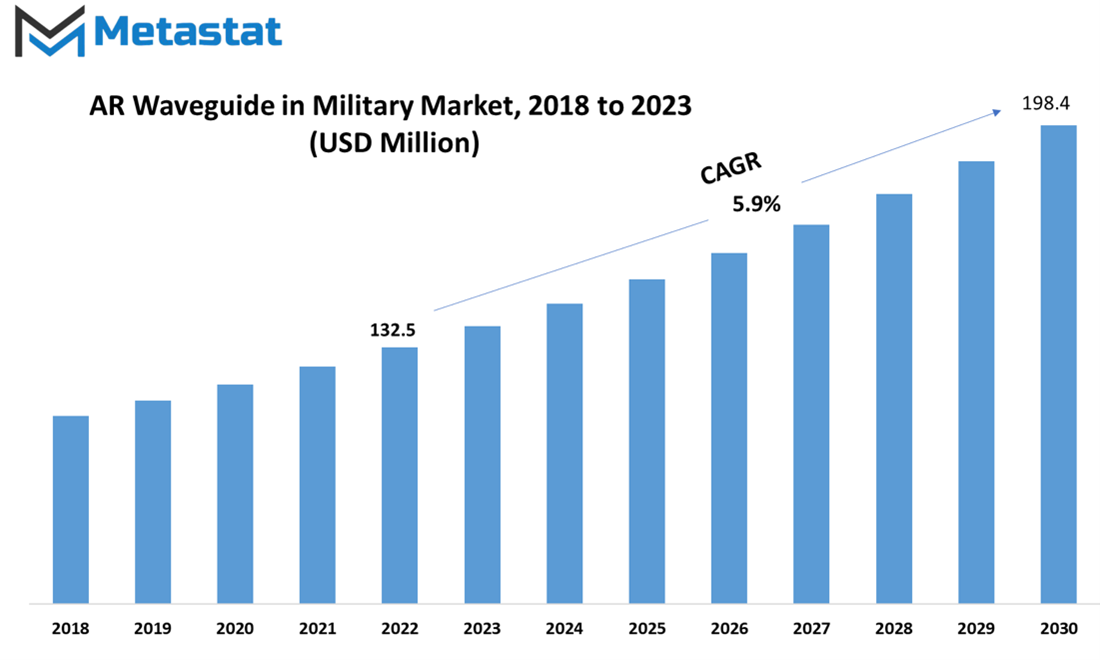

Global AR Waveguide in Military market is estimated to reach $198.4 Million by 2030; growing at a CAGR of 5.9% from 2023 to 2030.

GROWTH FACTORS

The AR (Augmented Reality) waveguide technology has found a significant niche in the military market due to several key growth factors. Augmented Reality, which overlays digital information and graphics onto the real world, has increasingly gained attention in various sectors, including the military, as it offers unique capabilities and advantages.

The growth of AR waveguide technology in the military market can be attributed to its ability to enhance situational awareness and decision-making. By providing real-time, context-specific information directly to military personnel, AR waveguides allow for quicker and more informed responses to changing conditions on the battlefield.

Another crucial growth factor is the versatility of AR waveguide systems. These systems can be integrated into various military applications, from infantry gear to armored vehicles and aircraft. This adaptability makes them a valuable asset for a wide range of military operations.

The effectiveness of AR waveguide technology in training and simulation cannot be overstated. Military personnel can use AR waveguides for realistic training scenarios, improving their readiness and reducing the risk associated with live training exercises. Furthermore, these systems can simulate complex battlefield situations, providing a safer and cost-effective alternative to traditional training methods.

Moreover, the rise of innovative technologies like the Internet of Things (IoT) and cloud computing has synergized with AR waveguides. This convergence allows for the seamless collection and sharing of real-time data, resulting in enhanced communication and coordination among military units.

Furthermore, the increasing focus on reducing cognitive load on military personnel has amplified the demand for AR waveguide technology. By displaying critical information directly in the field of vision, AR waveguides reduce the need to divert attention from the mission at hand, leading to improved efficiency and safety.

In the military market, the AR waveguide technology is seen as a force multiplier. It equips soldiers and commanders with a digital layer of information that can include data from sensors, maps, enemy positions, and much more. This augmented information can be invaluable in tactical decision-making, increasing the likelihood of mission success and reducing casualties.

The growth of AR waveguide technology in the military market is further fueled by ongoing research and development efforts. Manufacturers are continually improving the performance, durability, and affordability of AR waveguide systems, making them more accessible and practical for military applications.

