Global Ablation Devices Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

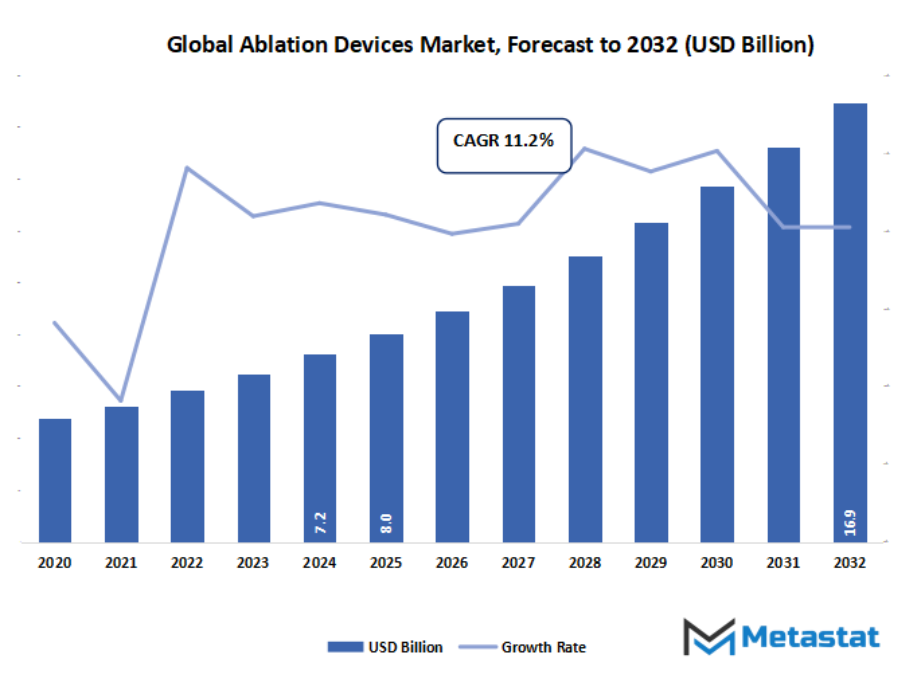

- The global ablation devices market valued at approximately USD 8 Billion in 2025, growing at a CAGR of around 11.2% through 2032, with potential to exceed USD 16.9 Billion.

- Thermal Ablation account for a market share of 65.3% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising prevalence of cancer, cardiac arrhythmias, and chronic pain conditions., Growing adoption of minimally invasive procedures with shorter recovery times.

- Opportunities include: Increasing innovation in image-guided, robotic-assisted, and multi-energy ablation systems.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

In the future, the global ablation devices market will continue to push beyond the boundaries of its current industry, as new ideas and expectations shape how medical tools will be designed, delivered, and understood. Instead of being confined to basic notions of treatment, the market will step into a space where technology, human need, and long-term clinical thinking come together in more thoughtful ways. What once looked like a rather straightforward business surrounding thermal or energy-based tools will slowly turn into a field marked by precision, adaptability, and deeper understanding of patient outcomes.

As time goes on, future products won't be evaluated based solely on how effectively they take out unwanted tissue; instead, they will be judged by just how naturally they're going to fit into a much wider healthcare system. Most likely, the engineers and clinicians will be working side by side in building such devices that can communicate most clearly with the diagnostic platforms, helping doctors to make quicker and more confident decisions. Hospitals will begin viewing ablation tools not in isolation from other equipment but as part of a larger treatment path to which each step should support the subsequent one.

Market Segmentation Analysis

The global ablation devices market is mainly classified based on Technology, Function, Application, Procedure.

By Technology is further segmented into:

- Thermal Ablation

Within the global ablation devices market, thermal ablation will continue toward finer precision, enabling controlled energy delivery for wider clinical use. Advancements will support safer tissue targeting, reduced recovery time, and higher accuracy, encouraging steady acceptance across medical settings as treatment needs expand in the future.

- Non-Thermal Ablation

Non-thermal ablation in the global ablation devices market will gain traction as demand strengthens for minimal tissue damage. Future systems shall have a common focus on improved energy control, enhanced imaging support, and settings adaptable for sensitive procedures, creating broader paths for clinical adoption across complex conditions requiring gentle yet effective intervention.

