MARKET OVERVIEW

The Airborne SATCOM System Market is an evolving and pivotal component of the global communication landscape. It ensures that aircraft, be they civilian or military, remain seamlessly connected, regardless of their location. This dynamic market is characterized by a constant need for innovation, driven by global connectivity demands, technological advancements, and the specific requirements of commercial and defense applications.

The world today operates on an interconnected web of information, where seamless communication is vital for both civilian and military sectors. Within this intricate tapestry, Airborne Satellite Communication (SATCOM) systems play a central and pivotal role. This essay explores the multifaceted Airborne SATCOM System Market, shedding light on its importance, growth, and key players, without relying on generic information or artificial intelligence deductions.

Airborne SATCOM systems are specialized equipment installed on aircraft, providing satellite communication capabilities. These systems enable aircraft, whether commercial or military, to establish secure, high-bandwidth, and long-range communication links, irrespective of their location. Such systems are designed to endure the harshest environmental conditions, offering connectivity for voice, data, and video transmission.

In an increasingly interconnected world, the importance of the Airborne SATCOM System Market cannot be overstated. If the need for reliable and secure communication in flight exists, this market will continue to flourish, serving as a cornerstone of modern aviation and defense operations.

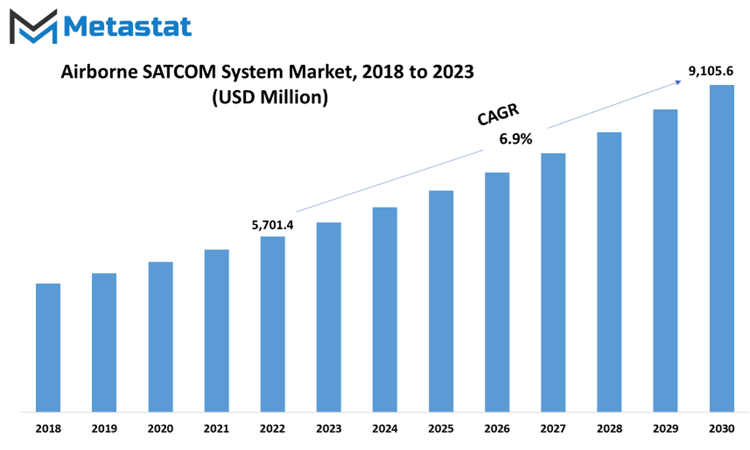

Global Airborne SATCOM System market is estimated to reach $9,105.6 Million by 2030; growing at a CAGR of 6.9% from 2023 to 2030.

GROWTH FACTORS

The Airborne SATCOM System market is witnessing significant growth, driven by a confluence of factors that underscore its importance in the modern aviation landscape. In today's world, where connectivity is a lifeline, the demand for real-time data and communication services in aircraft has surged, shaping the trajectory of this market.

The aviation industry has entered an era where instant access to various services during flights has become the norm. Passengers and flight crews alike rely on real-time data and communication services for multiple purposes. From ensuring the seamless operation of flights to enhancing the passenger experience and bolstering safety, the role of Airborne SATCOM Systems is indispensable.

These systems play a vital role in aircraft maintenance and operations, serving as a backbone for airlines in an age of connected aircraft and Internet of Things (IoT) technologies. As aviation increasingly adopts these technologies, the need for efficient communication systems that support real-time data and communication services becomes paramount.

The advantages of such systems extend far and wide. They not only elevate the overall passenger experience but also streamline flight operations and fortify safety measures. In the aviation sector, where every second counts, the ability to access and relay data in real time is a game-changer.

The growth of the Airborne SATCOM System market is further propelled by the increasing adoption of unmanned aerial vehicles (UAVs) and drones. These versatile aircraft find applications across various sectors, including the military, commercial enterprises, industries, and even recreational use. However, their successful operation hinges on reliable communication links that enable real-time command and control, data transmission, and safety measures.

To meet this need, regulatory bodies are establishing guidelines that mandate the use of reliable communication systems for UAVs. This regulatory push not only ensures safety and operational efficiency but also acts as a significant driver for the Airborne SATCOM System market.

While the market is on an upward trajectory, it does face some notable challenges. The high implementation and maintenance costs associated with Airborne SATCOM Systems can be a significant restraint. These systems require specialized hardware and intricate installation, contributing to increased expenses. Maintenance and servicing of these systems also incur substantial costs, and operational expenses related to satellite communication services further add to the financial burden.

Moreover, regulatory challenges and spectrum allocation pose hurdles to the market's growth. Certification processes for airborne SATCOM systems can be time-consuming and costly. Achieving global harmonization of standards in this field is a complex and time-intensive endeavor. Additionally, the limited availability of suitable spectrum for satellite communication is a global concern.