In conclusion, the growth of AR waveguide technology in the military market is driven by its ability to enhance situational awareness, its versatility in military applications, its effectiveness in training and simulation, and its synergy with emerging technologies. As the military continues to adapt and adapt to the possibilities presented by AR waveguides, we can expect to see further advancements and a broader range of applications soon.

MARKET SEGMENTATION

By Type

The military landscape is continually evolving, and one area that has garnered significant attention is the utilization of AR (Augmented Reality) waveguide technology. This technology is instrumental in enhancing situational awareness for military personnel, providing them with critical information overlaying their field of view (FOV). Within the military market, the AR waveguide technology is categorized into various types, each tailored to specific requirements.

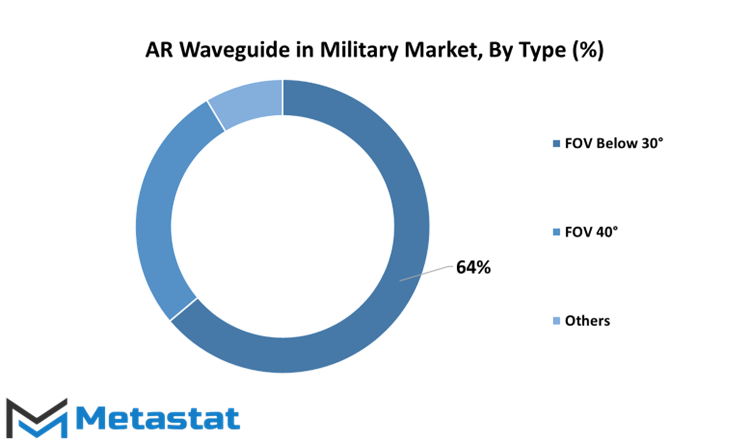

One of the primary segments is the FOV Below 30°, which was valued at 80.1 USD Million in 2022. This segment caters to scenarios where a narrower field of view is sufficient to display essential data to military personnel. It finds applications in situations where precision and focused information are paramount, enabling military personnel to maintain awareness of key details without overwhelming their vision.

In addition to the FOV Below 30° segment, there is the FOV 40° segment, valued at 34.4 USD Million in 2022. This segment offers a slightly wider field of view, making it suitable for scenarios where a broader perspective is necessary. It strikes a balance between providing comprehensive information and maintaining situational awareness.

Furthermore, there is the others segment, which was valued at 10.9 USD Million in 2022. The Others segment encompasses a range of FOV types that may not fall into the specific categories mentioned earlier. This segment is versatile and adaptable to various military applications, offering tailored solutions for specific needs.

The value of these segments underscores the growing importance of AR waveguide technology in the military sector. It reflects the military's recognition of the significance of providing soldiers with real-time data in their line of sight. As military operations become increasingly complex and data-driven, the ability to access information without diverting one's attention from the field is invaluable.

In summary, the military market's adoption of AR waveguide technology, categorized by FOV types such as Below 30°, 40°, and Others, highlights the commitment to enhancing the capabilities and effectiveness of military personnel. The values attributed to these segments in 2022 emphasize the significant role AR waveguides play in modern military operations. This technology is not only a tool for the present but also a glimpse into the future of military situational awareness and data integration.

By Application

The AR waveguide technology finds its applications in various sectors, and the military market is no exception. One key application of this technology in the military domain is in the development of military helmets, military glasses, and other related equipment.

In 2022, the military helmet segment was valued at approximately 19.7 million US dollars. This significant value reflects the importance of integrating AR waveguides into military helmets, which can provide soldiers with critical information directly in their line of sight. Such information may include maps, tactical data, or real-time intelligence, enhancing the situational awareness and decision-making capabilities of military personnel.

The military glasses segment, on the other hand, was valued even higher, at about 96.4 million US dollars in 2022. Military glasses equipped with AR waveguide technology offer soldiers a hands-free and unobtrusive way to access information. These glasses can display vital data without requiring soldiers to divert their attention from their surroundings. This feature is particularly valuable in tactical situations where split-second decisions can make a significant difference.

Apart from military helmets and glasses, there are other applications within the military sector, and the other segment, valued at 9.4 million US dollars in 2022, encompasses these varied applications. These may include AR waveguide technology integrated into visors, heads-up displays, or even specialized communication devices used by the military.

