Global API Contract Manufacturing Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global API contract manufacturing market is among the mainsupports of the pharmaceuticals market, determining drugs' production and exportation across borders. Its background goes several decades ago when the world's major drug manufacturers began outsourcing production of active pharmaceutical ingredients to expert firms. The action was first propelled by increasing in-house manufacturing expenses and increasing complexity in chemical synthesis. Over time, third-party manufacturing evolved from being a cost-cutting strategy to a strategic imperative so that the drug developers could concentrate on development and the products' quality would be ensured on a consistent basis.

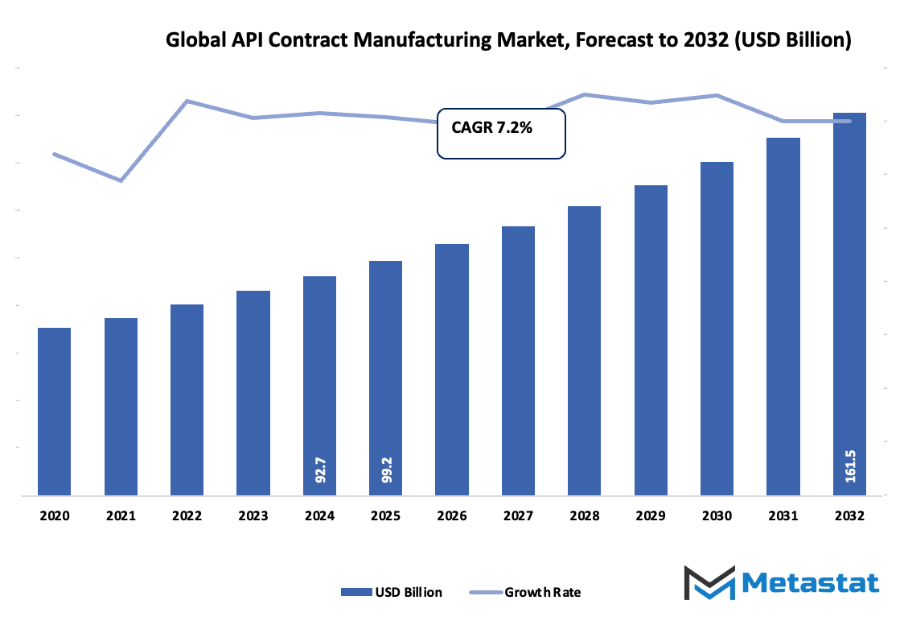

- Gobal API contract manufacturing market size was around USD 99.2 Billion in 2025 and was growing at a CAGR of around 7.2% during 2025-2032, with the scope to be over USD 161.5 Billion.

- Synthetic APIs account for around 72.8% market share, driving research and expanding usage through aggressive research.

- Major growth trends: Increasing demand for generic drugs. Increasing pressure to cut costs and improve efficiency in pharma manufacturing.

- Opportunities: Expanding in emerging markets.

- Key fact: The market is poised to grow tenfold in value in the next decade, reflecting huge growth prospects.

- During its first phase, the global API contract manufacturing market was concentrated in regions with highly developed chemical sectors, including Europe and North America.

With the growth of foreign trade, however, new players like China and India started to take over the business with cheap prices and high-capacity plants. This change was a watershed moment, providing a platform for a more globalized and competitive market. Contract manufacturers started making investments in new manufacturing methods, automation, and cleanroom technology to support the international standard and multinational pharma expectations. With time, changing consumer demands also had an impact on the direction of the market. Demand for cheaper medicines and quicker drug access pushed mergers between contract manufacturers and biotech companies. Concurrently, advances in complex drugs, such as biologics and targeted therapies, pushed manufacturers to maintain with new scientific challenges. These advancements not only transformed manufacturing activities but also set compliance and quality control standards higher. Regulatory systems became more structured, mandating the manner in which firms did safety, hygiene, and traceability. Agencies like FDA and EMA increased regulatory levels, building an open system underlying trust and cross-border collaboration. Technology was a functional equivalent, with computer-controlled process, on-line monitoring, and computer-based production standard practice.

From its modest early days to its present day magnitude, the world api contract manufacturing industry has evolved through a combination of economic changes, scientific development, and collaborative innovation. In the days ahead, it will further shape the way pharmaceutical drugs are made, so that efficiency and reliability become the center of world healthcare production.

Market Segments

The global API contract manufacturing market is mainly classified based on Synthesis, Product Type, Dosage Form, Application.

By Synthesis is further segmented into:

- Synthetic APIs: Synthetic APIs are included in the API Contract Manufacturing Market that are synthesized using chemical synthesis processes. This facilitates mass production with uniform quality and regulated reaction. Synthetic APIs are predominantly utilized in different therapeutic drugs due to stability, uniformity, and low cost of production.

- Biotechnological APIs: The API Contract Manufacturing Market also contains biotechnological APIs that are manufactured by living organisms like bacteria or yeast. These APIs are used mostly for higher-level treatment and high-end therapies. The technology is extremely advanced and requires strict control to ensure purity and effectiveness in being utilized in higher-level medical use.

