Global Isoparaffin Solvents Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

How will the global isoparaffin solvents market adapt to the developing call for for eco-friendly and excessive-overall performance solvents amid tightening environmental regulations? Could the emergence of sustainable options disrupt conventional production and deliver chains inside this industry? And as industries like cosmetics, paints, and prescribed drugs evolve, will innovation in isoparaffin formulations unlock new avenues for marketplace expansion or reveal unforeseen challenges?

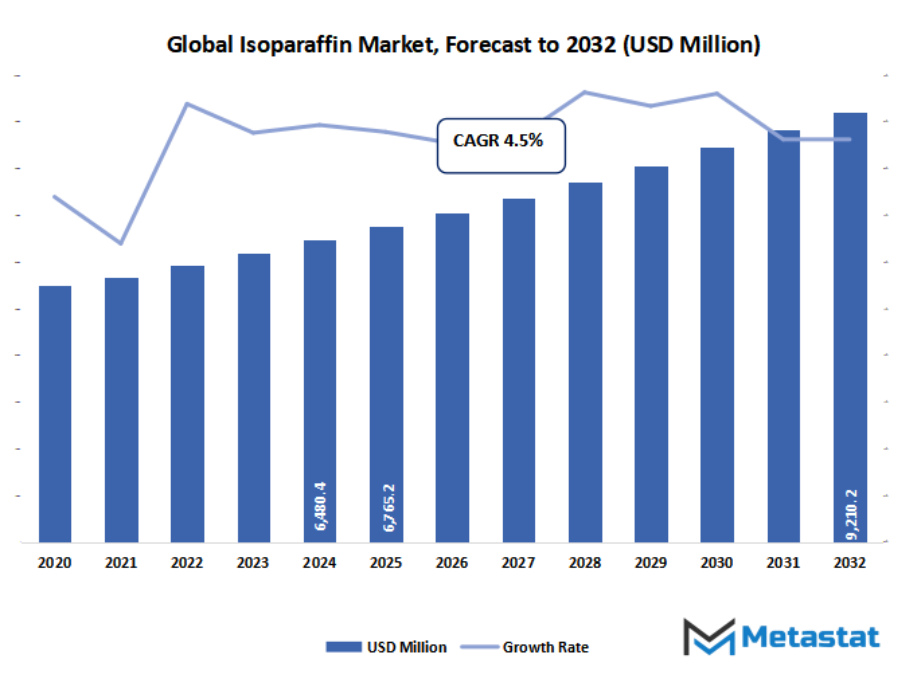

- The global isoparaffin solvents market valued at approximately USD 6765.2 million in 2025, growing at a CAGR of around 4.5% through 2032, with potential to exceed USD 9210.2 million.

- C8 account for nearly 29.9% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Growing demand for low-odor, high-performance solvents in paints and coatings industries., Rising use in personal care and cosmetics due to safe and stable formulation properties.

- Opportunities include Expanding applications in green cleaning and low-VOC formulations driving future growth.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

As such, the Global Floor Screeds Market will redefine how subfloor solutions are specified and applied in projects pertaining to both commercial and residential categories. Performance, durability, and ease of installation will be prioritized by engineers and project managers alike, thereby evolving existing specification practices and procurement decisions for good. With advances in materials technological know-how and an increasing number of complex site constraints, the emergence of mixes and delivery structures from producers will facilitate a reduction in on-web page hard work, remedy times, and variability, thereby permitting contractors to satisfy tighter schedules without sacrificing lengthy-time period performance.

Innovation will increase from mix design into logistics and schooling: suppliers will installation virtual ordering systems, just-in-time shipping, and licensed installer networks so that projects will see fewer scheduling dangers and assurance disputes. Sustainability standards will pressure components choices, encouraging recycled aggregates, low-carbon binders, and curing techniques that conserve water; lifecycle assessments will steer customers to the ones merchandise whose manufacturing indicates lower embodied effect without sacrificing durability or end high-quality. Performance testing becomes more obvious, with traceable best statistics accompanying batches from plant to slab.