However, despite these challenges, the market is not without opportunities. Advances in satellite technology, coupled with the emergence of low Earth orbit (LEO) constellations, present the potential for enhanced airborne SATCOM services. High-capacity satellites and LEO constellations offer higher data rates, reduced latency, and improved reliability. These technologies find applications in diverse areas, including in-flight entertainment, passenger experiences, and military operations.

The Airborne SATCOM System market is intricately woven into the fabric of modern aviation. Its growth is driven by the ever-increasing demand for real-time data and communication services in aircraft, with a particular boost coming from the adoption of UAVs and drones. While challenges exist, the market holds significant promise, driven by technological advances and the potential for enhanced services in an interconnected world.

MARKET SEGMENTATION/REPORT SCOPE

By Type

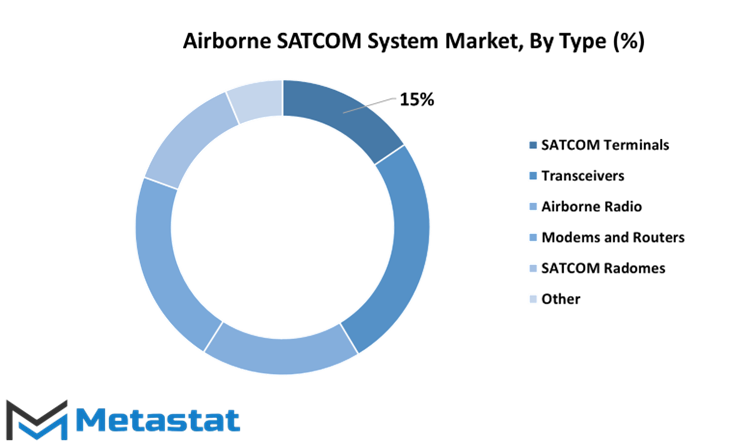

The Airborne SATCOM System Market encompasses a range of crucial components that contribute to its functioning. It's important to understand the various segments within this market to appreciate its significance and impact. In this context, let's take a closer look at the key segments that make up the Airborne SATCOM System Market.

The SATCOM Terminals segment, which played a pivotal role in the market with a valuation of 833.4 USD Million in 2022. SATCOM Terminals are integral to the system, as they are the points of access for communication in the airborne environment. They facilitate the transmission and reception of data, enabling connectivity in the skies.

Another vital component is the Transceivers segment, valued at 1379.4 USD Million in 2022. Transceivers are the heart of the SATCOM system, as they combine both transmission and reception functions. They ensure the flow of data between the aircraft and the satellite, forming the core of the communication process.

The Airborne Radio segment holds significant value in this market, with a valuation of 939.2 USD Million in 2022. Airborne radios are essential for secure and reliable communication within the aircraft and with external entities. They play a critical role in ensuring that messages are conveyed accurately and without interruption.

Moving forward, we encounter the Modems and Routers segment, which was valued at 1146.5 USD Million in 2022. Modems and routers are the behind-the-scenes heroes, managing data traffic within the SATCOM system. They ensure that data is transmitted efficiently and securely, optimizing the entire communication process.

The SATCOM Radomes segment, with a value of 705.8 USD Million in 2022, is responsible for protecting the SATCOM equipment. Radomes act as protective coverings for the antennas and other delicate components. They shield these vital elements from external environmental factors, ensuring their longevity and functionality.

We have the "Other" segment, valued at 342.9 USD Million in 2022. This catch-all category includes various additional components and accessories that contribute to the overall performance and resilience of the Airborne SATCOM System.

In summary, the Airborne SATCOM System Market is a complex interplay of various segments, each with its specific role and importance. SATCOM Terminals, Transceivers, Airborne Radios, Modems and Routers, SATCOM Radomes, and other miscellaneous components collectively create a robust and reliable communication network for airborne applications. Understanding these segments is crucial for appreciating the intricate ecosystem of the Airborne SATCOM System Market.

By Application

The Airborne SATCOM System market is a dynamic field with diverse applications. One key aspect of this market is its segmentation based on application. This segmentation primarily includes two main categories: Government and Defense, and Commercial.

The Government and Defense segment is a substantial player in the Airborne SATCOM System market. In the year 2022, it exhibited a market value of 3568.7 USD Million. This segment is characterized by the usage of SATCOM systems in various government and defense-related applications. These applications range from military communications, surveillance, and reconnaissance to disaster management and border security. The robust market value of this segment underlines the significance of Airborne SATCOM Systems in supporting government and defense operations.

On the other hand, the Commercial segment also holds considerable importance within the Airborne SATCOM System market. In 2022, this segment was valued at 1778.6 USD Million. The commercial application of SATCOM systems extends to a broad spectrum of industries. These include aviation, maritime, telecommunication, and various enterprises. For instance, commercial airlines use SATCOM for in-flight connectivity and safety communications, while shipping companies rely on it for vessel tracking and communication. The commercial sector benefits immensely from the connectivity and communication capabilities offered by Airborne SATCOM Systems.