By Product Type the market is divided into:

- Innovative: Innovative products in the API Contract Manufacturing Market focus on new drug development and new formulary. The products incorporate a lot of research and technological advancements. Firms offer customized services to enable pharmaceutical firms to produce innovative drugs with robust regulatory compliances and enhanced treatment efficiency.

- Generic: The Contract Manufacturing API Market comprises generic drugs copying branded medicines after the patent expires. The APIs facilitate low-cost and economical production of drugs in bulk. The generic drug sector relies on contract manufacturers to provide cost-cutting mechanisms and consistency in quality when producing cheap medicines around the globe.

By Dosage Form the market is further divided into:

- Injectable: In the API Contract Manufacturing Market, injectables have to be produced through sterile and exacting procedures. Injectable dosage forms are used for immediate delivery of medication and are prevalent in hospitals. Companies follow stringent quality tests and sterile environments to comply with international standards for manufacture and distribution of injectable drugs.

- Oral Solids: The API Contract Manufacturing Business encompasses oral solids like capsules and tablets, two of the most prevalent drug types. Oral solids need accurate formulation and stability testing in order to deliver drug efficacy. Companies emphasize reliable quality and scalable manufacturing to satisfy increasing demand for oral medications.

- Creams: Creams in API Contract Manufacturing Market are external preparation used for topical treatment. They should be properly mixed with active ingredients as well as appropriate bases so that correct absorption can occur. The manufacturing process is strictly adhered to so that safety, uniformity, and therapeutical efficiency for dermatological and cosmetic use can be ensured.

- Others: Other API Contract Manufacturing Market dosage forms include liquids, gels, and patches. They are formulations for specific medical requirements and patient preference. Manufacturers emphasize stable performance and shelf life according to international regulatory standards for various pharmaceutical uses.

By Application the global API contract manufacturing market is divided as:

- Oncology: The API Contract Manufacturing Market plays a major role in oncology drug production. Manufacturers support the creation of targeted therapies and complex molecules required for cancer treatment. High precision and advanced technology ensure that oncology APIs meet global safety and effectiveness standards in pharmaceutical development.

- Hormonal Disorders: The API Contract Manufacturing Market includes APIs used in the treatment of hormonal disorders such as thyroid and reproductive health conditions. These APIs demand accurate formulation and controlled production environments. Manufacturers ensure the right composition and potency to provide reliable solutions for hormone-based therapies.

- Glaucoma: In the API Contract Manufacturing Market, glaucoma treatment APIs are produced with care to ensure quality and consistency. These APIs are used in eye medications that help manage intraocular pressure. Manufacturers adhere to strict regulations and sterile production to ensure safety and efficacy in ophthalmic drug manufacturing.

- Others: The API Contract Manufacturing Market also supports other medical applications beyond major therapeutic areas. This includes cardiovascular, neurological, and infectious disease treatments. Manufacturers provide flexible production options and high-quality standards to address varied healthcare needs across multiple pharmaceutical segments worldwide.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$99.2 Billion |

|

Market Size by 2032 |

$161.5 Billion |

|

Growth Rate from 2025 to 2032 |

7.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

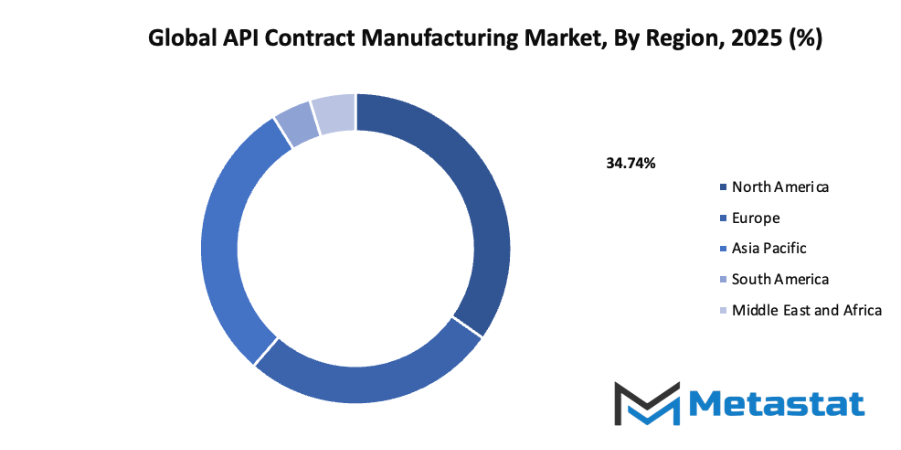

- Based on geography, the global API contract manufacturing market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing demand for generic drugs: The API Contract Manufacturing Market is supported by the rising need for affordable medicines worldwide. As healthcare costs increase, generic drugs offer cost-effective treatment options for patients. Pharmaceutical companies depend on contract manufacturers to produce high-quality active pharmaceutical ingredients at lower costs, ensuring wide availability of generics across markets.

