MARKET OVERVIEW

The global air valves market falls within the larger industrial components and fluid control systems sector, providing base functionality in wastewater management systems, water supply piping networks, and pressurized piping infrastructure. The market will remain a vital link in sustaining flow regulation, pressure control, and system component protection across many pipeline applications. As modernization of infrastructure is picking up speed in industrial and urban economies, air valve systems will have to provide enhanced efficiency, reliability, and safeguards against abrasive working conditions. Air valves are automatically operated equipment utilized for venting or allowing air during the filling, draining, or steady-state operation of a liquid pipeline system.

Their failure or absence frequently leads to negative pressure surges, pipe collapse, or energy loss. The global air valves market will be driven by growing demand for technologically advanced systems with multi-functionality and low-profile designs. Rather than relying on basic mechanical devices, the market will launch smart-enabled versions step-by-step that will be compatible with digital monitoring platforms and supervisory control systems. These versions will allow real-time sensing of pressure anomalies and trigger automatic adjustments, enabling more efficient pipeline control. The global air valves market shall not be restricted to solely public sector infrastructure projects. It will find a majority of its demand within industries like food and beverage, pharmaceuticals, chemical processing, mining, and thermal power generation.

In these industries, the air valve systems shall be able to work reliably while under the effect of corrosive or temperature-sensitive fluids. Manufacturers will answer to this call with the development of valves that draw on materials with chemical and thermal wear resistances, while retaining stability in performance with varying operating pressures.

Regarding regional strategies, the global air valves market will manifest itself differently. North America and Europe will remain focused on retrofitting existing systems with new air valve technology, particularly because governments require tighter control of fluid loss and pipeline integrity. Asian and Latin American nations, meanwhile, will need low-cost, scalable systems as they transition to deploy mega scale municipal systems and industrial parks.

These diverse requirements will propel the growth of modular arrangements and hybrid frameworks to address both technical requirements and economic factors. The global air valves market will also witness partnerships amongst market players, with original equipment manufacturers joining hands with digital solution providers to add software analytics to physical hardware. The outcome will be next-generation valve systems that will not only be able to execute mechanical functions but also diagnostic and predictive maintenance capabilities.

These capabilities will enable operational continuity, particularly in big pipeline systems where the shutdown results in huge economic costs. Ultimately, the global air valves market will continue to grow and increase its technologically driven presence, solving both operation issues and changing end-user needs. It will be a technology-driven business where the dynamic interaction between material science, fluid dynamics, and computer sophistication will dictate product specifications and operational standards for the next several years.

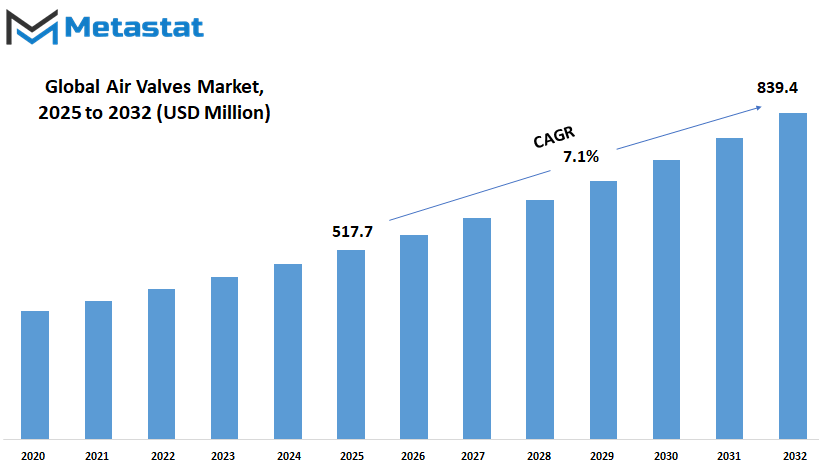

Global air valves market is estimated to reach $839.4 Million by 2032; growing at a CAGR of 7.1% from 2025 to 2032.