By Function the market is divided into:

- Automated/Robotic

Automated and robotic solutions in the global ablation devices market will lean toward refined navigation, adaptive response systems, and real-time accuracy. Growing investment in intelligent systems will shape a future where procedures are done with greater stability to enable healthcare facilities to aim for consistent outcomes with shortened operation times.

- Conventional

Conventional systems in the global ablation devices market will continue to hold value due to flexibility, cost-effectiveness, and ease of integration. Future upgrades will be supportive of improved ergonomics, wider energy compatibility, and smoother workflow alignment, which would assure its dependable use in facilities that adopt step-by-step technology transitions.

By Application the market is further divided into:

- Cancer

Cancer-related applications in the global ablation devices market will trend toward tools that facilitate targeted tissue removal with minimal disruption. Innovation ahead will be directed to integrating imaging guidance, controlled energy levels, and adaptive device structures to enable medical teams to approach tumors with higher confidence and improved comfort for patients.

- Cardiovascular

The cardiovascular use of the global ablation devices market may be bolstered with better mapping structures, more advantageous catheter designs, and optimized energy pathways. Future techniques will facilitate higher accuracies in rhythm management and vessel-associated treatments, allowing clinicians to deal with even the most complex instances with minimized procedural dangers.

- Ophthalmology

The ophthalmology programs within the global ablation devices market are probable to shift to extremely-specific systems that guard delicate tissues. Future improvements will assist controlled energy launch and progressed visualization, permitting eye-associated corrections with stability and reduced healing time.

- Gynecology

The section of gynecology in the global ablation devices market will shift toward patient-friendly structures that facilitate treatment for a number conditions. New gear will attention on shorter process instances, more desirable consolation, and targeted remedy alternatives that can facilitate simpler integration into outpatient settings.

- Urology

Urology applications will see increased growth in the global ablation devices market as more devices are designed for higher accuracy and better flow control during treatment. Future emphasis will lie in improved fiber designs, adaptable wavelengths, and optimized handling to support precise tissue management.

- Orthopedics

The orthopedic utilization of the global ablation devices market will move toward systems that can treat bone and soft-tissue problems more effectively. Designs in the future will support controlled heating or non-thermal action to achieve improved structural correction along with pain management.

- Others

The other applications in the global ablation devices market will grow through the use of multi-use devices that adapt to different clinical needs. Upcoming tools also provide flexibility, ease of manipulation, and compatibility with several imaging platforms; this will enable any medical center to widen services offered.

By Procedure the global ablation devices market is divided as:

- Aesthetics-Skin Rejuvenation and Tightening Aesthetic

Procedures in the global ablation devices market will be pushed to refine energy delivery for smooth skin, improved texture, and reduced downtime. Future systems will emphasize non-invasive comfort and flexible settings suitable for different skin types.

- Benign Prostatic Hyperplasia

Treatment of Benign Prostatic Hyperplasia by the global ablation devices market will be increasingly effective, with better targeting and less postoperative impact. Newer devices will balance the need for controlled tissue removal against increased patient comfort.

- Transurethral Needle Ablation

Transurethral Needle Ablation in the global ablation devices market will be further enhanced with sophisticated temperature control, advanced needle design, and adjustable therapy depth to achieve predictable results.

- Laser and Other Energy-Based Therapies/Holmium Laser Ablation/Enucleation of the Prostate

The laser-based approach in the global ablation devices market will see growth with enhanced beam stability, refined energy dispersion, and better fiber durability to help clinicians manage prostate-related conditions with more ease.

- Stress Urinary Incontinence

Stress Urinary Incontinence treatment backed by the global ablation devices market will be advanced by devices offering steady energy control and gentle tissue interaction, thus allowing faster recovery pathways.

- Uterine Fibroids

Uterine Fibroid procedures in the global ablation devices market will trend toward focused therapy options that limit surrounding tissue damage. Future systems will encourage comfort with minimally invasive procedures and greater predictability of treatment.

- Varicose Veins

The global ablation devices market varicose veins procedures will continue to move toward heat-controlled, faster treatments that are designed to minimize discomfort and yield better long-term vessel stability.