The significant values associated with these segments underscore the growing importance of AR waveguide technology in modern military operations. It not only enhances the capabilities of individual soldiers but also contributes to the overall efficiency and effectiveness of military units. As technology continues to advance, we can expect further innovations and applications in the military sector, driven by the potential of AR waveguide technology to provide critical information in real-time and in a hands-free manner.

REGIONAL ANALYSIS

The utilization of AR waveguide technology in the military market is gaining prominence. This technology, referred to as Augmented Reality (AR) waveguide, offers a range of applications and has specific geographical divisions. In North America, the global market for AR waveguide technology in the military sector has witnessed significant growth. This growth can be attributed to the strong presence of key players, substantial investments in research and development, and the adoption of advanced technologies by the military. The North American region, particularly the United States, is a hub for defense and military-related innovations. The AR waveguide technology has found its niche in applications such as heads-up displays, training simulations, and maintenance procedures in the military.

Moving to Europe, a similar trend is observed. The European market for AR waveguide in the military domain is on the ascent. Countries like the United Kingdom, France, and Germany have been at the forefront of incorporating this technology into their defense strategies. The European defense sector has been quick to recognize the advantages of AR waveguides in enhancing situational awareness, improving training programs, and streamlining maintenance processes.

In summary, the global AR waveguide technology in the military market is experiencing growth, with North America and Europe playing significant roles in its adoption and development. The application of AR waveguides in the military sector is poised to bring about innovative changes and improvements in various areas, from training and simulations to maintenance procedures, ultimately enhancing the overall efficiency and effectiveness of military operations.

COMPETITIVE PLAYERS

Augmented Reality (AR) technology has emerged as a transformative force, not just in consumer applications but in the defense sector as well. One of the key components enabling AR in the military market is the AR waveguide. This essay explores the significance of AR waveguides in the military domain and sheds light on key industry players.

AR waveguides, essentially optical devices, play a pivotal role in enhancing situational awareness for military personnel. These waveguides allow data and information to be displayed within the user's field of view, superimposed on the real-world environment. This technology aids soldiers in accessing critical data while remaining focused on their surroundings.

One of the primary applications of AR waveguides in the military is in head-mounted displays (HMDs). These displays are integrated into helmets or goggles, providing soldiers with valuable information like maps, thermal imaging, and communication data. This real-time data projection enables rapid decision-making on the battlefield.

The use of AR waveguides is not limited to land-based operations. They have found utility in various military domains, including aviation. Pilots equipped with AR waveguide-enabled helmets can receive essential flight data and guidance without taking their eyes off the sky. This leads to improved safety and operational efficiency. As for key industry players operating in the AR waveguide sector within the military market, two notable names stand out: Microsoft Corporation and Lingxi-AR Technology Co.

Microsoft Corporation, a global technology giant, has made substantial strides in the AR domain with its HoloLens technology. HoloLens employs waveguides to deliver immersive AR experiences. In the military sector, Microsoft's HoloLens has garnered attention for its potential to enhance training, maintenance, and field operations. Its advanced spatial mapping and gesture recognition capabilities offer military personnel an edge in various scenarios.

Lingxi-AR Technology Co., on the other hand, is a specialized player in the AR waveguide landscape. The company focuses on developing cutting-edge waveguide solutions tailored to military requirements. Lingxi-AR's waveguides are designed for durability, ensuring they can withstand the demanding conditions of military use. Their contributions to improving heads-up displays and AR integration have positioned them as key players in the military AR market.

In conclusion, AR waveguides are a critical component in the military's pursuit of enhanced situational awareness and operational effectiveness. These optical devices have practical applications in land, air, and sea domains, providing soldiers and personnel with real-time data and information. In the competitive landscape of AR waveguide technology, Microsoft Corporation and Lingxi-AR Technology Co. have emerged as prominent industry players, drove innovation and shaping the future of AR in the military sector.

AR Waveguide in Military Market Key Segments:

By Type

- FOV Below 30°

- FOV 40°

- Others

By Application

- Military Helmet

- Military Glasses

- Other

Key Global AR Waveguide in Military Industry Players

- Microsoft Corporation

- Lingxi-AR Technology Co., Ltd.

- Lumus Ltd.

- Optinvent S.A.

- Vuzix Corporation

- Zhejiang Crystal-Optech Co., Ltd.

- Shenzhen Longjing Optoelectronics Technology Co., Ltd.

- Holoptic, LLC

- DigiLens Inc.

- ThirdEye Gen, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252