GROWTH FACTORS

The global air valves market is projected to grow consistently with the increase in system efficiency and performance awareness across industries. With industries persistently relying on long-term cost savings, demand for durable and reliable valve systems will rise. Such valves are imperative in sustaining air pressure and evacuating unwanted air in pipelines, facilitating enhanced life of overall systems. As more businesses are now investing in sophisticated infrastructure and automation, air valves are increasingly becoming a necessity, not an optional feature. This change will compel manufacturers to provide more streamlined and technologically flexible solutions in the near future. It is one of the primary drivers for the global air valves market to expand, as the demand for effective water and wastewater management systems continues to grow. Cities are growing, and so is the pressure to make better use of resources.

This demands answers that are in favor of safety, minimize wastage, and enhance control under all operating conditions. Air valves, as small but very effective devices, will be playing an ever-increasing role in assisting with pressure change management and flow disruption. Their role in helping to reduce energy loss and prolong equipment life is being valued increasingly. Such recognition is anticipated to maintain demand in the long run. Nevertheless, there are certain factors that can restrain the development of the global air valves market. One among those is the lack of understanding or awareness of the role that these valves have among smaller industry players. In the absence of clear knowledge about their benefits, many will fail to consider upgrading or installing high-performance air valve systems.

Another issue is the expense of new systems, which could be perceived as too expensive by low-budget companies. Such issues may hinder adoption in some regions or sectors. Conversely, the future seems full of promise. The shift to smart infrastructure and increasing interest in digital monitoring equipment will create new opportunities for air valve manufacturers. With systems increasingly more interconnected, there will be a big push to integrate elements that provide beyond functionality. Valves that can communicate data, identify potential issues ahead of time, and adjust automatically will be in greater demand.

This emphasis on brighter, self-adjusting systems would create rewarding prospects for the market in future years. Those companies which are ready to innovate and produce user-friendly, affordable products will be the drivers, making sure that the global air valves market continues to grow and is in tune with current trends.

MARKET SEGMENTATION

By Application

The global air valves market will grow consistently as industries and infrastructure requirements keep growing. Air valves are instrumental in ensuring the efficiency and safety of pipelines by releasing stuck air and avoiding vacuum conditions. In the coming years, with an increased demand for cleaner water and more environmentally friendly water management, the application of air valves will continue to increase. This will particularly be observed in networks such as irrigation, municipal water supply, mining, and wastewater treatment, where air flow control is crucial to the functioning of pipelines. In irrigation systems, air valves assist in regulating pressure within pipes so that water can flow without hitches and minimize the likelihood of pipe damage.

With changing climate conditions and the necessity for smart farming, the significance of efficient irrigation will increase. Agricultural workers and farmers will increasingly depend on technologies that provide water exactly where and when needed, without loss. Air valves will assist by preventing air lockages and pressure spikes in systems, making farms more efficient and productive. Municipal water supply systems and waterworks will also experience increasing demand for air valves. With increasing cities and old water infrastructure, there will be a demand for systems that can work well for long periods of time.

Air valves will assist in water distribution by maintaining balanced pressure, decreasing the usage of energy and minimizing maintenance. As cities implement smart water systems, air valve technology will probably be enhanced by sensors and monitoring equipment to enable quicker response to problems. In the mining process, air valves play a critical role in ensuring flow and safety within slurry and water pipes. These systems tend to be large and have challenging operating conditions. Air management in pipelines will be more critical than ever with the trend towards cleaner mining and optimal use of resources. Mining companies will be able to minimize delays and ensure safety with the use of trusted air valves.

The wastewater treatment facilities will also stand to gain. Air valves in these facilities lower the risk of pipe rupture and preserve flow. As environmental regulations become stricter and cities expand, facilities will have to process more water using less power. Effective air flow control through high-tech valves will be able to achieve this. Other industrial applications, such as those in energy production and food manufacturing, will also require improved control of air. With advancing technology, air valves will become more intelligent, compact, and dependable, quietly performing a vital role in big systems everywhere on earth.

By End Users

The global air valves market shall witness significant developments in the coming years, stimulated by increasing demand for improved fluid control across a broad array of industries. With increasing demand, the global air valves market is expected to see robust growth among various end users, such as the agriculture industry, municipal water authorities, the mining sector, industrial manufacturing, and other such related sectors. The function of air valves has been increasingly necessary as companies seek to enhance efficiency, eliminate maintenance issues, and shield systems from pressure damage. In agriculture, application of air valves will assist in effectively managing irrigation systems.