- Atrial Fibrillation

Advanced mapping, stable catheter control, and energy uniformity will benefit the management of Atrial Fibrillation in the global ablation devices market, enabling specialists to target sources of arrhythmia with improved precision.

- Tumor Ablation

Tumor ablation will continue to shift, supported by the global ablation devices market, towards tools designed for higher accuracy, predictable energy output, and flexible access routes suitable for sensitive locations.

- Others

Other procedures in the global ablation devices market will reflect growing interest in adaptable, multi-functional systems. The tools of the future will support smoother integration into hospital workflows and align with expanding therapeutic needs.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$8 Billion |

|

Market Size by 2032 |

$16.9 Billion |

|

Growth Rate from 2025 to 2032 |

11.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

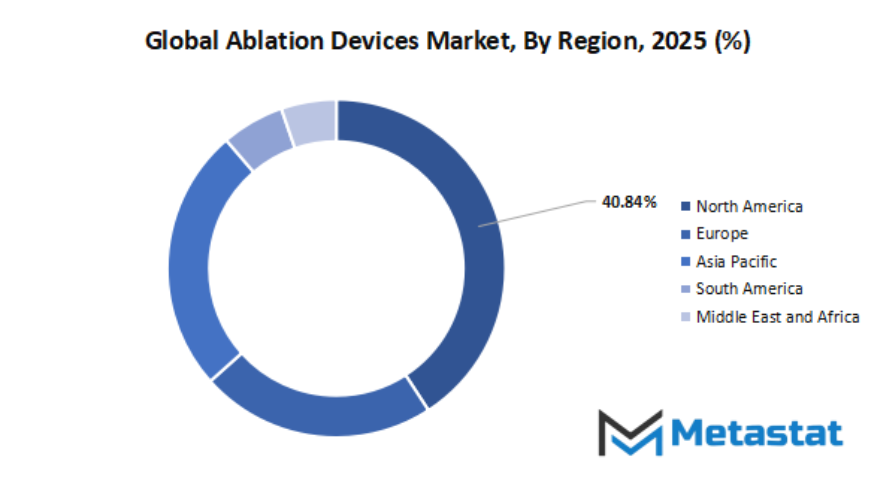

By Region:

- Based on geography, the global ablation devices market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Market Dynamics

Growth Drivers:

Increasing prevalence of cancer, cardiac arrhythmias, and chronic pain conditions.

Increasing medical cases related to tumors, irregular coronary heart rhythms, and chronic pain will power remedy desires in the global ablation devices market. Healthcare settings will seek out targeted energy solutions that support controlled tissue treatment by helping specialists manage conditions requiring timely care and less physically demanding interventions.

Growing adoption of minimally invasive procedures that have shorter recovery times.

Preferences for gentle treatment options are going to increase as both patients and medical teams seek methods that reduce physical stress and downtime. Demand is definitely moving toward approaches that allow for small incisions, precise action, and quick return to everyday activities, strengthening the position of the global ablation devices market in modern medical care.

Restraints & Challenges:

High fees of the gadgets and strategies restriction accessibility in developing regions.

Advanced structures frequently require a huge financial investment, developing boundaries for hospitals in low-resource settings. Small budgets will considerably slow down the price of adoption and widen era gaps, restricting get entry to trendy ablation tools, so as to effect well timed remedy for patients who should gain from more moderen strategies.

Tissue damage and procedural complications continue to be dangers during ablation therapy.

Energy-primarily based remedies convey the danger of unintended tissue effect. These should raise challenge many of the clinical teams and patients. Specialists will continue seeking safer tools that allow careful control of heat or energy spread, as reducing procedural risks will remain a key factor for wide diffusion and safer therapeutic outcome.

Opportunities:

Increasing innovation in image-guided, robotic-assisted, and multi-energy ablation systems.

Future growth will be enabled by tools offering real-time visuals, fine robotic movement, and flexible energy use. Such advancements in technology would enable specialists to conduct treatments with stronger accuracy and confidence, thus creating new frontiers in the global ablation devices market due to improved safety, efficiency, and procedural success.

