Global Air Mattress and Beds Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global air mattress and beds market in its operations will expand to create increasing and more interest as it develops from modest beginnings to a complex consumer-focused setting. It has its origins in early inflatable bedding, which was largely used for temporary sleep arrangements and military applications. Something of a novelty initially, air mattresses soon became incorporated into homes during the mid-20th century as an alternative solution to standard bedding for travel or entertaining home guests. By the 1970s, the market saw increased use of more durable materials and more streamlined designs, which marked the first significant milestone in opening doors to wider household use.

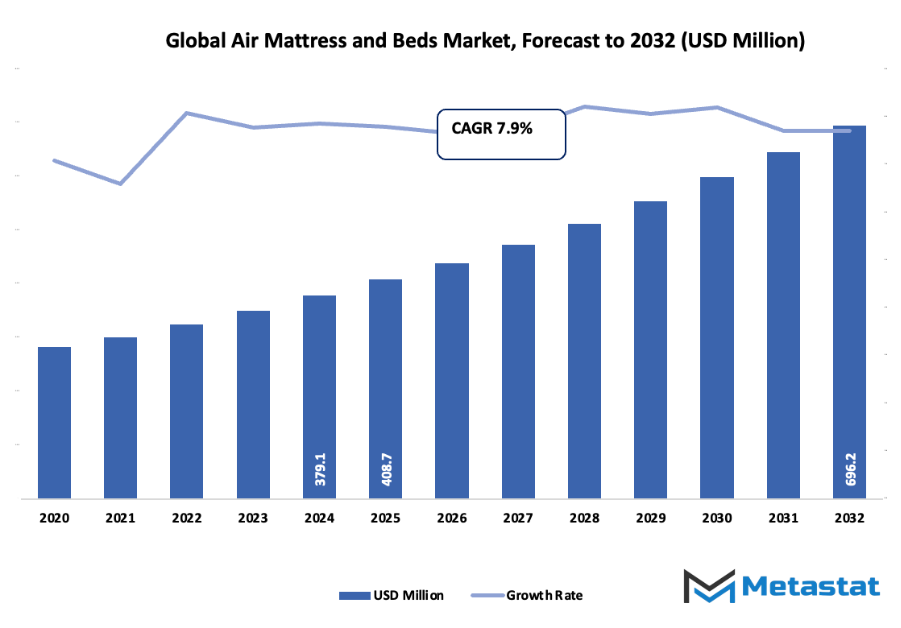

- Global air mattress and beds market value of approximately USD 408.7 million in 2025, rising at a CAGR of approximately 7.9% from 2032, with potential to reach beyond USD 696.2 million.

- Almost 58.7% market share is held by Air Mattresses, leading innovation and expanding applications through intense research.

- Key trends driving expansion: Expansion in Demand for Portable Solutions to Sleep, Expansion in Demand for Camping and Outdoor Sports

- Diversification into Medical and Healthcare Applications are the opportunities.

- Major insight: The market will expand exponentially in value in the coming decade, indicating high growth possibilities.

- Consumer preferences in the second half of the 20th century shifted towards convenience and comfort-oriented products.

The introduction of self-inflating technology and stronger synthetic materials revolutionized what was anticipated. It was also a period when on-line sales started taking off, allowing specialized producers to sell all around the world and create more customized products. Advances in air pump technology, two-chambered construction, and thermal-regulating materials continued to shape the evolution of air beds and mattresses, getting them from temporary setups to beds that can provide almost permanent comfort. The regulatory climate also had an impact on the market. Standards for materials and safety were becoming more stringent, ensuring products were fireproof, hypoallergenic, and chemical-free. It pushed manufacturers to be creative but at competitive prices while practicing responsible innovation. Environmental practice awareness among customers also began to influence design choices, bringing in ecologically friendly materials and packaging. Over the last few years, lifestyle changes will continue to redefine demand. Urban living areas with small space will drive the demand for foldable and multi-purpose air beds, whereas growing need for outdoor recreation and camping will drive demand for portable ones.

The use of smart technology, including apps to control firmness and track sleep quality, will become the norm. These trends are most likely to give rise to test-and-innovate hybrids that merge the conventional mattress characteristics with air-based adjustability, yielding a more tailored sleeping experience for an array of diverse users. The international air bed and mattress industry will remain to be in a market which is defined by innovation, shifting expectations, and engaged consumers, founded on a heritage which has seen it develop from humble inflatables to one of sophisticated, dynamic sleeping solutions.