With agriculture embracing sophisticated systems for conserving water, air valves will play a critical role in preventing pipe malfunction and maintaining water flow. Their role in releasing entrapped air and permitting the ingress of air at system shutdown will become vital to the proper operation of modern farm equipment. Precision agriculture will make small issues in water supply create huge losses, so air valves will be regarded as an integral component of the installation. Water authorities of municipalities are likely to continue relying on air valves to serve city-wide water systems. With increased population and aging water infrastructure, cities will require stronger and more intelligent water systems.

Air valves will assist in ensuring pressure equilibrium in long water pipes, safeguard them against collapse, and enable smooth flow. As digital monitoring is increasingly recognized, air valves will be coupled with sensors to realize remote control and automatic reaction to pressure changes to assist cities in minimizing water loss and enhancing service. In mining, where fluids and water are transported long distances, air valves will be utilized to minimize pipeline stress. Mining activities need robust systems that can withstand challenging conditions, and air valves assist in prolonging the lifespan of such systems.

The urge for cleaner and safer mining will contribute to the more extensive use of improved fluid handling devices like air valves. Industrial manufacturing will also be a dominant consumer. As factories become increasingly automated, the demand for dependable components will increase. Air valves will decrease downtime by facilitating smoother operations. Other industries that use fluid systems, including food processing or energy production, will also have a consistent demand for air valves as they work to achieve higher standards of efficiency and safety. The global air valves market, driven by these shifting demands, is most likely to continue growing with a keen emphasis on innovation and long-term utilization.

By Sales Channel

The global air valves market will remain a significant part of numerous industries that use fluid control systems. Air valves are applied to control airflow, vent stowaway air, and prevent pipeline gurgling and other equipment malfunctioning. As industries pay more attention to efficiency and safety, the demand for air valves will expand steadily. Businesses will work towards enhancing the performance of these valves through improved material and more intelligent designs. As there is increased focus on automation and smart systems, air valves will be engineered to interface more effectively with sensors and monitoring equipment, allowing users to better maintain command over their systems. When considering the sales channel of the global air valves market, it is segmented into direct sales, distributors, online sales, and other sources.

The development of each channel will vary. Direct sales offer manufacturers greater leverage over their products and enable them to have more intimate relationships with purchasers. This can result in greater awareness of customers' needs and quicker responses to shifts in demand. Distributors, however, facilitate the products to reach more destinations. They will continue to be a vital element of the supply chain since they provide assistance and possess extensive networks. Selling over the internet is also anticipated to increase since more entrepreneurs and consumers move to online platforms. This channel will offer comprehensive product descriptions, instant comparisons, and the ability to order at any time.

It provides both small and big buyers with an easier means of accessing such products, particularly where they seek fast solutions. Online also provides sellers with an opportunity to collect feedback and adjust their products according to what is being said by buyers. Other forms, such as trade shows or direct access via service teams, will also assist awareness and sales, particularly in areas where direct access is restricted. In the days to come, the global air valves market will not be merely about selling more units but also smarter decisions. Customers will seek products that enable them to save energy, reduce maintenance expenses, and minimize downtime. Manufacturers of these valves will have to remain poised to meet such demands.

They will also have to plan ahead, following changes in environmental regulations and emerging technologies. All sales channels will play their part in helping the global air valves market grow, each one adjusting to changes and customer expectations in its own way.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$517.7 million |