Geographic Dynamics

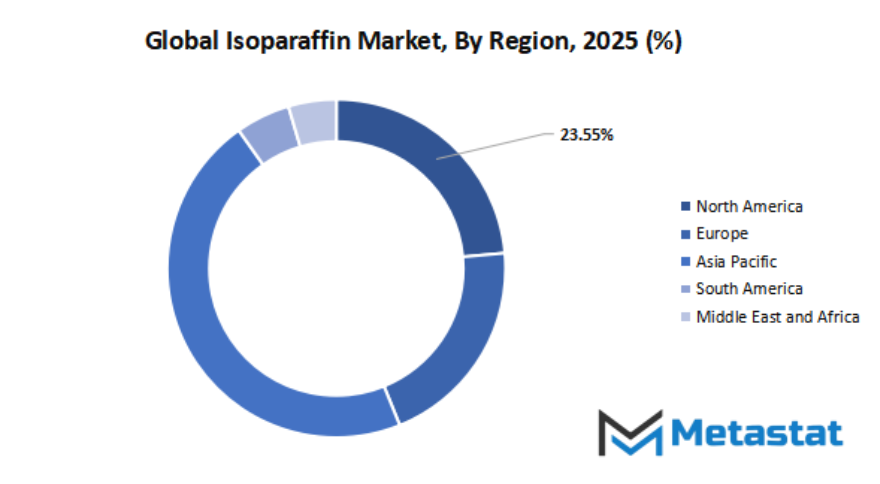

Based on geography, the global isoparaffin solvents market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Market Segmentation Analysis

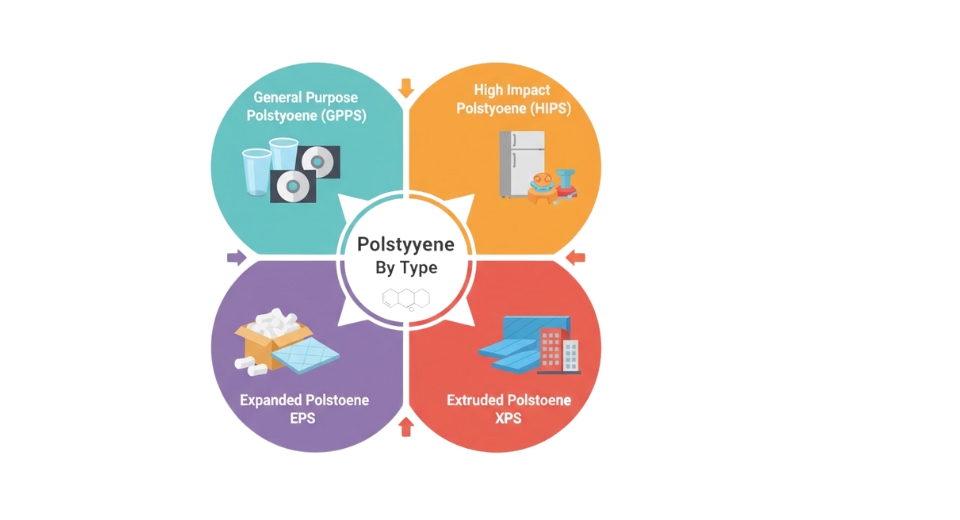

The global isoparaffin solvents market is mainly classified based on Type, Application.

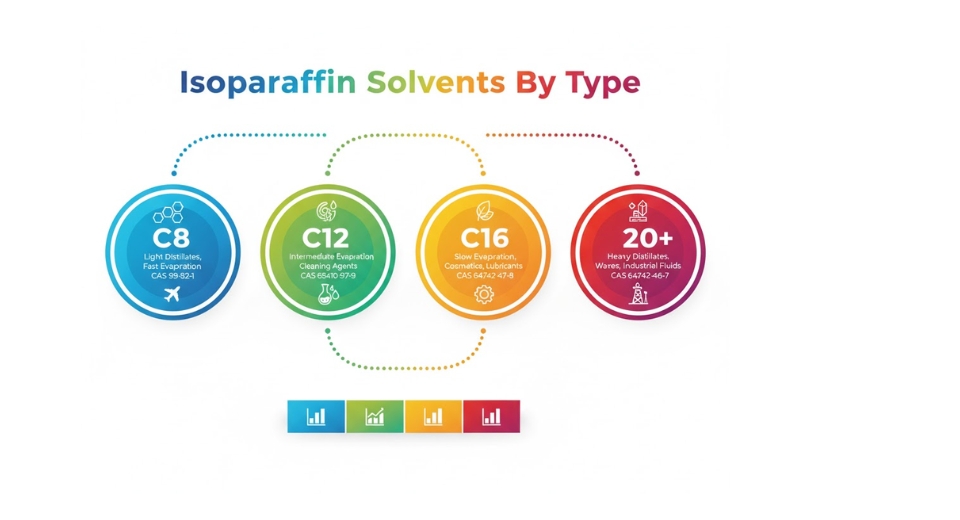

By Type is further segmented into:

- C8

The C8 category of the global isoparaffin solvents market will stay within the limelight for its incomparable characteristics of solvency and quick evaporation. The demand for C8-based totally solvents will growth with industries moving in the direction of cleaner and greater green chemical alternatives. With ongoing research aiming at sustainability, it is likely that, in the close to destiny, C8 will play an important position inside the attainment of low-emission and eco-friendly industrial approaches.