Market Segments

The global air mattress and beds market is mainly classified based on Type, Products, Application

By Type is further segmented into:

- Air Mattresses: The air mattress industry will grow as comfort and mobility become major factors in sleeping solutions. Inflatable lightweight models, ease of use, and quick inflation will be the drivers of consumer demand. Air mattresses will find wider acceptance in temporary residences and recreational settings, offering easy solutions for short-term needs.

- Air Beds: Air beds will grow more popular due to advanced durability, firmness adjustability, and rising availability in increased sizes. Increasing demand in homes and business facilities will fuel innovation with material and inflation technology. Convenient storage and transport will turn air beds into the go-to choice of consumers seeking convenient sleeping solutions

By Products the market is divided into:

- Twin: Twin-sized furniture will remain attractive for minimal spaces, guest rooms, and children's use. Upcoming designs will try to optimize comfort without occupying much space. Greater popularity of city lifestyles and small homes will boost demand for twin air mattresses and beds and render them a low-cost option for utilitarian and short-term sleeping accommodations.

- Full: Full-size options will keep increasing steadily since they balance between comfort and space utilization. Products will adapt to meet changing consumer needs for durability, material, and ease of setup. The full size will appeal to homes requiring sturdy sleeping solutions without compromising on affordability and flexibility in design.

- Queen: Queen beds will be the market leader in terms of comfort, spaciousness, and adaptability. New technologies will offer better air distribution and stability to accommodate heavier users. Queen products will become the standard for much of the population, with simplicity of use, support, and modern features combining to meet the requirements of diverse consumer preferences.

- King: King-size models will expand as high-end solutions for maximum comfort and luxury. Future designs will highlight the ability to support higher weights, enhance sleeping quality, and provide high-end adjustability. Consumer demand from families in search of high-end sleeping solutions and business accommodations will cause king-size air beds and mattresses to rise in popularity.

- Others: Other sizes and types will find niche uses, including travel designs and specialty sizes. Products will be framed in terms of portability, new functionality, and installation ease. Design flexibility will allow the market to respond to specialized customer requirements beyond standard sizes, propelling total market expansion.

By Application the market is further divided into:

- Commercial: Commercial applications will expand as medical facilities, rental properties, and hotels adopt air beds and mattresses. Low maintenance, quick setup, and durability will be leading drivers. Top-of-the-line models will handle high-frequency usage while being comfortable, allowing businesses to optimize operational efficiency and customer satisfaction in sleeping solutions.

- Home: Home use will continue to be the focus, with households seeking budget-friendly, versatile, and handy sleeping solutions. Air beds and mattresses will address temporary or guest accommodation needs, with comfort, portability, and usability over a longer period of time as the prime design factors. Product development will be determined by shifting consumer demands in terms of making products appropriate for everyday home usage.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$408.7 Million |

|

Market Size by 2032 |

$696.2 Million |

|

Growth Rate from 2025 to 2032 |

7.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

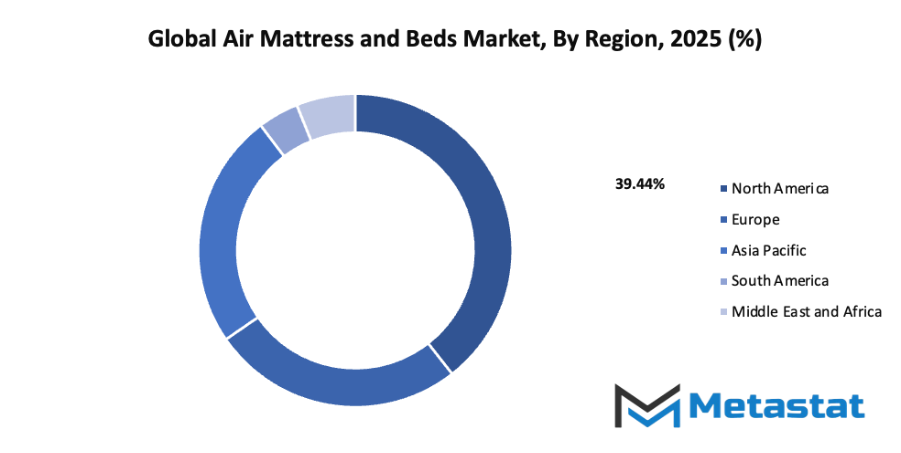

- Based on geography, the global air mattress and beds market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing Demand for Portable Sleeping Solutions: The global air mattress and beds market will benefit from the rising need for portable sleeping options. Urban living with limited space will push consumers to choose products that are easy to move and store. The portability of these beds will meet both short-term and temporary sleeping requirements efficiently.