|

Market Size by 2032 |

$839.4 Million |

|

Growth Rate from 2025 to 2032 |

7.1% |

|

Base Year |

2024 |

|

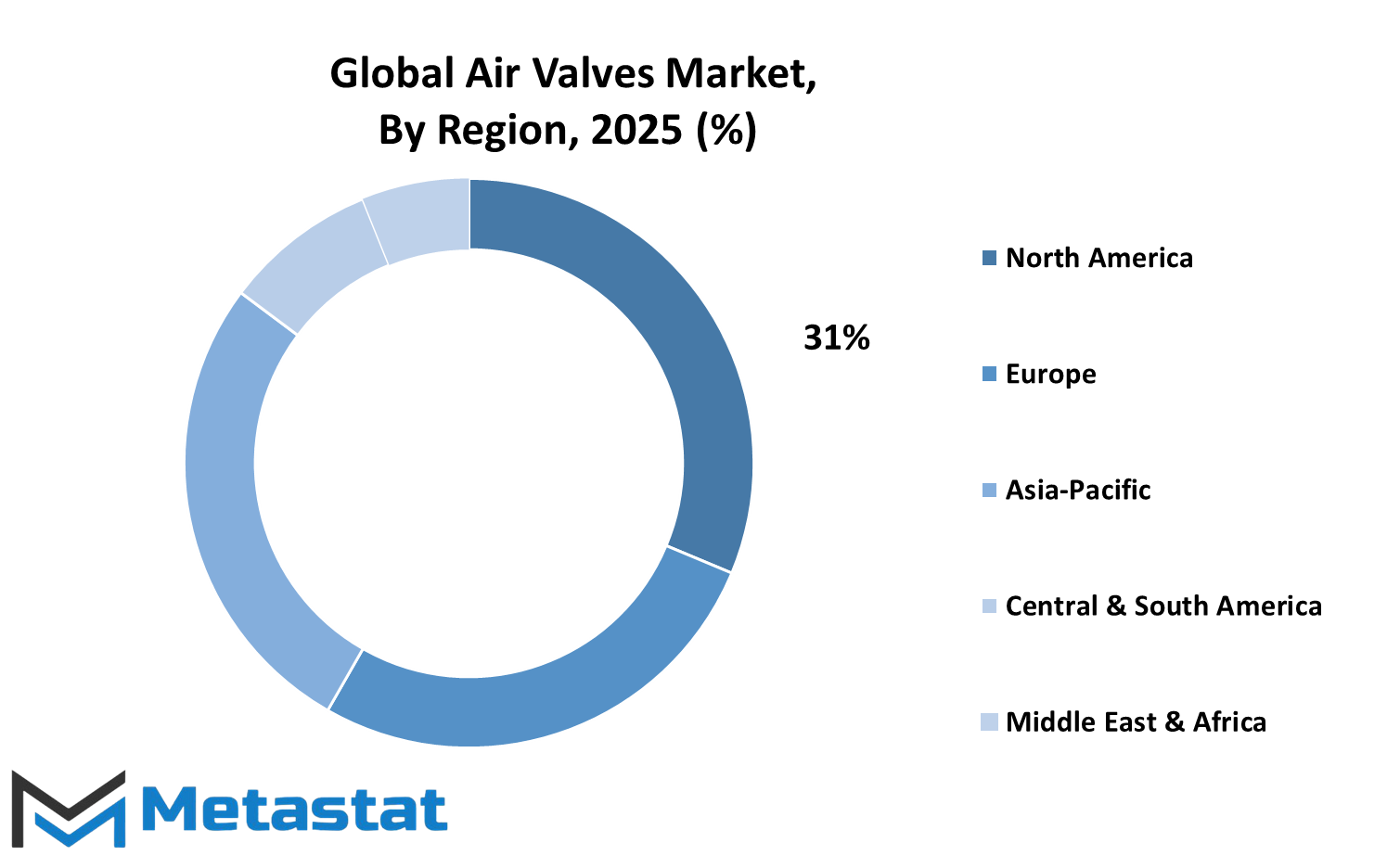

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global air valves market is slowly defining the future of industrial and infrastructure systems worldwide. With an increasing demand for reliable water and gas flow systems, air valves are increasingly becoming a critical element in the pursuit of safety and performance. These valves discharge air pockets and sustain pressure equilibrium within pipes, which prevents damage and saves maintenance expenses. As more focus is laid on sustainable development and new infrastructure, air valves are becoming increasingly significant not only in mass construction, but also in municipal water supply systems and public utilities. This trend is destined to consolidate over the years. From a global perspective, when considering the global air valves market, regional development takes center stage.