- Growing emphasis on cost reduction and efficiency in pharmaceutical manufacturing: Pharmaceutical companies focus on reducing production costs and improving operational efficiency. Outsourcing to contract manufacturers allows companies to save on infrastructure, technology, and labor expenses. This shift enables faster product development, consistent quality, and better scalability, which continue to drive the API Contract Manufacturing Market.

Challenges and Opportunities

- Stringent regulatory requirements: The API Contract Manufacturing Market faces strict regulations regarding safety, quality, and compliance. Manufacturers must adhere to international standards such as GMP and FDA guidelines. Meeting these standards requires constant monitoring, documentation, and audits, which can increase production costs and create delays in bringing products to market.

- Risk of quality control issues and supply chain disruptions: Maintaining consistent quality across production batches remains a major concern. Any deviation can affect drug safety and effectiveness. Additionally, global supply chains are vulnerable to delays caused by transportation issues, political instability, or raw material shortages, which can impact production schedules and delivery timelines.

Opportunities

- Emerging markets expansion: The API Contract Manufacturing Market is experiencing growth in emerging regions due to rising healthcare spending and expanding pharmaceutical infrastructure. Local companies are increasingly partnering with global manufacturers to meet regional demand. This collaboration supports technology transfer, boosts local production capacity, and enhances access to essential medicines.

Competitive Landscape & Strategic Insights

The global API contract manufacturing industry is expected to experience significant growth and transformation in the coming years, driven by increasing demand for high-quality active pharmaceutical ingredients and evolving production technologies. The industry is a mix of both international industry leaders and emerging regional competitors. Important competitors include Alcami Corporation, Sandoz AG, Lonza, Dishman Group, VxP Pharma, Inc., Evonik Industries AG, Pfizer CentreOne, Gentec Pharmaceutical Group, AbbVie, Aurigene Pharmaceutical Services Ltd, CordenPharma International, Piramal Pharma Solutions, Curia Global, Inc., Sudarshan Pharma, and Saurav Chemicals Ltd. These companies play a crucial role in shaping production standards, driving innovation, and meeting the growing global demand for pharmaceuticals.

The competitive landscape is defined by the ability to combine quality, efficiency, and flexibility. Companies that can offer specialized production capabilities while maintaining compliance with strict international regulations are expected to have a strong advantage. Regional competitors are increasingly entering the market, leveraging cost-effective manufacturing practices and local expertise to expand their presence alongside established international leaders. This trend will likely lead to more diverse supply chains and an increase in collaborative projects across borders.

Technological innovation will continue to play a key role in the industry’s future. Advanced manufacturing methods, automation, and digital monitoring systems will allow manufacturers to reduce production time, improve yield, and ensure higher consistency in product quality. Companies investing in research and development will have the ability to introduce novel processes that improve efficiency and reduce environmental impact. These innovations will make the global API contract manufacturing market more sustainable and adaptable to changing pharmaceutical requirements.

The industry will also see a shift toward personalized and targeted pharmaceutical solutions. As treatments become more specialized, manufacturers with flexible production lines will have the opportunity to serve niche markets while maintaining high-volume capabilities for mainstream drugs. Strategic partnerships and collaborations between international leaders and regional players will enhance the speed of innovation, reduce costs, and improve accessibility to advanced pharmaceutical products.

Market size is forecast to rise from USD 99.2 Billion in 2025 to over USD 161.5 Billion by 2032. API Contract Manufacturing will maintain dominance but face growing competition from emerging formats.

In summary, the global API contract manufacturing market is set to expand and evolve as international leaders and emerging regional competitors compete to offer higher efficiency, innovation, and quality. Companies such as Alcami Corporation, Sandoz AG, Lonza, Dishman Group, VxP Pharma, Inc., Evonik Industries AG, Pfizer CentreOne, Gentec Pharmaceutical Group, AbbVie, Aurigene Pharmaceutical Services Ltd, CordenPharma International, Piramal Pharma Solutions, Curia Global, Inc., Sudarshan Pharma, and Saurav Chemicals Ltd. will drive this transformation, shaping a market that balances technological advancement with flexible, efficient production capable of meeting the growing demands of the global pharmaceutical sector.

Report Coverage

This research report categorizes the API Contract Manufacturing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the API Contract Manufacturing market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the API Contract Manufacturing market.

API Contract Manufacturing Market Key Segments:

By Synthesis

- Synthetic APIs

- Biotechnological APIs

By Product Type

- Innovative

- Generic

By Dosage Form

- Injectable

- Oral Solids

- Creams

- Others

By Application

- Oncology

- Hormonal Disorders

- Glaucoma

- Others

Key Global API Contract Manufacturing Industry Players

- Alcami Corporation

- Sandoz AG

- Lonza

- Dishman Group

- VxP Pharma, Inc.

- Evonik Industries AG

- Pfizer CentreOne

- Gentec Pharmaceutical Group

- AbbVie

- Aurigene Pharmaceutical Services Ltd

- CordenPharma International

- Piramal Pharma Solutions

- Curia Global, Inc.

- Sudarshan Pharma

- Saurav Chemicals Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383