Competitive Landscape & Strategic Insights

The huge mix of properly-hooked up brands and growing local participants has fashioned the character of the global ablation devices market, with every contributing a one-of-a-kind energy to the enterprise. This blend shall keep to influence how technology will progress, how remedy choices will enlarge, and how hospitals and clinics will adopt new equipment for better effects. The presence of both lengthy-standing leaders and rapid-developing innovators creates consistent motion inside the region, permitting fresh thoughts to attain medical specialists the world over.

International players like Abbott Laboratories, Alcon Inc., AngioDynamics, Bausch + Lomb, Johnson & Johnson Biosense Webster, Inc., EDAP TMS S.A. Focal One, Elekta AB, Avanos Medical, Inc., Medtronic, Olympus Corporation, Varian Medical Systems Inc., and Accuray Incorporated have performed a huge position in product design, remedy precision, and usual fine requirements. These companies will continue to invest in the refining of devices that will support physicians in treating various states of health. Their presence in most parts of the world helps advanced solutions reach a greater number of treatment centers, thus setting a high bar for others that will enter the space.

Along with these global names, several specialized companies bring meaningful progress to the global ablation devices market. Brands inclusive of Becton Dickinson (BD), Hologic, Inc., Integra Lifesciences Holdings Corporation, Japan Lifeline Co., Ltd., Merit Medical Systems, Inc., Stryker Corporation, Terumo Corporation, AtriCure, Inc., Boston Scientific Corporation, CONMED Corporation, Creo Medical Ltd., and Smith & Nephew % are usually looking for new ways to similarly support the performance and protection of ablation procedures. Their involvement ensures consistent motion toward better accuracy, improved affected person comfort, and wider treatment accessibility.

This close interaction between powerful international groups and agile regional players will guide the future of the global ablation devices market. With each company bringing in ideas that support advanced care, the market will grow in a direction that encourages medical professionals to rely on tools that offer better control, cleaner outcomes, and greater reliability. This joint effort will allow ablation technology to reach more patients while promoting long-term improvement in the standards of medical treatment across many countries.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 8 Billion in 2025 to over USD 16.9 Billion by 2032. Ablation Devices will maintain dominance but face growing competition from emerging formats.

This market's movement, beyond its existing scope, will shape the expectations of practitioners in their search for devices offering cleaner, lighter structures, and more ease during procedures. As training methods become increasingly advanced, younger professionals will also expect tools that match their comfort with digital interfaces and real-time guidance. In view of this shift, manufacturers will rethink how an ablation device should feel, respond, and behave during actual use.

Report Coverage

This research report categorizes the Ablation Devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Ablation Devices market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Ablation Devices market.

Ablation Devices Market Key Segments:

By Technology

- Thermal Ablation

- Non-Thermal Ablation

By Function

- Automated/Robotic

- Conventional

By Application

- Cancer

- Cardiovascular

- Ophthalmology

- Gynecology

- Urology

- Orthopedics

- Others

By Procedure

- Aesthetics-Skin Rejuvenation and Tightening

- Benign Prostatic Hyperplasia

- Transurethral Needle Ablation

- Laser and Other Energy-Based Therapies/Holmium Laser Ablation/Enucleation of the Prostate

- Stress Urinary Incontinence

- Uterine Fibroids

- Varicose Veins

- Atrial Fibrillation

- Tumor Ablation

- Others

Key Global Ablation Devices Industry Players

- Abbott Laboratories

- Alcon Inc.

- AngioDynamics

- Bausch + Lomb

- Johnson & Johnson (Biosense Webster, Inc.)

- EDAP TMS S.A. (Focal One)

- Elekta AB

- Avanos Medical, Inc.

- Medtronic plc

- Olympus Corporation

- Varian Medical Systems Inc.

- Accuray Incorporated

- Becton Dickinson (BD)

- Hologic, Inc.

- Integra Lifesciences Holdings Corporation

- Japan Lifeline Co., Ltd.

- Merit Medical Systems, Inc.

- Stryker Corporation

- Terumo Corporation

- AtriCure, Inc.

- Boston Scientific Corporation

- CONMED Corporation

- Creo Medical Ltd.

- Smith & Nephew plc

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383