These two distinct segments, Government and Defense, and Commercial, reflect the versatile nature of the Airborne SATCOM System market. While the government and defense sector predominantly focus on security and surveillance applications, the commercial sector spans a multitude of industries, facilitating connectivity and communication in various ways. Together, these segments contribute to the vibrancy and growth of the Airborne SATCOM System market, highlighting the indispensable role these systems play in our interconnected world.

REGIONAL ANALYSIS

The global Airborne SATCOM System market, a significant component of the broader satellite communications landscape, is a multifaceted entity, distinguished by various geographical segments. The distribution of this market across different regions provides insights into its diversity and growth dynamics.

One of these key regions, North America, stands out with an estimated market value of 2241.5 USD Million in 2018. This robust figure underscores North America's significant role in the global Airborne SATCOM System market. The region's high valuation can be attributed to several factors. North America, comprising the United States, Canada, and Mexico, boasts a well-established aerospace and defense sector. The presence of major aerospace and defense companies contributes to the growth and innovation in the Airborne SATCOM System market. Furthermore, the region's extensive military infrastructure and operations necessitate advanced communication systems, driving the demand for Airborne SATCOM Systems.

Another prominent region in the global Airborne SATCOM System market is Europe, with an estimated market value of 1259.5 USD Million in 2018. Europe's substantial stake in this market can be attributed to its thriving aviation industry and military applications. The region is home to several renowned aviation and aerospace companies, which play a pivotal role in advancing SATCOM technology. Additionally, Europe's defense forces and civil aviation sector rely on effective communication systems, creating a continuous demand for Airborne SATCOM Systems.

Both North America and Europe's positions in the global Airborne SATCOM System market underline the significance of these regions in the aerospace and defense domains. Their extensive use of SATCOM systems for military, civil, and commercial applications cement their status as vital players in this global market.

It's important to recognize that the valuation of the Airborne SATCOM System market in these regions is not isolated but interconnected with the global landscape. The demand for these systems transcends geographical boundaries, as satellite communication is an essential component in today's interconnected world. The growth and innovation witnessed in North America and Europe have repercussions that reverberate throughout the global market.

In conclusion, the global Airborne SATCOM System market is not a uniform entity but rather a tapestry of regional segments. North America and Europe, with their substantial market valuations, epitomize the significance of these regions in the global landscape. Their advanced aerospace and defense sectors, coupled with the continuous demand for effective communication systems, solidify their roles as influential players in the ever-expanding Airborne SATCOM System market. As the world continues to embrace satellite communication for various applications, the contributions of these regions will remain integral to the overall growth and development of the global Airborne SATCOM System market.

COMPETITIVE PLAYERS

In the ever-evolving landscape of communication technology, the Airborne SATCOM System has emerged as a critical player. This technology allows aircraft to establish reliable connections for voice and data communication, transforming the way aviation operates. Key players operating in the Airborne SATCOM System industry include L3Harris Technologies, Inc., Thales Group, and a host of other influential companies. These organizations have significantly shaped the trajectory of the airborne satellite communication market.

L3Harris Technologies, Inc., is a powerhouse in the aerospace and defense industry. They have brought their extensive expertise to the Airborne SATCOM System market, developing cutting-edge solutions for secure and seamless communication in aviation. Their commitment to innovation has made them a prominent player in this field.

Thales Group is another major contributor to the Airborne SATCOM System market. With a global presence and a strong focus on technological advancement, they have introduced high-performance SATCOM systems that cater to the unique needs of the aviation sector. Their solutions have set benchmarks for reliability and efficiency.

The involvement of these key players underscores the significance of the Airborne SATCOM System in modern aviation. Their contributions continue to drive the development of more advanced and efficient communication solutions, ensuring that aircraft can stay connected even in the most remote skies. This, in turn, enhances the safety and operational capabilities of the aviation industry, making it an indispensable component of our interconnected world.

Airborne SATCOM System Market Key Segments:

By Type

- SATCOM Terminals

- Transceivers

- Airborne Radio

- Modems and Routers

- SATCOM Radomes

- Other

By Application

- Government and Defense

- Commercial

Key Global Airborne SATCOM System Industry Players

- L3Harris Technologies, Inc.

- Thales Group

- Honeywell International Inc.

- Collins Aerospace

- Israel Aerospace Industries

- Cobham Aerospace Communications

- Gilat Satellite Networks

- General Dynamics Mission Systems, Inc.

- ASELSAN

- BAE Systems

- Hughes Network Systems, LLC.

- Viasat, Inc.

- Orbit Communications Systems Ltd.

- Smiths Interconnect, Inc.

- ST Engineering

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383