- C12

In the global isoparaffin solvents market, C12 will see exceptional boom due to its balanced contribution to performance concerning viscosity, stability, and safety. This phase will discover significant applications in approaches that require managed drying and low smell. Steady advancement in system technology will further solidify the position of C12 in the ones industries wherein longevity within the overall performance of the products and consistency in first-rate effects are paramount.

- C16

The global isoparaffin solvents market for C16 will forge ahead while maximum industries begin to adopt advanced materials to achieve higher operational performance. Having a less speedy evaporation rate and considering its ability to be mixed with numerous formulations, C16 can be used as a reliable option in packages requiring sturdiness and resistance. Growing interest in high-performance substances will preserve to push the increasing significance of C16-primarily based solvents in the production industry.

- C20

C20, with its very high purity and stability over an extensive temperature variety, will entice investment inside the global isoparaffin solvents market. The phase is predicted to peer consistent adoption in industries consisting of paints and coatings that require long-lasting formulations with low surroundings. Future product developments are expected to aim at enhancing biodegradability, ensuring that C20 products continue to meet changing environmental standards.

By Application the market is divided into:

- Paints and Coatings

The global isoparaffin solvents market is going to see endured use in paints and coatings because of the solvent's enhancement of texture, gloss, and simplicity of software. The demand will be driven by way of eco-aware innovations with the regular upward thrust in creation and automotive activities. Trends within the destiny will consciousness on water-primarily based and low-VOC coatings that hold performance whilst assembly environmental goals.

- Metalworking

Metalworking may be considered one of the prominent sectors in the global isoparaffin solvents marketplace due to its homes which are powerful in lubrication, cleaning, and cooling. With continuous development concerning machinery and automation, the call for for steadfast solvent solutions will upward thrust in addition. In the future, high-purity solvents that goal at improving performance but lowering fitness and environmental dangers may be developed.

- Agrochemical Formulation

The global isoparaffin solvents market will discover regular utilization in agrochemical formula due to the solvent’s capacity to enhance product balance and alertness uniformity. With developing worries approximately sustainable agriculture, destiny tendencies will emphasize bio-primarily based solvent improvement. This method will make sure environmental protection with out sacrificing the effectiveness of present day agrochemical answers.

- Polymers

The production of polymers inside the global isoparaffin solvents market will be enabled through the solvent's high-quality compatibility with synthetic materials. C8, C12, and C16 sorts will, consequently, be essential to decorate the uniformity of blending and to provide greater flexibility. Future improvement will recognition on incorporating greener solvents that preserve the best of the polymer whilst facilitating power-efficient manufacturing.

- Cleaning

The global isoparaffin solvents market will see robust call for inside the cleansing zone because of its excessive solvency energy and coffee toxicity. Industrial and family cleansing programs will more and more select the usage of those sorts of solvents for safety and performance. More improvements inside the destiny can be directed in the direction of biodegradable cleaning dealers so as to pass hand-in-hand with worldwide environmental rules.

- Personal Care

The global isoparaffin solvents market in non-public care will an increasing number of upward push as patron tendencies shift closer to mild and pores and skin-pleasant components. They will keep to play an imperative function in cosmetics and skin care components for preserving texture, consistency, and balance of diverse products. Development inside the destiny will focus on safe, non-traumatic, and environmentally accountable solvent options for non-public care industries.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$6765.2 Million |

|

Market Size by 2032 |

$9210.2 Million |

|

Growth Rate from 2025 to 2032 |

4.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Competitive Landscape & Strategic Insights

The global isoparaffin solvents market presented by Metastat Insight is dynamic and competitive, with international giants as well as regional players. It finds broad applications across paints and coatings, cosmetics, metalworking, cleaning, and adhesives owing to its low odor, controlled evaporation rate, and very good solvent properties. Over time, high-purity, environmentally safer solvents have been in demand, thereby persuading manufacturers to focus on innovation and sustainable methods of production. With the world's industries moving toward greener and more efficient chemical formulations, the application of isoparaffin solvents is expected to see a steady rise both in developed and developing economies.

A few leading companies have a strong global foothold and significantly affect the market. This includes companies like Braskem S.A., Calumet Specialty Products Partners, Cepsa Química, Chevron Phillips Chemical Company, DHC Solvent Chemie GmbH, and Dow Chemical Company. The players are funding research and development to improve product quality and reduce environmental hazards. These companies are working to meet the shifting industrial requirements. Because performance consistency and adherence to regulations are the two most crucial factors in the market, such technological advancements coupled with extensive distribution networks have helped the players maintain their competitive edge.