- Rising Interest in Camping and Outdoor Activities: The global air mattress and beds market will see growth as more people engage in outdoor recreation. Camping, hiking, and other outdoor activities require convenient and comfortable sleeping arrangements. Lightweight and compact air mattresses will support a more enjoyable experience, boosting their popularity among outdoor enthusiasts.

Challenges and Opportunities

- Durability and Longevity Concerns Compared to Traditional Mattresses: The global air mattress and beds market faces concerns over product durability. Air mattresses may not last as long as traditional mattresses, leading to hesitancy among buyers. Manufacturers will need to improve materials and designs to build consumer confidence and ensure that longevity matches expectations.

- Potential for Air Leakage and Deflation Issues: The global air mattress and beds market must tackle the problem of air leakage and deflation. Customers may experience discomfort if the mattress loses air quickly, which can affect reputation. Solutions like reinforced seams and advanced valves will help address these issues, making products more reliable.

Opportunities

- Expansion into Medical and Healthcare Applications: The global air mattress and beds market has significant potential to expand. Opportunities exist in medical and healthcare applications where adjustable support and pressure relief are essential. Customizable air beds for hospitals and patient care will open new market avenues, driving growth and enhancing the overall market presence.

Competitive Landscape & Strategic Insights

The global air mattress and beds industry is a mix of both international industry leaders and emerging regional competitors. The market will continue to grow as consumer demand for portable, comfortable, and easy-to-use bedding solutions increases. Important competitors include Intex Recreation Corp., Coleman Company, Inc., AeroBed (Newell Brands), SoundAsleep Products, Drive DeVilbiss Sidhil Ltd., Insta-Bed, WENZEL Group, Simon’s, Serta Simmons Bedding, LLC, ALPS Mountaineering, Bestway Global Holdings Inc., Naulakha Industries, Klymit, and Exxel Outdoors. These companies will continue to innovate, offering products that are lighter, more durable, and equipped with advanced features such as built-in pumps and ergonomic designs.

The future of the market will be influenced by shifting consumer lifestyles, including an increase in outdoor recreational activities and the growing need for temporary bedding solutions in urban spaces. Companies will adopt new materials and technologies to enhance comfort, portability, and longevity of products. Regional competitors will emerge by offering cost-effective options that appeal to local markets while international brands will strengthen their presence through global distribution networks and brand recognition.

Sustainability will also play a significant role in shaping the industry. Manufacturers will focus on eco-friendly materials and energy-efficient production processes to meet evolving consumer expectations. Technological integration, such as smart air mattresses that adjust firmness automatically, will gradually become more common, giving companies a competitive advantage. Collaborations and strategic partnerships among manufacturers, retailers, and online platforms will expand market reach, providing consumers with more convenient access to these products.

Market size is forecast to rise from USD 408.7 million in 2025 to over USD 696.2 million by 2032. Air Mattress and Beds will maintain dominance but face growing competition from emerging formats.

Overall, the global air mattress and beds market will continue to grow and adapt, balancing innovation with affordability. Both established leaders and emerging competitors will shape the industry, ensuring that a wide range of products is available to meet consumer needs in the years to come.

Report Coverage

This research report categorizes the global air mattress and beds market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global air mattress and beds market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global air mattress and beds market.

Air Mattress and Beds Market Key Segments:

By Type

- Air Mattresses

- Air Beds

By Products

- Twin

- Full

- Queen

- King

- Others

By Application

- Commercial

- Household

Key Global Air Mattress and Beds Industry Players

- Intex Recreation Corp.

- Coleman Company, Inc.

- AeroBed (Newell Brands)

- SoundAsleep Products

- Drive DeVilbiss Sidhil Ltd.

- Insta-Bed

- WENZEL Group

- Simon’s

- Serta Simmons Bedding, LLC

- ALPS Mountaineering

- Bestway Global Holdings Inc.

- Naulakha Industries

- Klymit

- Exxel Outdoors

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252