North America is witnessing robust investment in urban facelifts, especially in the United States, where smart city initiatives are gaining momentum. Canada and Mexico are also starting to embrace advanced flow systems, albeit at a bit slower pace. In Europe, nations such as Germany and the UK are emphasizing energy-saving systems, and this is driving the need for dependable valve solutions. France and Italy are also adding more to their infrastructure expenditure, which will create further market opportunities.

The Asia-Pacific region will emerge as one of the most dynamic growth contributors in the sector. China and India are quickly modernizing their cities and industrial systems. The drive towards improved public infrastructure and cleaner energy systems in these countries may increase demand for sophisticated air valve technology. Japan and South Korea, which are also known to be precision- and technology-driven, are looking at innovations that may redefine the industry. Other regions in Asia are now taking cues from this direction, particularly with international funding for large-scale development projects. South America has Brazil and Argentina leading the way in implementing more intelligent water management systems, and there is a potential for gradual growth in the global air valves market. Although the rate may vary compared to other markets, there is certainly a high possibility of steady growth.

The Middle East and Africa are also depicted with a bright future. GCC nations and Egypt and South Africa are concentrating on upgrading water distribution and sanitation networks, which will automatically fuel demand for air valves. With increasing demand for reliable infrastructure, the global air valves market will be pivotal to ensure growth and sustainability in these regions.

COMPETITIVE PLAYERS

The global air valves market will, in the future, experience a transformation wave driven by a combination of technological innovation and evolving needs across industries. Air valves, which are crucial for regulating pressure and avoiding air-related interference in water and wastewater systems, are becoming increasingly sophisticated as manufacturers aim to enhance efficiency and reliability. As increasing numbers of industries look to improve their infrastructure, particularly in water distribution and management, demand will increase for smarter and more resilient air valve solutions. This consistent interest will build even greater competition between manufacturers. Checking out the competitive market, a number of well-established brands are poised to drive this transition.

Brands such as AVK International A/S, VAG GmbH, and DeZURIK, Inc. have reputations for having been around for a long time and possessing technical knowledge. These companies should stand firm through embracing more intelligent technologies and providing solutions that are customized to meet the unique requirements of various markets. AVK International A/S, for instance, should continue emphasizing reliability and long-term worth, which many public utilities are attracted to. Meanwhile, more recent technologies available in products from companies like Aquestia, including ARI Flow, and Val-Matic Valve & Manufacturing Corporation point toward the direction of automation and digital monitoring. These features can revolutionize the utilization of air valves to adjust in real-time and to eliminate manual upkeep. Businesses offering solutions with inbuilt intelligent monitoring will likely be better off as industries transition to automated systems. Besides, companies like Hawle Beteiligungsgesellschaft m.b.H. and American Manufacturing Company, Inc. will likely remain competitive by making investments in product adaptation and regional customizing. As more regions have particular climate and resource conditions, flexible solutions will be more important than universal designs. Netafim Limited, for example, is positioned to tackle irrigation systems in agriculture, where there is a need for control of air pressure in pipelines.

Mueller Water Products, Inc., particularly from its Henry Pratt division, will also be a key player. Its proven history in water infrastructure positions it to take advantage of the natural trend toward more robust urban systems as demand grows. As concern over climate expands, dependable water systems will come to the forefront in city planning, prompting these firms to move forward with innovative and enduring valve technology.

The global air valves market will be defined by how effectively these businesses embrace new expectations. Those that innovate while being reliable will have a greater ability to dominate the market in the years to come.

Air Valves Market Key Segments:

By Application

- Irrigation Systems

- Waterworks (Municipal Water Supply)

- Mining Operations

- Wastewater Treatment

- Industrial Processes

- Others

By End Users

- Agriculture Sector

- Municipal Water Authorities

- Mining Industry

- Industrial Manufacturing

- Others

By Sales Channel

- Direct Sales

- Distributors

- Online Sales

Key Global Air Valves Industry Players

- AVK International A/S

- VAG GmbH

- DeZURIK, Inc.

- Aquestia (Includes ARI Flow)

- Val-Matic Valve & Manufacturing Corporation

- Hawle Beteiligungsgesellschaft m.b.H.

- American Manufacturing Company, Inc.

- Flomatic Corporation

- Netafim Limited

- Mueller Water Products, Inc. (Henry Pratt)

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252