Meanwhile, regional competitors are making their presence felt by offering affordable alternatives and providing for localized industrial needs. Companies like Mehta Petro Refineries Ltd., Luan Group, and Petrochem Carless Ltd. contribute to market diversity by supplying regional demand with different specialized grades of isoparaffin solvents. This opposition has pushed innovation and charge flexibility, making them extra available to small- and medium-scale industries using those raw materials for diverse packages.

Globally renowned organizations which include Exxon Mobil Corporation, LyondellBasell Industries, Royal Dutch Shell percent, Sasol Limited, and TotalEnergies SE have additionally consolidated their marketplace position with strategic expansions, partnerships, and sustainability-related tasks. They are integrating superior refining and purification technology to enhance efficiency whilst bringing down carbon emissions associated with the production of solvents. Moreover, agencies including SK Global Chemical Co., Ltd, Idemitsu Kosan Co. Ltd, and Neste Oyj are adopting feedstock from renewable assets for the manufacturing of environmentally friendly solvent variants to align themselves with the worldwide push towards cleanser business answers. It follows that the worldwide isoparaffin solvents market keeps changing with industries' choice for cleaner and more effective substances. The combo of properly-established multinational operators with developing regional gamers transforms the competitive panorama into one that is balanced and revolutionary. With increasing client consciousness and environmental guidelines, the future will possibly attention on innovation, sustainability, and adaptableness to new chemical standards within this marketplace.

Market Risks & Opportunities

Restraints & Challenges:

Stringent environmental regulations limiting the usage of petroleum-based solvents:

The boom of the global isoparaffin solvents market is limited with the aid of strict environmental requirements that alter the usage of petroleum-derived merchandise. These regulations intention at restricting air pollutants and carbon emissions. With greater regions adopting tighter legal guidelines on sustainability, producers in the industry might be forced to undertake cleanser tactics to stay competitive.

Availability of eco-friendly and bio-based solvent alternatives lowering demand:

The growing presence of sustainable options is using the global isoparaffin solvents market. Some industries pick sustainable solvents made from renewable raw materials which can be more secure and more environmentally friendly. This sluggish shift in the direction of bio-based totally alternatives keeps to trade market options and challenge manufacturers to innovate in order to compete in the market.

Opportunities:

Applications in inexperienced cleaning and coffee-VOC formulations retain to make bigger and could power destiny increase:

The global isoparaffin solvents market will see full-size boom with increasing demand for inexperienced and low-VOC products. Therefore, industries are making greater investments in answers that do the task efficiently at the same time as minimizing environmental harm. The long-term opportunities for growth lie in the shift towards green cleansing applications with help from technological development and changes in purchaser priorities.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 6765.2 million in 2025 to over USD 9210.2 million by 2032. Isoparaffin Solvents will maintain dominance but face growing competition from emerging formats.

Regulatory updates and tighter constructing codes will power up minimal fire resistance and moisture manage necessities, making product trying out and third-celebration verification commonplace. The small and medium firms will locate niche possibilities through offering rapid-setting or self-levelling answers tailored to retrofit and modular building segments. Meanwhile, large manufacturers will put money into scale, automation, and regional distribution hubs to satisfy developing specification complexity and geographic call for. By moving recognition to stop-to-stop delivery-from fabric innovation and data-driven exceptional guarantee to installer competency and circularity-the industry will chart a direction balancing productiveness with environmental obligation.

Report Coverage

This research report categorizes the global isoparaffin solvents market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global isoparaffin solvents market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global isoparaffin solvents market.

Isoparaffin Solvents Market Key Segments:

By Type

- C8

- C12

- C16

- C20

By Application

- Paints and Coatings

- Metalworking

- Agrochemical Formulation

- Polymers

- Cleaning

- Personal Care

Key Global Isoparaffin Solvents Industry Players

- Braskem S.A

- Calumet Specialty Products Partners

- Cepsa Química

- Chevron Phillips Chemical Company,

- DHC Solvent Chemie GmbH

- Dow Chemical Company

- Exxon Mobil Corporation

- HCS Group (Haltermann Carless)

- Idemitsu Kosan Co. Ltd

- INEOS

- L.P.

- Luan Group

- LyondellBasell Industries

- Mehta Petro Refineries Ltd

- Neste Oyj

- Petrochem Carless Ltd

- RB Products

- Royal Dutch Shell plc

- Sasol Limited

- SK Global Chemical Co., Ltd

- TotalEnergies SE

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252